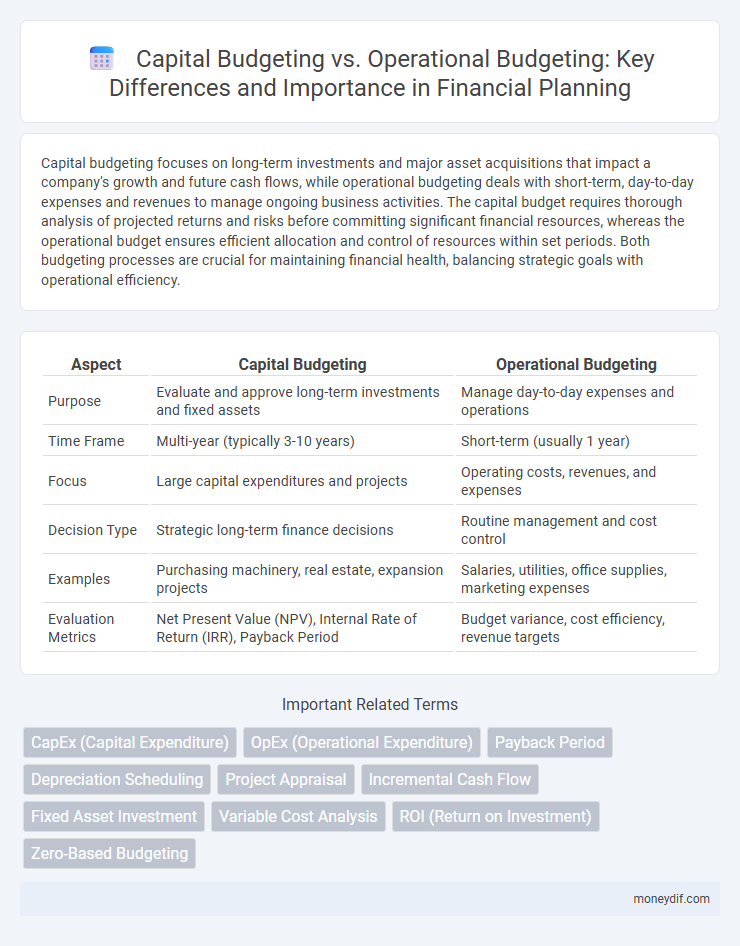

Capital budgeting focuses on long-term investments and major asset acquisitions that impact a company's growth and future cash flows, while operational budgeting deals with short-term, day-to-day expenses and revenues to manage ongoing business activities. The capital budget requires thorough analysis of projected returns and risks before committing significant financial resources, whereas the operational budget ensures efficient allocation and control of resources within set periods. Both budgeting processes are crucial for maintaining financial health, balancing strategic goals with operational efficiency.

Table of Comparison

| Aspect | Capital Budgeting | Operational Budgeting |

|---|---|---|

| Purpose | Evaluate and approve long-term investments and fixed assets | Manage day-to-day expenses and operations |

| Time Frame | Multi-year (typically 3-10 years) | Short-term (usually 1 year) |

| Focus | Large capital expenditures and projects | Operating costs, revenues, and expenses |

| Decision Type | Strategic long-term finance decisions | Routine management and cost control |

| Examples | Purchasing machinery, real estate, expansion projects | Salaries, utilities, office supplies, marketing expenses |

| Evaluation Metrics | Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period | Budget variance, cost efficiency, revenue targets |

Introduction to Capital and Operational Budgeting

Capital budgeting involves evaluating and selecting long-term investments and projects to maximize company value, focusing on assets like machinery, buildings, or technology acquisition. Operational budgeting, on the other hand, centers on short-term financial planning for daily business activities, managing expenses such as salaries, utilities, and raw materials. Both budgeting types are essential for financial planning, with capital budgeting guiding strategic growth and operational budgeting ensuring day-to-day efficiency.

Key Differences Between Capital and Operational Budgets

Capital budgeting involves long-term investment decisions aimed at acquiring or upgrading physical assets, focusing on large expenditures such as property, equipment, or infrastructure. Operational budgeting centers on short-term financial planning for day-to-day expenses, including salaries, utilities, and routine maintenance. Key differences include capital budgeting's emphasis on cash flow projections and asset lifespan, whereas operational budgeting prioritizes expense management and revenue tracking within a fiscal period.

Scope and Objectives of Capital Budgeting

Capital budgeting focuses on long-term investments and projects that impact the company's asset base, such as purchasing equipment or expanding facilities. Its primary objective is to evaluate potential capital expenditures to maximize shareholder value through cash flow analysis and risk assessment. In contrast, operational budgeting deals with short-term revenue and expense management to ensure efficient daily business operations.

Purpose and Functions of Operational Budgeting

Operational budgeting focuses on planning and controlling day-to-day expenses, ensuring efficient resource allocation for ongoing business activities. Its primary purpose is to manage costs related to production, marketing, and administration to achieve short-term financial targets. This budgeting process supports performance measurement, cost control, and operational decision-making within a specific fiscal period.

Decision-Making Processes in Capital vs Operational Budgeting

Capital budgeting decisions involve long-term investment analysis, emphasizing project viability through methods like net present value (NPV) and internal rate of return (IRR) to allocate resources effectively. Operational budgeting focuses on short-term planning, optimizing daily expenses and revenues to maintain business efficiency within set financial constraints. The decision-making process in capital budgeting requires strategic evaluation of potential growth and risk, while operational budgeting decisions prioritize cost control and routine financial management.

Time Horizon: Long-Term vs Short-Term Budgets

Capital budgeting focuses on long-term investments with a time horizon spanning several years, typically evaluating projects like infrastructure, equipment, or major expansions. Operational budgeting centers on short-term financial plans, usually covering one fiscal year, to manage day-to-day expenses and revenues. Understanding the difference in time horizons helps organizations allocate resources efficiently between strategic growth and routine operations.

Impact on Financial Planning and Resource Allocation

Capital budgeting drives long-term financial planning by evaluating investments in assets and projects that influence future growth and profitability, requiring substantial resource allocation for high-value expenditures. Operational budgeting focuses on short-term financial planning, managing daily expenses and operational costs to ensure efficient resource allocation across departments and maintain cash flow stability. Together, they create a comprehensive financial framework balancing immediate operational needs with strategic investments for sustained business success.

Risk Assessment in Capital and Operational Budgeting

Risk assessment in capital budgeting involves evaluating long-term financial commitments and potential project uncertainties, utilizing techniques such as sensitivity analysis and scenario planning to anticipate future market fluctuations and investment viability. Operational budgeting focuses on short-term risks related to daily business activities, emphasizing cash flow management, expense control, and variability in revenue streams to maintain operational efficiency. Effective risk assessment in both capital and operational budgeting ensures optimized resource allocation and financial stability under varying economic conditions.

Common Challenges and Best Practices

Capital budgeting and operational budgeting share common challenges such as forecasting accuracy, aligning budgets with strategic goals, and managing resource constraints. Best practices include implementing robust data analytics for reliable projections, fostering cross-departmental collaboration to ensure budget alignment, and regularly reviewing budget performance to adapt to changing business conditions. Leveraging technology and maintaining clear communication channels enhances both budgeting processes and overall financial efficiency.

Conclusion: Choosing the Right Budgeting Approach

Choosing the right budgeting approach depends on an organization's financial goals and project timelines, with capital budgeting suited for long-term investments and operational budgeting focused on day-to-day expenses. Businesses aiming to optimize resource allocation for asset acquisition benefit from capital budgeting's strategic planning. In contrast, operational budgeting ensures efficient management of routine costs, supporting sustainable cash flow and operational efficiency.

Important Terms

CapEx (Capital Expenditure)

Capital Expenditure (CapEx) focuses on long-term investments analyzed through capital budgeting processes, whereas operational budgeting manages short-term expenses related to daily business operations.

OpEx (Operational Expenditure)

Operational expenditure (OpEx) covers daily business expenses impacting operational budgeting, while capital budgeting focuses on long-term asset investments and major project funding decisions.

Payback Period

The Payback Period is a key capital budgeting metric that measures the time required to recover initial investment costs, distinct from operational budgeting which focuses on ongoing expenses and revenues.

Depreciation Scheduling

Depreciation scheduling impacts capital budgeting by allocating asset costs over time, while operational budgeting focuses on ongoing expenses without asset cost allocation.

Project Appraisal

Project appraisal involves evaluating the feasibility and potential returns of investments, focusing on capital budgeting to assess long-term asset acquisitions and strategic projects. Operational budgeting, contrastingly, manages short-term expenses and revenues, emphasizing routine costs and resource allocation within ongoing business activities.

Incremental Cash Flow

Incremental cash flow measures the additional cash generated by a capital budgeting project, distinguishing it from operational budgeting which focuses on ongoing business expenses and revenues.

Fixed Asset Investment

Fixed asset investment primarily involves capital budgeting decisions focused on long-term asset acquisition and expansion, whereas operational budgeting addresses short-term expense management and daily operational costs.

Variable Cost Analysis

Variable cost analysis evaluates expenses that fluctuate with production levels, playing a crucial role in operational budgeting by identifying cost behaviors, while capital budgeting focuses on long-term investment decisions and asset acquisition.

ROI (Return on Investment)

ROI (Return on Investment) measures profitability by comparing net returns to initial investment costs, playing a critical role in capital budgeting decisions that focus on long-term asset acquisitions and major projects. Operational budgeting, however, typically influences short-term cost control and efficiency improvements, indirectly affecting ROI through optimized resource allocation and expense management.

Zero-Based Budgeting

Zero-Based Budgeting (ZBB) requires justification of all expenses from a zero base, ensuring precise allocation of resources in both Capital Budgeting and Operational Budgeting. In Capital Budgeting, ZBB evaluates investment projects with a focus on long-term asset acquisition and financial returns, while in Operational Budgeting, it scrutinizes day-to-day expenses to optimize cost efficiency and operational performance.

Capital budgeting vs Operational budgeting Infographic

moneydif.com

moneydif.com