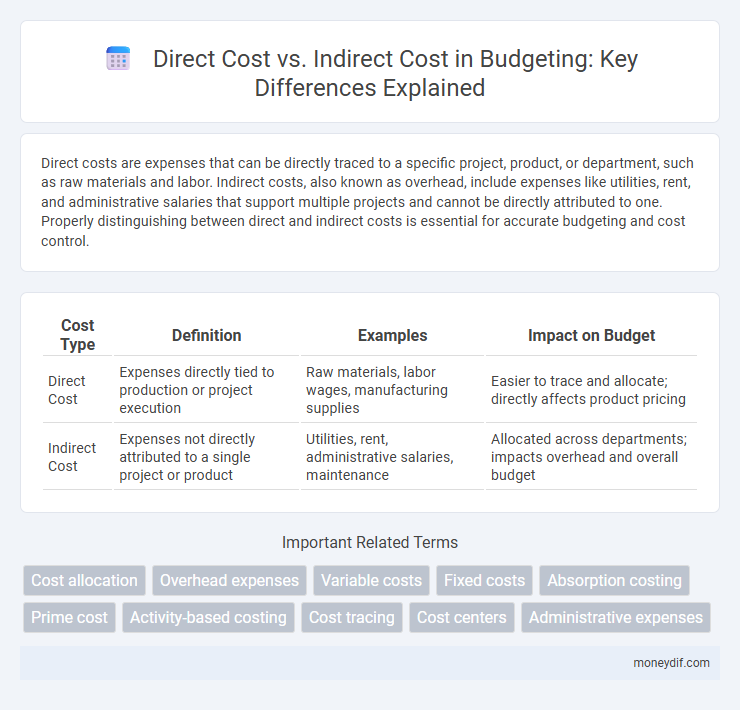

Direct costs are expenses that can be directly traced to a specific project, product, or department, such as raw materials and labor. Indirect costs, also known as overhead, include expenses like utilities, rent, and administrative salaries that support multiple projects and cannot be directly attributed to one. Properly distinguishing between direct and indirect costs is essential for accurate budgeting and cost control.

Table of Comparison

| Cost Type | Definition | Examples | Impact on Budget |

|---|---|---|---|

| Direct Cost | Expenses directly tied to production or project execution | Raw materials, labor wages, manufacturing supplies | Easier to trace and allocate; directly affects product pricing |

| Indirect Cost | Expenses not directly attributed to a single project or product | Utilities, rent, administrative salaries, maintenance | Allocated across departments; impacts overhead and overall budget |

Understanding Direct and Indirect Costs

Direct costs are expenses that can be directly attributed to a specific project, product, or service, such as raw materials and labor. Indirect costs include overhead expenses like utilities, rent, and administrative salaries that support multiple projects without direct assignment. Understanding the distinction between direct and indirect costs is essential for accurate budgeting, cost control, and pricing strategies.

Key Differences Between Direct and Indirect Costs

Direct costs are expenses directly attributable to a specific project, such as raw materials and labor, enabling precise cost tracking. Indirect costs, including utilities, rent, and administrative salaries, support multiple projects but cannot be linked to one particular cost object. Understanding these key differences helps organizations allocate budgets efficiently and accurately for project management and financial reporting.

Examples of Direct Costs in Budgeting

Direct costs in budgeting include expenses that can be directly attributed to a specific project or product, such as raw materials, labor wages for production staff, and manufacturing supplies. These costs vary with the level of production output and are essential for calculating the total cost of goods sold. Precise tracking of direct costs enables accurate project budgeting and financial forecasting.

Common Indirect Costs to Consider

Common indirect costs to consider in budgeting include overhead expenses such as utilities, rent, administrative salaries, and office supplies. These costs are not directly tied to a specific project but are essential for overall operations and must be allocated proportionally across departments. Properly identifying and accounting for indirect costs ensures accurate financial reporting and effective budget management.

Importance of Categorizing Costs Accurately

Accurately categorizing direct costs and indirect costs is essential for precise budget planning and financial reporting, enabling organizations to allocate resources efficiently and control expenses effectively. Direct costs, such as raw materials and labor directly tied to production, impact product pricing and profitability analysis, while indirect costs, including overhead and administrative expenses, influence overall operational budgeting. Proper classification improves cost tracking, supports compliance with regulatory standards, and enhances decision-making for cost management and strategic financial planning.

How Direct Costs Impact Project Budgets

Direct costs, such as labor and materials, significantly influence project budgets by providing clear, traceable expenses directly attributed to specific activities or outputs. These costs enable precise budget forecasting and resource allocation, reducing financial uncertainty during project execution. Accurately accounting for direct costs ensures efficient monitoring and control, essential for maintaining project financial health and meeting overall budget targets.

Allocating Indirect Costs: Best Practices

Effective allocation of indirect costs involves using accurate cost drivers such as labor hours, machine hours, or square footage to fairly distribute expenses across departments or projects. Best practices include implementing standardized allocation bases, regularly reviewing cost distribution for accuracy, and maintaining transparent documentation to support budget decisions. These strategies ensure precise budgeting, improved cost control, and enhanced financial reporting accuracy.

Challenges in Differentiating Cost Types

Distinguishing direct costs from indirect costs poses significant challenges due to overlapping expenses and shared resources that complicate precise allocation. Direct costs are easily traced to specific projects or products, such as raw materials and labor, whereas indirect costs, including utilities and administrative salaries, support multiple functions and lack straightforward attribution. Accurate cost differentiation requires robust accounting systems and consistent criteria to prevent misclassification, which can lead to budget distortions and impact financial decision-making.

Implications of Cost Allocation on Financial Reporting

Direct costs are expenses directly traceable to a specific project or product, such as raw materials and labor, which ensure precise financial reporting and profitability analysis. Indirect costs, like overhead and administrative expenses, require allocation methods that can impact cost accuracy, affecting budgeting decisions and financial statement transparency. Misallocation or inconsistent application of these costs can lead to distorted financial results, regulatory compliance issues, and misinformed managerial decisions.

Strategies to Control Direct and Indirect Costs

Effective strategies to control direct costs include meticulous tracking of raw materials, labor, and manufacturing expenses to minimize waste and improve efficiency. Managing indirect costs requires optimizing overhead by renegotiating supplier contracts, leveraging technology for automation, and reducing utility consumption. Implementing activity-based costing enhances accuracy in allocating indirect costs, enabling targeted cost reduction initiatives and improved budget management.

Important Terms

Cost allocation

Cost allocation differentiates direct costs, which are directly traceable to a specific product or service, from indirect costs, which are overhead expenses allocated across multiple departments or projects.

Overhead expenses

Overhead expenses are classified as indirect costs because they cannot be directly traced to a specific product, unlike direct costs that are directly attributable to production.

Variable costs

Variable costs directly fluctuate with production volume, classifying them primarily as direct costs, while indirect costs typically remain fixed regardless of output levels.

Fixed costs

Fixed costs remain constant regardless of production volume and can be classified as either direct or indirect costs; direct fixed costs are specifically traceable to a product or department, such as salaried personnel in manufacturing, while indirect fixed costs like rent or utilities support overall operations without direct attribution. Understanding the distinction between direct fixed costs and indirect fixed costs is essential for accurate cost allocation, budgeting, and profitability analysis in managerial accounting.

Absorption costing

Absorption costing allocates both direct costs, such as raw materials and labor, and indirect costs, like factory overhead, to product units for comprehensive cost measurement.

Prime cost

Prime cost consists of direct costs including direct materials and direct labor, while indirect costs are excluded as overhead expenses.

Activity-based costing

Activity-based costing allocates indirect costs to products by tracing expenses to activities, providing more accurate cost information compared to traditional direct cost allocation methods.

Cost tracing

Cost tracing directly assigns expenses to specific cost objects, distinguishing direct costs clearly from indirect costs that require allocation methods.

Cost centers

Cost centers are organizational units that track expenses, distinguishing direct costs like raw materials and labor from indirect costs such as utilities and administrative salaries.

Administrative expenses

Administrative expenses are classified as indirect costs because they cannot be directly traced to a specific product or service, unlike direct costs which are directly attributable to production activities.

Direct cost vs Indirect cost Infographic

moneydif.com

moneydif.com