Credit limit represents the maximum amount a borrower is authorized to utilize on a credit account, while available credit indicates the portion of that limit remaining for use after accounting for outstanding balances. Managing available credit carefully is crucial for maintaining a healthy credit utilization ratio, which directly impacts credit scores. Monitoring both credit limit and available credit helps prevent overspending and supports responsible credit behavior.

Table of Comparison

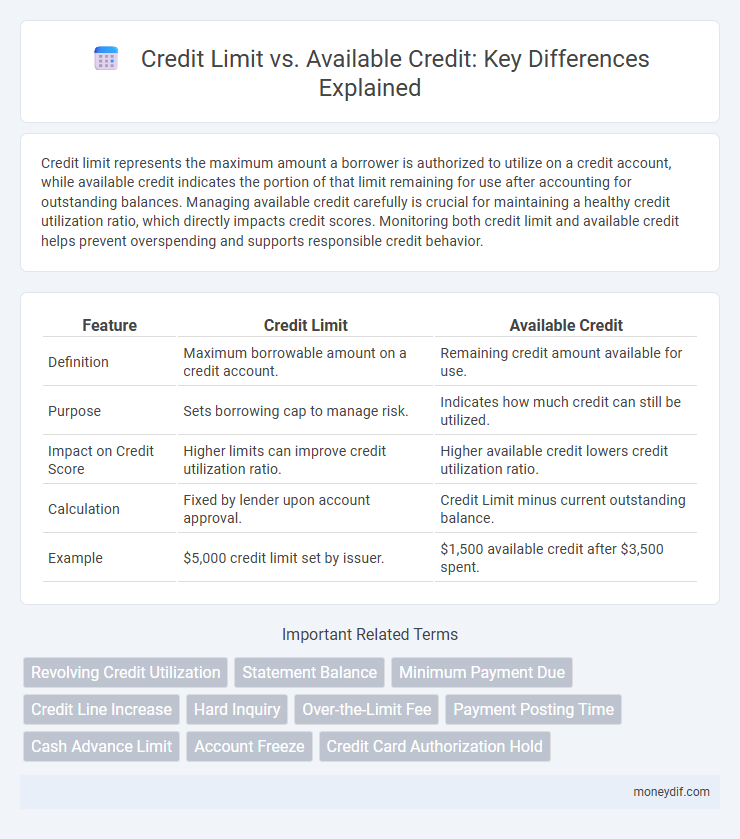

| Feature | Credit Limit | Available Credit |

|---|---|---|

| Definition | Maximum borrowable amount on a credit account. | Remaining credit amount available for use. |

| Purpose | Sets borrowing cap to manage risk. | Indicates how much credit can still be utilized. |

| Impact on Credit Score | Higher limits can improve credit utilization ratio. | Higher available credit lowers credit utilization ratio. |

| Calculation | Fixed by lender upon account approval. | Credit Limit minus current outstanding balance. |

| Example | $5,000 credit limit set by issuer. | $1,500 available credit after $3,500 spent. |

Understanding Credit Limit and Available Credit

Credit limit represents the maximum amount a lender allows a borrower to spend on a credit card or line of credit. Available credit is the remaining portion of the credit limit that has not been used and is accessible for new transactions. Monitoring both credit limit and available credit is essential for maintaining healthy credit utilization and avoiding overspending.

Key Differences Between Credit Limit and Available Credit

Credit limit is the maximum amount a lender allows a borrower to spend on a credit account, while available credit represents the remaining balance that can still be used without exceeding the credit limit. The key difference lies in credit limit being a fixed upper boundary set at the account opening or adjustment, whereas available credit fluctuates based on spending and repayments. Understanding these distinctions helps in managing debt responsibly and avoiding over-limit fees.

How Credit Limits Are Determined

Credit limits are determined based on factors such as an individual's credit score, income, debt-to-income ratio, and credit history. Lenders analyze these criteria to assess the borrower's creditworthiness and set a maximum borrowing amount. This limit impacts the available credit, which is the remaining balance that can be used before reaching the credit limit.

The Impact of Available Credit on Your Finances

Available credit directly influences your financial flexibility and credit utilization ratio, which accounts for approximately 30% of your credit score calculation. Maintaining a low credit utilization rate by keeping available credit high helps improve your creditworthiness and reduces the risk of overextending your finances. Effective management of available credit supports better loan approval chances and lower interest rates, enhancing overall financial health.

Why Available Credit Fluctuates

Available credit fluctuates due to recent transactions, payments, and pending authorizations impacting the total credit limit. Changes in credit utilization caused by purchases or payments directly affect the amount of credit available for future use. Credit limit adjustments by card issuers also contribute to variations in available credit balance.

Credit Utilization Ratio: Why It Matters

Credit utilization ratio, the percentage of a credit limit currently used, directly impacts credit scores by signaling risk to lenders. Maintaining a low utilization ratio, ideally below 30%, indicates responsible credit management and enhances creditworthiness. Monitoring available credit versus the total credit limit helps consumers avoid excessive debt and improve borrowing potential.

Effects of Maxing Out Your Credit Limit

Maxing out your credit limit significantly lowers your available credit, which in turn increases your credit utilization ratio--a key factor that can negatively impact your credit score. High credit utilization signals higher credit risk to lenders, potentially leading to higher interest rates or denial of new credit applications. Maintaining a low balance relative to your credit limit helps preserve your credit score and overall financial health.

How to Increase Your Available Credit

Increasing your available credit involves requesting a credit limit increase from your card issuer, which can enhance your credit utilization ratio and improve your credit score. Regularly paying down existing balances and maintaining a low credit utilization rate below 30% signals responsible credit management, encouraging lenders to raise your credit limit. Monitoring your credit report for accuracy and avoiding multiple credit inquiries also supports higher available credit by preserving your creditworthiness.

Common Misconceptions About Credit Limits

Credit limits represent the maximum amount a lender allows a borrower to spend on a credit account, whereas available credit is the portion of that limit not yet used and accessible for new purchases or cash advances. A common misconception is that a high credit limit means guaranteed spending power or immediate approval for larger loans, but available credit fluctuates based on recent transactions and payments. Understanding the distinction between credit limit and available credit is crucial for effective credit management and preventing unintentional overspending or credit score impact.

Tips to Manage Credit Limit and Available Credit Wisely

Effective management of your credit limit and available credit involves regularly monitoring your credit card statements to avoid overspending and ensure timely payments. Keeping your credit utilization ratio below 30% helps maintain a healthy credit score and unlocks better lending opportunities. Setting up alerts for due dates and spending thresholds allows you to stay within your limits and use your credit responsibly.

Important Terms

Revolving Credit Utilization

Revolving credit utilization measures the ratio of used credit to the total credit limit, directly impacting credit scores and financial health. Maintaining a low utilization by keeping available credit high relative to credit limits signals responsible credit management to lenders.

Statement Balance

Statement balance reflects the total amount owed on a credit card during the billing cycle, while the credit limit represents the maximum borrowing capacity. Available credit is calculated by subtracting the statement balance from the credit limit, indicating the remaining funds accessible for purchases.

Minimum Payment Due

The Minimum Payment Due on a credit card is typically a small percentage of the outstanding balance, which directly reduces the Available Credit within the overall Credit Limit. Maintaining payments above the Minimum Payment Due helps preserve Available Credit and prevents exceeding the Credit Limit, thereby avoiding penalties and interest charges.

Credit Line Increase

A credit line increase raises the credit limit, allowing for a higher total borrowed amount and potentially lowering credit utilization ratio, which benefits your credit score. Available credit reflects the remaining credit you can use within the credit limit after accounting for outstanding balances and pending transactions.

Hard Inquiry

A hard inquiry occurs when a lender reviews your credit report to set or increase your credit limit, which can temporarily lower your credit score. Credit limit represents the total authorized borrowing amount, while available credit reflects the remaining balance you can use without exceeding that limit.

Over-the-Limit Fee

Over-the-limit fees occur when credit card spending exceeds the credit limit, resulting in charges that can impact credit utilization ratios and available credit balance. Monitoring available credit closely helps avoid these fees and maintains a healthier credit score by preventing overextension beyond the credit limit.

Payment Posting Time

Payment posting time directly impacts the accuracy of available credit calculations, as delays in posting can temporarily reduce the available credit despite the credit limit remaining unchanged. Faster payment processing ensures real-time updates, preventing unnecessary credit holds and improving overall credit utilization management.

Cash Advance Limit

The Cash Advance Limit is a portion of the overall Credit Limit that can be accessed as cash, typically lower than the total available credit to reduce risk. Unlike Available Credit, which reflects the unused portion of the Credit Limit, the Cash Advance Limit determines the maximum cash amount a cardholder can withdraw.

Account Freeze

An account freeze restricts access to both the credit limit and available credit, preventing any new transactions or increases to the credit balance. While the credit limit remains unchanged, the available credit becomes effectively unusable until the freeze is lifted, protecting against unauthorized spending or fraud.

Credit Card Authorization Hold

A credit card authorization hold temporarily reduces your available credit by reserving a portion of your credit limit for a pending transaction, ensuring funds are secured before the final charge processes. This hold decreases your available credit but does not immediately affect your actual credit limit, which remains unchanged until the transaction posts or the hold is released.

Credit Limit vs Available Credit Infographic

moneydif.com

moneydif.com