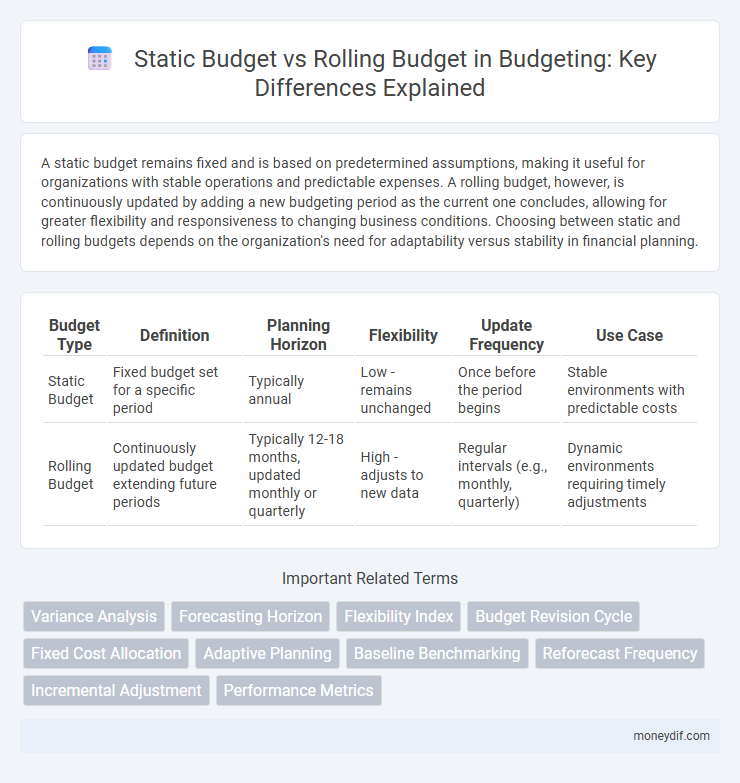

A static budget remains fixed and is based on predetermined assumptions, making it useful for organizations with stable operations and predictable expenses. A rolling budget, however, is continuously updated by adding a new budgeting period as the current one concludes, allowing for greater flexibility and responsiveness to changing business conditions. Choosing between static and rolling budgets depends on the organization's need for adaptability versus stability in financial planning.

Table of Comparison

| Budget Type | Definition | Planning Horizon | Flexibility | Update Frequency | Use Case |

|---|---|---|---|---|---|

| Static Budget | Fixed budget set for a specific period | Typically annual | Low - remains unchanged | Once before the period begins | Stable environments with predictable costs |

| Rolling Budget | Continuously updated budget extending future periods | Typically 12-18 months, updated monthly or quarterly | High - adjusts to new data | Regular intervals (e.g., monthly, quarterly) | Dynamic environments requiring timely adjustments |

Understanding Static Budgets: Definition and Key Features

A static budget is a financial plan that remains unchanged throughout the budget period, regardless of actual activity levels or fluctuations in business conditions. It is based on fixed assumptions and predetermined estimates, making it easier to control costs and assess performance against set targets. Key features include fixed allocations for revenues and expenses, simplicity in preparation, and suitability for organizations with predictable operations or stable business environments.

What Is a Rolling Budget? Core Concepts Explained

A rolling budget, also known as a continuous budget, is a dynamic financial plan that is regularly updated--typically monthly or quarterly--to reflect new data and changing business conditions. Unlike a static budget, which remains fixed for a set period, a rolling budget extends the planning horizon by adding a new budget period each time one period concludes, ensuring ongoing relevance and adaptability. This approach enhances forecasting accuracy and enables more responsive resource allocation based on current operational and market trends.

Static vs Rolling Budget: Key Differences

Static budgets are fixed and set for a specific period, providing a clear financial framework based on predetermined sales and expense levels. Rolling budgets continuously update by adding a new budget period as the current period ends, enabling more flexibility and real-time adjustments aligned with changing business conditions. Key differences lie in adaptability, with static budgets offering stability for fixed plans, while rolling budgets enhance responsiveness and ongoing financial forecasting.

Advantages of Using a Static Budget

A static budget provides financial stability and clear benchmarks by setting fixed expense and revenue targets for a specific period, facilitating consistent performance evaluation. It simplifies planning and control processes, reducing the complexity involved in frequent adjustments typical of rolling budgets. Organizations benefit from improved cost management and accountability, as deviations from the static budget highlight variances that require corrective actions.

Benefits of Rolling Budgets for Modern Businesses

Rolling budgets offer modern businesses enhanced flexibility by continuously updating financial plans to reflect real-time market changes and operational shifts. This dynamic approach improves accuracy in forecasting and resource allocation, enabling companies to respond promptly to emerging opportunities or risks. By maintaining an ongoing budgeting cycle, organizations foster better strategic alignment and proactive decision-making compared to static budgets.

Limitations of Static Budgets in a Dynamic Environment

Static budgets pose limitations in a dynamic environment due to their fixed nature, which prevents adjustments to unforeseen changes in business conditions or market fluctuations. These budgets often lead to inaccurate financial planning and performance evaluation because they do not reflect the real-time operational realities or evolving economic factors. Organizations relying solely on static budgets risk misallocating resources and missing opportunities for proactive financial management.

Rolling Budget Implementation: Best Practices

Effective rolling budget implementation requires continuous monitoring and frequent updates, typically monthly or quarterly, to reflect changing business conditions accurately. Engaging cross-functional teams ensures realistic assumptions and enhances responsiveness, while leveraging advanced budgeting software streamlines data integration and forecasting. Establishing clear communication channels and aligning rolling budgets with strategic goals maintain organizational agility and financial control.

Which Budgeting Approach Suits Your Organization?

Choosing between a static budget and a rolling budget depends on your organization's need for flexibility and accuracy in financial planning. A static budget is ideal for organizations with predictable expenses and stable revenue streams, providing a fixed financial plan that simplifies control and evaluation. Conversely, a rolling budget suits dynamic environments by continuously updating projections, enhancing responsiveness to market changes and improving decision-making accuracy.

Common Budgeting Mistakes to Avoid

Common budgeting mistakes include relying solely on static budgets that fail to adapt to changing business conditions, leading to inaccurate financial planning and resource allocation. Ignoring the dynamic nature of rolling budgets can result in missed opportunities for timely adjustments and improved forecasting accuracy. Emphasizing frequent budget reviews and flexible updates helps avoid the pitfalls of outdated assumptions and enhances overall financial control.

Future Trends: Evolving Practices in Business Budgeting

Static budgets remain popular for their simplicity and fixed targets, but rolling budgets increasingly dominate due to their adaptability and real-time responsiveness to market fluctuations. Advances in AI and predictive analytics facilitate more dynamic and accurate rolling budgets, enabling businesses to adjust forecasts regularly and align financial planning with ongoing strategic shifts. Future trends indicate a growing preference for integrated budgeting platforms that combine historical data with continuous updates to optimize resource allocation and improve financial agility.

Important Terms

Variance Analysis

Variance analysis compares actual financial outcomes against the static budget, highlighting deviations based on a fixed set of assumptions. Rolling budget variance analysis continuously updates forecasts and benchmarks, providing more dynamic insights by reflecting changing market conditions and operational adjustments.

Forecasting Horizon

The forecasting horizon defines the time frame for budget projections, where a static budget remains fixed for a set period, typically a fiscal year, providing limited flexibility and less responsiveness to market changes. In contrast, a rolling budget continuously updates forecasts over a moving horizon, enhancing adaptability by incorporating recent data and trends to improve financial accuracy and decision-making.

Flexibility Index

The Flexibility Index measures the adaptability of a budget by comparing static budgets, which remain fixed regardless of actual activity levels, with rolling budgets that continuously update based on real-time data and forecast changes. A higher Flexibility Index indicates better alignment with operational variations, allowing organizations to respond effectively to dynamic market conditions and optimize financial planning accuracy.

Budget Revision Cycle

The Budget Revision Cycle involves regular updates to adapt financial plans, contrasting the static budget's fixed figures with the rolling budget's periodic adjustments that incorporate recent data and forecasts. This approach enhances accuracy and flexibility in financial management, enabling organizations to respond promptly to market changes and operational shifts.

Fixed Cost Allocation

Fixed cost allocation in a static budget assigns predetermined fixed expenses to cost centers based on a set estimate for the period, maintaining consistency regardless of actual activity levels. In contrast, a rolling budget continuously updates fixed cost allocations to reflect changes in operational conditions and resource usage, enhancing accuracy and adaptability in financial planning.

Adaptive Planning

Adaptive Planning leverages rolling budgets to provide dynamic, real-time adjustments, enhancing financial accuracy compared to static budgets fixed for a fiscal period. This approach allows organizations to respond promptly to market fluctuations and operational changes, optimizing resource allocation and strategic decision-making.

Baseline Benchmarking

Baseline benchmarking involves comparing a static budget, fixed for a specific period, against a rolling budget that dynamically updates based on real-time financial data and operational changes. This comparison highlights variances, enabling organizations to identify performance gaps and adjust strategies for improved budget accuracy and resource allocation.

Reforecast Frequency

Reforecast frequency significantly impacts the effectiveness of static budgets versus rolling budgets, with rolling budgets requiring more frequent updates--often monthly or quarterly--to incorporate real-time data and adapt to market fluctuations. Static budgets, typically set annually, rely on less frequent reforecasting, which can reduce responsiveness but provide more stability and control over expenses.

Incremental Adjustment

Incremental adjustment involves modifying a static budget by applying percentage changes based on prior period figures, whereas a rolling budget continuously updates projections by adding new periods as time progresses, ensuring more dynamic financial planning. This approach enhances budgeting accuracy by balancing stability from incremental adjustments with flexibility from rolling forecasts.

Performance Metrics

Performance metrics for static budgets emphasize variance analysis by comparing actual financial outcomes against fixed budgeted amounts, highlighting deviations in cost control and revenue generation. In contrast, rolling budgets utilize continuous updates to performance metrics, enabling more dynamic forecasting and real-time adjustments that better align with changing business conditions.

static budget vs rolling budget Infographic

moneydif.com

moneydif.com