Secured credit requires collateral, such as a car or home, which lowers the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured credit does not involve collateral, making it riskier for lenders and typically leading to higher interest rates and stricter approval criteria. Understanding the differences can help borrowers choose the best credit option based on their financial situation and risk tolerance.

Table of Comparison

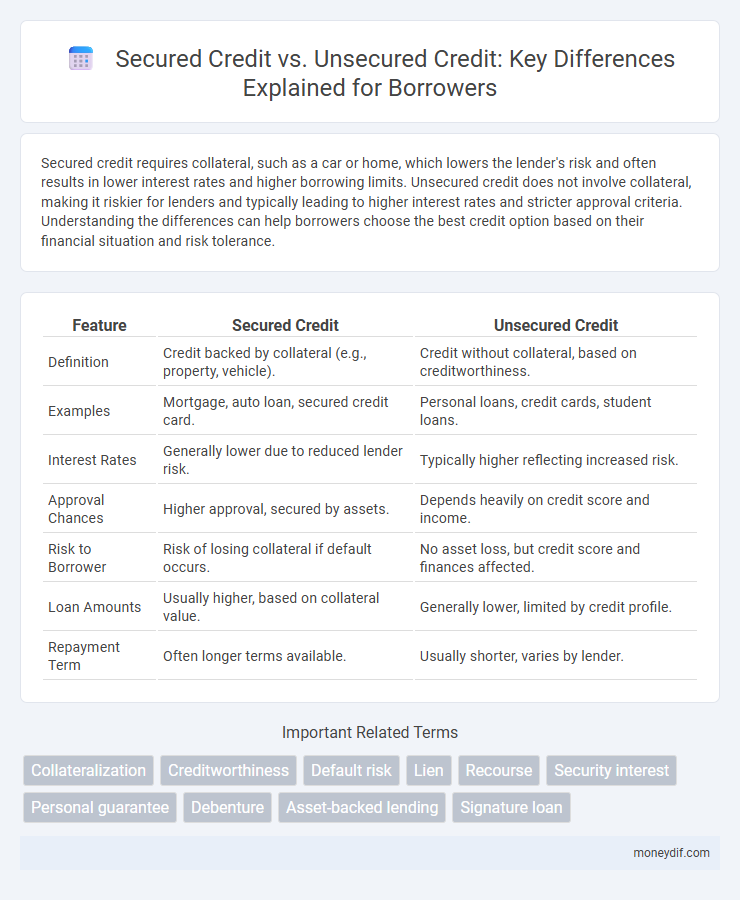

| Feature | Secured Credit | Unsecured Credit |

|---|---|---|

| Definition | Credit backed by collateral (e.g., property, vehicle). | Credit without collateral, based on creditworthiness. |

| Examples | Mortgage, auto loan, secured credit card. | Personal loans, credit cards, student loans. |

| Interest Rates | Generally lower due to reduced lender risk. | Typically higher reflecting increased risk. |

| Approval Chances | Higher approval, secured by assets. | Depends heavily on credit score and income. |

| Risk to Borrower | Risk of losing collateral if default occurs. | No asset loss, but credit score and finances affected. |

| Loan Amounts | Usually higher, based on collateral value. | Generally lower, limited by credit profile. |

| Repayment Term | Often longer terms available. | Usually shorter, varies by lender. |

Introduction to Secured and Unsecured Credit

Secured credit involves borrowing backed by collateral such as a house or vehicle, reducing risk for lenders and often resulting in lower interest rates. Unsecured credit, including credit cards and personal loans, does not require collateral, leading to higher interest rates due to increased lender risk. Understanding the distinction between secured and unsecured credit helps borrowers make informed financial decisions based on their credit needs and asset availability.

Key Differences Between Secured and Unsecured Credit

Secured credit requires collateral such as property or assets, reducing the lender's risk and often resulting in lower interest rates, while unsecured credit relies solely on the borrower's creditworthiness without any collateral. Unsecured credit typically includes credit cards and personal loans, carrying higher interest rates due to increased lender risk. Defaulting on secured credit can lead to asset repossession, whereas unsecured credit default impacts credit scores and may lead to collections or legal action.

How Secured Credit Works

Secured credit requires borrowers to provide collateral, such as a house or car, which reduces lender risk and often results in lower interest rates. The collateral serves as a guarantee that the lender can seize if the borrower defaults on payments. This mechanism helps borrowers with lower credit scores access credit while protecting lenders from potential losses.

How Unsecured Credit Works

Unsecured credit allows borrowers to access funds without collateral by relying on their creditworthiness and income stability as assessed by lenders. Interest rates on unsecured credit tend to be higher due to the increased risk borne by lenders compared to secured credit, which is backed by assets like property or vehicles. Common types of unsecured credit include credit cards, personal loans, and lines of credit, where approval and credit limits depend heavily on credit scores and financial history.

Common Types of Secured Credit

Common types of secured credit include mortgage loans, auto loans, and secured personal loans, each backed by specific collateral such as real estate, vehicles, or savings accounts. These credit forms often feature lower interest rates and higher borrowing limits compared to unsecured credit due to reduced lender risk. Secured credit facilitates access to larger amounts of financing while mitigating default risk through tangible asset security.

Common Types of Unsecured Credit

Common types of unsecured credit include credit cards, personal loans, and student loans, which do not require collateral for approval. These credit options typically have higher interest rates compared to secured credit due to the increased risk for lenders. Unsecured credit relies heavily on the borrower's creditworthiness and income stability to qualify.

Pros and Cons of Secured Credit

Secured credit offers lower interest rates and higher credit limits due to collateral backing, which reduces lender risk and can improve credit scores if managed responsibly. However, the major downside involves the risk of losing the secured asset, such as a home or car, if repayments are missed, making it less flexible than unsecured credit. While secured credit is ideal for borrowers seeking to access larger funds with favorable terms, it requires careful financial planning to avoid asset forfeiture.

Pros and Cons of Unsecured Credit

Unsecured credit, such as credit cards and personal loans, offers the advantage of no collateral requirement, providing easier access and faster approval for borrowers without assets. However, it typically comes with higher interest rates and stricter credit score criteria compared to secured credit, increasing the overall borrowing cost. The lack of collateral also means lenders face greater risk, which can lead to more stringent repayment terms and higher fees for late or missed payments.

Impact on Credit Scores

Secured credit, backed by collateral such as a car or savings account, typically has a more positive impact on credit scores due to lower risk for lenders and timely payments reflecting responsible credit management. Unsecured credit, like credit cards or personal loans, can also boost credit scores but carries higher risk, making on-time payments and credit utilization crucial for maintaining good credit health. Late payments or high balances on unsecured credit often lead to more significant drops in credit scores compared to secured credit.

Choosing Between Secured and Unsecured Credit

Choosing between secured and unsecured credit depends on your financial goals and risk tolerance. Secured credit, backed by collateral such as a home or vehicle, typically offers lower interest rates and higher credit limits but carries the risk of asset loss upon default. Unsecured credit, including most credit cards and personal loans, requires no collateral but tends to have higher interest rates and stricter qualification criteria.

Important Terms

Collateralization

Collateralization involves pledging assets to secure a loan, reducing lender risk and often resulting in lower interest rates compared to unsecured credit, which lacks pledged assets and carries higher risk premiums. Secured credit includes mortgages and auto loans backed by collateral, whereas unsecured credit encompasses credit cards and personal loans relying solely on borrower creditworthiness.

Creditworthiness

Creditworthiness determines the borrower's ability to repay loans, influencing approval for secured credit, which is backed by collateral, or unsecured credit, which relies solely on the borrower's credit history and income. Secured credit often offers lower interest rates due to reduced risk, while unsecured credit typically carries higher rates reflecting increased lender risk.

Default risk

Default risk is typically lower in secured credit because loans are backed by collateral, reducing the lender's potential losses in case of borrower default. In contrast, unsecured credit carries higher default risk since it relies solely on the borrower's creditworthiness without any asset protection.

Lien

A lien is a legal claim or right against a property used as collateral to secure a debt, commonly found in secured credit arrangements, ensuring the lender can recover the owed amount if the borrower defaults. Unsecured credit lacks this protective lien, relying solely on the borrower's creditworthiness and increasing the lender's risk due to the absence of collateral.

Recourse

Recourse loans require borrowers to repay the full debt amount even if collateral value falls short, commonly seen in unsecured credit where lenders rely solely on creditworthiness without asset backing. In secured credit, collateral such as property or vehicles limits lender risk, reducing recourse obligations since asset liquidation covers outstanding balances.

Security interest

Security interest provides a legal claim on collateral pledged by a borrower to secure a loan, significantly reducing the lender's risk in secured credit compared to unsecured credit, where no collateral is involved. This priority claim on assets enhances the lender's ability to recover funds in case of default, resulting in typically lower interest rates and more favorable terms for secured credit.

Personal guarantee

A personal guarantee in secured credit involves the borrower pledging specific assets as collateral, reducing lender risk and often resulting in lower interest rates. In unsecured credit, personal guarantees rely solely on the borrower's creditworthiness without collateral, typically leading to higher interest rates and stricter approval criteria.

Debenture

A debenture is a type of debt instrument that can be either secured or unsecured, with secured debentures backed by specific assets as collateral, reducing lender risk, while unsecured debentures rely solely on the issuer's creditworthiness and general credit standing. Secured credit offers lower interest rates due to asset backing, whereas unsecured credit demands higher interest rates to compensate for increased risk to creditors.

Asset-backed lending

Asset-backed lending involves secured credit where loans are backed by collateral such as real estate, equipment, or receivables, reducing lender risk and often lowering interest rates. In contrast, unsecured credit lacks collateral, relying solely on the borrower's creditworthiness and typically carries higher interest rates due to increased lender risk.

Signature loan

A signature loan is a type of unsecured credit that relies on the borrower's promise to repay rather than collateral, contrasting with secured credit which requires assets like property or vehicles as security. Secured credit typically offers lower interest rates due to reduced lender risk, while signature loans generally have higher rates reflecting their unsecured nature.

Secured credit vs Unsecured credit Infographic

moneydif.com

moneydif.com