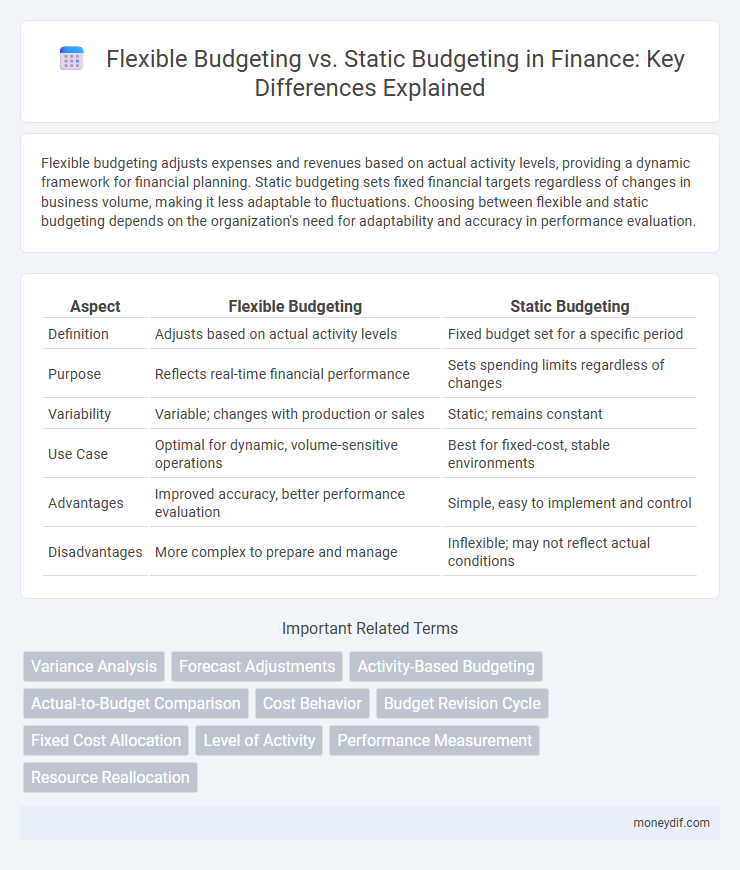

Flexible budgeting adjusts expenses and revenues based on actual activity levels, providing a dynamic framework for financial planning. Static budgeting sets fixed financial targets regardless of changes in business volume, making it less adaptable to fluctuations. Choosing between flexible and static budgeting depends on the organization's need for adaptability and accuracy in performance evaluation.

Table of Comparison

| Aspect | Flexible Budgeting | Static Budgeting |

|---|---|---|

| Definition | Adjusts based on actual activity levels | Fixed budget set for a specific period |

| Purpose | Reflects real-time financial performance | Sets spending limits regardless of changes |

| Variability | Variable; changes with production or sales | Static; remains constant |

| Use Case | Optimal for dynamic, volume-sensitive operations | Best for fixed-cost, stable environments |

| Advantages | Improved accuracy, better performance evaluation | Simple, easy to implement and control |

| Disadvantages | More complex to prepare and manage | Inflexible; may not reflect actual conditions |

Understanding Flexible Budgeting

Flexible budgeting adjusts expenses and revenues based on actual activity levels, providing a dynamic tool for performance evaluation compared to static budgeting's fixed projections. This approach allows organizations to better manage costs and resources by aligning budgetary expectations with real-world operational changes. Flexible budgeting enhances decision-making accuracy by accommodating fluctuations in production volume, sales, and other key business drivers.

What Is Static Budgeting?

Static budgeting involves creating a fixed budget based on estimated revenues and expenses for a specific period, regardless of actual activity levels. This approach enables straightforward financial planning and variance analysis but lacks adaptability to changes in operational volume or market conditions. Companies use static budgets primarily for administrative control when expenses and revenues are predictable and stable.

Key Differences Between Flexible and Static Budgets

Flexible budgeting adjusts expenses based on actual activity levels, allowing for more accurate performance evaluation, while static budgeting sets fixed financial targets regardless of changes in activity. Key differences include adaptability to volume fluctuations, with flexible budgets recalculating costs for varying production or sales, compared to static budgets that remain unchanged throughout the period. Flexible budgets enhance variance analysis by comparing actual results to adjusted expectations, whereas static budgets often lead to misleading variances due to fixed assumptions.

Advantages of Flexible Budgeting

Flexible budgeting adjusts expenses based on actual activity levels, providing more accurate cost control and performance evaluation compared to static budgeting. It enhances management's ability to respond to changes in sales volume, production levels, or market conditions, improving resource allocation efficiency. This dynamic approach supports real-time decision-making and reduces variances by aligning budgeted costs with operational realities.

Limitations of Flexible Budgeting

Flexible budgeting limits arise from its reliance on accurate activity level estimation, making it less effective if actual business conditions deviate significantly. This budgeting method may also become complex and time-consuming to update continuously, reducing its practicality for smaller organizations with limited resources. Furthermore, flexible budgets can struggle to account for unpredictable external factors such as market volatility or regulatory changes.

Benefits of Static Budgeting

Static budgeting provides a clear and fixed financial framework, enabling straightforward performance evaluation against predetermined targets. It simplifies cost control by setting consistent expenditure limits regardless of fluctuations in activity levels. Organizations benefit from enhanced predictability and easier variance analysis, facilitating more disciplined fiscal management.

Drawbacks of Static Budgeting

Static budgeting often fails to accommodate unexpected changes in sales volume or costs, leading to inaccuracies in financial planning and performance evaluation. It lacks responsiveness to market fluctuations, making it difficult for businesses to adapt their spending or operational strategies effectively. This rigidity can result in inefficient resource allocation and missed opportunities for cost savings or revenue growth.

When to Use Flexible Budgeting

Flexible budgeting is ideal for organizations experiencing fluctuating activity levels or sales volumes, allowing adjustments to budgeted expenses based on actual performance. It provides more accurate performance evaluation by aligning costs with real-time operational changes, especially useful in manufacturing, retail, and service industries with variable demand. Companies should use flexible budgeting during uncertain economic conditions or seasonal variations to maintain cost control and improve decision-making.

Ideal Scenarios for Static Budgeting

Static budgeting is ideal for organizations with stable operating environments and predictable expenses, such as government agencies or fixed-cost manufacturing processes. It provides a fixed financial plan that facilitates straightforward variance analysis and performance evaluation against predefined benchmarks. This budgeting approach is most effective when costs and revenues remain consistent over the budget period, minimizing the need for frequent adjustments.

Flexible vs Static Budgeting: Which Is Right for Your Business?

Flexible budgeting adjusts costs and revenues based on actual activity levels, providing real-time financial insights for dynamic business environments. Static budgeting sets fixed projections regardless of performance, ideal for stable operations with predictable expenses. Choosing between flexible vs static budgeting depends on your business's volatility, with flexible budgets offering adaptability while static budgets ensure strict financial control.

Important Terms

Variance Analysis

Variance analysis evaluates differences between actual results and budgeted amounts, highlighting performance discrepancies in flexible budgeting by adjusting for activity levels, unlike static budgeting which sets fixed targets regardless of operational changes.

Forecast Adjustments

Forecast adjustments in flexible budgeting enable more accurate resource allocation by incorporating actual activity levels, unlike static budgeting which remains fixed regardless of performance variations.

Activity-Based Budgeting

Activity-Based Budgeting enhances flexible budgeting accuracy by allocating costs based on actual activities, unlike static budgeting which relies on fixed estimates regardless of changes in activity levels.

Actual-to-Budget Comparison

Actual-to-budget comparison reveals variances more accurately in flexible budgeting by adjusting for activity levels, unlike static budgeting which remains fixed regardless of operational changes.

Cost Behavior

Cost behavior analysis is essential for flexible budgeting as it adjusts expenses based on activity levels, unlike static budgeting which remains fixed regardless of operational changes.

Budget Revision Cycle

The Budget Revision Cycle enhances financial adaptability by comparing Flexible Budgeting, which adjusts for varying activity levels, against Static Budgeting that remains fixed regardless of operational changes.

Fixed Cost Allocation

Fixed cost allocation involves assigning fixed expenses across departments or products, which impacts both flexible and static budgeting approaches; flexible budgeting adjusts fixed costs based on activity levels for more dynamic variance analysis, while static budgeting maintains fixed cost estimates regardless of operational changes, potentially leading to less accurate performance evaluations. Understanding these distinctions is crucial for effective cost control and decision-making in managerial accounting.

Level of Activity

Flexible budgeting adjusts cost estimates based on varying levels of activity, whereas static budgeting remains fixed regardless of actual activity changes.

Performance Measurement

Flexible budgeting adjusts performance measurement by aligning budgeted costs with actual activity levels, providing more accurate variance analysis than static budgeting which uses fixed cost estimates regardless of activity changes.

Resource Reallocation

Resource reallocation enables organizations to adapt spending dynamically by comparing actual costs to flexible budgeting forecasts rather than fixed static budgets, enhancing financial responsiveness and efficiency.

Flexible budgeting vs Static budgeting Infographic

moneydif.com

moneydif.com