Delinquency refers to the failure to make a credit payment on time, often resulting in late fees and a negative impact on credit score but does not yet signify a permanent failure to repay. Default occurs when a borrower fails to meet the legal obligations of the credit agreement, typically after 90 days or more of missed payments, leading to serious consequences such as legal action or loan acceleration. Understanding the distinction between delinquency and default helps lenders manage risk and borrowers to take timely corrective actions to protect their credit standing.

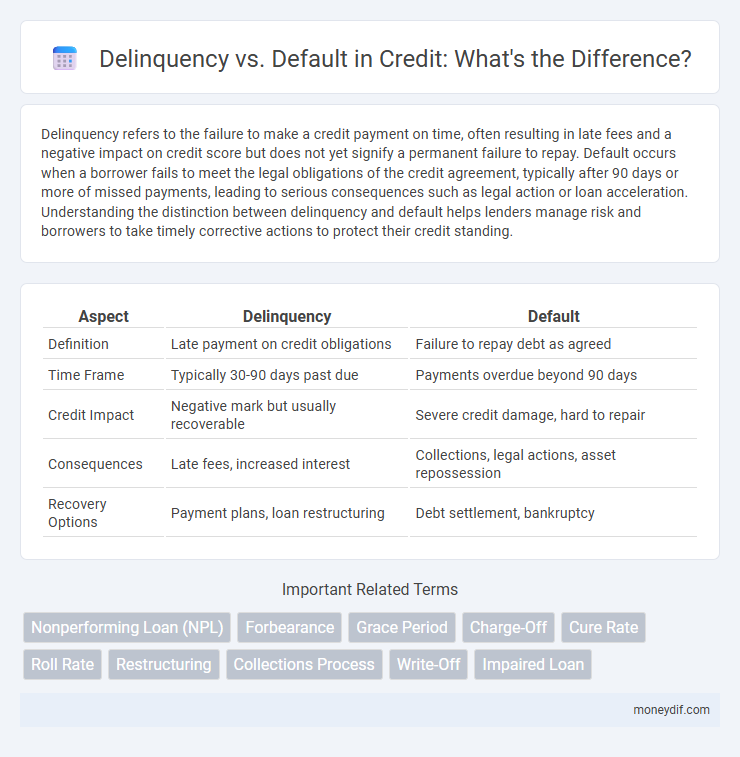

Table of Comparison

| Aspect | Delinquency | Default |

|---|---|---|

| Definition | Late payment on credit obligations | Failure to repay debt as agreed |

| Time Frame | Typically 30-90 days past due | Payments overdue beyond 90 days |

| Credit Impact | Negative mark but usually recoverable | Severe credit damage, hard to repair |

| Consequences | Late fees, increased interest | Collections, legal actions, asset repossession |

| Recovery Options | Payment plans, loan restructuring | Debt settlement, bankruptcy |

Understanding Delinquency and Default in Credit

Delinquency in credit occurs when a borrower misses a scheduled payment, typically after 30 days past due, signaling potential financial distress but not yet resulting in legal action. Default happens when delinquency persists beyond 90 to 180 days, indicating severe credit risk and often triggering lender recovery processes such as loan restructuring or foreclosure. Understanding these stages is crucial for managing credit risk, improving borrower communication, and minimizing losses in lending portfolios.

Key Differences Between Delinquency and Default

Delinquency occurs when a borrower misses a scheduled payment but has not yet reached the time frame that triggers default status, typically considered late after 30 days past due. Default happens when the borrower fails to meet the legal obligations of the loan agreement, often after 90 to 180 days of missed payments, depending on the loan terms. Key differences include the severity of financial consequences and impact on credit score, with default leading to more significant credit damage, potential legal action, and loan acceleration.

How Delinquency Impacts Your Credit Score

Delinquency occurs when a borrower misses a scheduled payment, significantly lowering their credit score by increasing the credit utilization ratio and indicating higher risk to lenders. Credit scores typically drop after 30 days of missed payments, with extended delinquency causing more severe score reductions and possibly leading to default status. Maintaining timely payments is crucial as persistent delinquency damages creditworthiness, resulting in higher interest rates and limited access to new credit.

What Happens When a Loan Goes Into Default

When a loan goes into default, the borrower fails to meet the lender's repayment terms for an extended period, typically 90 days or more. The lender initiates collection actions, which may include reporting the default to credit bureaus, accelerating the loan balance, and pursuing legal remedies such as foreclosure or wage garnishment. Defaulting on a loan severely damages the borrower's credit score and can limit access to future credit opportunities.

Early Signs of Credit Delinquency

Early signs of credit delinquency include missed payments, increasing utilization rates, and frequent credit inquiries, which indicate potential financial stress. Monitoring such indicators helps lenders identify borrowers at risk before default occurs. Timely interventions based on these signs can prevent escalation from delinquency to default, protecting credit health and reducing losses.

Common Causes of Loan Delinquency and Default

Loan delinquency often arises from temporary financial setbacks such as job loss, medical emergencies, or unforeseen expenses that hinder timely payments. Default typically follows prolonged delinquency when borrowers exhaust their resources or fail to restructure debt, leading to serious credit damage. High debt-to-income ratios, insufficient emergency savings, and poor credit management are primary contributors to both delinquency and default scenarios.

Consequences of Defaulting on a Loan

Defaulting on a loan severely damages credit scores, making it challenging to secure future financing or favorable interest rates. Lenders may initiate legal actions, including wage garnishments or asset repossession, to recover outstanding debts. Prolonged default can lead to increased financial strain due to escalating penalties, higher interest rates, and potential bankruptcy filings.

Steps to Prevent Credit Delinquency

Regularly monitoring credit reports and setting up automatic payments can significantly reduce the risk of credit delinquency. Communicating proactively with creditors to negotiate payment plans during financial hardship helps maintain account status and prevents delinquency escalation. Establishing a realistic budget to prioritize debt repayments ensures timely payments and protects credit scores from the negative impacts of missed deadlines.

Legal Implications of Loan Default

Loan default triggers severe legal consequences, including potential foreclosure, wage garnishment, and lawsuits that can damage credit scores and financial reputation. Delinquency represents missed payments without immediate legal action, whereas default signifies a formal breach of loan terms, prompting lenders to pursue recovery through court processes. Understanding these distinctions is crucial for managing risks and mitigating long-term financial liabilities.

Strategies for Managing and Recovering From Default

Implementing proactive credit monitoring and borrower communication reduces the risk of default by addressing early signs of delinquency. Structured repayment plans and financial counseling help borrowers regain payment capacity while minimizing losses for lenders. Leveraging data analytics for risk assessment and targeted interventions enhances recovery rates and supports sustainable credit portfolio management.

Important Terms

Nonperforming Loan (NPL)

Nonperforming loans (NPLs) represent loans in delinquency exceeding 90 days without payments, indicating a high risk of default where the borrower fails to meet contractual debt obligations.

Forbearance

Forbearance temporarily suspends or reduces loan payments to prevent delinquency from escalating into default and damaging credit.

Grace Period

A grace period is a designated timeframe after a delinquency event during which a borrower can make a payment without being classified as in default.

Charge-Off

A charge-off occurs when a debt remains delinquent for an extended period, typically 180 days, and the creditor writes it off as a loss, signaling default status.

Cure Rate

A higher cure rate indicates a greater proportion of delinquent loans returning to performing status before escalating to default, reducing overall credit risk.

Roll Rate

Roll Rate measures the percentage of delinquent accounts that progress to default within a specific timeframe, serving as a critical indicator for credit risk management.

Restructuring

Restructuring helps mitigate the risk of loan delinquency escalating into default by modifying payment terms to improve borrower repayment capacity.

Collections Process

The collections process focuses on recovering overdue payments during delinquency stages to prevent loan default and minimize financial losses.

Write-Off

Write-off occurs when a delinquent debt is deemed uncollectible after prolonged nonpayment, signaling its transition into default status.

Impaired Loan

Impaired loans are financial assets classified based on a borrower's delinquency status, with delinquency indicating late payments and default representing the failure to repay as agreed, significantly impacting credit risk assessment and provisioning.

delinquency vs default Infographic

moneydif.com

moneydif.com