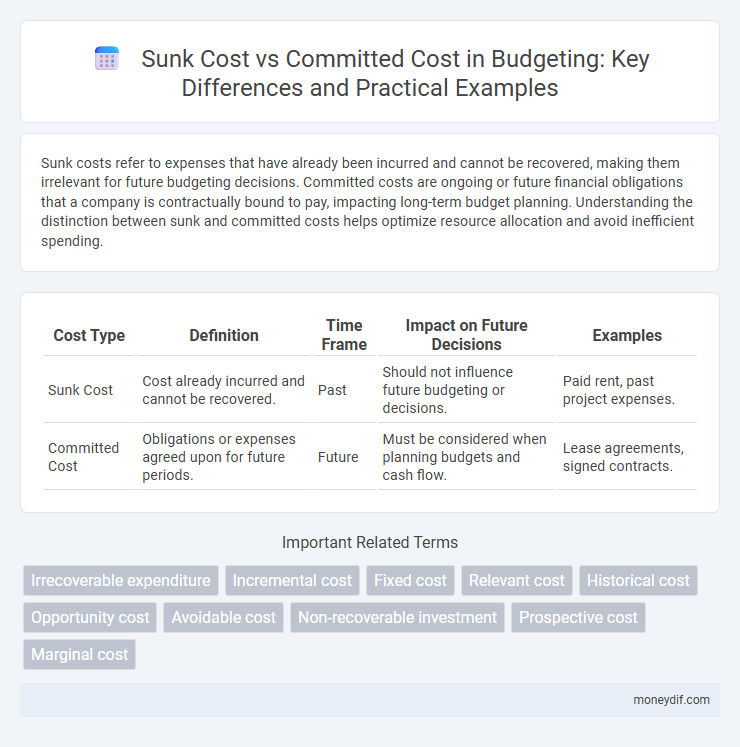

Sunk costs refer to expenses that have already been incurred and cannot be recovered, making them irrelevant for future budgeting decisions. Committed costs are ongoing or future financial obligations that a company is contractually bound to pay, impacting long-term budget planning. Understanding the distinction between sunk and committed costs helps optimize resource allocation and avoid inefficient spending.

Table of Comparison

| Cost Type | Definition | Time Frame | Impact on Future Decisions | Examples |

|---|---|---|---|---|

| Sunk Cost | Cost already incurred and cannot be recovered. | Past | Should not influence future budgeting or decisions. | Paid rent, past project expenses. |

| Committed Cost | Obligations or expenses agreed upon for future periods. | Future | Must be considered when planning budgets and cash flow. | Lease agreements, signed contracts. |

Understanding Sunk Costs in Budgeting

Sunk costs are past expenses that cannot be recovered and should not influence current budgeting decisions. Unlike committed costs, which are future obligations requiring payment, sunk costs represent irretrievable expenditures already incurred. Effective budgeting requires ignoring sunk costs to avoid biased financial choices and focus on relevant costs impacting future outcomes.

Defining Committed Costs in Financial Planning

Committed costs represent financial obligations that a company has already incurred or firmly agreed to, making them non-recoverable and unavoidable regardless of future decisions. These costs typically include long-term contracts, lease agreements, and fixed asset investments that are integral to ongoing operations and strategic planning. Understanding committed costs in financial planning is essential for accurately forecasting budget constraints and maintaining fiscal discipline.

Key Differences Between Sunk and Committed Costs

Sunk costs represent expenses already incurred and cannot be recovered, making them irrelevant for future decision-making, while committed costs are obligations that must be paid in the future regardless of business actions. Key differences include timing and flexibility: sunk costs are historical and fixed, whereas committed costs involve contractual or planned expenditures that lock resources ahead of time. Understanding these distinctions is crucial for accurate budgeting and cost control in financial planning.

Impact of Sunk Costs on Budget Decisions

Sunk costs represent past expenditures that cannot be recovered, and their presence can distort budget decisions by causing managers to irrationally continue funding projects to justify prior expenses. Committed costs, on the other hand, are future obligations that must be accounted for in budgeting processes to ensure accurate financial planning. Understanding the distinction helps avoid the sunk cost fallacy, optimizing resource allocation and improving overall budget efficiency.

How Committed Costs Influence Budget Flexibility

Committed costs, such as long-term contracts and fixed obligations, significantly reduce budget flexibility by locking resources into predetermined expenditures. Unlike sunk costs, which are past expenses that should not affect current decision-making, committed costs limit an organization's ability to reallocate funds in response to changing financial conditions. Understanding these costs is essential for effective budget management and maintaining operational adaptability.

Common Examples of Sunk and Committed Costs

Sunk costs often include expenses such as research and development, marketing campaigns, or equipment purchases that cannot be recovered once spent. Committed costs typically involve long-term obligations like lease agreements, salaried personnel, or contractual services that a business must pay regardless of its current operations. Understanding these examples helps distinguish between irreversible past expenditures and ongoing financial commitments critical for effective budget planning.

Avoiding the Sunk Cost Fallacy in Budget Management

Sunk costs represent past expenses that cannot be recovered, while committed costs refer to future financial obligations that are contractually binding. Effective budget management requires recognizing sunk costs as irrelevant to current decision-making to avoid the sunk cost fallacy, which leads to irrational continued investment in failing projects. Prioritizing committed costs and future cash flows enhances resource allocation and organizational financial health.

Strategies to Manage Committed Costs Effectively

Effective strategies to manage committed costs involve rigorous contract reviews, focusing on flexible terms that allow adjustments based on performance or market conditions. Implementing periodic cost audits and forecasting helps identify potential overruns early, enabling proactive budget reallocation. Leveraging supplier negotiations and adopting scalable solutions can also optimize committed expenditures, maintaining alignment with overall financial goals.

Sunk Cost vs Committed Cost: Real-World Budget Scenarios

Sunk costs represent past expenditures that cannot be recovered and should not influence future budgeting decisions, while committed costs are ongoing financial obligations tied to resources already allocated. In real-world budget scenarios, recognizing the distinction helps prevent decision-making based on irrecoverable expenses and ensures accurate forecasting by accounting for fixed commitments. Effective budget management requires analyzing committed costs to maintain operational continuity while ignoring sunk costs to avoid budgetary distortions.

Optimizing Your Budget by Distinguishing Cost Types

Sunk costs represent past expenditures that cannot be recovered and should not influence future budget decisions, while committed costs are ongoing or future obligations requiring allocation in current budget planning. By carefully distinguishing between sunk and committed costs, businesses can optimize their budget by avoiding unnecessary spending on irrecoverable expenses and focusing resources on essential financial commitments. Prioritizing committed costs improves cash flow management and enables more strategic investment decisions.

Important Terms

Irrecoverable expenditure

Irrecoverable expenditure, also known as sunk cost, refers to past costs that cannot be recovered and should not influence future decisions, whereas committed costs are ongoing obligations that must be paid regardless of business outcomes.

Incremental cost

Incremental cost represents the additional expense incurred from a decision, distinct from sunk costs which are past, irrecoverable expenses, and committed costs which are future obligations already agreed upon.

Fixed cost

Fixed costs include both sunk costs, which are past expenditures that cannot be recovered, and committed costs, which are long-term financial obligations that cannot be easily altered.

Relevant cost

Relevant cost excludes sunk costs and committed costs because sunk costs are past expenses that cannot be recovered and committed costs are future obligations that cannot be changed.

Historical cost

Historical cost represents the original purchase price of an asset, distinguishing it from sunk costs which are irrecoverable past expenses, and committed costs which are future obligations based on previous decisions.

Opportunity cost

Opportunity cost represents the potential benefits lost when choosing committed costs, which are future expenses that can be avoided, over sunk costs that are past, unrecoverable expenditures.

Avoidable cost

Avoidable cost refers to expenses that can be eliminated if a business decision is altered, contrasting with sunk costs that are past, irrecoverable expenditures, and committed costs that are fixed obligations regardless of future actions.

Non-recoverable investment

Non-recoverable investment refers to sunk costs that cannot be recovered after commitment, whereas committed costs are future expenses obligated by prior decisions but not yet incurred.

Prospective cost

Prospective cost refers to future expenses that can be influenced by current decisions, unlike sunk costs which are past expenditures that cannot be recovered. Committed costs represent future financial obligations that are already contractually fixed, limiting flexibility compared to prospective costs which remain variable.

Marginal cost

Marginal cost reflects the additional expense of producing one more unit, distinct from sunk costs which are unrecoverable prior expenses, and committed costs which are long-term obligations that cannot be reduced in the short term.

Sunk cost vs Committed cost Infographic

moneydif.com

moneydif.com