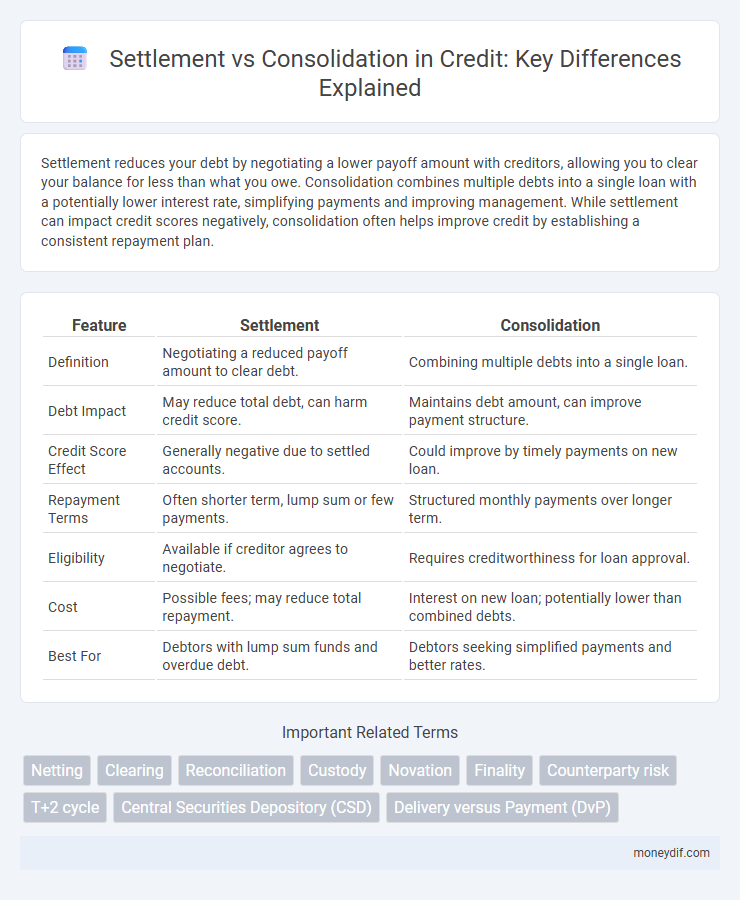

Settlement reduces your debt by negotiating a lower payoff amount with creditors, allowing you to clear your balance for less than what you owe. Consolidation combines multiple debts into a single loan with a potentially lower interest rate, simplifying payments and improving management. While settlement can impact credit scores negatively, consolidation often helps improve credit by establishing a consistent repayment plan.

Table of Comparison

| Feature | Settlement | Consolidation |

|---|---|---|

| Definition | Negotiating a reduced payoff amount to clear debt. | Combining multiple debts into a single loan. |

| Debt Impact | May reduce total debt, can harm credit score. | Maintains debt amount, can improve payment structure. |

| Credit Score Effect | Generally negative due to settled accounts. | Could improve by timely payments on new loan. |

| Repayment Terms | Often shorter term, lump sum or few payments. | Structured monthly payments over longer term. |

| Eligibility | Available if creditor agrees to negotiate. | Requires creditworthiness for loan approval. |

| Cost | Possible fees; may reduce total repayment. | Interest on new loan; potentially lower than combined debts. |

| Best For | Debtors with lump sum funds and overdue debt. | Debtors seeking simplified payments and better rates. |

Settlement vs Consolidation: Key Differences in Credit Solutions

Settlement involves negotiating with creditors to pay a reduced balance, often impacting credit scores but providing quicker debt resolution. Consolidation combines multiple debts into a single loan with a fixed interest rate, simplifying payments and potentially lowering monthly costs without immediately harming credit scores. Choosing between settlement and consolidation depends on individual financial situations, credit health, and long-term debt management goals.

How Credit Settlement Works Compared to Debt Consolidation

Credit settlement involves negotiating with creditors to pay a reduced lump sum as full repayment, often resulting in immediate debt relief but potentially impacting credit scores negatively. Debt consolidation combines multiple debts into a single loan with a lower interest rate, improving payment management and often preserving credit standing. While settlement reduces the total debt owed, consolidation restructures payments without necessarily lowering the principal amount.

Pros and Cons of Credit Settlement vs Consolidation

Credit settlement often reduces the total debt amount by negotiating with creditors, providing quicker relief but potentially harming credit scores and incurring tax liabilities on forgiven debt. Consolidation combines multiple debts into a single loan with a fixed interest rate, simplifying payments and potentially lowering monthly costs while possibly extending the repayment term and increasing total interest paid. Choosing between settlement and consolidation depends on factors like credit health, debt amount, and the borrower's ability to negotiate or maintain consistent payments.

Impact on Credit Score: Settlement vs Consolidation

Settlement often causes a significant drop in credit scores because it involves paying less than the full debt amount, signaling lenders of potential credit risk. Consolidation can improve credit scores over time by streamlining debt payments into a single account with lower interest rates, reducing credit utilization ratio and enhancing payment history. Lenders typically view consolidation more favorably than settlement due to consistent repayment behavior reflected in credit reports.

Eligibility Criteria for Settlement and Consolidation

Settlement eligibility typically requires a borrower to demonstrate financial hardship and an outstanding debt amount that creditors are willing to negotiate, often involving accounts in default or delinquency. Consolidation eligibility generally depends on the borrower's credit score, income stability, and existing debt levels, as it involves combining multiple debts into a single loan with more manageable payments. Lenders for consolidation often require proof of steady income and a minimum credit score to approve lower interest rates and extended repayment terms.

Cost Comparison: Settlement Fees vs Consolidation Costs

Settlement fees typically involve paying a lump sum amount, often below the total debt owed, which can reduce the overall financial burden but may incur tax implications on forgiven debt. Consolidation costs include origination fees, interest over the loan term, and possibly higher total repayment amounts due to extended loan periods. Comparing these options requires evaluating immediate savings against long-term financial impact, factoring in fees, interest rates, and repayment timelines.

Timeframe: How Long Does Settlement vs Consolidation Take?

Settlement typically resolves debt within a few months, often between 3 to 6 months, as creditors negotiate a payoff amount less than what is owed. Consolidation usually requires a longer timeframe, ranging from 12 to 48 months, as it involves combining multiple debts into a single loan with a structured repayment plan. The faster timeline of settlement can impact credit scores differently compared to the extended, consistent payment schedule of consolidation.

Risks Involved in Credit Settlement and Consolidation

Credit settlement poses risks such as damage to credit scores, potential tax liabilities on forgiven debt, and immediate payment demands from creditors if agreements fail. Consolidation risks include higher overall interest costs, longer repayment terms, and the possibility of accumulating more debt if spending habits are not controlled. Both options require careful assessment of financial stability to avoid deeper debt cycles and ensure effective credit management.

Choosing the Best Option: Factors to Consider

Evaluate interest rates, repayment terms, and overall debt amounts when choosing between settlement and consolidation to reduce credit burdens effectively. Settlement often lowers the total owed but can impact credit scores negatively, while consolidation streamlines payments with potentially lower interest rates without severely affecting credit history. Consider your financial stability, long-term goals, and lender terms to determine the most beneficial strategy for managing credit.

Frequently Asked Questions About Settlement and Consolidation

Settlement and consolidation are common debt relief strategies, with settlement involving negotiating debt for less than owed and consolidation merging multiple debts into a single loan with one payment. Frequently asked questions include the impact on credit scores, where settlement may lower credit temporarily due to negotiated amounts, while consolidation can maintain or slightly improve scores by simplifying payments. Borrowers often inquire about eligibility, costs, and whether these methods reduce overall debt or just manage payments.

Important Terms

Netting

Netting in financial transactions reduces the number of payments between parties by offsetting debits and credits, optimizing settlement efficiency and minimizing counterparty risk. Settlement involves the actual exchange of funds or assets after netting, whereas consolidation aggregates multiple transactions into a single net amount to streamline settlement processes.

Clearing

Clearing involves the process of reconciling purchase and sale orders before settlement, ensuring accurate transfer of securities and funds between parties. Settlement finalizes the transaction by exchanging the securities and payment, whereas consolidation combines multiple trades into a single net position to reduce settlement obligations and risk.

Reconciliation

Reconciliation involves verifying and matching financial data to ensure accuracy, which is critical in both settlement and consolidation processes; settlement focuses on individual transaction completion, while consolidation aggregates multiple accounts or data sets for unified reporting. Efficient reconciliation reduces discrepancies and supports reliable financial statements during consolidation, ensuring all settlements are properly accounted for.

Custody

Custody involves safeguarding financial assets, while settlement refers to the process of transferring ownership of securities between parties after a trade. Consolidation in custody services aggregates multiple accounts or securities to streamline reporting and management, enhancing operational efficiency compared to individual settlement handling.

Novation

Novation refers to the legal process where one party transfers its obligations and rights under a contract to a third party, resulting in the substitution of parties without necessarily altering the substance of the original agreement. This differs from consolidation, which involves combining multiple obligations or contracts into a single agreement, fundamentally changing the contractual structure and potentially affecting settlement processes.

Finality

Finality in financial transactions ensures irrevocable settlement, preventing any reversal or modification once the transaction is confirmed. Settlement finality differs from consolidation finality where settlement pertains to the completion of individual transactions, while consolidation involves the aggregation of multiple transactions into a single, authoritative record.

Counterparty risk

Counterparty risk in settlement arises when one party fails to fulfill contractual obligations during the exchange of assets, potentially leading to financial losses. Consolidation processes mitigate this risk by centralizing transactions and netting exposures, reducing the number of settlements and enhancing credit risk management efficiency.

T+2 cycle

The T+2 settlement cycle mandates the completion of securities transactions within two business days after the trade date, enhancing market liquidity and reducing counterparty risk compared to longer cycles. This shorter timeframe contrasts with consolidation processes, which often involve the aggregation of multiple trades or accounts over a longer period to streamline reporting and operational efficiency.

Central Securities Depository (CSD)

Central Securities Depository (CSD) plays a critical role in the settlement process by electronically transferring securities ownership, ensuring efficient and secure transactions. It also facilitates consolidation by centralizing securities records, reducing risks and increasing transparency in post-trade activities.

Delivery versus Payment (DvP)

Delivery versus Payment (DvP) is a settlement mechanism ensuring securities transfer occurs only upon corresponding payment, minimizing counterparty risk and enhancing transactional integrity. In contrast, consolidation refers to aggregating multiple settlements into a single transaction to improve operational efficiency and reduce settlement costs without altering the fundamental DvP process.

Settlement vs consolidation Infographic

moneydif.com

moneydif.com