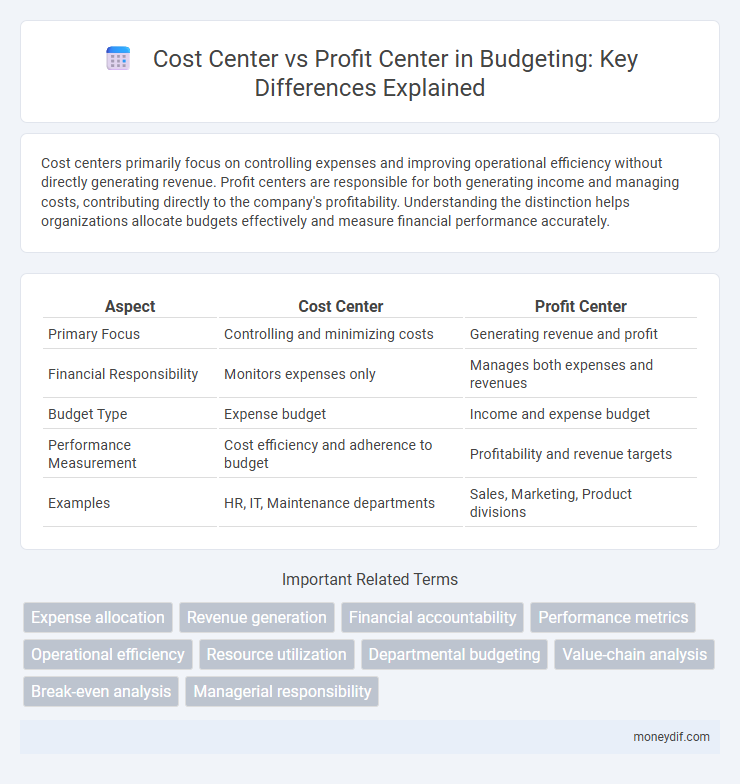

Cost centers primarily focus on controlling expenses and improving operational efficiency without directly generating revenue. Profit centers are responsible for both generating income and managing costs, contributing directly to the company's profitability. Understanding the distinction helps organizations allocate budgets effectively and measure financial performance accurately.

Table of Comparison

| Aspect | Cost Center | Profit Center |

|---|---|---|

| Primary Focus | Controlling and minimizing costs | Generating revenue and profit |

| Financial Responsibility | Monitors expenses only | Manages both expenses and revenues |

| Budget Type | Expense budget | Income and expense budget |

| Performance Measurement | Cost efficiency and adherence to budget | Profitability and revenue targets |

| Examples | HR, IT, Maintenance departments | Sales, Marketing, Product divisions |

Understanding Cost Centers and Profit Centers

Cost centers are departments or units within a company that incur expenses but do not directly generate revenue, focusing on controlling and minimizing costs to improve overall budget efficiency. Profit centers, on the other hand, are responsible for both generating revenue and managing their own expenses, making them key drivers of profitability and financial performance. Understanding the distinction between cost centers and profit centers enables organizations to allocate resources effectively and implement targeted budget strategies.

Key Differences Between Cost Centers and Profit Centers

Cost centers are organizational units focused on controlling and minimizing expenses without directly generating revenue, whereas profit centers are responsible for both revenues and costs, aiming to maximize profitability. Key differences include performance measurement: cost centers are evaluated based on cost efficiency, while profit centers are assessed by their ability to generate net profit. This distinction impacts budgeting processes, where cost centers receive fixed budgets for expense control and profit centers forecast revenues and costs to drive business growth.

Roles of Cost Centers in Budgeting

Cost centers play a crucial role in budgeting by tracking and controlling expenses within specific departments, ensuring efficient allocation of resources. They enable organizations to monitor operational costs closely, facilitating accurate cost analysis and variance reporting. This focused oversight supports strategic decision-making by highlighting areas for cost optimization without directly impacting revenue generation.

Functions of Profit Centers in Financial Planning

Profit centers play a critical role in financial planning by directly influencing revenue generation and profitability evaluation for individual business units. They enable detailed tracking of income and expenses, facilitating performance measurement and accountability within the organization. Effective management of profit centers supports strategic decision-making, resource allocation, and optimization of operational efficiency.

Impact on Organizational Performance

Cost centers focus on controlling expenses and optimizing resource allocation, directly influencing an organization's efficiency and financial discipline. Profit centers drive revenue generation and profitability, impacting overall business growth and competitive advantage. Effective budget management in both centers enhances organizational performance by aligning financial goals with operational strategies.

Budget Allocation Strategies for Cost Centers and Profit Centers

Budget allocation strategies for cost centers prioritize controlling operational expenses by assigning fixed budgets aligned with departmental needs and efficiency goals, ensuring minimal variance and adherence to financial targets. Profit centers receive budget allocations based on revenue-generating potential, with flexible funding to support growth initiatives, marketing efforts, and product development aimed at maximizing profitability. Effective allocation balances cost control in cost centers with investment in profit centers to drive overall organizational performance and sustainable financial health.

Advantages and Limitations of Cost Centers

Cost centers provide precise tracking of expenses, enabling organizations to control and reduce operational costs effectively by monitoring departments such as HR or IT. They facilitate budget accountability and enhance cost efficiency but lack direct revenue generation, limiting their impact on overall profitability. The main limitation is their focus solely on cost control without incentivizing innovation or revenue growth, potentially leading to inefficiencies.

Advantages and Limitations of Profit Centers

Profit centers enable precise tracking of revenue and expenses, fostering accountability and encouraging managers to optimize profitability within their units. This structure supports performance-based evaluation and strategic decision-making by clearly linking outcomes to responsible teams. However, profit centers may face limitations such as internal competition, potential resource misallocation, and challenges in accurately allocating shared costs across divisions.

Performance Measurement: Cost vs. Profit Centers

Cost centers evaluate organizational performance by monitoring expenses and efficiency in resource utilization without directly generating revenue. Profit centers measure both revenues and costs, providing a comprehensive view of financial performance and profitability. Effective performance measurement distinguishes cost control in cost centers from profit maximization in profit centers, aligning management accountability with financial objectives.

Choosing Between Cost Center and Profit Center Structures

Choosing between cost center and profit center structures depends on organizational goals and control requirements. Cost centers focus on managing expenses and operational efficiency without direct revenue accountability, making them ideal for support functions. Profit centers are designed for units responsible for both revenues and costs, promoting accountability and incentivizing performance improvements aligned with profitability.

Important Terms

Expense allocation

Expense allocation distinguishes between cost centers, which focus on tracking and limiting operational costs, and profit centers, which manage both revenues and expenses to evaluate overall profitability. Efficient expense allocation ensures accurate financial reporting and performance assessment by assigning costs to the appropriate cost or profit centers based on business activities and resource consumption.

Revenue generation

Revenue generation in a profit center directly contributes to a company's bottom line by producing both income and controlling expenses, whereas a cost center focuses solely on managing and minimizing operational costs without directly generating revenue. Effective financial management distinguishes profit centers through targeted revenue growth strategies, while cost centers prioritize budget adherence and cost-efficiency to support overall profitability.

Financial accountability

Financial accountability in cost centers focuses on controlling and minimizing expenses without directly generating revenue, whereas profit centers are responsible for both revenue generation and cost management, emphasizing overall profitability. Effective performance evaluation in profit centers hinges on measuring net income, while cost centers prioritize budget adherence and cost efficiency to optimize financial outcomes.

Performance metrics

Performance metrics for cost centers primarily focus on controlling and minimizing expenses while maintaining operational efficiency, using indicators like budget variance, cost per unit, and expense ratio. Profit centers measure financial success through revenue generation and profitability metrics such as gross margin, return on investment (ROI), and net profit margin, reflecting their direct impact on the organization's bottom line.

Operational efficiency

Operational efficiency improves when cost centers focus on minimizing expenses without compromising quality, while profit centers drive revenue generation by optimizing both costs and sales performance. Distinguishing between these centers enables targeted strategies that enhance overall financial management and resource allocation.

Resource utilization

Resource utilization in cost centers focuses on optimizing expenses to maintain budget efficiency, while in profit centers, it aims to maximize revenue generation by effectively allocating assets and labor. Accurate tracking of resource usage in cost centers helps control operational costs, whereas in profit centers, it enhances profitability through strategic investment and productivity improvements.

Departmental budgeting

Departmental budgeting distinguishes cost centers, which focus on controlling expenses without direct revenue generation, from profit centers that manage both costs and revenues to evaluate profitability. Allocating budgets effectively requires analyzing cost behavior and revenue potential within each center to optimize financial performance and operational efficiency.

Value-chain analysis

Value-chain analysis identifies and evaluates activities within an organization to optimize cost efficiency and enhance profit generation, distinguishing cost centers that focus on expense control from profit centers responsible for revenue creation. By aligning value-chain components with specific cost or profit centers, businesses can strategically manage resources, improve operational performance, and increase overall profitability.

Break-even analysis

Break-even analysis helps organizations determine the sales volume at which total revenues equal total costs, pinpointing the financial equilibrium for both cost centers and profit centers. While cost centers focus on controlling expenses without direct revenue generation, profit centers emphasize maximizing both revenues and profits, making break-even analysis crucial for setting performance targets and evaluating financial viability in each center.

Managerial responsibility

Managerial responsibility in a cost center focuses on controlling and minimizing expenses to enhance operational efficiency without direct profit generation. In contrast, responsibility in a profit center encompasses both revenue generation and cost management, requiring managers to optimize overall profitability.

cost center vs profit center Infographic

moneydif.com

moneydif.com