Performance budgeting allocates funds based on measurable outcomes and efficiency, ensuring resources directly support strategic goals and improve service delivery. Input-based budgeting focuses on the amount of resources allocated, such as personnel or materials, without directly linking expenditures to results. Shifting to performance budgeting enhances accountability and optimizes public sector spending by prioritizing effectiveness over mere resource allocation.

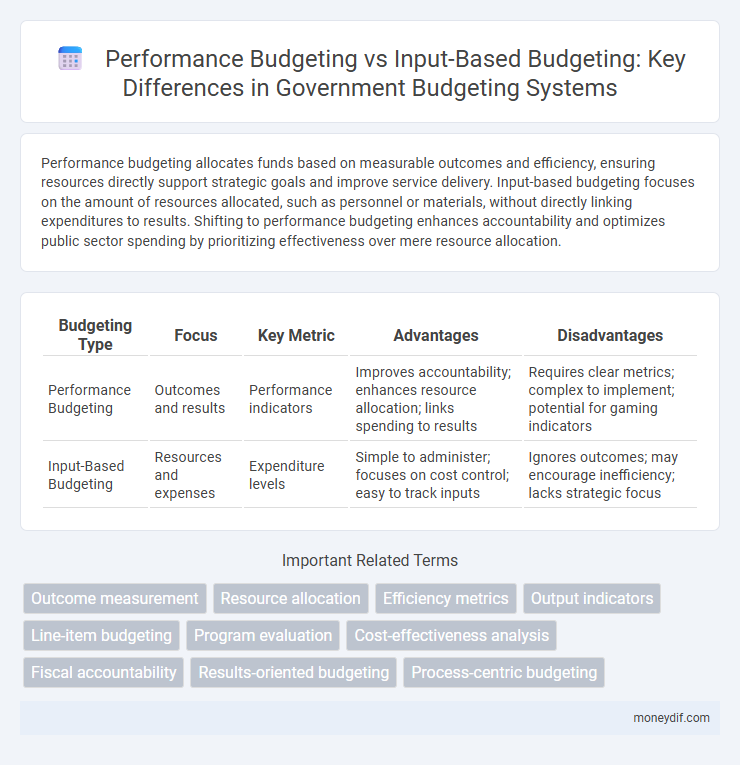

Table of Comparison

| Budgeting Type | Focus | Key Metric | Advantages | Disadvantages |

|---|---|---|---|---|

| Performance Budgeting | Outcomes and results | Performance indicators | Improves accountability; enhances resource allocation; links spending to results | Requires clear metrics; complex to implement; potential for gaming indicators |

| Input-Based Budgeting | Resources and expenses | Expenditure levels | Simple to administer; focuses on cost control; easy to track inputs | Ignores outcomes; may encourage inefficiency; lacks strategic focus |

Introduction to Performance Budgeting and Input-Based Budgeting

Performance budgeting allocates resources based on measurable outcomes and results, emphasizing efficiency and effectiveness in public spending. Input-based budgeting focuses on the allocation of funds according to resources like personnel, equipment, and operational costs without directly linking expenditures to achieved results. This approach allows governments to track spending inputs but may lack accountability for actual performance outcomes.

Core Principles of Performance Budgeting

Performance budgeting focuses on allocating resources based on measurable outcomes and effectiveness, emphasizing accountability and results-driven management. Core principles include setting clear objectives, linking budget allocations to performance targets, and regularly monitoring and evaluating program achievements. This approach contrasts with input-based budgeting, which primarily tracks the quantity of resources used rather than the impact generated.

Fundamental Concepts of Input-Based Budgeting

Input-based budgeting allocates resources based on predefined inputs such as labor, materials, and capital, emphasizing the costs required to perform activities rather than outcomes. This method prioritizes controlling expenditures and ensuring budget compliance by detailing specific resource requirements. It contrasts with performance budgeting, which focuses on results and efficiency, making input-based budgeting more process- and cost-driven.

Key Differences Between Performance and Input-Based Budgeting

Performance budgeting allocates funds based on measurable outcomes and results, emphasizing efficiency and accountability in achieving specific goals. Input-based budgeting focuses on the distribution of resources according to predefined categories like personnel, materials, and operational costs, irrespective of final outputs. The key difference lies in performance budgeting's outcome-driven approach versus input-based budgeting's emphasis on resource allocation without directly linking expenditures to results.

Advantages of Performance Budgeting

Performance budgeting enhances resource allocation by linking funds directly to measurable outcomes, improving accountability and efficiency in public sector management. It enables policymakers to prioritize programs with higher impact, fostering data-driven decision-making and better justification for expenditures. This approach promotes transparency and continuous performance improvement by emphasizing results rather than mere input tracking.

Drawbacks of Performance Budgeting

Performance budgeting can obscure the allocation process by focusing on outcomes rather than detailed resource inputs, sometimes leading to misinterpretation of efficiency and effectiveness. It often relies on complex metrics that are difficult to quantify accurately, causing challenges in measurement and accountability. Furthermore, this approach may neglect the importance of inputs during the budgeting phase, potentially resulting in underfunded essential activities despite favorable performance indicators.

Benefits of Input-Based Budgeting

Input-based budgeting enhances financial control by allocating resources according to specific cost elements, ensuring transparency in expenditure tracking. This method simplifies budget preparation and monitoring by focusing on measurable inputs like labor hours and material costs. Organizations using input-based budgeting can achieve greater predictability and reduce the risk of overspending compared to performance-based approaches.

Limitations of Input-Based Budgeting

Input-based budgeting often results in inefficient allocation of resources due to its focus on expenditures rather than outcomes, limiting the ability to measure program effectiveness. This method encourages maintaining or increasing inputs without assessing whether they translate into improved performance or service delivery. Consequently, input-based budgeting can lead to resource waste and reduced accountability in public sector financial management.

Real-World Examples: Performance vs Input-Based Budgeting

Performance budgeting in the United States allocates funds based on measurable outcomes, such as student graduation rates influencing education budgets in Texas. Input-based budgeting, exemplified by Brazil's federal government, focuses on historical expenditure and resource allocation without directly linking to performance results. The shift toward performance budgeting enables governments like South Korea to improve public service efficiency by tying financial resources to quantifiable achievements rather than mere input levels.

Choosing the Right Budgeting Approach for Your Organization

Performance budgeting prioritizes outcomes and results, allowing organizations to allocate resources efficiently based on measurable achievements and strategic goals. Input-based budgeting focuses on allocating funds according to fixed categories, such as salaries or materials, without directly linking spending to performance or impact. Choosing the right budgeting approach depends on your organization's priorities: use performance budgeting to enhance accountability and decision-making, or input-based budgeting for simplicity and control over expenditures.

Important Terms

Outcome measurement

Outcome measurement focuses on assessing the effectiveness of programs by evaluating results and impacts rather than merely tracking resources spent, making it central to performance budgeting systems. Performance budgeting allocates funds based on achieved outcomes and goals, contrasting with input-based budgeting, which emphasizes the quantity of resources used regardless of results.

Resource allocation

Resource allocation in performance budgeting focuses on linking funds to measurable outcomes and efficiency, optimizing expenditure based on program results, whereas input-based budgeting allocates resources primarily according to predefined inputs like staffing or materials, often without direct consideration of achieved performance metrics. Performance budgeting enhances accountability and strategic use of resources by emphasizing outputs and outcomes, contrasting with the more static, input-focused approach of traditional budgeting systems.

Efficiency metrics

Efficiency metrics in performance budgeting focus on measuring outcomes relative to resources used, emphasizing cost-effectiveness and value delivery, while input-based budgeting centers on allocating funds based on predefined resource quantities without directly assessing output impact. Performance budgeting enhances fiscal responsibility by linking expenditures to measurable results, whereas input-based budgeting may lead to resource misallocation due to its focus on inputs rather than outcome efficiency.

Output indicators

Output indicators measure the actual results or outcomes achieved from budget allocations, enabling performance budgeting to link financial resources directly to specific performance goals. In contrast, input-based budgeting focuses on the amount of resources allocated without directly assessing the effectiveness or efficiency of those expenditures.

Line-item budgeting

Line-item budgeting focuses on categorizing expenses by specific items, which simplifies tracking but often lacks direct links to outcomes, contrasting with performance budgeting that allocates funds based on measurable results and efficiency. Input-based budgeting emphasizes expenditures on resources like personnel and materials, whereas performance budgeting prioritizes outputs and outcomes to enhance accountability and resource optimization.

Program evaluation

Program evaluation strengthens performance budgeting by systematically assessing the outcomes and effectiveness of government programs, enabling resource allocation based on measurable results rather than mere input expenditures. Performance budgeting emphasizes outputs and outcomes, contrasting with input-based budgeting that focuses primarily on financial inputs without directly linking them to program performance or impact.

Cost-effectiveness analysis

Cost-effectiveness analysis reveals that performance budgeting allocates resources based on measurable outcomes, enhancing efficiency and accountability compared to input-based budgeting, which focuses solely on resource quantities without evaluating results. By linking expenditures to performance metrics, performance budgeting facilitates better decision-making and optimized public sector spending.

Fiscal accountability

Fiscal accountability improves significantly with performance budgeting by linking resource allocation to measurable outcomes, unlike input-based budgeting which focuses primarily on resource quantities without assessing efficiency or results. Performance budgeting enables government entities to justify expenditures based on achieved results, fostering transparency and strategic use of public funds.

Results-oriented budgeting

Results-oriented budgeting emphasizes allocating resources based on measurable outcomes and performance indicators, contrasting with input-based budgeting which focuses on allocating funds according to historical spending and resource inputs. Performance budgeting integrates results-oriented principles by linking budget decisions directly to program effectiveness and goal achievement, enhancing accountability and strategic resource management.

Process-centric budgeting

Process-centric budgeting focuses on allocating resources based on key operational workflows, enhancing efficiency and goal achievement compared to input-based budgeting that prioritizes resource quantities without outcome emphasis. Performance budgeting integrates metrics and results, aligning closely with process-centric budgeting by linking funding to measurable outputs and process effectiveness.

performance budgeting vs input-based budgeting Infographic

moneydif.com

moneydif.com