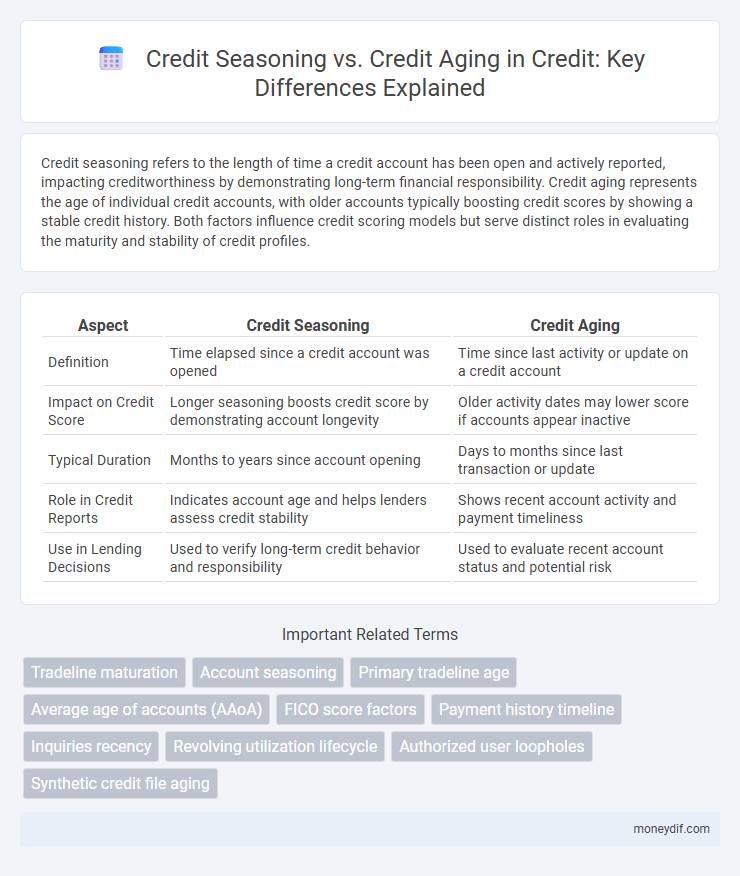

Credit seasoning refers to the length of time a credit account has been open and actively reported, impacting creditworthiness by demonstrating long-term financial responsibility. Credit aging represents the age of individual credit accounts, with older accounts typically boosting credit scores by showing a stable credit history. Both factors influence credit scoring models but serve distinct roles in evaluating the maturity and stability of credit profiles.

Table of Comparison

| Aspect | Credit Seasoning | Credit Aging |

|---|---|---|

| Definition | Time elapsed since a credit account was opened | Time since last activity or update on a credit account |

| Impact on Credit Score | Longer seasoning boosts credit score by demonstrating account longevity | Older activity dates may lower score if accounts appear inactive |

| Typical Duration | Months to years since account opening | Days to months since last transaction or update |

| Role in Credit Reports | Indicates account age and helps lenders assess credit stability | Shows recent account activity and payment timeliness |

| Use in Lending Decisions | Used to verify long-term credit behavior and responsibility | Used to evaluate recent account status and potential risk |

Understanding Credit Seasoning and Credit Aging

Credit seasoning refers to the length of time an account or credit history has been established, impacting lenders' assessment of creditworthiness and risk. Credit aging measures the time elapsed since the last activity on an account or the average age of all accounts, influencing credit scores by reflecting account stability. Understanding both credit seasoning and credit aging is essential for optimizing credit profiles and improving loan approval chances.

Key Differences Between Credit Seasoning and Credit Aging

Credit seasoning refers to the length of time a credit account has been open, indicating the history and stability of the credit relationship, while credit aging focuses on how long individual credit accounts or debts have remained unpaid or outstanding. Seasoning impacts credit score by demonstrating responsible long-term credit management, whereas aging affects credit risk assessment by highlighting potential delinquency or default. The key difference lies in seasoning measuring account lifespan, whereas aging measures delinquency duration on specific debts.

How Credit Seasoning Impacts Your Credit Profile

Credit seasoning refers to the length of time credit accounts have been open and actively managed, which positively influences your credit profile by demonstrating financial responsibility over time. Lenders use credit seasoning to assess risk, as longer account histories typically indicate stability and reduce the likelihood of default. Consistently maintaining older credit accounts can improve credit scores by enhancing the average account age, a key factor in credit scoring models.

The Role of Credit Aging in Credit Scores

Credit aging plays a crucial role in credit scores by reflecting the length of time credit accounts have been active, which demonstrates credit management experience to lenders. Longer credit aging typically leads to higher credit scores because it indicates stability and responsible borrowing behavior over time. Credit seasoning, while related to how long an account has been open, primarily impacts loan eligibility and terms rather than directly influencing credit scores.

Benefits of Credit Seasoning for New Accounts

Credit seasoning enhances a new account's credibility by demonstrating consistent, timely payments over a defined period, typically six months to a year. This positive payment history can improve credit scores and increase the likelihood of loan approvals and better interest rates. Lenders favor seasoned accounts as they provide a reliable track record, reducing perceived risk compared to newly opened accounts without established history.

Credit Aging: Why Older Accounts Matter

Credit aging refers to the length of time credit accounts have been open, significantly impacting credit scores by demonstrating credit management stability. Older accounts contribute positively to the credit history length, a key factor in credit scoring models like FICO and VantageScore, which assess the risk associated with lending. Maintaining long-standing accounts can lower credit risk and enhance the likelihood of loan approvals and favorable interest rates.

Strategies to Maximize Credit Seasoning

Credit seasoning refers to the length of time credit accounts have been open, directly impacting creditworthiness and lending decisions. Strategies to maximize credit seasoning include maintaining long-term credit accounts, avoiding unnecessary account closures, and strategically adding new credit only when necessary to preserve the average account age. Monitoring credit reports regularly ensures accurate reporting of account opening dates, which supports optimal credit seasoning and improves overall credit scores.

Common Myths About Credit Seasoning and Aging

Credit seasoning refers to the length of time credit accounts have been open, while credit aging tracks how long specific accounts have remained on a credit report. A common myth is that credit seasoning resets with every new credit inquiry, but it actually continues to accumulate as accounts age. Another misconception is that credit aging only impacts credit scores after several years, whereas even small increases in account age can positively influence creditworthiness over time.

Potential Risks of Manipulating Credit Age

Manipulating credit age by frequently opening new accounts or closing old ones can distort credit history, negatively impacting credit scoring algorithms that prioritize long-term account activity. Such actions may lead to a falsely improved credit profile, increasing the risk of loan application rejections or higher interest rates when lenders detect inconsistencies. Credit seasoning is essential for establishing trustworthiness, and tampering with credit age can undermine financial credibility and damage future borrowing potential.

Best Practices for Building Strong Credit Over Time

Credit seasoning refers to the length of time an account has been open, while credit aging measures how long each credit account has remained active without negative marks. Maintaining a diverse mix of credit accounts and consistently making on-time payments enhances credit aging, which in turn strengthens overall credit scores. Best practices include regularly reviewing credit reports, avoiding frequent account closures, and keeping older credit lines open to maximize credit seasoning and demonstrate financial responsibility.

Important Terms

Tradeline maturation

Tradeline maturation refers to the process by which a credit account becomes more established over time, improving a borrower's credit profile through consistent timely payments. Credit seasoning tracks the age of individual credit accounts, while credit aging encompasses the overall duration and development of all credit lines in a portfolio, both crucial for boosting credit scores.

Account seasoning

Account seasoning refers to the length of time an account has been open and actively used, directly impacting creditworthiness by demonstrating financial stability over time. Unlike credit aging, which tracks the duration since the last activity on a credit account, credit seasoning emphasizes the overall account history and its influence on credit scoring models.

Primary tradeline age

Primary tradeline age represents the duration since the first credit account was opened, significantly impacting credit seasoning by demonstrating a borrower's credit history length. Credit aging measures the recent activity and updates on credit accounts, highlighting current financial behavior distinct from the overall credit seasoning reflected by primary tradeline age.

Average age of accounts (AAoA)

Average Age of Accounts (AAoA) measures the mean duration since credit accounts were opened, playing a critical role in credit seasoning by reflecting the length of credit history. Credit aging tracks the progression of account activity over time, whereas credit seasoning focuses on the overall maturity and stability indicated by the AAoA, impacting credit scores and lending decisions.

FICO score factors

FICO score factors weigh credit seasoning and credit aging differently, with credit seasoning reflecting the length of credit history and credit aging focusing on the average age of accounts; longer credit seasoning and older account age generally improve creditworthiness. Credit seasoning impacts the overall credit history duration, while credit aging influences risk assessment by showing stability in credit behavior over time.

Payment history timeline

Payment history timeline reflects the chronological record of on-time and late payments, directly impacting credit seasoning, which measures the length of credit accounts, while credit aging refers to the duration since the last update or activity on an account. Understanding the distinction between credit seasoning and credit aging helps lenders assess creditworthiness by evaluating both the maturity of accounts and recent payment patterns.

Inquiries recency

Credit seasoning measures the length of time a credit account has been open, impacting creditworthiness by demonstrating financial stability over months or years. Credit aging focuses on the recency and frequency of credit inquiries, where recent inquiries can temporarily lower credit scores by signaling potential new debt risk.

Revolving utilization lifecycle

Revolving utilization lifecycle reflects how credit card balances fluctuate over time, directly impacting credit seasoning--the length of time accounts have been active--and credit aging, which measures the age of individual credit accounts. Monitoring these metrics helps lenders assess borrower creditworthiness by evaluating both recent credit usage patterns and the historical stability of credit accounts.

Authorized user loopholes

Authorized user loopholes exploit credit seasoning by adding users to seasoned accounts, artificially boosting credit profiles without actual credit history buildup. This practice manipulates credit aging metrics, potentially misleading lenders about a borrower's true creditworthiness.

Synthetic credit file aging

Synthetic credit file aging simulates the progression of credit accounts to analyze creditworthiness over time, differentiating from credit seasoning which measures the actual duration since account opening; credit aging refers to the real-time status and updates of credit accounts, impacting credit scores based on current account activity and payment history. Understanding synthetic aging models helps lenders predict risk by projecting credit behavior, while seasoning and actual aging provide empirical data essential for accurate credit evaluations.

Credit seasoning vs Credit aging Infographic

moneydif.com

moneydif.com