A contingency fund is specifically set aside to address unexpected expenses or emergencies that arise during a project or fiscal period, providing immediate liquidity for unforeseen costs. In contrast, a reserve fund is accumulated over time to support long-term financial stability and planned future expenses, often serving as a safety net for ongoing operational needs or capital projects. Understanding the distinct purposes of contingency and reserve funds is essential for effective budget management and risk mitigation.

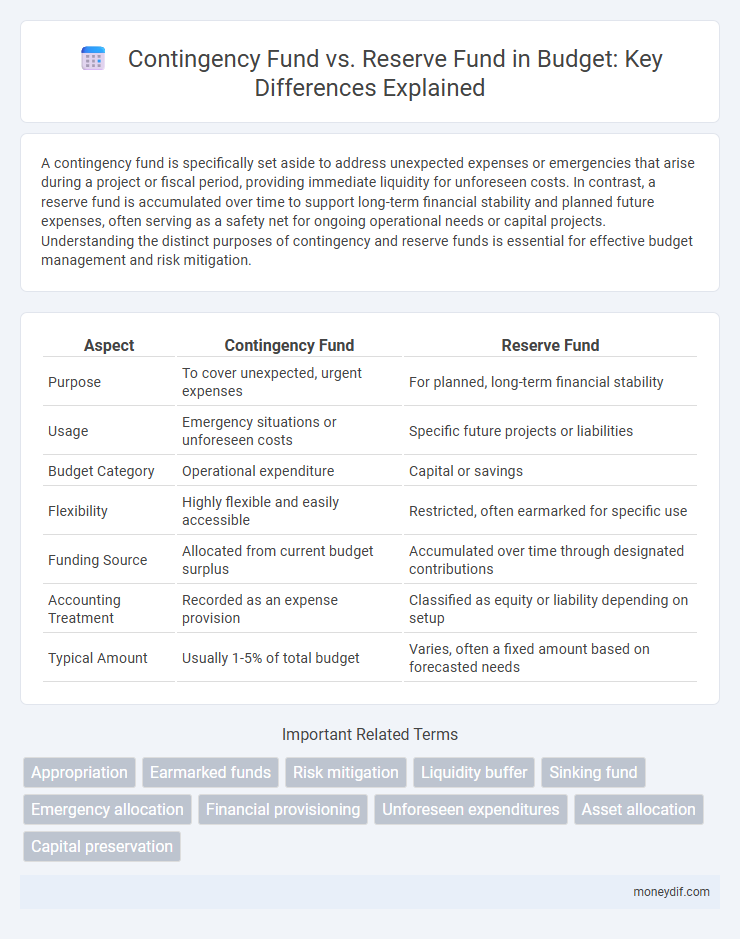

Table of Comparison

| Aspect | Contingency Fund | Reserve Fund |

|---|---|---|

| Purpose | To cover unexpected, urgent expenses | For planned, long-term financial stability |

| Usage | Emergency situations or unforeseen costs | Specific future projects or liabilities |

| Budget Category | Operational expenditure | Capital or savings |

| Flexibility | Highly flexible and easily accessible | Restricted, often earmarked for specific use |

| Funding Source | Allocated from current budget surplus | Accumulated over time through designated contributions |

| Accounting Treatment | Recorded as an expense provision | Classified as equity or liability depending on setup |

| Typical Amount | Usually 1-5% of total budget | Varies, often a fixed amount based on forecasted needs |

Understanding Contingency Funds and Reserve Funds

Contingency funds are allocated within a budget to cover unexpected expenses or emergencies, ensuring financial stability without disrupting planned activities. Reserve funds, often larger and separate, serve as a safeguard for long-term liabilities and strategic opportunities, maintaining organizational resilience. Proper management of these funds enhances fiscal responsibility and mitigates financial risks effectively.

Key Differences Between Contingency and Reserve Funds

Contingency funds are allocated for unexpected expenses that arise during a budget period, providing financial flexibility for unforeseen events. Reserve funds are set aside for planned future expenses or long-term financial goals, ensuring stability and readiness for scheduled or anticipated needs. The key difference lies in contingency funds addressing immediate emergencies, while reserve funds are intended for strategic, future-oriented financial planning.

Purpose and Objectives of Contingency Funds

Contingency funds are allocated specifically to address unforeseen expenses and emergencies that arise during a budget period, ensuring financial stability without disrupting planned expenditures. Their primary purpose is to provide a safety net for unexpected risks, such as natural disasters, economic shocks, or urgent repairs, maintaining operational continuity. Unlike reserve funds, which are accumulated for long-term projects or future liabilities, contingency funds focus on immediate and short-term financial uncertainties.

Purpose and Objectives of Reserve Funds

Reserve funds are specifically established to address long-term financial needs, such as major repairs, replacements, or unforeseen capital expenditures, ensuring organizational stability. Their purpose is to provide a financial safety net that supports sustainability and mitigates risks associated with asset depreciation and economic fluctuations. Unlike contingency funds, which cover immediate or unexpected expenses, reserve funds are strategic savings aimed at future planned obligations and capital projects.

How Contingency Funds Support Budget Flexibility

Contingency funds play a critical role in supporting budget flexibility by providing readily available financial resources to address unforeseen expenses or emergencies without disrupting planned allocations. Unlike reserve funds, which are often earmarked for specific long-term projects or obligations, contingency funds enable organizations to respond swiftly to unexpected changes in costs or economic conditions, maintaining operational stability. This adaptability enhances overall fiscal management, ensuring that immediate budgetary needs are met without compromising strategic financial goals.

Strategic Role of Reserve Funds in Financial Planning

Reserve funds serve as a critical strategic component in financial planning, providing a dedicated pool of resources to address unforeseen expenses or economic downturns. Unlike contingency funds, which are typically short-term and specific, reserve funds are built over time to ensure long-term financial stability and support planned capital investments. Effective management of reserve funds enhances organizational resilience by safeguarding against financial volatility and enabling sustained operational performance.

Advantages and Limitations of Contingency Funds

Contingency funds provide immediate financial resources to address unforeseen expenses without requiring prior approval, enhancing organizational flexibility during emergencies. However, their limitations include restricted usage strictly for unexpected events and potential mismanagement if not monitored, which can lead to inadequate budgeting for planned reserves. Unlike reserve funds, contingency funds are typically smaller and depleted quickly, necessitating careful planning to avoid operational disruptions.

Advantages and Limitations of Reserve Funds

Reserve funds provide a financial safety net by setting aside resources for future expenses or emergencies, ensuring budget stability and reducing the need for sudden borrowing. They enhance fiscal discipline by promoting long-term planning but may limit immediate cash flow availability, potentially restricting operational flexibility. Unlike contingency funds, which address unforeseen short-term needs, reserve funds are typically earmarked for specific purposes, creating constraints on their usage.

Best Practices for Managing Contingency and Reserve Funds

Effective management of contingency and reserve funds involves clearly defining their purposes: contingency funds address unexpected expenses, while reserve funds support long-term financial stability. Best practices include regularly reviewing fund adequacy based on risk assessments, maintaining transparent documentation, and ensuring separate accounting to prevent fund commingling. Organizations should also establish approval protocols for fund usage to maintain accountability and align with strategic financial planning.

Choosing the Right Fund for Your Organization’s Budget

Contingency funds are allocated for unexpected expenses during the fiscal year, typically covering emergencies or sudden financial shortfalls, while reserve funds are set aside for long-term financial stability and planned future investments. Selecting the right fund depends on your organization's risk management strategy, cash flow predictability, and financial goals, with contingency funds offering flexibility for immediate needs and reserve funds supporting sustainable growth. Analyzing past financial volatility and forecasting future capital requirements ensures optimal allocation between contingency and reserve funds for budget resilience.

Important Terms

Appropriation

Appropriation in financial management involves allocating specific amounts from a contingency fund, which covers unforeseen expenses, while a reserve fund is designated for long-term financial stability and planned future obligations. Understanding the distinction ensures proper fund utilization, with contingency funds addressing immediate, unexpected costs and reserve funds serving as financial safeguards.

Earmarked funds

Earmarked funds are specific financial allocations designated for particular purposes, distinct from contingency funds, which cover unexpected expenses, and reserve funds, which are accumulated savings for future liabilities or investments. While contingency funds provide immediate financial flexibility during emergencies, reserve funds ensure long-term financial stability, and earmarked funds restrict spending to predetermined needs.

Risk mitigation

Risk mitigation involves allocating financial resources through contingency funds and reserve funds to address potential uncertainties in project management or business operations. Contingency funds are designated for identified risks with estimated costs, while reserve funds cover unforeseen risks, ensuring stability and continuity in financial planning.

Liquidity buffer

A liquidity buffer, crucial for financial stability, differs from a contingency fund or reserve fund by focusing on readily accessible cash or liquid assets to meet short-term obligations or unexpected cash flow needs. While contingency and reserve funds are commonly earmarked for specific future liabilities or emergencies, the liquidity buffer ensures immediate liquidity to maintain operational continuity without asset liquidation delays.

Sinking fund

A sinking fund is a dedicated financial account used to gradually repay debt or replace assets, distinct from a contingency fund which covers unexpected expenses, and a reserve fund primarily set aside for long-term financial stability and planned capital expenditures. Unlike contingency funds that address unforeseen costs, sinking funds are pre-planned and structured, while reserve funds maintain organizational liquidity for future obligations or economic uncertainties.

Emergency allocation

Emergency allocation ensures immediate access to funds during unforeseen events, typically drawn from a contingency fund designed for short-term, unpredictable expenses. Reserve funds, by contrast, are accumulated long-term savings intended to support sustained financial stability during extended emergencies or revenue shortfalls.

Financial provisioning

Financial provisioning involves allocating resources to manage future uncertainties, with contingency funds specifically set aside for unforeseen emergencies, while reserve funds are accumulated for planned, long-term financial stability and specific purposes. Effective financial management distinguishes contingency funds as flexible, immediate-use capital, whereas reserve funds represent strategic savings to support sustained operations or major investments.

Unforeseen expenditures

Unforeseen expenditures are typically covered by a contingency fund, which is specifically allocated for unexpected costs during project execution, ensuring financial stability without affecting planned budgets. Reserve funds, on the other hand, serve as a broader financial buffer for long-term risks and uncertainties, often retained for strategic purposes beyond immediate project-related contingencies.

Asset allocation

Asset allocation plays a critical role in managing both contingency funds and reserve funds by balancing risk and liquidity to ensure financial stability during emergencies or unforeseen expenses. Contingency funds typically require highly liquid, low-risk assets for immediate access, whereas reserve funds may allow for a more diversified asset allocation to optimize long-term growth and security.

Capital preservation

Capital preservation focuses on maintaining the principal amount of investment, crucial for both contingency funds and reserve funds, which act as financial safety nets. Contingency funds are liquid assets set aside for unexpected emergencies, while reserve funds are accumulated over time to cover planned future expenses or liabilities, both ensuring long-term financial stability.

contingency fund vs reserve fund Infographic

moneydif.com

moneydif.com