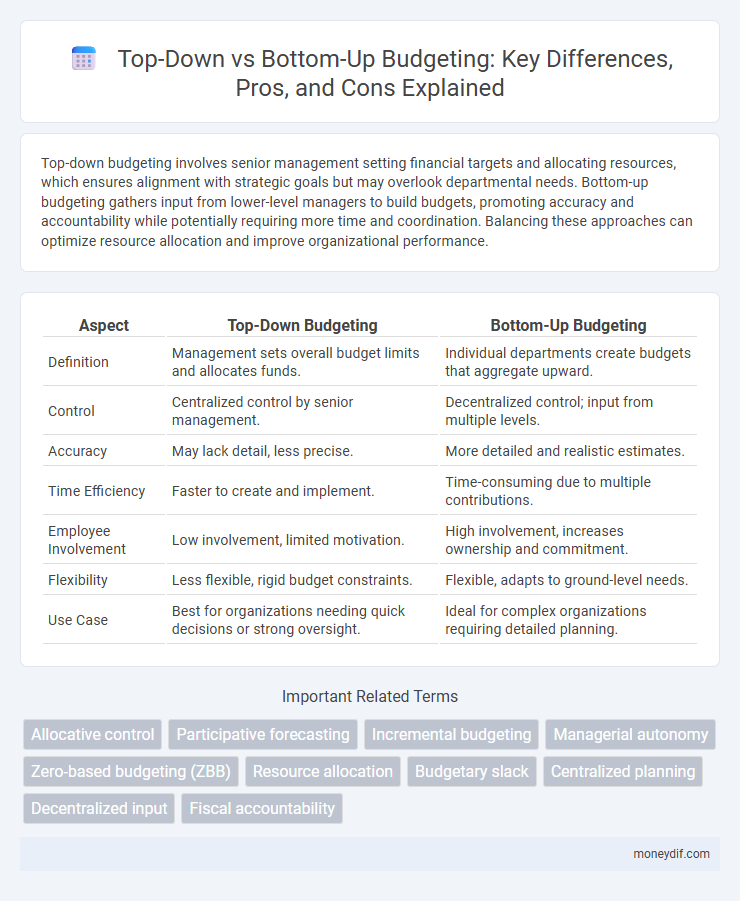

Top-down budgeting involves senior management setting financial targets and allocating resources, which ensures alignment with strategic goals but may overlook departmental needs. Bottom-up budgeting gathers input from lower-level managers to build budgets, promoting accuracy and accountability while potentially requiring more time and coordination. Balancing these approaches can optimize resource allocation and improve organizational performance.

Table of Comparison

| Aspect | Top-Down Budgeting | Bottom-Up Budgeting |

|---|---|---|

| Definition | Management sets overall budget limits and allocates funds. | Individual departments create budgets that aggregate upward. |

| Control | Centralized control by senior management. | Decentralized control; input from multiple levels. |

| Accuracy | May lack detail, less precise. | More detailed and realistic estimates. |

| Time Efficiency | Faster to create and implement. | Time-consuming due to multiple contributions. |

| Employee Involvement | Low involvement, limited motivation. | High involvement, increases ownership and commitment. |

| Flexibility | Less flexible, rigid budget constraints. | Flexible, adapts to ground-level needs. |

| Use Case | Best for organizations needing quick decisions or strong oversight. | Ideal for complex organizations requiring detailed planning. |

Understanding Top-Down Budgeting

Top-down budgeting involves senior management setting financial targets and allocating resources, which streamlines the budgeting process and ensures alignment with overall strategic goals. This approach facilitates quicker decision-making and centralized control but may limit input from lower-level departments. Understanding top-down budgeting is essential for organizations prioritizing efficiency and clear accountability in budget planning.

Key Features of Bottom-Up Budgeting

Bottom-up budgeting emphasizes detailed input from lower-level managers and employees who create budget estimates based on operational knowledge, resulting in more accurate and realistic financial plans. This approach fosters greater ownership and accountability across departments while encouraging collaboration and communication throughout the organization. By aggregating individual budgets, bottom-up budgeting enhances flexibility and responsiveness to changing business conditions compared to the rigid structure of top-down budgeting.

Main Differences Between Top-Down and Bottom-Up Approaches

Top-down budgeting is driven by senior management setting overall financial targets and allocating resources accordingly, while bottom-up budgeting starts with individual departments estimating their financial needs which are then aggregated. The top-down approach often results in faster budget approval and stronger control but may overlook ground-level insights, whereas bottom-up budgeting promotes accuracy and employee engagement but can be time-consuming and prone to optimistic forecasts. Key differences include decision-making authority, level of detail, and the balance between control and flexibility in resource allocation.

Advantages of Top-Down Budgeting

Top-down budgeting accelerates the planning process by allowing senior management to set clear financial targets aligned with strategic goals, fostering organizational coherence. It ensures budget discipline by imposing fiscal constraints that prevent overspending and resource misallocation. This approach enhances efficiency by reducing the time and complexity involved in gathering input from multiple departments.

Benefits of Bottom-Up Budgeting

Bottom-up budgeting enhances accuracy by incorporating detailed input from individual departments, ensuring realistic financial planning aligned with operational needs. This approach fosters greater employee engagement and accountability, as team members contribute directly to budget estimates and resource allocation. Additionally, bottom-up budgeting improves flexibility and responsiveness to changing business conditions by leveraging frontline insights and data.

Challenges of Implementing Top-Down Budgets

Top-down budgeting often faces challenges such as lack of employee buy-in and unrealistic target setting due to limited input from lower-level managers. This approach can lead to misaligned priorities and reduced motivation, as frontline insights are overlooked during the budget formulation. Consequently, organizations may encounter difficulties in execution and variance management when budgets do not reflect operational realities.

Common Issues with Bottom-Up Budgeting

Bottom-up budgeting often faces challenges such as time-consuming data collection from multiple departments and difficulties in aligning individual budgets with overall organizational goals. This method can lead to inflated estimates due to departmental bias, resulting in budgetary inefficiencies and potential resource misallocation. Collaboration issues and the complexity of consolidating diverse inputs further complicate accurate financial forecasting in bottom-up budgeting.

When to Use Top-Down Budgeting

Top-down budgeting is ideal for organizations with centralized decision-making structures where quick alignment with strategic goals is essential. This approach is beneficial during periods of financial constraint or economic uncertainty when tight budget control is necessary. Corporations aiming to maintain consistent cost management across multiple departments often prefer top-down budgeting to ensure adherence to overall financial targets.

Ideal Scenarios for Bottom-Up Budgeting

Bottom-up budgeting excels in scenarios where detailed department-level input is critical, such as in complex organizations with diverse activities requiring precise cost allocation. This approach fosters employee engagement and accountability by involving frontline managers in the budgeting process, leading to more accurate and realistic financial forecasts. Industries with rapidly changing environments or project-based operations benefit significantly from bottom-up budgeting's adaptability and granular control.

Choosing the Right Budgeting Method for Your Organization

Top-down budgeting streamlines decision-making by setting financial targets at the executive level, ensuring alignment with overall corporate strategy and expediting implementation. Bottom-up budgeting fosters detailed input from departmental managers, enhancing accuracy and employee engagement by incorporating ground-level insights into resource allocation. Selecting the appropriate budgeting method depends on organizational size, culture, and strategic priorities, with hybrid approaches often balancing control and flexibility for optimal financial planning.

Important Terms

Allocative control

Allocative control in budgeting focuses on efficiently distributing resources to align with organizational goals, where top-down budgeting involves senior management setting fixed budget limits based on strategic priorities, ensuring centralized control over resource allocation. In contrast, bottom-up budgeting gathers detailed input from lower-level managers, promoting more accurate, flexible resource allocation through collective insights but requires thorough coordination to prevent misalignment with overarching objectives.

Participative forecasting

Participative forecasting enhances accuracy by integrating insights from bottom-up budgeting while aligning with strategic objectives set through top-down budgeting.

Incremental budgeting

Incremental budgeting adjusts previous budgets by small amounts, contrasting with top-down budgeting where management sets limits, and bottom-up budgeting where departments propose budgets based on detailed needs.

Managerial autonomy

Managerial autonomy is enhanced in bottom-up budgeting by enabling managers to participate in budget creation, while top-down budgeting limits autonomy through centralized budget directives.

Zero-based budgeting (ZBB)

Zero-based budgeting (ZBB) requires detailed justification of all expenses from a zero base, contrasting with top-down budgeting where leadership sets budgets, and bottom-up budgeting where departments propose budgets based on operational needs.

Resource allocation

Top-down budgeting allocates resources based on strategic priorities set by senior management, while bottom-up budgeting allocates resources through detailed input from lower-level departments reflecting operational needs.

Budgetary slack

Budgetary slack often occurs more frequently in bottom-up budgeting as employees intentionally underestimate revenues or overestimate costs, while top-down budgeting typically minimizes slack through centralized control and fixed targets.

Centralized planning

Centralized planning emphasizes top-down budgeting where organizational goals drive resource allocation, contrasting with bottom-up budgeting which aggregates input from lower levels for a more flexible financial plan.

Decentralized input

Decentralized input enhances accuracy and accountability in bottom-up budgeting by incorporating detailed insights from lower organizational levels, contrasting with top-down budgeting's centralized directive approach.

Fiscal accountability

Fiscal accountability ensures responsible allocation and monitoring of public funds, with top-down budgeting emphasizing centralized control and strategic alignment, while bottom-up budgeting fosters participatory decision-making and accurate resource estimation from operational levels. Balancing these approaches enhances transparency, efficient resource utilization, and stakeholder engagement in financial management.

Top-down budgeting vs Bottom-up budgeting Infographic

moneydif.com

moneydif.com