Zero-based budgeting requires building the budget from the ground up, justifying each expense as if starting from scratch, which promotes cost efficiency and eliminates unnecessary expenditures. Incremental budgeting adjusts previous budgets by a set percentage, simplifying the process but often perpetuating inefficiencies and overlooking changing priorities. Choosing between these methods depends on organizational goals, with zero-based budgeting offering a thorough review and incremental budgeting favoring ease and stability.

Table of Comparison

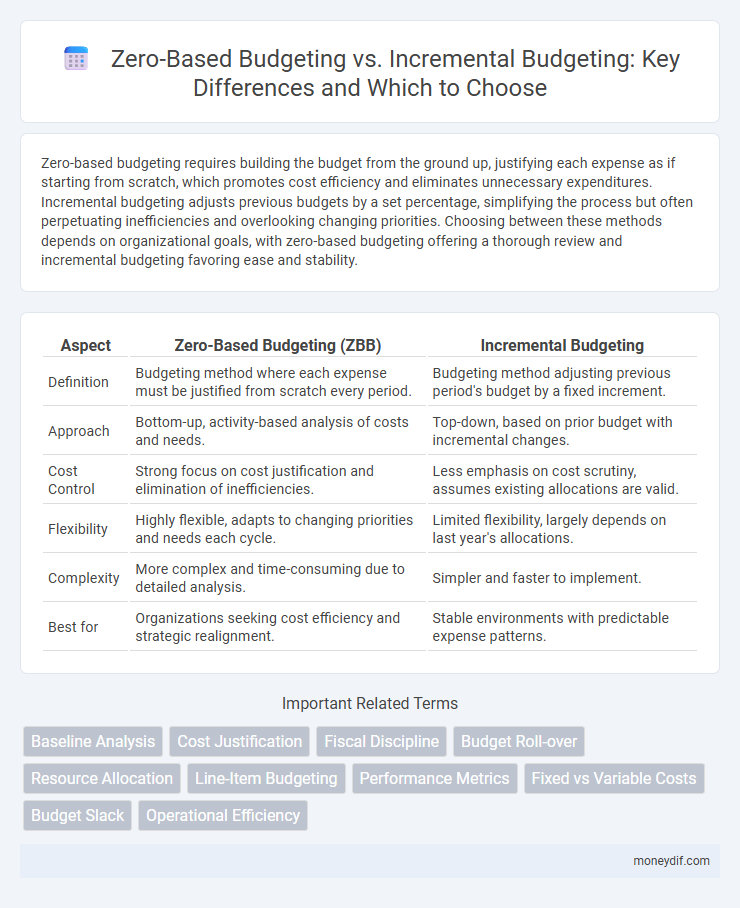

| Aspect | Zero-Based Budgeting (ZBB) | Incremental Budgeting |

|---|---|---|

| Definition | Budgeting method where each expense must be justified from scratch every period. | Budgeting method adjusting previous period's budget by a fixed increment. |

| Approach | Bottom-up, activity-based analysis of costs and needs. | Top-down, based on prior budget with incremental changes. |

| Cost Control | Strong focus on cost justification and elimination of inefficiencies. | Less emphasis on cost scrutiny, assumes existing allocations are valid. |

| Flexibility | Highly flexible, adapts to changing priorities and needs each cycle. | Limited flexibility, largely depends on last year's allocations. |

| Complexity | More complex and time-consuming due to detailed analysis. | Simpler and faster to implement. |

| Best for | Organizations seeking cost efficiency and strategic realignment. | Stable environments with predictable expense patterns. |

Introduction to Zero-Based and Incremental Budgeting

Zero-based budgeting requires every expense to be justified from scratch for each budget period, promoting cost-efficiency and resource optimization by ignoring prior budgets. Incremental budgeting adjusts previous budgets by adding or subtracting increments, simplifying planning but potentially perpetuating outdated spending patterns. Understanding these approaches enables organizations to choose between a rigorous, detail-oriented method and a stable, continuity-focused strategy for financial planning.

Key Principles of Zero-Based Budgeting

Zero-based budgeting requires each expense to be justified from scratch, starting at a "zero base," ensuring that all expenditures align directly with organizational goals and priorities. This method emphasizes thorough analysis and evaluation of every budget item, eliminating unnecessary costs and reallocating resources efficiently. By contrast, incremental budgeting adjusts previous budgets with incremental changes, often perpetuating inefficiencies and limiting financial flexibility.

Fundamentals of Incremental Budgeting

Incremental budgeting focuses on adjusting the previous period's budget by a certain percentage to account for changes in cost or revenue, simplifying the budgeting process by building on historical data. This method emphasizes stability and ease of preparation but may perpetuate inefficiencies by allocating resources based on past spending rather than current needs. Organizations using incremental budgeting benefit from predictability but risk overlooking opportunities for cost savings and innovation.

Comparing Budgeting Approaches: Zero-Based vs Incremental

Zero-based budgeting requires justifying every expense from zero each period, promoting cost-efficiency and resource optimization by focusing on necessity rather than historical spending. Incremental budgeting builds on previous budgets by adjusting existing allocations, simplifying the process but potentially perpetuating inefficiencies and limiting flexibility. Organizations prioritizing strategic realignment and agility often prefer zero-based budgeting, whereas those emphasizing stability and ease of implementation lean toward incremental budgeting.

Pros and Cons of Zero-Based Budgeting

Zero-based budgeting requires justifying every expense from scratch, promoting efficient resource allocation and eliminating unnecessary costs. This method enhances financial transparency and adaptability but can be time-consuming and demanding in terms of data collection and analysis. Unlike incremental budgeting, zero-based budgeting prevents budgetary inertia and reduces the risk of perpetuating outdated spending patterns.

Benefits and Drawbacks of Incremental Budgeting

Incremental budgeting simplifies the budget process by adjusting previous budgets with minor increments, which enhances stability and reduces the time needed for preparation. It encourages predictability in financial planning but often perpetuates inefficiencies by ignoring outdated expenditures and discouraging resource reallocation. This method lacks flexibility, making it less effective in dynamic environments demanding frequent budget reassessments.

Key Differences in Implementation

Zero-based budgeting requires building the budget from scratch each period, justifying every expense without reference to prior budgets, promoting detailed scrutiny and resource optimization. Incremental budgeting adjusts previous budgets by adding or subtracting incremental amounts, relying heavily on historical data and often resulting in less flexibility and potential inefficiencies. Zero-based budgeting demands substantial time and analytical effort during implementation, while incremental budgeting offers a simpler, quicker approach suitable for stable environments with predictable needs.

Impact on Organizational Cost Control

Zero-based budgeting requires every expense to be justified from scratch, leading to more precise cost control and eliminating unnecessary expenditures in organizational budgets. Incremental budgeting adjusts previous budgets by a fixed percentage, which can perpetuate inefficiencies and limit cost-saving opportunities. Organizations using zero-based budgeting often achieve greater financial discipline and improved allocation of resources compared to those relying on incremental budgeting.

Real-World Examples: Zero-Based vs Incremental Budgeting

Zero-based budgeting (ZBB) requires organizations like Kraft Heinz to justify every expense from scratch, leading to more efficient resource allocation and cost reduction, as seen in their streamlining efforts. In contrast, incremental budgeting, commonly used by government agencies such as the U.S. federal budget, adjusts previous budgets slightly, simplifying the process but potentially perpetuating inefficiencies. Real-world applications highlight that ZBB promotes strategic prioritization, while incremental budgeting favors stability and ease of administration.

Choosing the Right Budgeting Method for Your Organization

Zero-based budgeting requires justifying all expenses from scratch, enhancing cost control and resource allocation efficiency, while incremental budgeting adjusts previous budgets based on historical data, offering simplicity and stability. Organizations with dynamic environments and fluctuating costs benefit from zero-based budgeting, whereas those seeking continuity and ease prefer incremental budgeting. Selecting the right budgeting method depends on factors like organizational complexity, financial goals, and available resources.

Important Terms

Baseline Analysis

Baseline analysis in zero-based budgeting starts from a zero base requiring justification of all expenses, whereas incremental budgeting builds on the previous period's budget by adjusting existing allocations.

Cost Justification

Zero-based budgeting requires detailed cost justification for every expense from zero, contrasting with incremental budgeting that adjusts previous budgets with minimal justification.

Fiscal Discipline

Zero-based budgeting enforces stricter fiscal discipline by requiring each expense to be justified from zero annually, unlike incremental budgeting which bases budgets on previous years' figures, potentially perpetuating inefficiencies.

Budget Roll-over

Budget roll-over is minimized in zero-based budgeting by reassessing all expenses annually, unlike incremental budgeting which often carries over previous allocations with minimal adjustments.

Resource Allocation

Zero-based budgeting optimizes resource allocation by justifying all expenses from scratch, unlike incremental budgeting which adjusts previous budgets with incremental changes.

Line-Item Budgeting

Line-item budgeting allocates funds to specific expense categories, differing from zero-based budgeting which requires justifying all expenses from scratch, and incremental budgeting which adjusts previous budgets by adding or subtracting amounts.

Performance Metrics

Zero-based budgeting improves performance metrics by aligning expenses with current business objectives, while incremental budgeting often perpetuates inefficiencies by adjusting previous budgets without thorough evaluation.

Fixed vs Variable Costs

Zero-based budgeting minimizes fixed costs by justifying each expense from scratch, while incremental budgeting often perpetuates fixed and variable costs based on prior budgets.

Budget Slack

Budget slack occurs when managers deliberately underestimate revenues or overestimate expenses, a practice more prevalent in incremental budgeting since zero-based budgeting requires justifying all expenses from scratch, reducing opportunities for slack.

Operational Efficiency

Zero-based budgeting enhances operational efficiency by requiring each expense to be justified from scratch, unlike incremental budgeting which risks perpetuating inefficiencies through routine cost increases based on previous budgets.

Zero-based budgeting vs Incremental budgeting Infographic

moneydif.com

moneydif.com