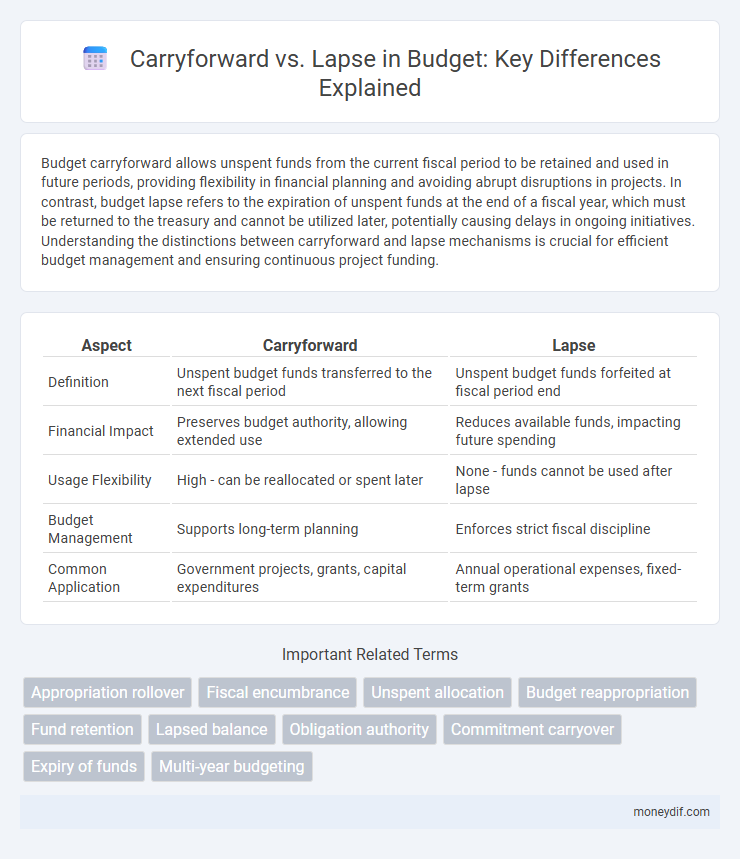

Budget carryforward allows unspent funds from the current fiscal period to be retained and used in future periods, providing flexibility in financial planning and avoiding abrupt disruptions in projects. In contrast, budget lapse refers to the expiration of unspent funds at the end of a fiscal year, which must be returned to the treasury and cannot be utilized later, potentially causing delays in ongoing initiatives. Understanding the distinctions between carryforward and lapse mechanisms is crucial for efficient budget management and ensuring continuous project funding.

Table of Comparison

| Aspect | Carryforward | Lapse |

|---|---|---|

| Definition | Unspent budget funds transferred to the next fiscal period | Unspent budget funds forfeited at fiscal period end |

| Financial Impact | Preserves budget authority, allowing extended use | Reduces available funds, impacting future spending |

| Usage Flexibility | High - can be reallocated or spent later | None - funds cannot be used after lapse |

| Budget Management | Supports long-term planning | Enforces strict fiscal discipline |

| Common Application | Government projects, grants, capital expenditures | Annual operational expenses, fixed-term grants |

Understanding Budget Carryforward and Lapse

Budget carryforward allows unspent funds from a prior fiscal period to be retained and used in the next period, enhancing financial flexibility and project continuity. In contrast, budget lapse occurs when unused funds expire at the end of a fiscal period and are returned to the treasury or funding source, often leading to stricter spending deadlines. Understanding the rules and implications of carryforward and lapse is crucial for effective budget management and maximizing resource utilization.

Key Differences Between Carryforward and Lapse

Carryforward allows unspent budget funds to be retained and used in future fiscal periods, enhancing financial flexibility and continuity. Lapse occurs when unutilized budget allocations expire at the end of a fiscal period, resulting in the automatic forfeiture of these funds. The key difference lies in carryforward's permission-driven extension of fund usage, whereas lapse enforces a strict deadline that prevents fund rollover.

Pros and Cons of Budget Carryforward

Budget carryforward allows unspent funds to be allocated to future fiscal periods, enabling flexibility in project completion and strategic planning. It helps prevent rushed spending at period-end but requires stringent oversight to avoid misuse or budget inflation. However, reliance on carryforwards may reduce the urgency of efficient budget utilization within the current period.

Implications of Budget Lapse

Budget lapse occurs when allocated funds remain unspent by the fiscal year-end, resulting in their expiration and removal from available resources. This lapse can lead to project delays, reduced operational efficiency, and missed opportunities for reinvestment in priority areas. Understanding the implications of budget lapse is essential for optimizing financial planning and ensuring maximum utilization of public or organizational funds.

Impact on Financial Planning and Forecasting

Carryforward provisions enable unspent budget allocations to be utilized in subsequent fiscal periods, providing flexibility and improving accuracy in financial forecasting. Lapse policies require unused funds to be forfeited at the end of the budget cycle, potentially leading to underutilization of resources and conservative spending projections. Understanding the carryforward versus lapse dynamic is crucial for precise cash flow management and long-term financial planning in both public and private sectors.

Legal and Regulatory Considerations

Carryforward provisions allow unspent budget allocations to be used in subsequent fiscal periods, subject to specific legal frameworks and regulatory approvals designed to prevent misuse of public funds. Lapse occurs when unutilized budget amounts expire at the end of the fiscal year, ensuring strict compliance with statutory expenditure limits and financial accountability. Regulatory mandates often define the criteria and documentation required to validate carryforwards, aligning with public sector financial management standards and audit requirements.

Best Practices for Managing Unspent Funds

Effective management of unspent funds involves analyzing carryforward policies to optimize budget utilization while preventing lapses that reduce available resources. Implementing clear guidelines for timely approval and documentation ensures authorized retention of excess funds for future use, enhancing fiscal responsibility. Regular monitoring and transparent reporting enable organizations to balance spending needs with regulatory compliance, maximizing financial efficiency.

Common Causes of Budget Lapses

Budget lapses commonly occur due to unspent allocations from projects delayed or canceled, resulting in unused funds that cannot be carried forward. Inadequate planning and unrealistic timelines often lead to lapses when expenses are not incurred within the fiscal year. Failure to submit timely expenditure reports or approval delays also contribute significantly to budget lapses, reducing funding efficiency.

Strategies to Maximize Carryforward Opportunities

To maximize carryforward opportunities, organizations should implement comprehensive budget tracking systems that identify unspent funds early, ensuring timely allocation for future use. Prioritizing detailed expenditure forecasts and maintaining clear documentation of carryforward policies helps prevent fund lapse and enhances financial flexibility. Strategic communication with stakeholders about carryforward rules and deadlines supports proactive decision-making and efficient resource management.

Case Studies: Carryforward vs. Lapse in Action

Case studies reveal that effective budget carryforward allows organizations to maximize resource utilization by reallocating unspent funds to future projects, enhancing financial flexibility and project continuity. In contrast, budgets that lapse result in the forfeiture of unutilized funds, often leading to constrained cash flow and missed opportunities for strategic investments. Analyzing sectors like government agencies and educational institutions illustrates how optimized carryforward policies drive improved fiscal management and operational efficiency.

Important Terms

Appropriation rollover

Appropriation rollover refers to the process where unspent government funds from a fiscal year are carried forward to the next period, enabling continued use without lapse. Unlike lapse, where unused appropriations expire and revert to the treasury, carryforward provisions allow agencies to maintain budget authority and ensure program continuity.

Fiscal encumbrance

Fiscal encumbrance ensures budgetary funds are reserved for specific obligations, allowing the carryforward of unspent appropriations into the next fiscal period to prevent lapsing of funds. This mechanism safeguards financial resources from expiration, maintaining accountability and enabling continued project funding without budgetary resets.

Unspent allocation

Unspent allocation refers to budgeted funds not utilized within the designated fiscal period, often subject to carryforward or lapse policies that determine their availability in subsequent periods. Carryforward allows these unused funds to be retained and used beyond the original timeframe, while lapse results in the automatic forfeiture of unspent amounts back to the treasury or allocating authority.

Budget reappropriation

Budget reappropriation allows unspent funds from a previous fiscal year to be redirected to new or ongoing projects, contrasting with lapse where unutilized budget allocations expire and return to the treasury. Understanding the distinction between carryforward authority and budget lapse is critical for effective public financial management and maximizing fiscal efficiency.

Fund retention

Fund retention policies directly impact whether unused budget amounts carry forward to the next fiscal period or lapse at year-end, affecting organizational financial flexibility and project continuity. Carryforward provisions enable funds to remain available for future expenditures, supporting long-term planning, while lapse rules enforce budget discipline by reclaiming unspent allocations.

Lapsed balance

A lapsed balance occurs when unused funds or credits from a previous period are not carried forward and instead expire, becoming unavailable for future use. Carryforward policies allow these balances to be retained and applied in subsequent periods, preventing the lapse and maximizing resource utilization.

Obligation authority

Obligation authority allows federal agencies to commit funds for expenses within a specified period, and unspent balances may either carry forward to the next fiscal year or lapse, depending on the type of funds and statutory provisions. Carryforward enables continued use of unobligated budget authority, while lapse results in cancellation of unused funds, impacting agency budgeting flexibility and project continuity.

Commitment carryover

Commitment carryover allows unspent budget allocations to be transferred to the following fiscal period, contrasting with lapsing funds that expire if not utilized within the designated timeframe. This practice supports fiscal flexibility and continuous project funding, preventing automatic budget depletion associated with carryforward limitations.

Expiry of funds

Expiry of funds occurs when unspent budget allocations fail to be utilized within the fiscal period, resulting in lapsing funds that revert to the treasury. In contrast, carryforward allows unused funds to be retained and used in subsequent periods, optimizing financial flexibility and project continuity.

Multi-year budgeting

Multi-year budgeting enables the allocation of funds across multiple fiscal years, improving financial planning and project continuity by allowing unspent funds to be carried forward rather than lapsing at year-end. Carryforward provisions prevent budget lapses by permitting the rollover of unused appropriations, thereby enhancing resource efficiency and minimizing waste in government and organizational financial management.

carryforward vs lapse Infographic

moneydif.com

moneydif.com