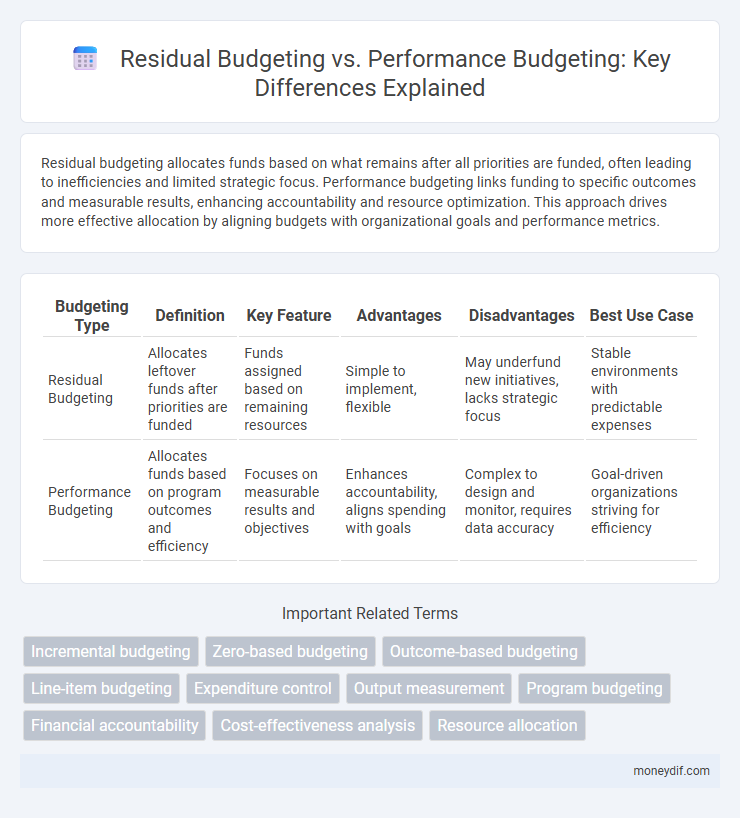

Residual budgeting allocates funds based on what remains after all priorities are funded, often leading to inefficiencies and limited strategic focus. Performance budgeting links funding to specific outcomes and measurable results, enhancing accountability and resource optimization. This approach drives more effective allocation by aligning budgets with organizational goals and performance metrics.

Table of Comparison

| Budgeting Type | Definition | Key Feature | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|---|---|

| Residual Budgeting | Allocates leftover funds after priorities are funded | Funds assigned based on remaining resources | Simple to implement, flexible | May underfund new initiatives, lacks strategic focus | Stable environments with predictable expenses |

| Performance Budgeting | Allocates funds based on program outcomes and efficiency | Focuses on measurable results and objectives | Enhances accountability, aligns spending with goals | Complex to design and monitor, requires data accuracy | Goal-driven organizations striving for efficiency |

Introduction to Residual Budgeting and Performance Budgeting

Residual budgeting allocates remaining funds after essential expenses are covered, often reflecting historical spending patterns without direct alignment to specific goals. Performance budgeting focuses on linking financial resources to measurable outcomes and objectives, enhancing accountability and efficiency. Comparing these approaches highlights the trade-off between simplicity in residual budgeting and the strategic orientation of performance budgeting.

Core Principles of Residual Budgeting

Residual budgeting allocates resources based on remaining funds after all planned expenditures are covered, emphasizing simplicity and flexibility in financial management. Its core principles prioritize expenditure authorization before budget formulation, ensuring spending aligns with organizational priorities and available resources. This approach contrasts with performance budgeting by focusing less on outcome measurement and more on adapting to fiscal constraints dynamically.

Key Features of Performance Budgeting

Performance budgeting emphasizes allocating resources based on measurable outcomes and efficiency, linking expenditure to specific program results. Key features include setting clear performance targets, continuous monitoring of actual results against benchmarks, and prioritizing funding for initiatives demonstrating high impact. This approach contrasts with residual budgeting, which allocates funds based on previous periods without detailed assessment of program effectiveness.

Differences Between Residual and Performance Budgeting

Residual budgeting allocates funds based on remaining resources after all expenses are accounted for, prioritizing financial flexibility but often lacking detailed performance metrics. Performance budgeting assigns budgets according to specific program outcomes and measurable targets, enhancing accountability and resource efficiency. The primary difference lies in residual budgeting's focus on leftover funds versus performance budgeting's emphasis on linking expenditure directly to results.

Advantages of Residual Budgeting

Residual budgeting offers simplicity and efficiency by allocating remaining resources after all fixed expenses are covered, enabling quick adjustments and flexibility in managing discretionary spending. This method reduces the need for detailed line-item reviews, saving time and administrative effort during the budgeting process. Organizations benefit from streamlined decision-making and can more easily accommodate unexpected costs or investment opportunities using residual budgeting.

Benefits of Performance Budgeting

Performance budgeting enhances resource allocation by linking funds directly to measurable outcomes, increasing accountability and transparency in public spending. It enables governments to prioritize programs based on effectiveness and results, leading to more efficient use of taxpayer money. Unlike residual budgeting, performance budgeting supports strategic decision-making and continuous improvement through data-driven evaluation.

Challenges Faced in Residual Budgeting

Residual budgeting often struggles with inefficiency due to its reliance on last year's expenditures, which can perpetuate outdated financial allocations and limit innovation. This method fails to align budget priorities with current organizational goals because it lacks a rigorous evaluation of performance metrics. Consequently, resource misallocation and resistance to change pose significant challenges in achieving optimal fiscal management.

Limitations of Performance Budgeting

Performance budgeting often faces limitations such as difficulty in accurately measuring outcomes and attributing results to specific expenditures, leading to potential inefficiencies. The reliance on quantitative performance indicators can overlook qualitative factors and complex service dynamics, reducing flexibility in resource allocation. Additionally, performance budgeting requires robust data collection and analysis systems, which may strain administrative capacity and increase operational costs.

Choosing the Right Budgeting Method for Your Organization

Residual budgeting allocates funds based on remaining resources after all expenses are covered, offering simplicity but limited flexibility for growth. Performance budgeting links funds directly to specific outcomes and objectives, enhancing accountability and strategic alignment. Selecting the right budgeting method depends on your organization's priorities, financial stability, and need for outcome-driven resource management.

Future Trends in Budgeting Techniques

Residual budgeting relies on previous spending patterns to allocate funds, often leading to inefficiencies in adapting to changing organizational needs. Performance budgeting emphasizes outcomes and accountability by linking resource allocation to specific goals, improving transparency and strategic planning. Future trends in budgeting techniques include the integration of advanced data analytics and AI-driven forecasting, enhancing the precision and adaptability of both residual and performance budgeting models.

Important Terms

Incremental budgeting

Incremental budgeting adjusts previous budgets by a fixed amount, making it less flexible than performance budgeting which allocates funds based on measurable outcomes, while residual budgeting focuses on funding remaining after priority expenses.

Zero-based budgeting

Zero-based budgeting requires justifying all expenses from zero each period, contrasting with residual budgeting that allocates funds based on leftover amounts and performance budgeting that links funding directly to measurable outcomes.

Outcome-based budgeting

Outcome-based budgeting prioritizes measurable results by allocating funds according to performance metrics, contrasting with residual budgeting which distributes resources based on leftover funds, and aligns closely with performance budgeting that links expenditures directly to defined outcomes.

Line-item budgeting

Line-item budgeting focuses on detailed expense categories, while residual budgeting allocates leftover funds after fixed costs, and performance budgeting emphasizes funding based on measurable outcomes and results.

Expenditure control

Expenditure control in residual budgeting focuses on limiting spending to leftover funds after accounting for fixed costs, often resulting in less efficient resource allocation. Performance budgeting allocates resources based on measurable outcomes and program effectiveness, enhancing fiscal responsibility and optimizing expenditure efficiency.

Output measurement

Output measurement compares actual results against targets to evaluate efficiency in residual budgeting, while performance budgeting allocates funds based on measurable outcomes to enhance resource optimization.

Program budgeting

Program budgeting allocates resources based on specific programs to achieve defined objectives, contrasting with residual budgeting, which allocates remaining funds after other priorities, and performance budgeting, which ties funding to measurable outcomes and efficiency metrics.

Financial accountability

Financial accountability in residual budgeting focuses on verifying expenditures against remaining funds after planned costs, which may lead to less precise allocation and potential inefficiencies; performance budgeting enhances accountability by linking funds directly to measurable outcomes and program performance, promoting transparency and more effective resource utilization. This shift from residual to performance budgeting supports improved financial management through systematic evaluation of goals, results, and fiscal responsibility.

Cost-effectiveness analysis

Cost-effectiveness analysis compares residual budgeting, which allocates funds based on leftover resources after other priorities are funded, with performance budgeting that ties funding to measurable outcomes and efficiency metrics. Performance budgeting generally yields higher cost-effectiveness by aligning expenditures with strategic goals and improving resource allocation transparency.

Resource allocation

Resource allocation in residual budgeting focuses on distributing remaining funds after essential expenses, often leading to suboptimal utilization, while performance budgeting allocates resources based on specific outcomes and efficiency metrics to enhance accountability and strategic impact. Performance budgeting integrates measurable objectives and performance indicators to align financial resources with organizational goals, improving transparency and effectiveness in public and private sectors.

Residual budgeting vs Performance budgeting Infographic

moneydif.com

moneydif.com