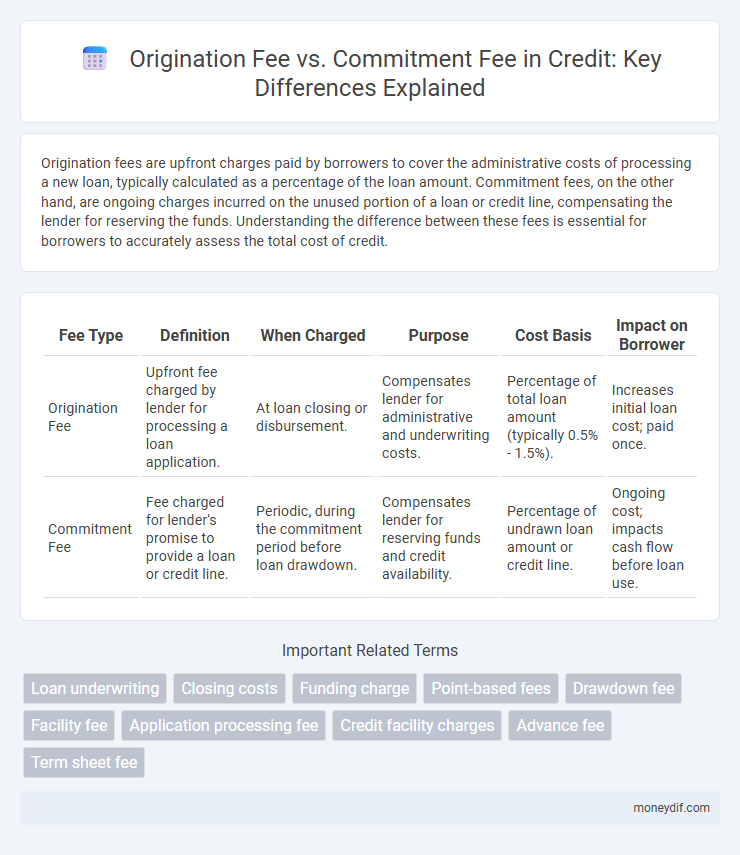

Origination fees are upfront charges paid by borrowers to cover the administrative costs of processing a new loan, typically calculated as a percentage of the loan amount. Commitment fees, on the other hand, are ongoing charges incurred on the unused portion of a loan or credit line, compensating the lender for reserving the funds. Understanding the difference between these fees is essential for borrowers to accurately assess the total cost of credit.

Table of Comparison

| Fee Type | Definition | When Charged | Purpose | Cost Basis | Impact on Borrower |

|---|---|---|---|---|---|

| Origination Fee | Upfront fee charged by lender for processing a loan application. | At loan closing or disbursement. | Compensates lender for administrative and underwriting costs. | Percentage of total loan amount (typically 0.5% - 1.5%). | Increases initial loan cost; paid once. |

| Commitment Fee | Fee charged for lender's promise to provide a loan or credit line. | Periodic, during the commitment period before loan drawdown. | Compensates lender for reserving funds and credit availability. | Percentage of undrawn loan amount or credit line. | Ongoing cost; impacts cash flow before loan use. |

Origination Fee vs Commitment Fee: Key Differences

Origination fees are upfront charges applied when a loan is initiated, covering the lender's administrative costs and typically calculated as a percentage of the loan amount. Commitment fees are ongoing fees paid for reserving credit availability, often charged on the unused portion of a credit line during the loan term. The key difference lies in timing and purpose: origination fees are one-time charges for loan processing, while commitment fees compensate lenders for maintaining access to funds.

Understanding Origination Fees in Credit Agreements

Origination fees in credit agreements represent charges lenders impose to cover the administrative costs of processing a loan application, typically calculated as a percentage of the loan amount. These fees differ from commitment fees, which are charged on the unused portion of a credit line to compensate lenders for keeping funds available. Understanding origination fees is crucial for borrowers to accurately assess the full cost of credit and compare financing options effectively.

What Is a Commitment Fee?

A commitment fee is a charge paid by a borrower to a lender for reserving unused credit on a loan or credit line, ensuring funds are available when needed. Typically calculated as a percentage of the unused portion of the credit facility, this fee compensates the lender for maintaining liquidity and readiness to disburse funds. Unlike an origination fee, which is a one-time upfront cost for processing a loan, the commitment fee is ongoing and applies to the unused credit commitment during the loan period.

Why Lenders Charge Origination Fees

Lenders charge origination fees to cover the administrative costs of processing a new loan, including underwriting, credit checks, and document preparation. This fee compensates the lender for the time and resources invested before the loan is disbursed, ensuring risk assessment and regulatory compliance. Unlike commitment fees, which secure the lender's promise to provide credit, origination fees are directly tied to the initiation and approval of the loan.

The Purpose of Commitment Fees in Credit Facilities

Commitment fees in credit facilities serve as compensation to lenders for reserving a specified amount of credit, ensuring borrower access to funds when needed. Unlike origination fees, which are charged upfront for processing and underwriting a loan, commitment fees are typically calculated as a percentage of the unused portion of the credit line. This fee incentivizes borrowers to draw on the credit facility while providing lenders with compensation during periods of non-utilization.

How Origination Fees Impact Borrowers’ Costs

Origination fees directly increase the upfront cost of a loan, typically calculated as a percentage of the total loan amount, and are paid at closing. These fees affect the borrower's effective interest rate by adding to the overall loan expenses, often resulting in higher monthly payments or a larger initial outlay. Unlike commitment fees, which charge for unused credit availability, origination fees impact borrowers' costs by increasing the principal balance that accrues interest over time.

When Do Commitment Fees Apply?

Commitment fees apply when a lender agrees to provide a borrower with a specific loan amount, but the funds have not yet been drawn down or fully utilized. These fees compensate the lender for keeping the credit line available and are typically calculated as a percentage of the unused portion of the loan commitment. Commitment fees differ from origination fees, which are charged upfront based on the total loan amount at the time of loan approval or disbursement.

Comparing Fee Structures: Origination vs Commitment

Origination fees are one-time charges paid upfront for processing a loan application, typically calculated as a percentage of the total loan amount, ranging from 0.5% to 1.5%. Commitment fees are recurring costs imposed on the undisbursed portion of a credit line or loan facility, usually between 0.25% and 0.5%, serving as compensation for the lender's obligation to provide funds. Comparing fee structures reveals origination fees impact initial borrowing costs, while commitment fees affect ongoing expenses for maintaining credit availability.

Negotiating Origination and Commitment Fees

Negotiating origination and commitment fees requires understanding their distinct purposes: origination fees cover processing and underwriting costs, while commitment fees compensate lenders for reserving credit. Borrowers can leverage their creditworthiness and loan size to request reductions or waivers, particularly for origination fees that often represent a percentage of the loan amount. Thorough comparison of lender fee structures and clear communication about intended loan utilization improves the likelihood of securing favorable terms on both fees.

Which Fee Affects Your Loan the Most?

Origination fees directly impact your loan by increasing the upfront cost, typically ranging from 0.5% to 1% of the loan amount, which is paid at closing. Commitment fees apply to the unused portion of a credit line, usually around 0.25% to 0.5%, and affect ongoing borrowing costs rather than the initial loan balance. Understanding that origination fees influence the total loan principal and repayment schedule more significantly helps borrowers prioritize costs when evaluating loan offers.

Important Terms

Loan underwriting

Loan underwriting involves evaluating borrower risk and creditworthiness, where the origination fee covers the lender's processing costs and the commitment fee compensates for reserving funds during the loan approval period.

Closing costs

Closing costs typically include an origination fee, which covers loan processing, and a commitment fee, charged for reserving the loan amount before closing.

Funding charge

Funding charges typically include the origination fee, a one-time upfront cost for processing a loan, whereas the commitment fee is an ongoing charge imposed on the unused portion of a credit line.

Point-based fees

Point-based origination fees represent a percentage of the loan amount charged upfront for processing, while commitment fees are ongoing charges on unused credit lines ensuring lender compensation.

Drawdown fee

Drawdown fees are charged when funds are accessed, differing from origination fees, which are upfront charges for loan processing, and commitment fees, which are periodic fees on unused credit commitments.

Facility fee

Facility fees are upfront charges paid by borrowers for loan processing, distinct from origination fees that cover loan creation costs, while commitment fees are ongoing payments for lender's reserved credit availability.

Application processing fee

Application processing fees are one-time charges during loan initiation, distinct from origination fees which cover loan disbursement costs, while commitment fees are ongoing charges on unused loan amounts.

Credit facility charges

Credit facility charges include an origination fee, which is a one-time cost for processing the loan, and a commitment fee, which is a recurring charge on the unused portion of the credit line.

Advance fee

Advance fees typically include origination fees, which cover loan processing costs, while commitment fees are charged for reserving the loan amount without immediate disbursement.

Term sheet fee

Term sheet fees typically include an origination fee, which is a one-time charge for processing the loan, and a commitment fee, which is a periodic charge for reserving the loan amount until disbursement.

origination fee vs commitment fee Infographic

moneydif.com

moneydif.com