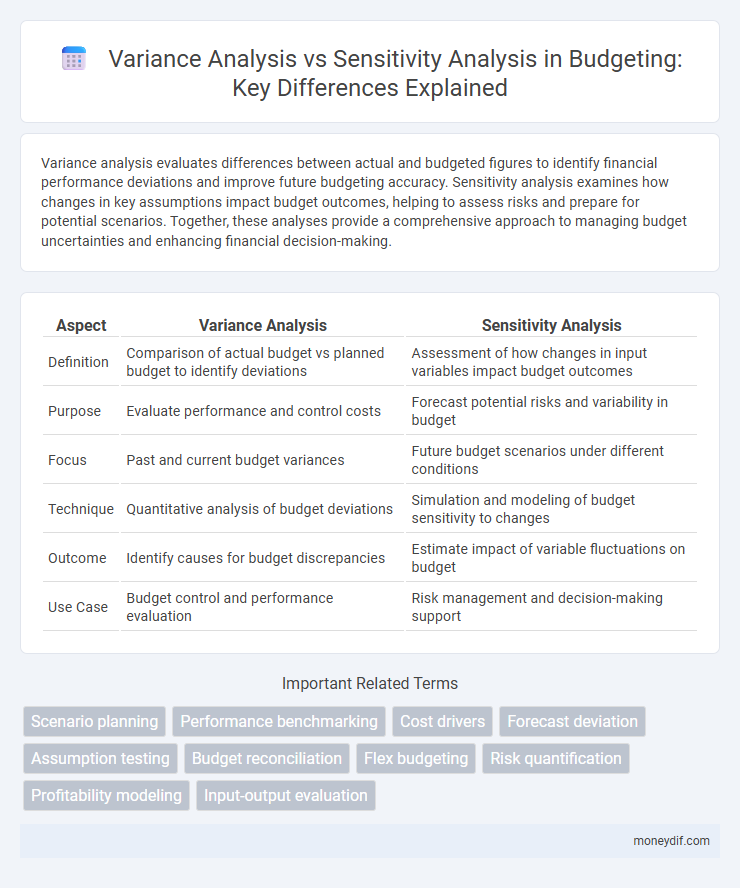

Variance analysis evaluates differences between actual and budgeted figures to identify financial performance deviations and improve future budgeting accuracy. Sensitivity analysis examines how changes in key assumptions impact budget outcomes, helping to assess risks and prepare for potential scenarios. Together, these analyses provide a comprehensive approach to managing budget uncertainties and enhancing financial decision-making.

Table of Comparison

| Aspect | Variance Analysis | Sensitivity Analysis |

|---|---|---|

| Definition | Comparison of actual budget vs planned budget to identify deviations | Assessment of how changes in input variables impact budget outcomes |

| Purpose | Evaluate performance and control costs | Forecast potential risks and variability in budget |

| Focus | Past and current budget variances | Future budget scenarios under different conditions |

| Technique | Quantitative analysis of budget deviations | Simulation and modeling of budget sensitivity to changes |

| Outcome | Identify causes for budget discrepancies | Estimate impact of variable fluctuations on budget |

| Use Case | Budget control and performance evaluation | Risk management and decision-making support |

Definition of Variance Analysis

Variance analysis evaluates the difference between budgeted and actual financial performance by examining deviations in costs, revenues, or profits to identify areas needing corrective action. It quantifies budget variances by comparing expected figures from financial plans with real outcomes, enabling businesses to control costs and improve forecasting accuracy. This analysis often involves breaking down variances into price, volume, and efficiency components to pinpoint specific operational issues affecting budget adherence.

Definition of Sensitivity Analysis

Sensitivity analysis measures how changes in key budget assumptions impact overall financial outcomes, identifying which variables most influence variance. It systematically tests the effect of varying one or more input parameters to assess risk and uncertainty in budget forecasts. This technique helps prioritize areas for cost control and resource allocation based on potential financial impact.

Key Objectives of Variance Analysis

Variance analysis focuses on identifying and quantifying deviations between budgeted and actual financial performance to highlight inefficiencies and areas requiring corrective action. It aims to provide precise insights into cost control, revenue management, and operational effectiveness by comparing planned targets against real outcomes. This analytical approach supports decision-makers in refining budget accuracy and enhancing financial accountability.

Primary Goals of Sensitivity Analysis

Sensitivity analysis primarily aims to assess how different input variables impact budget outcomes, identifying key factors that cause significant variations in financial forecasts. It helps organizations evaluate potential risks and uncertainties by modeling various scenarios, enabling more informed decision-making under fluctuating conditions. By quantifying the influence of individual parameters, sensitivity analysis supports proactive budget adjustments and more accurate resource allocation.

Methodologies Used in Variance Analysis

Variance analysis employs a systematic methodology that involves comparing actual financial performance against predetermined budgeted figures to identify deviations. Techniques such as flexible budgeting, cost-volume-profit analysis, and standard costing are frequently used to isolate and quantify the causes of variances in revenue and expenses. These methodologies enable organizations to pinpoint inefficiencies, control costs, and implement corrective actions effectively.

Techniques Applied in Sensitivity Analysis

Sensitivity analysis employs techniques such as scenario analysis, tornado diagrams, and Monte Carlo simulations to evaluate how changes in key input variables impact budget outcomes. These methods quantify uncertainty by varying one or multiple parameters within defined ranges, revealing the most influential factors on financial forecasts. The approach aids decision-makers in stress-testing budgets against potential risks and opportunities to enhance planning accuracy.

Advantages of Variance Analysis in Budgeting

Variance analysis allows organizations to compare actual financial performance against budgeted figures, enabling early identification of deviations and facilitating timely corrective actions. It provides quantitative insights into cost control and resource allocation efficiency by pinpointing specific areas where discrepancies occur. This targeted approach enhances accountability and supports continuous improvement in budgeting processes for better financial management.

Benefits of Sensitivity Analysis for Budget Planning

Sensitivity analysis enhances budget planning by identifying which variables have the greatest impact on financial outcomes, allowing more precise risk management. It helps forecast the potential effects of changing assumptions on key budget components, improving decision-making accuracy. This method supports proactive adjustments to budget plans, optimizing resource allocation under uncertainty.

Variance Analysis vs Sensitivity Analysis: Key Differences

Variance analysis measures the difference between budgeted and actual financial performance to identify deviations and their causes. Sensitivity analysis evaluates how changes in key assumptions or variables impact budget outcomes, highlighting risk factors and decision-making scenarios. Variance analysis is backward-looking for performance assessment, while sensitivity analysis is forward-looking for forecasting and strategic planning.

Choosing the Right Analysis for Effective Budget Management

Variance analysis evaluates the differences between budgeted and actual financial performance to identify discrepancies and control costs effectively. Sensitivity analysis examines how changes in key assumptions or variables impact budget outcomes, helping managers anticipate potential risks and adjust plans accordingly. Selecting the appropriate analysis depends on whether the focus is on past performance assessment or forecasting future uncertainties for strategic budget management.

Important Terms

Scenario planning

Scenario planning systematically evaluates potential future outcomes by integrating variance analysis to measure actual vs. budget deviations and sensitivity analysis to assess the impact of variable changes on financial projections.

Performance benchmarking

Performance benchmarking involves comparing key metrics to industry standards, where variance analysis identifies deviations between actual and budgeted performance, while sensitivity analysis evaluates how changes in input variables impact outcomes. Both methods enhance decision-making by quantifying financial risks and operational efficiencies through targeted financial and statistical evaluations.

Cost drivers

Cost drivers in variance analysis identify factors causing deviations between actual and budgeted costs, while sensitivity analysis assesses how changes in these drivers impact overall cost outcomes.

Forecast deviation

Forecast deviation measures the difference between actual outcomes and predicted values, serving as a key metric in variance analysis to identify performance gaps caused by changes in input variables. Sensitivity analysis complements this by assessing how variations in specific factors impact forecast results, enabling more precise adjustments and risk management in predictive modeling.

Assumption testing

Assumption testing evaluates the accuracy of input variables in variance analysis by quantifying deviations from expected values, while sensitivity analysis measures how changes in these assumptions impact overall model outcomes.

Budget reconciliation

Budget reconciliation involves comparing actual financial outcomes with budgeted figures through variance analysis while sensitivity analysis evaluates how changes in assumptions impact financial projections.

Flex budgeting

Flex budgeting adjusts budgets based on actual activity levels, enabling precise variance analysis by comparing flexible budgets to actual results to identify performance deviations. Sensitivity analysis evaluates how changes in key variables impact financial outcomes, but unlike variance analysis, it does not rely on actual versus budgeted comparisons within flexible budgets.

Risk quantification

Risk quantification involves using variance analysis to measure the dispersion of possible outcomes around the expected value and sensitivity analysis to evaluate how changes in input variables impact the variability of project results.

Profitability modeling

Profitability modeling leverages variance analysis to identify deviations from expected financial performance while sensitivity analysis evaluates the impact of varying key assumptions on profit outcomes.

Input-output evaluation

Input-output evaluation compares variance analysis, which quantifies output variability due to input uncertainties, with sensitivity analysis, which identifies the most influential inputs affecting output changes.

Variance analysis vs Sensitivity analysis Infographic

moneydif.com

moneydif.com