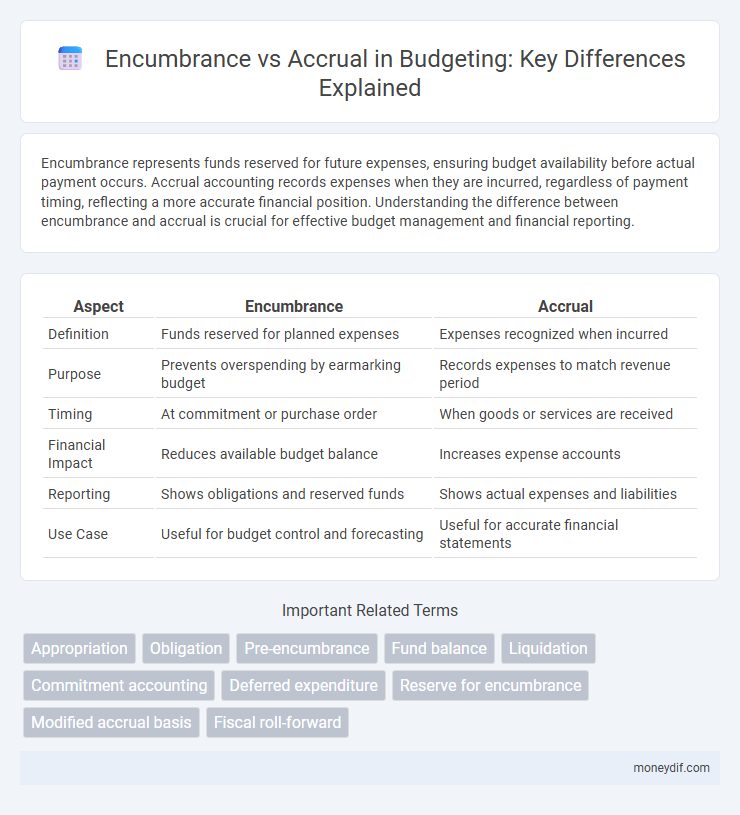

Encumbrance represents funds reserved for future expenses, ensuring budget availability before actual payment occurs. Accrual accounting records expenses when they are incurred, regardless of payment timing, reflecting a more accurate financial position. Understanding the difference between encumbrance and accrual is crucial for effective budget management and financial reporting.

Table of Comparison

| Aspect | Encumbrance | Accrual |

|---|---|---|

| Definition | Funds reserved for planned expenses | Expenses recognized when incurred |

| Purpose | Prevents overspending by earmarking budget | Records expenses to match revenue period |

| Timing | At commitment or purchase order | When goods or services are received |

| Financial Impact | Reduces available budget balance | Increases expense accounts |

| Reporting | Shows obligations and reserved funds | Shows actual expenses and liabilities |

| Use Case | Useful for budget control and forecasting | Useful for accurate financial statements |

Understanding Budget Encumbrance

Budget encumbrance represents reserved funds earmarked for specific future expenses, ensuring that budgetary allocations are not overspent before actual disbursement occurs. Unlike accruals, which record expenses when incurred regardless of payment status, encumbrances track commitments to purchase goods or services, providing proactive budget control and accurate obligation reporting. This distinction supports financial transparency and effective resource management within governmental and organizational budgeting processes.

What Is Accrual in Budgeting?

Accrual in budgeting records expenses and revenues when they are incurred, regardless of cash flow timing, providing a more accurate financial picture. This method ensures liabilities and assets are recognized in the period they occur, improving financial forecasting and decision-making. Unlike encumbrance, which reserves funds for anticipated expenses, accrual focuses on actual incurred costs to reflect true financial obligations.

Key Differences: Encumbrance vs Accrual

Encumbrance refers to the reservation of budgeted funds for future expenses, ensuring money is set aside before actual payment occurs, while accrual records expenses when they are incurred, regardless of payment timing. Encumbrance tracking helps prevent overspending by capturing commitments, whereas accrual accounting aligns expenses with the period they relate to, providing a more accurate financial picture. Key differences include timing of recognition, with encumbrance focusing on budgeting control and accrual emphasizing financial reporting accuracy.

Importance of Encumbrance Tracking

Encumbrance tracking is crucial in budget management as it ensures that funds are reserved for committed expenses before actual payments occur, preventing overspending. Unlike accrual accounting, which records expenses when incurred regardless of payment, encumbrances provide a proactive control mechanism by blocking budget amounts for pending obligations. Accurate encumbrance tracking enhances fiscal discipline, improves financial forecasting, and supports transparent reporting in public and private sector budgeting.

Accrual Accounting in Budget Management

Accrual accounting in budget management records expenses and revenues when they are incurred, not when cash is exchanged, providing a more accurate financial picture over time. This method ensures that all financial obligations and earned income are reflected in the budget period they relate to, improving forecasting and resource allocation. Unlike encumbrance accounting, accrual accounting captures liabilities and assets, enhancing accountability and enabling better compliance with financial reporting standards.

Benefits of Using Encumbrances

Encumbrances provide precise budget control by reserving funds for future obligations, preventing overspending and maintaining financial discipline. They improve transparency in budget tracking by clearly distinguishing between committed and available funds, enhancing forecasting accuracy. Utilizing encumbrances facilitates proactive financial management, reducing the risk of budget overruns and ensuring alignment with organizational spending policies.

Limitations of Accrual Method

The accrual method records expenses when incurred, which can obscure actual cash flow and complicate budget tracking, limiting real-time financial decision-making. It often fails to provide immediate visibility into outstanding commitments, delaying proactive budget adjustments. This delay can result in overspending or misallocation of resources, challenging effective budget control.

Encumbrance vs Accrual: Impact on Financial Statements

Encumbrance records commitments for future expenses, reducing available budget without affecting current financial statements, while accruals recognize expenses incurred regardless of payment, directly impacting income statements and liabilities. Encumbrances provide budgetary control by earmarking funds, whereas accruals ensure financial statements accurately reflect actual liabilities and expenses within a period. Understanding the distinction is critical for precise budget management and transparent financial reporting.

Best Practices in Budget Control

Encumbrance accounting involves reserving funds for committed expenses, ensuring budget availability before expenditure occurs, while accrual accounting records expenses when incurred regardless of payment timing. Best practices in budget control emphasize using encumbrance to prevent overspending by tracking purchase commitments and combining accrual reporting to reflect accurate financial obligations. Integrating both methods enhances fiscal discipline, improves budget accuracy, and promotes transparent financial management.

Choosing Between Encumbrance and Accrual Methods

Choosing between encumbrance and accrual methods depends on the organization's financial tracking needs and reporting accuracy. Encumbrance accounting reserves funds for anticipated expenses, providing better budget control by preventing overspending, while accrual accounting records expenses when incurred, offering a precise reflection of financial obligations. Organizations prioritizing cash flow management and budget adherence often prefer encumbrance, whereas those focusing on comprehensive financial statements typically select accrual.

Important Terms

Appropriation

Appropriation refers to the formal authorization of funds for specific government expenditures, distinguishing it from encumbrance, which represents commitments reserving part of the budget. Unlike accrual accounting that recognizes expenses when incurred regardless of payment, appropriation ensures spending stays within legally approved limits before expenses or encumbrances occur.

Obligation

Obligation represents a firm's legally binding commitment to pay, encumbrance restricts budget availability by earmarking funds for specific purposes, and accrual records expenses when incurred regardless of payment, highlighting different stages in financial accountability.

Pre-encumbrance

Pre-encumbrance tracks committed funds before actual expenditure, distinguishing it from encumbrance which reserves budgeted amounts for expected expenses, while accrual records financial obligations when incurred regardless of cash flow timing.

Fund balance

Fund balance decreases when encumbrances are recorded as commitments of funds, whereas accruals reduce fund balance by recognizing expenses incurred but not yet paid.

Liquidation

Liquidation reduces encumbrance by releasing reserved funds and converts accruals into actual expenses, ensuring accurate financial reporting and budget control.

Commitment accounting

Commitment accounting records encumbrances to reserve funds for future expenses while accrual accounting records expenses when incurred regardless of payment timing.

Deferred expenditure

Deferred expenditure refers to costs that are paid in advance but recognized as expenses over multiple accounting periods, differing from encumbrance which records budget commitments before actual transactions, and accrual which records expenses when they are incurred regardless of payment timing. Understanding the distinctions between deferred expenditure, encumbrance, and accrual accounting ensures accurate financial reporting and budget control in government and corporate finance.

Reserve for encumbrance

Reserve for encumbrance tracks committed funds for pending expenses, distinguishing it from accruals which record incurred but unpaid liabilities.

Modified accrual basis

Modified accrual basis accounting records encumbrances as commitments that reserve budget funds, while accruals recognize expenses when incurred regardless of cash flow.

Fiscal roll-forward

Fiscal roll-forward ensures accurate budget tracking by transferring encumbrance balances reflecting committed funds and accruals representing incurred expenses from one fiscal period to the next.

Encumbrance vs Accrual Infographic

moneydif.com

moneydif.com