Credit utilization refers to the percentage of your available credit limit that you are currently using, which directly impacts your credit score. Maintaining a low credit utilization ratio, ideally below 30%, demonstrates responsible borrowing and helps improve creditworthiness. Monitoring your credit limit and managing your spending within it prevents overextension and potential negative effects on your financial health.

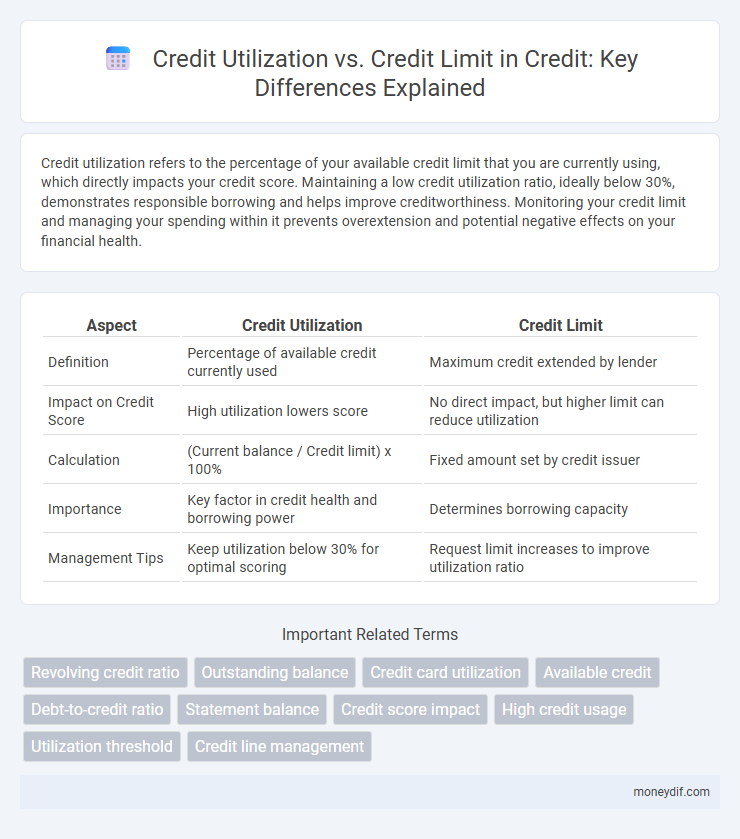

Table of Comparison

| Aspect | Credit Utilization | Credit Limit |

|---|---|---|

| Definition | Percentage of available credit currently used | Maximum credit extended by lender |

| Impact on Credit Score | High utilization lowers score | No direct impact, but higher limit can reduce utilization |

| Calculation | (Current balance / Credit limit) x 100% | Fixed amount set by credit issuer |

| Importance | Key factor in credit health and borrowing power | Determines borrowing capacity |

| Management Tips | Keep utilization below 30% for optimal scoring | Request limit increases to improve utilization ratio |

Understanding Credit Utilization

Credit utilization represents the percentage of your available credit limit that you are currently using, which directly impacts your credit score. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management to lenders and improves creditworthiness. Monitoring and managing your credit utilization helps prevent over-borrowing and supports a healthy credit profile.

What Is a Credit Limit?

A credit limit is the maximum amount of credit a financial institution extends to a borrower on a credit card or revolving credit account. It represents the total spending capacity granted, influencing credit utilization ratios that impact credit scores. Maintaining a low credit utilization ratio--typically below 30% of the credit limit--can enhance creditworthiness and borrowing potential.

How Credit Utilization Impacts Your Credit Score

Credit utilization, the ratio of your current credit balances to your credit limits, plays a crucial role in determining your credit score. Maintaining a credit utilization rate below 30% signals responsible credit management to lenders and can improve your score. High utilization rates suggest increased risk, potentially lowering your credit score and affecting your ability to obtain new credit.

Credit Limit: Why It Matters

Credit limit represents the maximum amount a credit issuer allows a borrower to spend on a credit card or revolving account, directly influencing credit utilization rates. Maintaining a low credit utilization ratio, calculated by dividing outstanding balances by credit limits, can enhance credit scores and signal responsible credit management to lenders. A higher credit limit provides greater borrowing flexibility while preserving credit utilization below recommended thresholds, which benefits long-term credit health.

Calculating Your Credit Utilization Ratio

Calculating your credit utilization ratio involves dividing your total credit card balances by your overall credit limits and multiplying by 100 to get a percentage. Maintaining a credit utilization ratio below 30% is recommended to positively impact credit scores. Accurate tracking of current balances and credit limits across all accounts ensures effective management of credit usage.

Ideal Credit Utilization Percentage

Maintaining an ideal credit utilization percentage between 1% and 30% is crucial for a healthy credit score, as it indicates responsible credit management. Credit utilization is calculated by dividing the total credit card balances by the total credit limits, reflecting the proportion of available credit being used. Keeping utilization below 30% signals low credit risk to lenders and can improve creditworthiness over time.

Strategies to Lower Credit Utilization

Maintaining credit utilization below 30% is essential for optimizing credit scores and financial health. Strategies to lower credit utilization include requesting credit limit increases, spreading purchases across multiple credit cards, and paying down balances frequently throughout the billing cycle. Monitoring credit reports regularly helps identify high utilization instances, allowing timely adjustments to spending habits and credit management.

Increasing Your Credit Limit: Pros and Cons

Increasing your credit limit can lower your credit utilization ratio, which positively impacts your credit score by demonstrating responsible credit management. However, a higher credit limit may encourage overspending, leading to potential debt accumulation and financial strain. Carefully weigh the benefits of improved credit utilization against the risk of increased debt before requesting a credit limit increase.

Credit Utilization vs. Credit Limit: Key Differences

Credit utilization measures the percentage of your available credit limit being used, directly impacting your credit score by reflecting spending habits and credit management. The credit limit represents the maximum amount a lender allows you to borrow on a credit card or line of credit, setting the boundary for your spending potential. Maintaining a low credit utilization ratio relative to the credit limit, ideally below 30%, demonstrates responsible credit usage and enhances creditworthiness in the eyes of lenders.

Tips for Managing Credit Responsibly

Maintaining a credit utilization ratio below 30% of your credit limit is essential for a healthy credit score and responsible credit management. Regularly monitoring your credit card balances and making timely payments helps avoid exceeding your credit limit, which can result in fees and credit score damage. Setting alerts for balance thresholds and using budget tracking tools support disciplined spending habits while maximizing credit benefits.

Important Terms

Revolving credit ratio

Revolving credit ratio measures the proportion of credit used compared to the total credit limit, directly impacting credit utilization rates. Maintaining a low revolving credit ratio, ideally below 30%, is crucial for optimizing credit scores and demonstrating responsible credit management.

Outstanding balance

An outstanding balance represents the total amount owed on a credit account, directly impacting credit utilization, which is the ratio of the outstanding balance to the credit limit. Maintaining a low credit utilization ratio, ideally below 30%, is essential for optimizing credit scores and demonstrating responsible credit management.

Credit card utilization

Credit card utilization refers to the percentage of your credit limit currently being used, calculated by dividing your outstanding balance by your credit limit. Maintaining a credit utilization ratio below 30% is essential for a healthy credit score, as high utilization signals increased credit risk to lenders.

Available credit

Available credit represents the difference between your credit limit and current credit utilization, directly impacting your credit score by showing how much credit remains unused. Maintaining a low credit utilization ratio, ideally below 30%, maximizes available credit and signals responsible credit management to lenders.

Debt-to-credit ratio

The debt-to-credit ratio measures the proportion of outstanding debt against the total credit limit, directly reflecting credit utilization, which impacts credit scores by indicating how much available credit is being used. Maintaining a low debt-to-credit ratio, ideally below 30%, helps optimize credit utilization and enhances creditworthiness in lenders' assessments.

Statement balance

Statement balance reflects the total amount owed on a credit card at the end of a billing cycle, directly impacting credit utilization, which is calculated by dividing the statement balance by the credit limit. Maintaining a low credit utilization ratio, ideally below 30%, can improve credit scores and demonstrate responsible credit management to lenders.

Credit score impact

Credit utilization ratio, calculated by dividing total credit card balances by credit limits, directly influences credit scores, with lower utilization typically boosting scores by demonstrating responsible credit management. Maintaining credit utilization below 30% of available credit limits signals creditworthiness to scoring models like FICO and VantageScore, helping improve overall credit health.

High credit usage

High credit usage occurs when the credit utilization ratio--the amount of credit used relative to the total credit limit--exceeds recommended thresholds, often above 30%. Elevated credit utilization negatively impacts credit scores by signaling higher credit risk to lenders and can limit future borrowing capacity.

Utilization threshold

Utilization threshold represents the maximum percentage of your credit limit you should ideally use to maintain a healthy credit score, commonly recommended to be below 30%. Monitoring credit utilization, calculated as the credit balance divided by the credit limit, helps avoid surpassing this threshold and signals responsible credit management to lenders.

Credit line management

Effective credit line management involves monitoring credit utilization, the ratio of credit used to the total credit limit, to maintain a healthy credit score. Keeping credit utilization below 30% of the credit limit optimizes creditworthiness and prevents excessive debt accumulation.

Credit utilization vs Credit limit Infographic

moneydif.com

moneydif.com