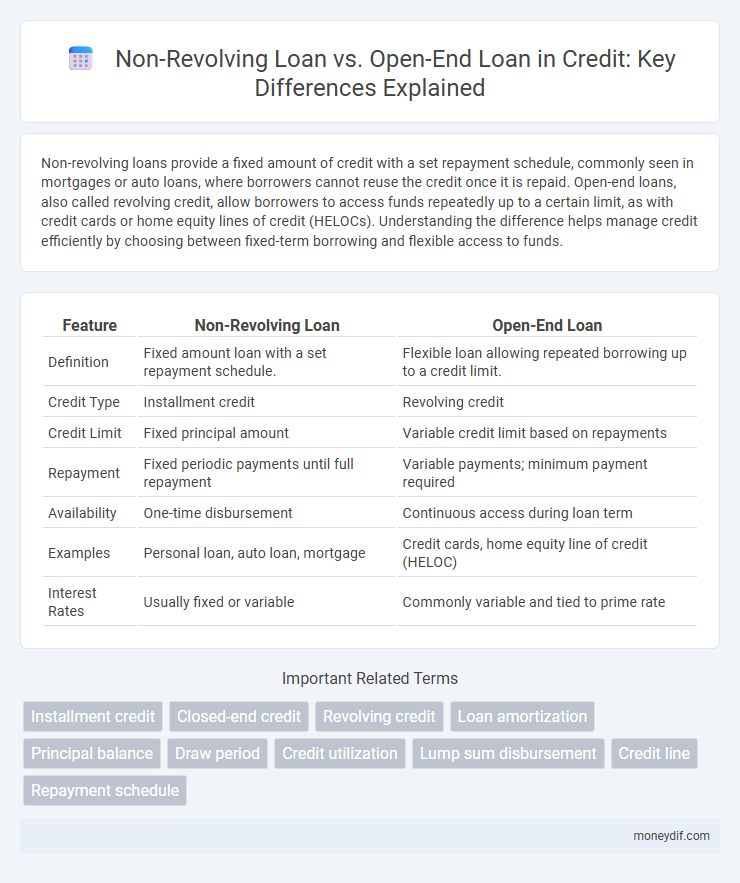

Non-revolving loans provide a fixed amount of credit with a set repayment schedule, commonly seen in mortgages or auto loans, where borrowers cannot reuse the credit once it is repaid. Open-end loans, also called revolving credit, allow borrowers to access funds repeatedly up to a certain limit, as with credit cards or home equity lines of credit (HELOCs). Understanding the difference helps manage credit efficiently by choosing between fixed-term borrowing and flexible access to funds.

Table of Comparison

| Feature | Non-Revolving Loan | Open-End Loan |

|---|---|---|

| Definition | Fixed amount loan with a set repayment schedule. | Flexible loan allowing repeated borrowing up to a credit limit. |

| Credit Type | Installment credit | Revolving credit |

| Credit Limit | Fixed principal amount | Variable credit limit based on repayments |

| Repayment | Fixed periodic payments until full repayment | Variable payments; minimum payment required |

| Availability | One-time disbursement | Continuous access during loan term |

| Examples | Personal loan, auto loan, mortgage | Credit cards, home equity line of credit (HELOC) |

| Interest Rates | Usually fixed or variable | Commonly variable and tied to prime rate |

Understanding Non-Revolving Loans: Definition and Features

Non-revolving loans are fixed-amount credit products where borrowers receive a lump sum and repay it over a predetermined period with fixed installments, commonly used for mortgages, auto loans, and personal loans. Unlike open-end loans, non-revolving loans do not allow additional borrowing without reapplication once the initial amount is paid off. Key features include fixed interest rates, set repayment terms, and a clear end date, providing predictable debt management for borrowers.

What Is an Open-End Loan? Key Characteristics Explained

An open-end loan, also known as a revolving credit loan, allows borrowers to access funds repeatedly up to a set credit limit without reapplying. Key characteristics include variable balance adjustments based on repayments and new borrowings, flexible repayment options, and often a fluctuating interest rate tied to usage. Unlike non-revolving loans, open-end loans provide ongoing access to credit until the limit is reached, making them ideal for managing short-term cash flow needs or ongoing expenses.

Comparing Non-Revolving and Open-End Loans: Core Differences

Non-revolving loans, such as personal and auto loans, provide a fixed loan amount with scheduled repayments and no option to re-borrow once paid off, ensuring predictable debt management. In contrast, open-end loans, including credit cards and lines of credit, offer ongoing access to funds up to a credit limit, allowing borrowers to reuse available credit without reapplication. Key differences revolve around loan structure, borrowing flexibility, and repayment predictability.

Eligibility Requirements: Non-Revolving vs Open-End Loans

Non-revolving loans typically require a strong credit score, stable income, and proof of ability to repay a fixed amount over a set term, making eligibility more stringent. Open-end loans, such as credit cards or lines of credit, often have more flexible eligibility criteria, focusing on creditworthiness and income verification without rigid repayment schedules. Lenders assess debt-to-income ratio and credit history closely in both cases, but open-end loans emphasize ongoing credit management ability due to their revolving nature.

Typical Uses: When to Choose Each Loan Type

Non-revolving loans are ideal for one-time expenses such as mortgages, auto loans, or education where a fixed amount is borrowed and repaid over a set term. Open-end loans suit ongoing credit needs like credit cards or home equity lines of credit, allowing borrowers to repeatedly access funds up to a credit limit. Choosing a non-revolving loan provides predictability in payments, while open-end loans offer flexibility for recurring or variable spending.

Interest Rates and Repayment Structures: A Comparative Overview

Non-revolving loans typically have fixed interest rates and structured repayment schedules, requiring consistent monthly payments over a set term. Open-end loans usually feature variable interest rates and flexible repayment structures, allowing borrowers to adjust payment amounts and reuse credit up to a limit. The stability of fixed rates in non-revolving loans contrasts with the adaptability but potential cost variability of open-end loans, influencing borrower preferences based on financial stability and flexibility needs.

Pros and Cons of Non-Revolving Loans

Non-revolving loans offer fixed borrowing amounts with predictable repayment schedules, making budgeting easier and reducing the risk of overspending. These loans typically have lower interest rates than open-end loans since they are less flexible and pose less risk to lenders. However, the inflexibility of non-revolving loans means borrowers cannot re-borrow funds once repaid, limiting access to additional credit compared to open-end loans.

Advantages and Disadvantages of Open-End Loans

Open-end loans offer the advantage of flexible borrowing, allowing borrowers to access funds repeatedly up to a set credit limit without reapplying, which suits ongoing financing needs. They typically have variable interest rates, which can lead to lower initial costs but may result in higher payments if rates rise, posing a risk for budget management. The convenience of continuous credit access is balanced by the potential for accumulating debt and higher long-term costs compared to fixed-term, non-revolving loans.

Impact on Credit Score: Non-Revolving vs Open-End Loans

Non-revolving loans, such as personal or auto loans, impact credit scores by reflecting fixed payment schedules and reducing available credit lines, which can improve credit utilization ratios. Open-end loans, like credit cards or lines of credit, influence credit scores through dynamic balances and ongoing borrowing capacity, emphasizing the importance of timely payments and credit utilization management. Both loan types affect credit scores differently, with non-revolving loans showing consistent payment history and open-end loans requiring careful balance control to maintain a positive credit profile.

Which Loan Is Right for You? Making an Informed Decision

Non-revolving loans provide a fixed amount of credit with scheduled payments, ideal for borrowers needing a specific sum for purchases like vehicles or home improvements. Open-end loans, such as credit cards or lines of credit, offer flexible borrowing and repayment options, suitable for ongoing expenses or varying financial needs. Evaluating your spending habits, repayment ability, and credit goals helps determine whether a structured non-revolving loan or the adaptable open-end loan fits your financial situation best.

Important Terms

Installment credit

Installment credit involves borrowing a fixed amount repaid in regular, scheduled payments, characteristic of non-revolving loans like auto loans and mortgages, which do not allow borrowing beyond the original amount. Open-end loans, or revolving credit such as credit cards, permit repeated borrowing up to a set credit limit, offering flexibility unlike the fixed repayment structure of installment loans.

Closed-end credit

Closed-end credit involves a non-revolving loan with a fixed amount and set repayment schedule, such as auto loans or mortgages, requiring full repayment over a specific term. In contrast, open-end loans, like credit cards, offer revolving credit with variable borrowing limits and flexible repayment options.

Revolving credit

Revolving credit allows borrowers to access funds repeatedly up to a set limit, distinguishing it from non-revolving loans which provide a one-time lump sum repayment structure. Unlike open-end loans that can expand credit limits, revolving credit typically offers a fixed maximum balance with ongoing availability as payments are made.

Loan amortization

Loan amortization for non-revolving loans involves fixed principal and interest payments over a set term, ensuring full repayment by maturity, while open-end loans feature flexible borrowing and repayment amounts with interest calculated on outstanding balances, lacking a predetermined amortization schedule. Non-revolving loans, such as auto or mortgage loans, require structured amortization whereas open-end loans, like credit cards or home equity lines of credit, allow ongoing access to credit without a fixed payoff timeline.

Principal balance

Principal balance in a non-revolving loan steadily decreases as fixed payments reduce the original loan amount over time, while in an open-end loan, the principal balance fluctuates based on borrower usage and repayments within the credit limit. Non-revolving loans, such as mortgages or auto loans, have a predetermined repayment schedule, whereas open-end loans like credit cards or home equity lines of credit allow for ongoing borrowing and repayment cycles affecting the principal balance dynamically.

Draw period

The draw period in a non-revolving loan refers to the timeframe during which borrowers can access funds up to a specified limit, typically ending when the loan converts into repayment mode without the option for re-borrowing. Open-end loans, characterized by their revolving credit structure, allow continuous borrowing and repayment within the draw period, enabling repeated access to funds as long as the credit limit is maintained.

Credit utilization

Credit utilization measures the percentage of available credit used and significantly impacts credit scores; non-revolving loans, such as personal or auto loans, have fixed amounts and do not affect credit utilization ratios, while open-end loans, like credit cards and lines of credit, continuously allow borrowing within a set limit, directly influencing credit utilization rates. Maintaining a low credit utilization ratio on open-end loans is crucial for favorable credit evaluations, whereas non-revolving loan balances primarily affect debt-to-income ratios rather than utilization metrics.

Lump sum disbursement

Lump sum disbursement in non-revolving loans refers to the full loan amount being provided upfront for a fixed term, whereas open-end loans allow borrowers to withdraw funds repeatedly up to a set credit limit without fixed disbursement schedules. Non-revolving loans typically have fixed interest rates and repayment plans, while open-end loans often feature variable interest rates and flexible repayment options based on the outstanding balance.

Credit line

A credit line refers to a predetermined borrowing limit that can be accessed as needed, distinguishing between non-revolving loans, which have a fixed amount and cannot be reused once repaid, and open-end loans, which allow borrowers to repeatedly draw funds up to the credit limit while making ongoing payments. The key characteristic of non-revolving loans is the single disbursement and fixed repayment schedule, whereas open-end loans provide flexibility through continuous borrowing and repayment cycles.

Repayment schedule

A repayment schedule for a non-revolving loan typically involves fixed, periodic payments of principal and interest over a predetermined term, such as auto or mortgage loans. In contrast, an open-end loan features a flexible repayment schedule where borrowers can repay, redraw, and make interest-only payments within a set credit limit, as seen in credit cards or home equity lines of credit (HELOCs).

Non-revolving loan vs Open-end loan Infographic

moneydif.com

moneydif.com