A budget surplus occurs when income exceeds expenses, enabling increased savings or investment opportunities. In contrast, a budget deficit arises when expenditures surpass revenue, often requiring borrowing to cover the shortfall. Efficient budget management involves balancing these outcomes to ensure financial stability and long-term growth.

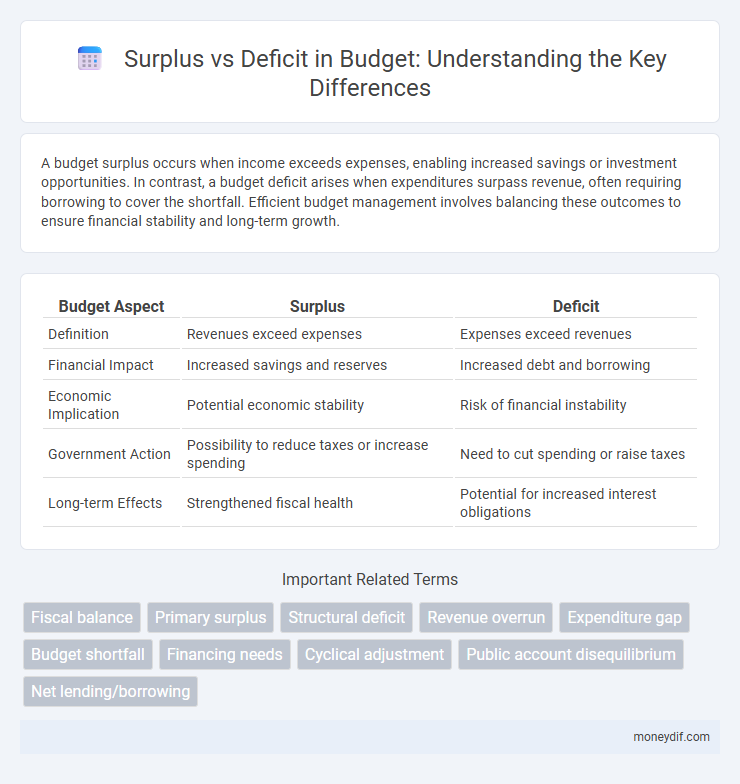

Table of Comparison

| Budget Aspect | Surplus | Deficit |

|---|---|---|

| Definition | Revenues exceed expenses | Expenses exceed revenues |

| Financial Impact | Increased savings and reserves | Increased debt and borrowing |

| Economic Implication | Potential economic stability | Risk of financial instability |

| Government Action | Possibility to reduce taxes or increase spending | Need to cut spending or raise taxes |

| Long-term Effects | Strengthened fiscal health | Potential for increased interest obligations |

Understanding Budget Surplus and Deficit

Budget surplus occurs when government revenues exceed expenditures, indicating a positive fiscal balance that allows for debt reduction or increased savings. In contrast, a budget deficit arises when spending surpasses income, often leading to increased borrowing and potential economic challenges. Understanding these concepts is crucial for analyzing fiscal policy effectiveness and long-term economic stability.

Key Differences Between Surplus and Deficit

A budget surplus occurs when total revenues exceed total expenditures, resulting in excess funds available for saving or investment. In contrast, a budget deficit arises when expenditures surpass revenues, necessitating borrowing or use of reserves to cover the shortfall. Key differences between surplus and deficit include their impact on national debt, fiscal policy decisions, and economic growth potential.

Causes of Budget Surplus

A budget surplus occurs when government revenues exceed expenditures, often due to strong economic growth boosting tax collections from income, corporate, and sales taxes. Conservative fiscal policies that limit government spending, combined with reduced public debt servicing costs, further contribute to surplus generation. Unexpected increases in revenue from resource exports or one-time fiscal windfalls can also lead to a surplus in government budgets.

Causes of Budget Deficit

A budget deficit occurs when government expenditures exceed revenue, often driven by increased public spending on social programs, defense, or infrastructure projects without adequate tax revenue. Economic downturns reduce tax collections due to lower incomes and profits, exacerbating deficits. Persistent deficits arise from structural imbalances such as inefficient tax policies, rising interest payments on debt, and unplanned emergency expenditures.

Economic Impacts of Surplus Budgets

Surplus budgets lead to reduced government borrowing, lowering national debt and interest costs, which boosts long-term economic stability. Increased public savings from surpluses can finance future investments without raising taxes, fostering sustained economic growth. Surplus budgets often signal fiscal discipline, enhancing investor confidence and encouraging domestic and foreign investments.

Economic Impacts of Deficit Budgets

Deficit budgets increase government borrowing, leading to higher interest rates that can crowd out private investment and slow economic growth. Persistent deficits may drive inflation as governments finance spending through money creation, reducing currency value and purchasing power. Long-term deficits also elevate national debt, imposing fiscal constraints that limit future public spending and economic policy flexibility.

Surplus vs Deficit: Effects on Public Services

A budget surplus occurs when government revenue exceeds expenditures, enabling increased funding for public services such as healthcare, education, and infrastructure development. Conversely, a budget deficit means government spending surpasses revenue, often leading to cuts in public services or increased borrowing that may hinder long-term economic stability. Effective management of surpluses supports improved service delivery, while persistent deficits can strain resources and reduce the quality of essential public programs.

Managing a Budget Surplus

Effectively managing a budget surplus involves allocating excess funds toward debt reduction, investment in infrastructure, or bolstering reserve funds to strengthen fiscal stability. Prioritizing strategic use of surplus resources can enhance long-term financial health and reduce reliance on borrowing. Implementing transparent policies for surplus allocation promotes accountability and supports sustainable economic growth.

Strategies to Address Budget Deficits

Implementing spending cuts and increasing revenue through tax reforms are key strategies to address budget deficits. Governments often prioritize reducing non-essential expenditures while enhancing efficiency in public services. Developing policies to stimulate economic growth can also expand the tax base, helping to achieve long-term fiscal balance.

Long-Term Implications of Surplus and Deficit

A budget surplus enables increased investment in infrastructure and debt reduction, fostering long-term economic stability and growth. Conversely, a persistent deficit often results in escalated national debt, higher interest expenses, and potential crowding out of private investment. Sustainable fiscal policies balance surpluses and deficits to support enduring economic health and intergenerational equity.

Important Terms

Fiscal balance

Fiscal balance measures the difference between government revenues and expenditures, where a surplus occurs when revenues exceed spending, indicating positive fiscal health. Conversely, a deficit arises when expenditures surpass revenues, signaling potential debt accumulation and fiscal stress.

Primary surplus

The primary surplus occurs when a government's revenues exceed its non-interest expenditures, indicating fiscal discipline before debt servicing costs are considered. This contrasts with a fiscal deficit, where expenditures surpass revenues, necessitating borrowing that can increase public debt and affect economic stability.

Structural deficit

A structural deficit occurs when a government's expenditures consistently exceed its revenues even at full economic capacity, indicating a fundamental imbalance in fiscal policy. Unlike a cyclical deficit that fluctuates with economic conditions, a structural deficit reflects deeper issues requiring long-term budget adjustments to transition toward a surplus or balanced budget.

Revenue overrun

Revenue overrun occurs when actual income exceeds budgeted or projected amounts, creating a surplus that can strengthen financial stability and fund additional investments. Conversely, failing to achieve expected revenue results in a deficit, which may necessitate budget cuts or increased borrowing to cover shortfalls.

Expenditure gap

The expenditure gap signifies the difference between government spending and revenue, where a surplus occurs if revenue exceeds expenditures, and a deficit arises when spending surpasses income. Monitoring this gap is essential for fiscal policy decisions, debt management, and economic stability.

Budget shortfall

A budget shortfall occurs when expenditures exceed revenues, resulting in a deficit that contrasts with a surplus where revenues surpass spending. Managing the balance between surplus and deficit is crucial for ensuring fiscal stability and avoiding long-term financial strain.

Financing needs

Financing needs arise when a budget or account experiences a deficit, requiring external funds to cover the shortfall and maintain operations or investments. In contrast, a surplus indicates excess funds, allowing for debt reduction, increased savings, or reinvestment opportunities.

Cyclical adjustment

Cyclical adjustment measures a government's fiscal surplus or deficit by removing the effects of economic fluctuations to reveal the underlying structural balance. This adjustment allows policymakers to distinguish between temporary imbalances caused by economic cycles and sustainable fiscal positions, guiding more informed decisions on budgetary policies.

Public account disequilibrium

Public account disequilibrium occurs when a country's government budget experiences a persistent surplus or deficit, disrupting economic stability. A surplus indicates excess revenue over expenditures, often leading to debt reduction, while a deficit reflects higher spending than income, potentially increasing national debt and affecting fiscal policy sustainability.

Net lending/borrowing

Net lending/borrowing measures the difference between a government's total revenues and expenditures, indicating whether it runs a fiscal surplus or deficit; a positive net lending value denotes a surplus, while a negative value signals a deficit. This metric is crucial for assessing a country's fiscal health, debt sustainability, and capacity for future investments.

surplus vs deficit Infographic

moneydif.com

moneydif.com