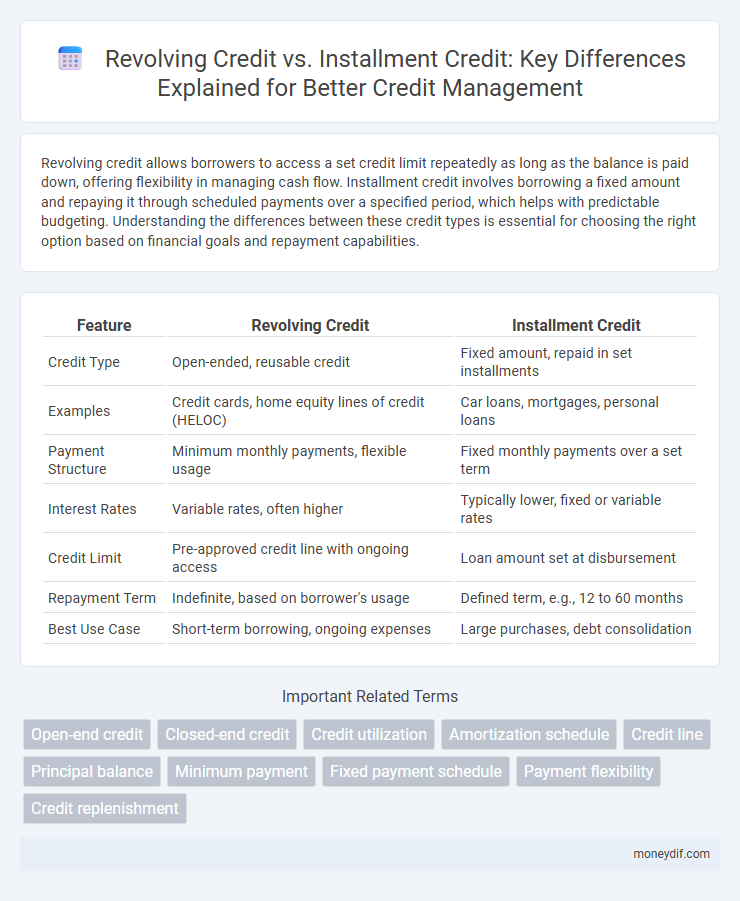

Revolving credit allows borrowers to access a set credit limit repeatedly as long as the balance is paid down, offering flexibility in managing cash flow. Installment credit involves borrowing a fixed amount and repaying it through scheduled payments over a specified period, which helps with predictable budgeting. Understanding the differences between these credit types is essential for choosing the right option based on financial goals and repayment capabilities.

Table of Comparison

| Feature | Revolving Credit | Installment Credit |

|---|---|---|

| Credit Type | Open-ended, reusable credit | Fixed amount, repaid in set installments |

| Examples | Credit cards, home equity lines of credit (HELOC) | Car loans, mortgages, personal loans |

| Payment Structure | Minimum monthly payments, flexible usage | Fixed monthly payments over a set term |

| Interest Rates | Variable rates, often higher | Typically lower, fixed or variable rates |

| Credit Limit | Pre-approved credit line with ongoing access | Loan amount set at disbursement |

| Repayment Term | Indefinite, based on borrower's usage | Defined term, e.g., 12 to 60 months |

| Best Use Case | Short-term borrowing, ongoing expenses | Large purchases, debt consolidation |

Understanding Revolving Credit

Revolving credit provides a flexible borrowing option where the borrower can spend, repay, and spend again up to a set credit limit without reapplying. This type of credit includes credit cards and lines of credit, allowing for varying monthly payments based on the outstanding balance. Understanding how interest accrues on unpaid balances is crucial for managing revolving credit effectively and avoiding high debt costs.

Key Features of Installment Credit

Installment credit involves borrowing a fixed amount and repaying it over a set period through scheduled payments, typically monthly. Key features include a fixed interest rate, a predetermined repayment term, and consistent payment amounts, which allow for predictable budgeting. Common examples include mortgages, auto loans, and personal loans, distinguishing installment credit from the flexible borrowing limits of revolving credit.

How Revolving Credit Works

Revolving credit allows borrowers to access a credit limit repeatedly as long as the balance is paid down, with interest charged on the outstanding amount. Payments can vary each month based on usage, offering flexibility to manage cash flow. Common examples include credit cards and home equity lines of credit (HELOCs), which enable continuous borrowing without reapplying for a loan.

How Installment Credit Operates

Installment credit operates by providing a fixed loan amount repaid over a predetermined period through regular, equal monthly payments that cover both principal and interest. Common examples include mortgages, auto loans, and student loans, which foster predictable budgeting by locking in interest rates and payment schedules. This structured repayment contrasts with revolving credit, which allows flexible borrowing up to a credit limit with variable minimum payments.

Pros and Cons of Revolving Credit

Revolving credit offers flexibility by allowing borrowers to spend up to a credit limit and make variable payments based on the outstanding balance, making it ideal for managing cash flow and emergencies. However, it often comes with higher interest rates and the risk of accumulating significant debt if balances are not paid off promptly. Compared to installment credit, revolving credit can lead to fluctuating monthly payments and potential credit score impacts if utilization rates become too high.

Advantages and Disadvantages of Installment Credit

Installment credit offers the advantage of fixed monthly payments, enabling better budgeting and predictable debt repayment over a defined term, which helps improve credit scores if managed responsibly. However, its disadvantages include less flexibility since payments must be made on a set schedule regardless of financial fluctuations, and potential penalties or fees for early repayment or missed payments. Compared to revolving credit, installment credit limits borrowing capacity until the full balance is paid, restricting access to additional funds during the loan period.

Credit Score Impact: Revolving vs Installment

Revolving credit, such as credit cards, can impact credit scores significantly by influencing credit utilization ratios, which typically should remain below 30% to maintain a healthy score. Installment credit, like auto loans or mortgages, impacts credit scores by demonstrating consistent payment history and loan term completion, contributing positively over time. Both types affect credit mix diversity, an important factor constituting about 10% of credit score calculations by major credit bureaus.

Common Examples of Each Credit Type

Revolving credit commonly includes credit cards and lines of credit, allowing borrowers to access funds repeatedly up to a credit limit while making flexible payments. Installment credit typically involves mortgages, auto loans, and personal loans with fixed repayment schedules over a set term. These distinct credit types suit different financial needs, with revolving credit offering ongoing access and installment credit providing structured payoff plans.

Choosing Between Revolving and Installment Credit

Choosing between revolving credit and installment credit depends on individual financial needs and spending habits. Revolving credit, such as credit cards, offers flexibility for ongoing purchases with variable payments and interest rates, while installment credit provides fixed payments over a set period, ideal for large, planned expenses like car loans or mortgages. Evaluating credit utilization, interest rates, and repayment terms helps determine the best option to manage debt effectively and maintain a healthy credit score.

Tips for Managing Different Types of Credit

Revolving credit, such as credit cards, requires careful monitoring of balances and timely payments to avoid high interest charges and maintain a healthy credit score. Installment credit, including personal loans and mortgages, benefits from consistent monthly payments and budgeting to ensure full repayment by the due date. Utilizing automated payments and tracking credit utilization ratios are effective strategies for managing both revolving and installment credit responsibly.

Important Terms

Open-end credit

Open-end credit, also known as revolving credit, allows borrowers to access funds up to a set credit limit repeatedly as they repay balances, commonly seen in credit cards and home equity lines of credit. Installment credit, by contrast, provides a lump sum repaid over fixed monthly payments, typical in auto loans, mortgages, and personal loans.

Closed-end credit

Closed-end credit involves a fixed loan amount repaid through scheduled payments over a set term, characteristic of installment credit such as mortgages and auto loans. Revolving credit, by contrast, offers a flexible borrowing limit with variable monthly payments based on outstanding balances, exemplified by credit cards and lines of credit.

Credit utilization

Credit utilization measures the percentage of revolving credit used relative to the total available credit limit, directly impacting credit scores by signaling credit management efficiency. Unlike revolving credit, such as credit cards, which involve ongoing borrowing and repayment cycles, installment credit includes fixed payments for loans like mortgages or auto loans, where credit utilization does not fluctuate during the term.

Amortization schedule

An amortization schedule for installment credit provides a detailed breakdown of fixed monthly payments over the loan term, highlighting principal and interest components, whereas revolving credit does not follow a fixed amortization schedule due to its flexible borrowing and repayment structure. Installment credit amortization enables predictable budgeting and debt payoff timelines, contrasting with the variable balance and payment amounts typical of revolving credit accounts.

Credit line

A credit line offers flexible borrowing with revolving credit, allowing users to borrow repeatedly up to a set limit while making varying payments based on usage. Installment credit provides a fixed loan amount repaid through scheduled payments over a defined period, typically with consistent monthly amounts.

Principal balance

Principal balance in revolving credit fluctuates based on ongoing borrowing and repayments, while in installment credit, it steadily decreases through fixed payments over a set term. Revolving credit, such as credit cards, allows continuous access to funds up to a limit, whereas installment credit, like car loans or mortgages, involves fixed loan amounts repaid in regular installments.

Minimum payment

Minimum payment on revolving credit, such as credit cards, typically covers a small percentage of the outstanding balance plus interest, allowing balances to carry over and accrue additional interest. In contrast, installment credit requires fixed monthly payments that fully amortize the loan over a set period, eliminating remaining balances after the final payment.

Fixed payment schedule

Fixed payment schedules in installment credit provide borrowers with a consistent repayment timeline, enhancing budget predictability, whereas revolving credit offers flexible payments without a set schedule, often leading to variable monthly dues based on outstanding balances. Installment credit typically involves equal payments over a specified term, contrasting with revolving credit's ongoing borrowing and repayment cycle that adjusts to credit usage.

Payment flexibility

Revolving credit offers payment flexibility by allowing borrowers to carry a balance and make varying monthly payments based on outstanding debt, while installment credit requires fixed payments over a set period, limiting flexibility but providing predictable budgeting. Consumers seeking adaptable cash flow management often prefer revolving credit, whereas those aiming for structured repayment schedules typically choose installment credit.

Credit replenishment

Credit replenishment allows revolving credit accounts like credit cards to restore available credit as payments are made, enabling ongoing borrowing flexibility, whereas installment credit involves fixed repayment schedules without replenishment, typical of loans like mortgages or auto financing. Revolving credit supports dynamic credit usage by recalculating limits after each payment, while installment credit maintains consistent balance reduction until full repayment.

Revolving credit vs Installment credit Infographic

moneydif.com

moneydif.com