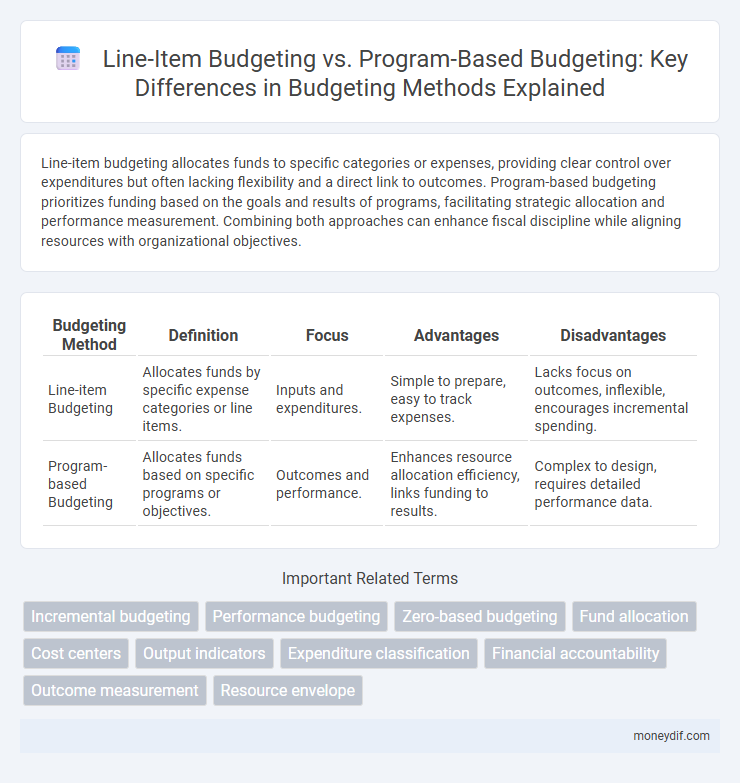

Line-item budgeting allocates funds to specific categories or expenses, providing clear control over expenditures but often lacking flexibility and a direct link to outcomes. Program-based budgeting prioritizes funding based on the goals and results of programs, facilitating strategic allocation and performance measurement. Combining both approaches can enhance fiscal discipline while aligning resources with organizational objectives.

Table of Comparison

| Budgeting Method | Definition | Focus | Advantages | Disadvantages |

|---|---|---|---|---|

| Line-item Budgeting | Allocates funds by specific expense categories or line items. | Inputs and expenditures. | Simple to prepare, easy to track expenses. | Lacks focus on outcomes, inflexible, encourages incremental spending. |

| Program-based Budgeting | Allocates funds based on specific programs or objectives. | Outcomes and performance. | Enhances resource allocation efficiency, links funding to results. | Complex to design, requires detailed performance data. |

Introduction to Budgeting Approaches

Line-item budgeting allocates funds to specific categories, such as salaries or supplies, emphasizing control and accountability through detailed expense tracking. Program-based budgeting focuses on funding entire programs or projects, linking resource allocation to performance outcomes and strategic goals. Organizations choose between these approaches based on their priorities for financial control versus results-oriented management.

Defining Line-Item Budgeting

Line-item budgeting is a financial management approach that categorizes expenditures by specific items or accounts, such as salaries, supplies, and utilities, allowing for detailed tracking and control of individual cost components. This method emphasizes accountability and transparency by clearly defining each expense category, facilitating straightforward financial reporting and variance analysis. Unlike program-based budgeting, line-item budgeting prioritizes expense classification over linking expenditures to specific objectives or outcomes.

Understanding Program-Based Budgeting

Program-based budgeting allocates funds based on specific programs and their intended outcomes, enhancing transparency and accountability in public spending. Unlike line-item budgeting, which focuses on individual expense categories, program-based budgeting links resources directly to performance goals and measurable results. This approach improves strategic planning, resource allocation, and evaluation of program effectiveness within governmental and organizational budgets.

Key Differences Between Line-Item and Program-Based Budgeting

Line-item budgeting allocates funds by specific categories such as salaries, supplies, and equipment, providing detailed control over expenditures but limited insight into outcomes. Program-based budgeting organizes expenses around programs or objectives, emphasizing performance and results to align resources with strategic goals. This shift from input-driven to outcome-focused budgeting improves accountability and aids in prioritizing funding based on program effectiveness.

Advantages of Line-Item Budgeting

Line-item budgeting offers precise control over individual expense categories, making it easier to track and manage specific costs. This method enhances transparency and accountability by clearly detailing expenditures for each budget item. Its straightforward structure simplifies the approval process and facilitates compliance with financial regulations.

Benefits of Program-Based Budgeting

Program-based budgeting enhances resource allocation by linking funds directly to specific outcomes and objectives, improving transparency and accountability. It facilitates better performance measurement and strategic planning, enabling organizations to prioritize programs that advance their goals effectively. This approach promotes efficient use of resources by focusing on results rather than merely tracking expenses across line items.

Challenges and Limitations of Line-Item Budgeting

Line-item budgeting faces challenges such as limited flexibility, as funds are rigidly allocated to specific categories, restricting the ability to reallocate resources based on changing priorities or unforeseen needs. This approach often results in a focus on inputs rather than outcomes, making it difficult to assess the effectiveness and efficiency of spending in achieving program goals. The lack of integration with program objectives hampers performance measurement and limits strategic decision-making within public and private sector financial management.

Drawbacks and Obstacles in Program-Based Budgeting

Program-based budgeting presents challenges such as the complexity of identifying and defining programs clearly, which can lead to difficulties in tracking expenditures and outcomes accurately. The need for detailed performance data and cross-departmental coordination often results in increased administrative costs and resource demands. Resistance from staff accustomed to line-item budgeting and the lack of standardized metrics hinder effective implementation and evaluation in program-based budgeting.

Choosing the Right Budgeting Method for Your Organization

Line-item budgeting provides detailed control by allocating funds to specific categories, making it ideal for organizations requiring clear expense tracking. Program-based budgeting focuses on outcomes and aligns resources with strategic goals, enhancing efficiency in mission-driven entities. Selecting the right method depends on organizational priorities, such as the need for financial control versus result-oriented planning.

The Future of Budgeting: Trends and Best Practices

Line-item budgeting maintains control through detailed expense tracking but limits flexibility and innovation in resource allocation. Program-based budgeting promotes strategic alignment by linking expenditures directly to outcomes, enhancing transparency and performance measurement. Emerging trends emphasize hybrid models integrating data analytics and dynamic forecasting to optimize fiscal decision-making and promote adaptive financial planning.

Important Terms

Incremental budgeting

Incremental budgeting adjusts previous budgets by small amounts based on new demands, contrasting with line-item budgeting which allocates funds to specific expenses without considering program outcomes. Program-based budgeting prioritizes funding according to strategic goals and measurable results, offering a more outcome-focused alternative to the incremental and line-item approaches.

Performance budgeting

Performance budgeting emphasizes measuring outcomes by linking budget allocations to specific results, contrasting with line-item budgeting which focuses on tracking expenses by categories without directly assessing effectiveness. Program-based budgeting allocates funds to achieve defined objectives within programs, enhancing resource efficiency and accountability compared to the rigid, input-oriented structure of line-item budgeting.

Zero-based budgeting

Zero-based budgeting requires detailed justification of every expense, contrasting with line-item budgeting that allocates funds based on preset categories without reassessment, while program-based budgeting emphasizes funding specific objectives and outcomes over individual expense lines. Integrating zero-based budgeting enhances fiscal discipline by evaluating program efficiency and prioritizing resource allocation, unlike static line-item budgets that may perpetuate outdated spending patterns.

Fund allocation

Fund allocation in line-item budgeting focuses on assigning specific amounts to individual expense categories, ensuring detailed control over expenditures, whereas program-based budgeting allocates funds according to goals and outcomes tied to specific programs, promoting strategic resource distribution aligned with organizational objectives. The choice between these methods impacts financial transparency, accountability, and the ability to evaluate program effectiveness.

Cost centers

Cost centers in line-item budgeting focus on tracking expenses by specific categories such as salaries, supplies, and equipment, ensuring detailed control over individual cost elements. In contrast, program-based budgeting allocates funds based on broader programs or objectives, linking costs to outcomes and facilitating performance measurement across organizational initiatives.

Output indicators

Output indicators in line-item budgeting focus primarily on tracking expenditures and resource utilization by specific cost categories, limiting insight into actual service delivery or outcomes. Program-based budgeting emphasizes output indicators tied to program goals, measuring the quantity and quality of goods or services delivered to assess effectiveness and impact.

Expenditure classification

Expenditure classification in line-item budgeting focuses on detailed categories such as salaries, supplies, and equipment, emphasizing control and accountability for each specific cost element. In contrast, program-based budgeting organizes expenses by functional programs or objectives, enhancing efficiency and alignment with policy goals through performance measurement and outcome tracking.

Financial accountability

Financial accountability improves through line-item budgeting by providing detailed tracking of expenses classified by specific categories, ensuring precise control over individual cost elements. Program-based budgeting enhances accountability by aligning expenditures with program outcomes and objectives, facilitating evaluation of resource efficiency and effectiveness in achieving strategic goals.

Outcome measurement

Outcome measurement in program-based budgeting focuses on assessing the effectiveness and impact of funded programs, aligning resource allocation with specific goals and results; in contrast, line-item budgeting primarily tracks expenditures by category without directly linking spending to performance outcomes. Emphasizing outcome measurement in program-based budgeting enhances transparency and accountability by connecting financial inputs to achieved benefits, supporting strategic decision-making and improved public sector efficiency.

Resource envelope

Resource envelopes define the total financial allocations available for specific sectors or departments, guiding spending limits under both line-item budgeting and program-based budgeting. Line-item budgeting allocates resources based on detailed expenditure categories, whereas program-based budgeting distributes funds according to specific programs or objectives, enhancing efficiency and outcome measurement.

Line-item budgeting vs Program-based budgeting Infographic

moneydif.com

moneydif.com