Envelope budgeting allocates specific amounts of money to distinct spending categories, ensuring disciplined control over expenses by limiting spending to predefined envelopes. Priority-based budgeting directs funds toward high-impact areas aligned with strategic goals, optimizing resource allocation for maximum value. Both methods improve financial management, but envelope budgeting emphasizes spending limits while priority-based budgeting focuses on funding priorities.

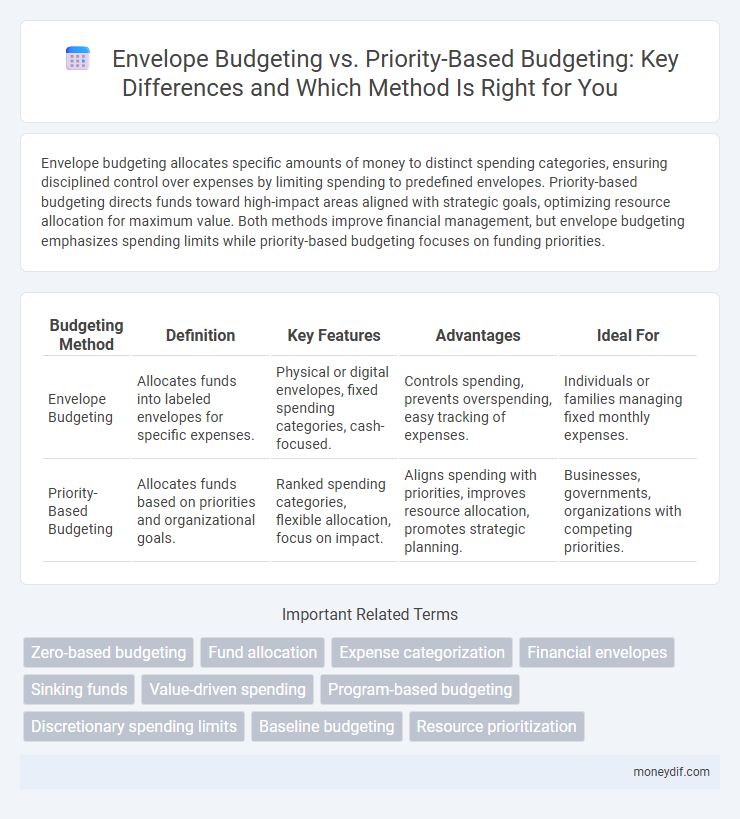

Table of Comparison

| Budgeting Method | Definition | Key Features | Advantages | Ideal For |

|---|---|---|---|---|

| Envelope Budgeting | Allocates funds into labeled envelopes for specific expenses. | Physical or digital envelopes, fixed spending categories, cash-focused. | Controls spending, prevents overspending, easy tracking of expenses. | Individuals or families managing fixed monthly expenses. |

| Priority-Based Budgeting | Allocates funds based on priorities and organizational goals. | Ranked spending categories, flexible allocation, focus on impact. | Aligns spending with priorities, improves resource allocation, promotes strategic planning. | Businesses, governments, organizations with competing priorities. |

Introduction to Envelope Budgeting and Priority-Based Budgeting

Envelope budgeting allocates specific amounts of money into categories or "envelopes" to control spending and avoid debt, promoting clear financial boundaries for discretionary expenses. Priority-based budgeting organizes funds by ranking essential needs and allocating resources according to their importance, ensuring critical expenses receive funding first. Both methods enhance financial discipline but cater to different planning styles and goals.

Core Principles of Envelope Budgeting

Envelope budgeting centers on allocating a specific amount of money to distinct categories or "envelopes" ensuring controlled spending and preventing debt accumulation. This method emphasizes discipline by physically or digitally dividing income into predetermined sections for expenses like groceries, rent, or entertainment. Core principles include strict adherence to budget limits per envelope, prioritizing essential expenses, and promoting mindful financial management to avoid overspending.

Fundamentals of Priority-Based Budgeting

Priority-based budgeting prioritizes funding allocation based on program importance and outcomes rather than predefined spending limits, ensuring resources are directed toward critical goals. This method evaluates each activity's impact and cost-effectiveness, aligning budgets with strategic objectives and public value. Envelope budgeting, by contrast, sets fixed spending limits per category, potentially limiting flexibility and responsiveness to changing priorities.

Key Differences Between Envelope and Priority-Based Approaches

Envelope budgeting allocates fixed amounts of money to different spending categories to control cash flow, limiting overspending by using physical or digital envelopes. Priority-based budgeting ranks expenditures according to their importance or impact on organizational goals, directing resources first to high-priority projects or services. The key difference lies in envelope budgeting's rigid allocation versus priority-based budgeting's strategic resource distribution driven by organizational objectives.

Pros and Cons of Envelope Budgeting

Envelope budgeting offers clear spending limits by allocating specific amounts to predefined categories, which helps prevent overspending and encourages disciplined financial management. However, this method can be inflexible, as it does not easily accommodate unexpected expenses or changes in priorities without reallocating funds manually. Envelope budgeting's tangible approach enhances control but may require frequent adjustments to remain effective in dynamic financial situations.

Advantages and Limitations of Priority-Based Budgeting

Priority-based budgeting aligns financial resources with organizational goals, enhancing strategic decision-making and ensuring funds target high-impact areas. It promotes transparency and accountability by clearly linking expenditures to specific priorities, though it can be time-consuming and complex to implement due to the need for detailed analysis and consensus-building. Unlike envelope budgeting, which strictly caps spending categories, priority-based budgeting offers flexibility but requires continuous evaluation to adjust priorities as conditions change.

Suitability: Who Should Use Envelope Budgeting?

Envelope budgeting is ideal for individuals or households seeking strict control over discretionary spending by allocating fixed amounts to various categories, helping to prevent overspending. It suits those with variable incomes or limited financial discipline who benefit from tangible spending limits. This method provides clear visibility into available funds within each category, making it effective for managing day-to-day expenses and fostering disciplined saving habits.

Suitability: Who Benefits from Priority-Based Budgeting?

Priority-based budgeting suits organizations prioritizing strategic goals and resource allocation efficiency, such as government agencies and nonprofits with diverse programs. It benefits entities seeking to align expenditures directly with mission-critical outcomes rather than fixed categories. This method enhances decision-making for stakeholders aiming to maximize impact and transparency in budget management.

Real-Life Examples: Envelope vs Priority-Based Budgeting

Envelope budgeting divides income into specific spending categories with set limits, exemplified by someone allocating $500 monthly for groceries and $200 for entertainment in separate envelopes. Priority-based budgeting prioritizes funding essential expenses first, like housing and utilities, before allocating remaining funds to discretionary items, as seen in local governments funding public safety before recreation programs. Real-life application shows envelope budgeting excels in individual expense control, while priority-based budgeting effectively aligns spending with organizational or personal priorities.

Choosing the Right Budgeting Method for Your Financial Goals

Envelope budgeting allocates specific amounts of money to categorized spending envelopes, promoting disciplined cash flow management and preventing overspending. Priority-based budgeting allocates resources based on the importance and urgency of expenses, aligning spending with strategic financial goals for optimal resource utilization. Choosing the right budgeting method depends on individual financial goals, spending habits, and the need for flexibility or control in managing expenses.

Important Terms

Zero-based budgeting

Zero-based budgeting requires every expense to be justified from scratch, aligning closely with Priority-based budgeting by focusing resources on critical activities, contrasting with Envelope budgeting which limits spending using predefined cash categories without evaluating purpose or priority. This approach ensures efficient allocation by prioritizing essential expenditures rather than merely capping budgets as in Envelope budgeting.

Fund allocation

Fund allocation in envelope budgeting involves distributing specific amounts of money into predefined categories to control spending and avoid overspending, while priority-based budgeting allocates funds according to organizational or project priorities to ensure resources maximize strategic objectives. Envelope budgeting emphasizes spending limits within fixed categories, whereas priority-based budgeting focuses on aligning budget allocation with the most critical goals and outcomes.

Expense categorization

Expense categorization in envelope budgeting involves assigning specific cash amounts to predefined spending categories, ensuring controlled expenditure per envelope. Priority-based budgeting allocates resources according to the importance of financial goals, directing funds first to essential needs and high-impact priorities before discretionary expenses.

Financial envelopes

Financial envelopes in envelope budgeting involve allocating specific amounts of money into distinct categories to control spending, ensuring each expense is funded without overspending. Priority-based budgeting, in contrast, allocates funds according to strategic priorities and organizational goals, optimizing resource distribution based on the relative importance of programs and services.

Sinking funds

Sinking funds provide a systematic way to save for future expenses by allocating specific amounts into designated categories, aligning closely with envelope budgeting's method of dividing money into separate envelopes for each expense. Priority-based budgeting differs by focusing on funding programs and expenses based on their importance and impact rather than fixed categories, making sinking funds less central but still useful for addressing high-priority financial goals through targeted savings.

Value-driven spending

Value-driven spending focuses on aligning expenditures with organizational goals to maximize impact, making Priority-based budgeting ideal as it allocates resources based on strategic importance rather than fixed limits. Envelope budgeting restricts spending within predefined categories, which may limit flexibility and responsiveness compared to the dynamic allocation inherent in Priority-based budgeting.

Program-based budgeting

Program-based budgeting allocates funds according to specific programs' objectives and outcomes, ensuring resources directly support targeted services, unlike Envelope budgeting which sets fixed spending limits per category, often restricting flexibility. Priority-based budgeting evaluates and ranks programs by their impact and strategic importance, enabling more efficient resource allocation compared to the rigid caps in Envelope budgeting.

Discretionary spending limits

Discretionary spending limits in envelope budgeting allocate fixed amounts to specific categories, helping control expenses by preventing overspending in each pre-set envelope. Priority-based budgeting, however, sets discretionary spending limits based on organizational or personal priorities, directing funds toward high-impact areas for optimized resource allocation.

Baseline budgeting

Baseline budgeting allocates funds based on previous expenditures, often limiting flexibility and innovation compared to envelope budgeting, which controls spending by category-specific limits, and priority-based budgeting, which allocates resources according to program effectiveness and strategic goals. Envelope budgeting enhances fiscal discipline by capping expenses within set categories, while priority-based budgeting drives resource allocation aligned with organizational priorities to maximize impact.

Resource prioritization

Resource prioritization in envelope budgeting allocates fixed financial limits to specific spending categories, ensuring expenditure control but limiting flexibility. Priority-based budgeting directs funds according to strategic importance and outcomes, enhancing resource alignment with organizational goals and improving decision-making efficiency.

Envelope budgeting vs Priority-based budgeting Infographic

moneydif.com

moneydif.com