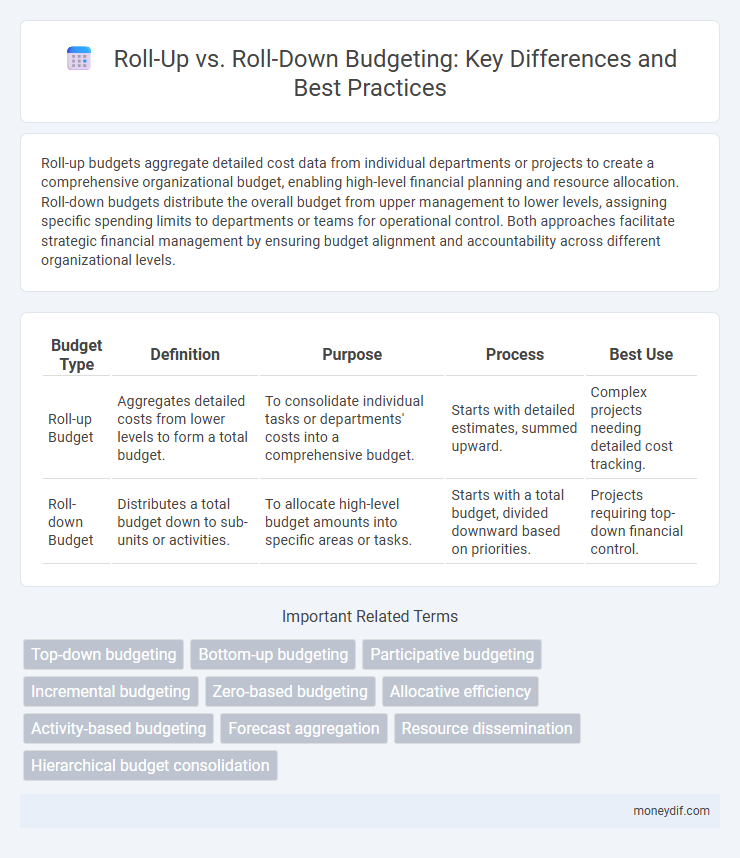

Roll-up budgets aggregate detailed cost data from individual departments or projects to create a comprehensive organizational budget, enabling high-level financial planning and resource allocation. Roll-down budgets distribute the overall budget from upper management to lower levels, assigning specific spending limits to departments or teams for operational control. Both approaches facilitate strategic financial management by ensuring budget alignment and accountability across different organizational levels.

Table of Comparison

| Budget Type | Definition | Purpose | Process | Best Use |

|---|---|---|---|---|

| Roll-up Budget | Aggregates detailed costs from lower levels to form a total budget. | To consolidate individual tasks or departments' costs into a comprehensive budget. | Starts with detailed estimates, summed upward. | Complex projects needing detailed cost tracking. |

| Roll-down Budget | Distributes a total budget down to sub-units or activities. | To allocate high-level budget amounts into specific areas or tasks. | Starts with a total budget, divided downward based on priorities. | Projects requiring top-down financial control. |

Introduction to Roll-up and Roll-down Budgets

Roll-up budgets consolidate detailed, lower-level budget data into a comprehensive, high-level summary, facilitating strategic financial planning and performance analysis. Roll-down budgets begin with broad, top-level financial targets and distribute allocations downward to specific departments or projects, ensuring alignment with organizational goals. Understanding the interplay between roll-up and roll-down budgeting enhances accuracy in forecasting and resource management across complex enterprises.

Key Differences Between Roll-up and Roll-down Budgeting

Roll-up budgeting consolidates detailed budget data from individual departments into an aggregated company-wide budget, enhancing overall financial visibility and strategic alignment. Roll-down budgeting distributes the total corporate budget into smaller, department-specific amounts, enabling precise control and resource allocation at lower organizational levels. Key differences include the direction of budget flow--roll-up aggregates bottom-up data, while roll-down allocates top-down targets--impacting accuracy, accountability, and flexibility in financial planning.

Advantages of Roll-up Budgeting

Roll-up budgeting streamlines financial reporting by consolidating individual department budgets into a comprehensive organizational overview, enhancing accuracy and consistency. It facilitates strategic decision-making through aggregated data, enabling executives to identify overall resource allocation and funding priorities efficiently. This approach also reduces redundant efforts and minimizes errors by centralizing budget inputs into a unified framework.

Advantages of Roll-down Budgeting

Roll-down budgeting enhances detailed financial control by breaking down the total budget into specific units or departments, enabling more accurate tracking and accountability. This approach promotes transparency and facilitates early detection of variances, improving operational efficiency and resource allocation. Organizations benefit from better alignment between strategic goals and departmental execution, leading to improved financial discipline and performance.

Limitations of Roll-up Budgeting

Roll-up budgeting consolidates individual department budgets into a corporate total, often resulting in less detailed financial control and difficulty in identifying specific cost drivers. This aggregation can obscure variability and nuances in departmental spending, limiting accurate forecasting and resource allocation. The centralization inherent in roll-up budgeting reduces flexibility in responding to changing market conditions at the operational level.

Limitations of Roll-down Budgeting

Roll-down budgeting often struggles with accuracy due to its dependence on approximated top-level budget figures, which can distort detailed departmental expenditures. It limits granular control because lower-level managers receive constraints rather than tailored budgets based on specific operational needs. This top-down approach reduces flexibility and may hinder responsiveness to dynamic financial conditions within individual units.

Choosing the Right Budgeting Approach

Choosing the right budgeting approach involves evaluating the organization's size, complexity, and control requirements. Roll-up budgets aggregate detailed departmental budgets into a consolidated total, providing a comprehensive overview for strategic decision-making. Roll-down budgets distribute top-level targets to lower units, promoting accountability and alignment with overall financial goals.

Implementation Steps for Roll-up Budgets

Implementing roll-up budgets involves consolidating departmental or project-level financial data into a comprehensive organizational budget, requiring precise data collection from individual units. Establishing standardized reporting formats and timelines ensures consistency and accuracy during aggregation. Regular validation and reconciliation of rolled-up figures mitigate discrepancies and enhance overall budget reliability.

Implementation Steps for Roll-down Budgets

Roll-down budgets require detailed allocation of the overall budget into specific departmental or project-level expenditures, ensuring accuracy in financial forecasting. Implementation steps include setting top-level budget limits, cascading these limits to individual units, and continuously monitoring variance to adjust allocations dynamically. This method enhances accountability and alignment with organizational goals by enabling granular budget control and resource optimization.

Roll-up vs Roll-down: Which Suits Your Organization?

Roll-up budgets consolidate financial data from smaller units into a comprehensive overview, ideal for organizations requiring centralized control and high-level strategic planning. Roll-down budgets distribute the overall budget into detailed allocations for departments or projects, supporting organizations that emphasize accountability and operational precision at multiple levels. Choosing between roll-up and roll-down budgeting depends on the company's structure, management style, and the need for either top-down oversight or bottom-up detail.

Important Terms

Top-down budgeting

Top-down budgeting involves senior management setting overall financial goals, which are then allocated to departments, exemplifying a roll-down budget approach where high-level targets cascade downward to individual units. Conversely, roll-up budgeting aggregates detailed departmental budgets upwards to form a comprehensive organizational budget, enabling alignment and control from the bottom up.

Bottom-up budgeting

Bottom-up budgeting involves aggregating detailed cost estimates from individual departments or units, aligning closely with roll-up budgeting where these granular inputs are consolidated into a comprehensive organizational budget. In contrast, roll-down budgeting starts with a top-level budget that is broken down into smaller components, guiding the allocation of resources in a more directive manner compared to the participatory nature of bottom-up planning.

Participative budgeting

Participative budgeting involves collaborative input from various organizational levels, enhancing accuracy and commitment to goals. Roll-up budgeting consolidates detailed lower-level budgets into a comprehensive top-level budget, while roll-down budgeting distributes high-level targets down to individual departments for detailed planning.

Incremental budgeting

Incremental budgeting adjusts previous budgets by a fixed amount, making it simpler than roll-up budgeting, which consolidates detailed department budgets into a comprehensive overall budget. Roll-down budgeting allocates the total budget from the top management level down to individual departments, promoting alignment with strategic goals.

Zero-based budgeting

Zero-based budgeting requires building budgets from zero every cycle, which aligns closely with roll-up budgets where detailed expense data from lower organizational levels aggregates upward for a consolidated view. In contrast, a roll-down budget distributes the overall budget targets and constraints from top management down to departments, which may conflict with zero-based budgeting's fundamental principle of justifying all expenses from scratch.

Allocative efficiency

Allocative efficiency in budgeting ensures resources are distributed to maximize value, with roll-up budgets aggregating detailed costs from lower levels to provide a comprehensive overview, while roll-down budgets allocate funds from a higher-level budget to specific departments or projects for targeted spending. Understanding the relationship between roll-up and roll-down budgets improves decision-making by aligning granular cost control with strategic resource allocation to achieve optimal organizational performance.

Activity-based budgeting

Activity-based budgeting allocates costs based on actual activities driving expenses, enhancing accuracy compared to traditional roll-up budgeting, which consolidates detailed departmental budgets into a master budget. Roll-down budgeting starts from a top-level budget, distributing funds to departments based on strategic priorities, making it complementary to activity-based methods by aligning resources with operational drivers.

Forecast aggregation

Forecast aggregation involves consolidating individual budget estimates to create a comprehensive financial projection, with roll-up budgets compiling detailed departmental forecasts into higher-level summaries, while roll-down budgets distribute overall financial targets into specific, actionable plans for subunits, ensuring alignment and accuracy across organizational levels. Effective roll-up budgets enhance strategic decision-making by providing aggregated insight, whereas roll-down budgets drive operational execution by breaking down goals into measurable components.

Resource dissemination

Resource dissemination involves allocating available assets across projects with either a roll-up budget, which aggregates individual departmental costs to form a comprehensive total budget, or a roll-down budget, which distributes the overall financial plan into specific line-item expenditures. Efficient resource dissemination aligns with the chosen budgeting method to ensure accurate financial tracking and optimization of resource utilization throughout the project lifecycle.

Hierarchical budget consolidation

Hierarchical budget consolidation integrates financial data across multiple organizational levels, enhancing accuracy and control in aggregating roll-up budgets from departments to corporate levels, whereas roll-down budgeting allocates top-level budget targets down through subdivisions for detailed planning. Effective use of roll-up and roll-down budgets in hierarchical consolidation streamlines variance analysis and supports strategic financial management.

Roll-up Budget vs Roll-down Budget Infographic

moneydif.com

moneydif.com