Appropriation refers to the legal authorization granted by a legislative body to allocate funds for specific government programs or departments. Allocation is the process of distributing appropriated funds among various projects, activities, or sectors based on priorities and needs. Clear differentiation between appropriation and allocation ensures effective financial management and accountability in the budgeting process.

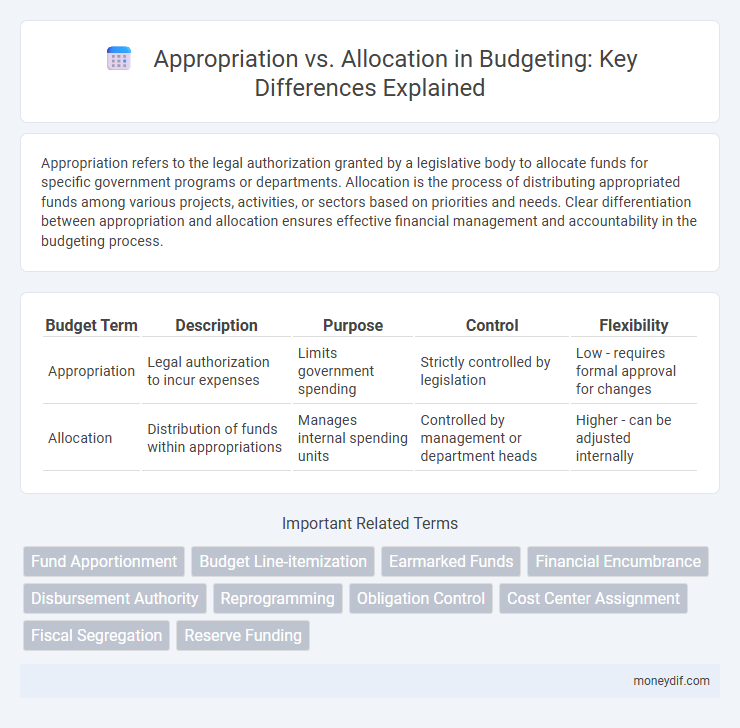

Table of Comparison

| Budget Term | Description | Purpose | Control | Flexibility |

|---|---|---|---|---|

| Appropriation | Legal authorization to incur expenses | Limits government spending | Strictly controlled by legislation | Low - requires formal approval for changes |

| Allocation | Distribution of funds within appropriations | Manages internal spending units | Controlled by management or department heads | Higher - can be adjusted internally |

Understanding Appropriation and Allocation in Budgeting

Appropriation refers to the legal authorization granted by a legislature to allocate a specific amount of funds for government programs or departments, ensuring control over public spending. Allocation, on the other hand, involves the detailed distribution of appropriated funds across various projects, units, or initiatives within the authorized budget. Understanding the distinction between appropriation and allocation is crucial for effective budget management and fiscal accountability.

Key Differences Between Appropriation and Allocation

Appropriation refers to the legal authorization granted by a legislative body to incur expenses and commit government funds for specific purposes, establishing spending limits within a fiscal year. Allocation, in contrast, involves the distribution or assignment of the approved appropriated funds to various departments, projects, or units for operational use. The key difference lies in appropriation being the formal approval of expenditure ceilings, while allocation is the internal distribution and management of those authorized funds.

Legal Frameworks: Appropriation vs Allocation

Appropriation refers to the legal authorization granted by a legislative body allowing the government to incur obligations and make expenditures from the public treasury, establishing the maximum amount of funds available for specific purposes. Allocation, on the other hand, involves the distribution of appropriated funds by authorized agencies or departments to various projects or programs within the framework established by the appropriation law. Legal frameworks mandate that appropriations must precede allocations, ensuring that expenditures are legally sanctioned and aligned with budgetary controls and fiscal responsibility.

The Budgeting Process: Role of Appropriation and Allocation

Appropriation in the budgeting process authorizes the legal authority to spend funds within specified limits, ensuring government entities have permission to incur obligations and make payments. Allocation involves distributing the appropriated funds among various departments or projects based on strategic priorities and operational needs. Effective coordination between appropriation and allocation ensures fiscal discipline and optimal resource utilization in public financial management.

Impact on Financial Management

Appropriation sets the legal limit on the amount of funds a government or organization can spend, ensuring controlled financial governance and preventing overspending. Allocation determines the distribution of these appropriated funds across departments or programs, directly influencing operational efficiency and resource prioritization. Effective management of both appropriation and allocation is crucial for maintaining financial discipline and achieving strategic budgetary objectives.

Government Practices: Appropriation and Allocation Explained

Government budgeting involves appropriation, where legislative bodies authorize specific spending limits, ensuring legal compliance and fiscal control. Allocation distributes these appropriated funds to various departments or programs based on policy priorities and operational needs. Clear distinction in government practices enhances transparency and accountability in public financial management.

Common Challenges in Appropriation vs Allocation

Budget appropriation often faces challenges such as rigid legal constraints limiting flexibility, while allocation struggles with balancing competing departmental priorities within fixed resource limits. Misalignment between appropriated funds and actual allocation needs can result in inefficiencies and underutilization of budgeted resources. Inaccurate forecasting and delayed adjustments further complicate the reconciliation of appropriation authority with effective fund distribution.

Importance in Public Sector Budgeting

Appropriation grants legal authority to government agencies to incur obligations and make payments from the treasury, ensuring controlled fiscal discipline. Allocation involves distributing approved funds to specific departments or projects, enabling effective resource management within the public sector. Precise appropriation and strategic allocation are crucial for transparent budget execution and achieving governmental development goals.

Appropriation and Allocation in Private Organizations

Appropriation in private organizations refers to the formal approval of budgeted funds by management to ensure resources are designated for specific projects or departments, establishing spending limits. Allocation occurs when the approved funds are distributed across various units or activities based on organizational priorities and operational needs. Understanding the distinction between appropriation as the authorized budget ceiling and allocation as the practical distribution of resources is crucial for effective financial control in private sector budgeting.

Best Practices for Managing Appropriation and Allocation

Effective management of appropriation and allocation requires clear documentation and adherence to legal guidelines to ensure funds are used for their intended purposes. Employing real-time tracking systems and regular financial audits enhances transparency and accountability in budget execution. Collaboration between departments and continuous review of appropriation limits and allocation efficiency helps optimize resource distribution and prevent overspending.

Important Terms

Fund Apportionment

Fund apportionment refers to the distribution of budgetary funds into specific categories, balancing appropriation--the legal authorization to incur obligations--and allocation--the actual assignment of budgeted amounts to departments or projects. Effective fund apportionment ensures compliance with appropriation limits while facilitating precise allocation to optimize resource utilization and financial control.

Budget Line-itemization

Budget line-itemization breaks down expenditures into detailed categories, enhancing transparency and control by specifying precise amounts for each item. Appropriation authorizes the maximum spending limit by law, while allocation distributes these funds to specific departments or projects within the approved appropriation, ensuring fiscal discipline and accountability.

Earmarked Funds

Earmarked funds refer to financial resources designated for specific purposes, distinguishing appropriation as the legal authorization to incur expenditure from allocation, which involves the distribution of funds within the approved budget categories. Effective management of earmarked funds ensures compliance with legislative intent by preventing the reallocation of resources intended for targeted programs or projects.

Financial Encumbrance

Financial encumbrance represents funds reserved for specific expenditures, impacting the unspent balance after appropriation but before actual allocation occurs. Appropriation legally authorizes maximum spending limits, while allocation assigns portions of these funds to departments or projects, ensuring controlled budget execution.

Disbursement Authority

Disbursement authority defines the legal permission to spend funds, directly linked to appropriations, which are legislative approvals of budgeted amounts, while allocations distribute these appropriated funds to specific departments or projects. Understanding the distinction between appropriations and allocations ensures proper financial control and compliance within government or organizational budget management.

Reprogramming

Reprogramming in government finance refers to the process of shifting funds within an already approved budget allocation to address emerging priorities without increasing the overall appropriation. This contrasts with allocation, which is the initial distribution of budgeted resources, while appropriation legally authorizes the expenditure limits for specific programs or projects.

Obligation Control

Obligation control ensures financial commitments do not exceed appropriations, linking budget authority to actual spending limits by authorizing obligations only within allocated funds. This mechanism prevents overspending by monitoring the difference between budget appropriations and the allocation of funds for specific purposes.

Cost Center Assignment

Cost center assignment involves designating expenses to specific departments for accurate financial tracking; in this process, appropriation refers to the authorized budget limit, while allocation denotes the distribution of funds within the cost centers. Proper alignment between appropriation and allocation ensures budget compliance and effective cost management across organizational units.

Fiscal Segregation

Fiscal segregation distinguishes between appropriation, which legally authorizes the expenditure of public funds, and allocation, which designates the specific distribution of those authorized funds to various departments or projects, ensuring transparent financial management. This separation enhances accountability by clearly defining the roles of legislative approval (appropriation) versus executive implementation (allocation) in public budgeting.

Reserve Funding

Reserve Funding refers to designated financial resources set aside to cover unforeseen expenses or project adjustments, ensuring budget flexibility. Appropriation is the legal authorization to incur obligations and make payments from the Treasury for specified purposes, while Allocation is the distribution of appropriated funds to specific agencies or programs for implementation.

Appropriation vs Allocation Infographic

moneydif.com

moneydif.com