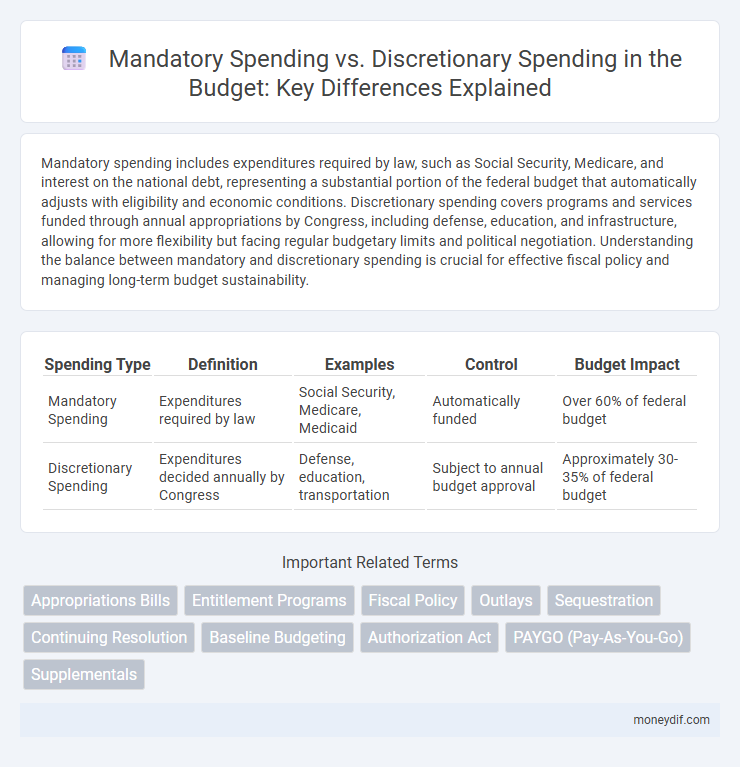

Mandatory spending includes expenditures required by law, such as Social Security, Medicare, and interest on the national debt, representing a substantial portion of the federal budget that automatically adjusts with eligibility and economic conditions. Discretionary spending covers programs and services funded through annual appropriations by Congress, including defense, education, and infrastructure, allowing for more flexibility but facing regular budgetary limits and political negotiation. Understanding the balance between mandatory and discretionary spending is crucial for effective fiscal policy and managing long-term budget sustainability.

Table of Comparison

| Spending Type | Definition | Examples | Control | Budget Impact |

|---|---|---|---|---|

| Mandatory Spending | Expenditures required by law | Social Security, Medicare, Medicaid | Automatically funded | Over 60% of federal budget |

| Discretionary Spending | Expenditures decided annually by Congress | Defense, education, transportation | Subject to annual budget approval | Approximately 30-35% of federal budget |

Understanding Mandatory vs Discretionary Spending

Mandatory spending accounts for approximately two-thirds of the U.S. federal budget, covering essential programs like Social Security, Medicare, and Medicaid, which are required by law. Discretionary spending, making up the remaining one-third, funds government agencies and programs subject to annual congressional approval, including defense, education, and transportation. Recognizing the distinction between these two budget categories is crucial for effective fiscal policy and long-term economic planning.

Key Differences Between Mandatory and Discretionary Budgets

Mandatory spending accounts for roughly 60% of the U.S. federal budget, encompassing entitlement programs like Social Security, Medicare, and Medicaid, which are legally obligated expenditures based on eligibility criteria. Discretionary spending, making up about 30-35% of the budget, includes funding allocated through annual appropriations bills for defense, education, and transportation, allowing policymakers flexibility in allocation decisions. Key differences lie in the fact that mandatory spending is automatically enacted and not subject to annual review, whereas discretionary spending requires periodic congressional approval and can be adjusted based on fiscal priorities.

Major Programs Funded by Mandatory Spending

Mandatory spending covers major programs such as Social Security, Medicare, and Medicaid, which together consume over 60% of the federal budget. These programs provide essential benefits to retirees, low-income families, and individuals with disabilities, ensuring financial security and access to healthcare. Unlike discretionary spending, mandatory spending is set by eligibility rules and benefit formulas rather than annual appropriations.

Examples of Discretionary Spending in the Federal Budget

Discretionary spending in the federal budget includes funding for defense programs such as the Department of Defense, education initiatives like the Department of Education grants, and transportation projects managed by the Department of Transportation. Other key areas encompass research and development through agencies such as the National Institutes of Health and infrastructure investments in public works. These allocations contrast with mandatory spending, which primarily covers entitlement programs like Social Security and Medicare.

How Mandatory Spending Impacts Long-Term Budget Planning

Mandatory spending, which includes entitlement programs like Social Security, Medicare, and Medicaid, constitutes a significant and growing portion of the federal budget, limiting flexibility in long-term budget planning. This fixed expenditure reduces the government's ability to allocate resources toward discretionary programs such as defense, education, and infrastructure, potentially constraining economic growth and innovation. Rising mandatory spending driven by demographic shifts and healthcare costs increases long-term fiscal pressures, necessitating policy reforms to ensure sustainable budget management.

The Role of Congress in Discretionary Budget Allocation

Congress plays a critical role in discretionary budget allocation by reviewing, modifying, and approving annual appropriations bills that determine funding levels for government programs and agencies. Unlike mandatory spending, which is pre-determined by existing laws such as entitlement programs and interest on debt, discretionary spending is subject to congressional priorities and political negotiation each fiscal year. Through the budgeting and appropriations process, Congress exercises control over defense, education, infrastructure, and other vital sectors, shaping national policy and resource distribution.

Trends and Projections in Mandatory Spending

Mandatory spending, primarily driven by entitlement programs such as Social Security, Medicare, and Medicaid, has exhibited a steady upward trend, now accounting for nearly two-thirds of the federal budget. Projections indicate that mandatory spending will continue to rise due to factors like an aging population and escalating healthcare costs, potentially reaching 75% of total federal expenditures within the next decade. This growth challenges budgetary flexibility, as discretionary spending faces constraints amid increasing obligations mandated by existing law.

Challenges in Reducing Mandatory Expenditures

Mandatory spending, which includes entitlement programs like Social Security, Medicare, and Medicaid, constitutes a significant portion of the federal budget and is driven by eligibility criteria rather than annual appropriations. Challenges in reducing mandatory expenditures stem from the political difficulty of reforming programs with widespread public support and legal obligations, as well as the demographic pressures of an aging population increasing benefit payments. Efforts to cut mandatory spending often face resistance due to the essential nature of these benefits, making significant reductions complex and contentious.

Policy Debates: Reforms for Mandatory and Discretionary Spending

Policy debates on mandatory and discretionary spending center on restructuring entitlement programs like Social Security and Medicare to contain long-term costs while preserving benefits. Proposals emphasize adjusting eligibility ages, benefit formulas, and implementing means-testing to curb mandatory spending growth. Discretionary spending reforms focus on prioritizing defense and non-defense programs, promoting efficiency, and reallocating funds toward infrastructure and education to optimize budget impact.

The Effect of Mandatory and Discretionary Spending on National Debt

Mandatory spending, which includes entitlement programs like Social Security and Medicare, automatically consumes a significant portion of the federal budget, contributing to rising national debt when revenues fall short. Discretionary spending, controlled through annual appropriations by Congress, covers defense, education, and infrastructure but represents a smaller but flexible portion of the budget. The persistent growth in mandatory spending combined with limited discretionary spending adjustments intensifies budget deficits, accelerating the accumulation of national debt.

Important Terms

Appropriations Bills

Appropriations bills primarily fund discretionary spending, covering areas such as defense, education, and transportation, while mandatory spending, including Social Security, Medicare, and interest on debt, is governed by existing statutes and not subject to annual appropriations. The balance between these two spending categories significantly impacts federal budget decisions and fiscal policy.

Entitlement Programs

Entitlement programs such as Social Security, Medicare, and Medicaid compose the majority of mandatory spending, requiring government funding based on eligibility criteria established by law rather than annual appropriations. Discretionary spending, controlled through the congressional budget process, primarily covers defense, education, and transportation, allowing adjustments each fiscal year unlike the fixed nature of entitlement obligations.

Fiscal Policy

Fiscal policy involves government decisions on tax and spending to influence the economy, with mandatory spending covering essential programs like Social Security and Medicare that are legally required, while discretionary spending funds non-essential programs such as defense and education, subject to annual appropriation by Congress. Understanding the balance between mandatory and discretionary spending is crucial for assessing budget deficits, managing national debt, and implementing effective economic stimulus or austerity measures.

Outlays

Outlays for mandatory spending, driven primarily by entitlement programs like Social Security, Medicare, and Medicaid, constitute a significant portion of the federal budget and operate under statutory requirements. Discretionary spending outlays, controlled through annual appropriations by Congress, fund areas such as defense, education, and transportation, allowing more flexibility but subject to fiscal constraints.

Sequestration

Sequestration refers to automatic, across-the-board cuts to both mandatory and discretionary spending as a fiscal enforcement mechanism to control federal budget deficits. Mandatory spending, including entitlement programs like Social Security and Medicare, constitutes the largest portion of the federal budget and faces limited sequestration cuts compared to discretionary spending, which covers defense and non-defense agencies and is more flexible in budget reductions.

Continuing Resolution

Continuing Resolutions (CRs) primarily affect discretionary spending by temporarily funding government operations at current levels when annual appropriations bills are delayed, while mandatory spending, including entitlement programs like Social Security and Medicare, remains unaffected due to its automatic funding structure. CRs help prevent government shutdowns by maintaining discretionary spending but do not alter the fixed nature of mandatory spending obligations.

Baseline Budgeting

Baseline budgeting involves projecting future government spending based on current funding levels, distinguishing mandatory spending--such as Social Security and Medicare, which are required by law--from discretionary spending, which funds programs like defense and education subject to annual appropriations. This method allows policymakers to identify spending trends and assess budgetary impacts by separating fixed obligations from adjustable expenditures.

Authorization Act

The Authorization Act establishes legal guidelines for federal programs and spending levels, distinguishing between mandatory spending--such as entitlement programs like Social Security and Medicare, which are set by law and do not require annual approval--and discretionary spending, which funds government agencies and programs subject to annual appropriations by Congress. Understanding the nuances within Authorization Acts is crucial for analyzing the budgetary control and fiscal policy implications related to mandatory and discretionary expenditures.

PAYGO (Pay-As-You-Go)

PAYGO (Pay-As-You-Go) is a budget enforcement mechanism requiring new mandatory spending or tax cuts to be offset by equivalent spending cuts or revenue increases, ensuring deficit neutrality. This rule primarily affects mandatory spending programs like Social Security and Medicare, while discretionary spending, which is set through annual appropriations, is typically exempt from PAYGO constraints.

Supplementals

Supplemental appropriations increase funding beyond initial budget allocations, often targeting mandatory spending categories such as Social Security and Medicare that require automatic funding. These funds contrast with discretionary spending, which is determined annually by Congress through appropriations bills and is subject to change based on supplemental requests.

mandatory spending vs discretionary spending Infographic

moneydif.com

moneydif.com