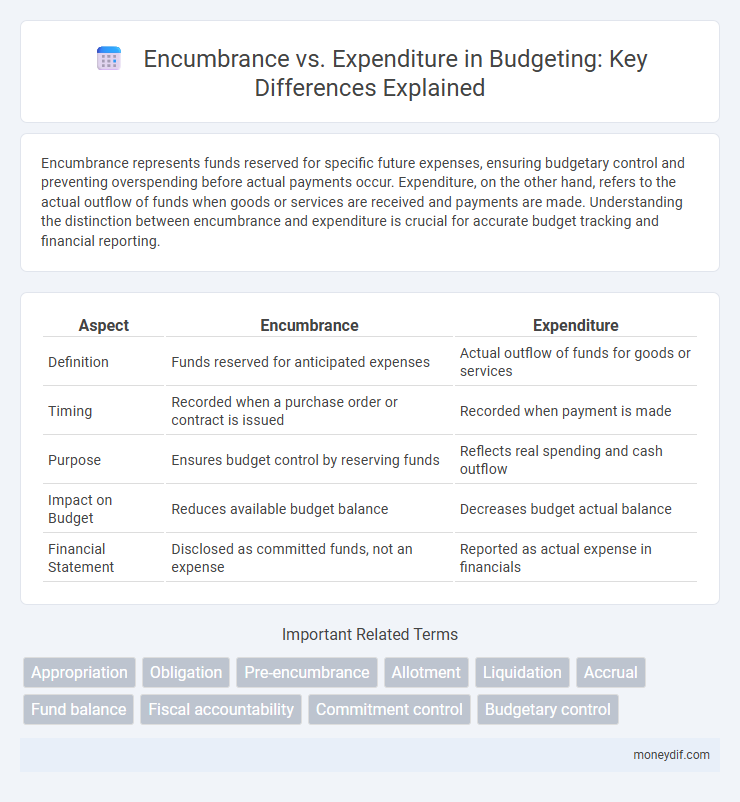

Encumbrance represents funds reserved for specific future expenses, ensuring budgetary control and preventing overspending before actual payments occur. Expenditure, on the other hand, refers to the actual outflow of funds when goods or services are received and payments are made. Understanding the distinction between encumbrance and expenditure is crucial for accurate budget tracking and financial reporting.

Table of Comparison

| Aspect | Encumbrance | Expenditure |

|---|---|---|

| Definition | Funds reserved for anticipated expenses | Actual outflow of funds for goods or services |

| Timing | Recorded when a purchase order or contract is issued | Recorded when payment is made |

| Purpose | Ensures budget control by reserving funds | Reflects real spending and cash outflow |

| Impact on Budget | Reduces available budget balance | Decreases budget actual balance |

| Financial Statement | Disclosed as committed funds, not an expense | Reported as actual expense in financials |

Definition of Encumbrance in Budgeting

Encumbrance in budgeting refers to the reservation of funds to cover anticipated expenditures, ensuring that budgeted amounts are allocated for specific commitments before actual spending occurs. It acts as a financial control tool to prevent overspending by accounting for purchase orders, contracts, or other obligations. This accounting practice provides a more accurate representation of available budget resources by reflecting future liabilities.

Understanding Expenditure in Financial Management

Expenditure in financial management represents the actual outflow of funds spent on goods, services, or obligations, reflecting realized costs rather than commitments. Unlike encumbrances, which reserve funds for future expenses, expenditure records the definitive usage of budget resources, impacting financial statements and cash flow. Accurate tracking of expenditures ensures effective budget control, compliance, and transparency in organizational financial operations.

Key Differences Between Encumbrance and Expenditure

Encumbrance represents funds reserved for future expenses, ensuring budget availability before actual spending occurs, while expenditure reflects the actual outflow of funds after goods or services are received. Encumbrances are recorded as commitments reducing available budget, but do not impact cash flow until they convert into expenditures. Understanding this distinction enhances budget control by separating planned obligations from realized payments, aiding in accurate financial management.

The Role of Encumbrance in Budget Planning

Encumbrance plays a critical role in budget planning by reserving funds for anticipated expenditures, ensuring that obligations are tracked before actual spending occurs. This process prevents overspending by holding aside portions of the budget for pending contracts or purchase orders, maintaining financial control and accountability. Effective use of encumbrance enhances fiscal discipline by providing a clearer picture of available resources versus committed funds.

How Expenditures Impact Budget Execution

Expenditures directly reduce available budget balances by consuming allocated funds, thereby influencing the accuracy of financial forecasting. Unlike encumbrances, which reserve funds for future obligations without immediate cash outflow, expenditures reflect actual cash disbursement impacting liquidity. Monitoring expenditures is critical for maintaining fiscal control and ensuring budget adherence throughout the execution phase.

Encumbrance Process: Step-by-Step Overview

The encumbrance process begins with the identification and reservation of budget funds to ensure availability before committing to expenditures. Departments submit purchase requisitions, which undergo approval workflows to validate appropriations against budget allocations. Once approved, encumbrances are recorded in the financial system, reducing the available budget and providing real-time tracking of committed funds prior to actual payment disbursement.

Tracking and Managing Expenditures

Encumbrance represents the reserved funds for anticipated expenses, allowing organizations to track commitments before actual spending occurs. Expenditure reflects the actual outflow of funds when goods or services are received and paid for, providing real-time financial status. Effective tracking and managing of encumbrances versus expenditures help maintain budget control and ensure accurate financial reporting.

Benefits of Using Encumbrances in Budget Control

Encumbrances provide a proactive mechanism for budget control by reserving funds for anticipated expenses, ensuring that spending aligns with approved budgets and preventing overspending. This approach enhances financial transparency and accountability by clearly tracking commitments before actual expenditures occur. Utilizing encumbrances improves fiscal discipline, aids in cash flow management, and facilitates more accurate forecasting within public and private sector budgeting processes.

Common Challenges with Encumbrance and Expenditure Reporting

Common challenges with encumbrance and expenditure reporting include discrepancies between recorded commitments and actual spending, leading to inaccurate budget tracking. Difficulty in real-time data synchronization often causes delayed financial insights, complicating cash flow management. Insufficient integration between encumbrance systems and expenditure reporting tools results in errors and inconsistent financial statements.

Best Practices for Accurate Budget Monitoring

Encumbrance represents reserved funds for future obligations, while expenditure reflects actual spending within a budget period. Best practices for accurate budget monitoring include regularly reconciling encumbrances against expenditures to prevent overspending and maintain fiscal discipline. Implementing real-time tracking systems and thorough documentation ensures transparency and supports efficient allocation of financial resources.

Important Terms

Appropriation

Appropriation refers to the authorized allocation of funds within a budget, serving as a financial limit against which encumbrances--commitments such as purchase orders--are recorded to reserve resources before actual expenses occur. Encumbrances reduce the available budget without reflecting cash outflow, whereas expenditures represent the actual disbursement of funds, directly reducing the appropriation balance.

Obligation

Obligation represents a legally binding commitment to disburse funds, often recorded as a formal order or contract, while encumbrance refers to the reservation of budgeted funds to cover these obligations before actual expenditures occur. Expenditure denotes the actual outflow of financial resources when goods are received or services rendered, marking the fulfillment of the obligation and release of the encumbered funds.

Pre-encumbrance

Pre-encumbrance represents a reserved budget amount for anticipated expenses before actual purchase orders are generated, distinguishing it from encumbrance, which reflects legally committed funds upon order placement, and expenditure, which denotes the actual disbursement of funds. Effective financial management in accounting systems relies on accurately tracking pre-encumbrance to prevent overspending and maintain budget control throughout procurement processes.

Allotment

Allotment represents the approved budget allocation for specific purposes within a financial period, serving as a control mechanism to prevent overspending before actual expenses occur. Encumbrance reflects commitments or obligations reserved from the allotment but not yet spent, while expenditure denotes the actual disbursement of funds, highlighting the distinction between planned versus incurred financial outflows.

Liquidation

Liquidation involves settling encumbrances, which are commitments or reserved funds, by converting them into actual expenditures when payments are made. This process ensures that previously obligated amounts are accurately expended, reflecting true financial outflows in accounting records.

Accrual

Accrual accounting records expenses when they are incurred, contrasting with encumbrance accounting, which earmarks funds for future commitments before actual expenditure occurs. Encumbrances reduce budget availability by reserving funds, while expenditures finalize the reduction by recognizing the actual cost and payment obligation.

Fund balance

Fund balance represents the net resources available after accounting for liabilities, with encumbrances reflecting committed funds reserved for future expenditures, thereby reducing the available fund balance. Expenditures indicate actual outflows of resources, directly decreasing the fund balance as goods or services are received and paid for.

Fiscal accountability

Fiscal accountability ensures accurate tracking by distinguishing encumbrances, which reserve funds for future expenses, from expenditures, representing actual financial outflows. Proper management of encumbrance versus expenditure prevents budget overruns and maintains transparent public or organizational financial reporting.

Commitment control

Commitment control ensures budgetary discipline by managing encumbrances, which are commitments of funds for future expenditures, thereby preventing overspending before actual financial obligations occur. Encumbrances differ from expenditures as they represent reserved amounts for planned purchases, while expenditures reflect the actual outflow of cash or liabilities after goods or services are received.

Budgetary control

Budgetary control involves monitoring encumbrances, which are commitments to spend funds, separately from expenditures, representing actual outflows of cash or liabilities incurred. Tracking encumbrances ensures that obligated amounts are reserved within the budget, preventing overspending before expenditures are recorded.

Encumbrance vs Expenditure Infographic

moneydif.com

moneydif.com