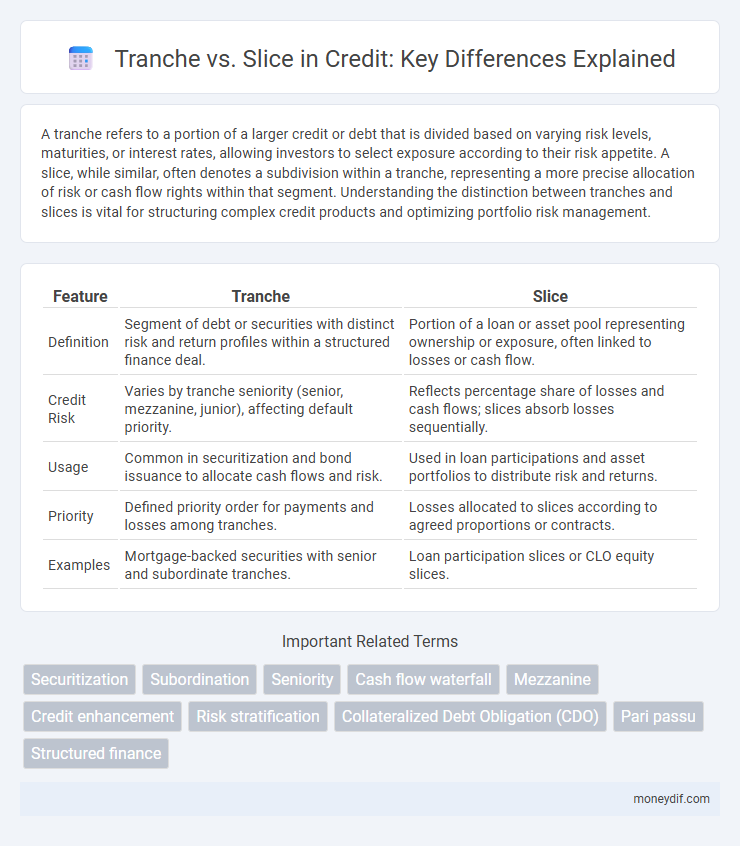

A tranche refers to a portion of a larger credit or debt that is divided based on varying risk levels, maturities, or interest rates, allowing investors to select exposure according to their risk appetite. A slice, while similar, often denotes a subdivision within a tranche, representing a more precise allocation of risk or cash flow rights within that segment. Understanding the distinction between tranches and slices is vital for structuring complex credit products and optimizing portfolio risk management.

Table of Comparison

| Feature | Tranche | Slice |

|---|---|---|

| Definition | Segment of debt or securities with distinct risk and return profiles within a structured finance deal. | Portion of a loan or asset pool representing ownership or exposure, often linked to losses or cash flow. |

| Credit Risk | Varies by tranche seniority (senior, mezzanine, junior), affecting default priority. | Reflects percentage share of losses and cash flows; slices absorb losses sequentially. |

| Usage | Common in securitization and bond issuance to allocate cash flows and risk. | Used in loan participations and asset portfolios to distribute risk and returns. |

| Priority | Defined priority order for payments and losses among tranches. | Losses allocated to slices according to agreed proportions or contracts. |

| Examples | Mortgage-backed securities with senior and subordinate tranches. | Loan participation slices or CLO equity slices. |

Understanding Tranches and Slices in Credit

Tranches in credit represent segmented portions of a loan or security, categorized by varying risk levels and payment priorities. Slices refer to portions of a credit portfolio sliced across different asset classes or risk exposures, allowing diversification within the investment. Understanding the distinction between tranches and slices is crucial for assessing credit risk allocation and structuring financial instruments effectively.

Origins and Evolution of Tranches and Slices

Tranches originated in the 1980s within the mortgage-backed securities market, designed to allocate varying risk levels and cash flow priorities among investors. Over time, the concept evolved into slices, a more flexible structure used in collateralized loan obligations (CLOs) to diversify exposure across different asset classes and maturities. The evolution from tranches to slices reflects advancements in credit risk management and structured finance techniques, enhancing investor options and market efficiency.

Defining a Tranche in Credit Structures

A tranche in credit structures represents a segment of debt or securities that is divided based on varying levels of risk, maturity, or interest rates, allowing investors to select exposure that suits their risk appetite. Each tranche absorbs losses sequentially, with senior tranches having priority on payments and lower risk, while junior tranches face higher risk and potentially higher returns. This segmentation enhances portfolio diversification and risk management by aligning cash flow priorities and credit quality with investor preferences.

What Is a Slice? Key Differences from Tranche

A slice refers to a portion of a credit risk that is segmented within a larger credit product, often representing specific risk exposure to investors. Unlike a tranche, which defines varying levels of credit risk and priority in repayment, a slice typically denotes a distributed share of overall risk across multiple tranches or loans, offering diversified exposure. Key differences include that tranches are structured by seniority and loss priority, while slices serve to allocate risk proportionally among different participants.

Risk Allocation: Tranche vs Slice

Tranches differentiate risk by dividing debt securities into layers with distinct credit ratings, maturity dates, and interest rates, enabling targeted investment based on risk tolerance. Slices allocate risk proportionally across different classes of creditors, sharing losses and cash flows simultaneously without separate structural seniority. This approach allows investors in slices to experience parallel exposure to credit events, whereas tranche investors face sequential risk absorption.

Applications in Structured Finance: Tranches vs Slices

Tranches in structured finance represent debt segments ranked by priority and risk exposure, commonly used in collateralized debt obligations (CDOs) to allocate cash flow and losses. Slices, while similar, often refer to portions of asset pools without strict seniority, providing flexible investment options across credit instruments. Understanding the distinction aids in optimizing portfolio risk management and tailoring credit risk exposure in securitized products.

Investor Perspectives: Choosing Tranches or Slices

Investors analyzing credit securities prioritize tranches for their distinct risk and return profiles within a structured finance deal, allowing targeted exposure to senior, mezzanine, or equity risk layers. Slices, on the other hand, offer proportional participation across all tranches, providing comprehensive returns but necessitating a broader risk appetite. Selecting between tranches and slices thus depends on investor risk tolerance, yield objectives, and portfolio diversification strategies.

Regulatory Implications for Tranches and Slices

Tranches in credit transactions often face distinct regulatory implications compared to slices due to their structured hierarchy and varying risk profiles, which affect capital requirements and risk-weighted asset calculations under frameworks like Basel III. Tranches require detailed disclosure and risk assessment to comply with regulatory standards, particularly concerning credit risk transfer and loss absorption. Slices generally represent proportional ownership across multiple tranches, leading to more complex regulatory treatment that emphasizes transparency and precise allocation of credit risk exposure.

Common Misconceptions: Tranche vs Slice

Tranches and slices are often confused in credit structures, but tranches refer to the division of debt or securities by risk level and payment priority, while slices indicate portions of a broader portfolio, such as asset-backed securities, divided among investors. A common misconception is that tranches and slices are interchangeable terms, yet tranches carry specific credit rating implications and cash flow hierarchies, unlike slices which represent proportional ownership without altering risk profiles. Understanding this distinction is vital for accurate risk assessment and investment strategy in credit markets.

Future Trends in Credit Structuring: Tranches and Slices

Future trends in credit structuring emphasize increased granularity in tranches and slices to enhance risk distribution and investor targeting. Advanced analytics and AI-driven models enable precise assessment of tranche performance and slice-level cash flow optimization, driving more tailored credit products. Regulatory evolution and market demand push for transparency, making tranche and slice segmentation critical in structured finance innovation.

Important Terms

Securitization

Securitization divides pooled assets into tranches, representing risk levels and payment priorities, while slices refer to portions allocated to specific investors within those tranches.

Subordination

Subordination in finance refers to the priority ranking of debt or securities, where tranche and slice delineate different layers of risk and repayment order within structured finance products. Tranches typically indicate debt segments with varying levels of credit risk and maturity, while slices represent proportions of securities distributed among investors, reflecting subordination levels that affect cash flow and loss absorption hierarchy.

Seniority

Seniority determines the priority of payment within a tranche, where each tranche may be divided into slices representing different levels of credit risk and repayment order.

Cash flow waterfall

A cash flow waterfall allocates payments sequentially through prioritized tranches, while slices represent proportional portions of cash flow shared concurrently across investors.

Mezzanine

Mezzanine financing represents a hybrid of debt and equity, positioned between senior debt and equity in the capital structure, where tranches define distinct layers of risk and return within the mezzanine layer. Each tranche, or slice, corresponds to specific terms, interest rates, and repayment priorities, allowing investors to select risk exposure and expected yield accordingly.

Credit enhancement

Credit enhancement increases the credit quality of a tranche by reducing default risk through mechanisms such as subordination, over-collateralization, or reserve accounts, whereas a slice represents a proportional interest in all tranches of a structured finance security.

Risk stratification

Risk stratification in structured finance involves categorizing tranches based on their credit risk profiles, where each tranche represents a distinct slice of the underlying asset pool with varying exposure to default risk.

Collateralized Debt Obligation (CDO)

Collateralized Debt Obligations (CDOs) are structured financial products divided into tranches, representing different slices of credit risk with varying priority, yields, and exposure to default.

Pari passu

Pari passu ensures equal ranking and proportional distribution of payments across tranches and slices within structured finance transactions.

Structured finance

Structured finance divides risk into tranches, each representing a different slice of credit exposure with distinct priority and payment rights.

tranche vs slice Infographic

moneydif.com

moneydif.com