Qualifying ratio and debt-to-income ratio are key metrics used by lenders to assess a borrower's ability to manage monthly payments and repay debts. The qualifying ratio typically focuses on housing-related expenses as a proportion of gross income, while the debt-to-income ratio includes all monthly debt obligations compared to gross income. Understanding the differences between these ratios helps borrowers improve creditworthiness and optimize loan approvals.

Table of Comparison

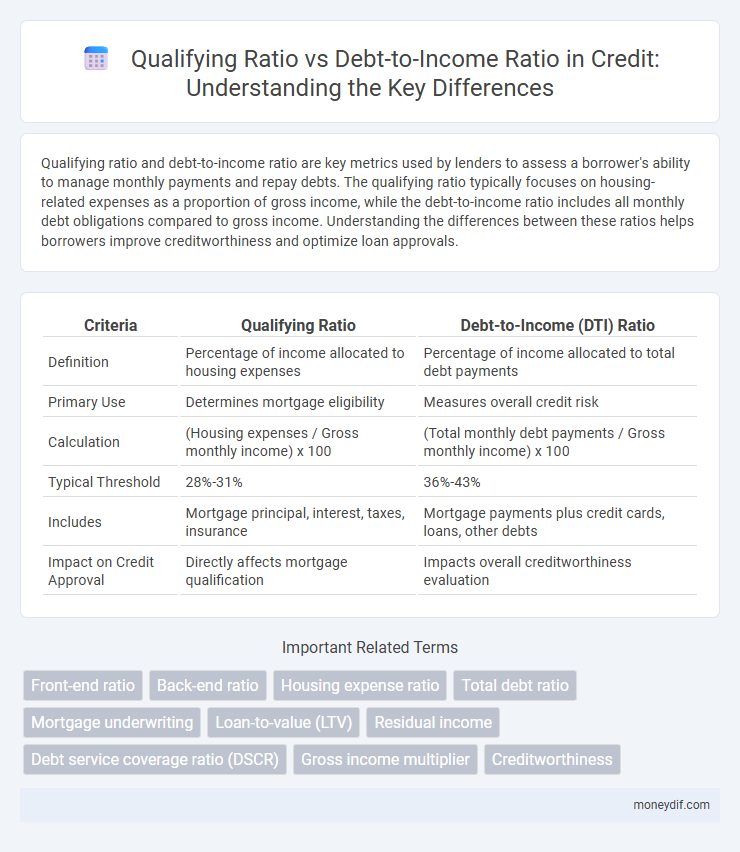

| Criteria | Qualifying Ratio | Debt-to-Income (DTI) Ratio |

|---|---|---|

| Definition | Percentage of income allocated to housing expenses | Percentage of income allocated to total debt payments |

| Primary Use | Determines mortgage eligibility | Measures overall credit risk |

| Calculation | (Housing expenses / Gross monthly income) x 100 | (Total monthly debt payments / Gross monthly income) x 100 |

| Typical Threshold | 28%-31% | 36%-43% |

| Includes | Mortgage principal, interest, taxes, insurance | Mortgage payments plus credit cards, loans, other debts |

| Impact on Credit Approval | Directly affects mortgage qualification | Impacts overall creditworthiness evaluation |

Understanding Qualifying Ratios in Credit Evaluation

Qualifying ratios play a critical role in credit evaluation by measuring a borrower's ability to manage monthly debt obligations relative to income. These ratios often include the front-end ratio, which compares housing expenses to income, and the back-end ratio, which encompasses total debt payments, providing a clearer picture than the broader debt-to-income ratio alone. Lenders use qualifying ratios to ensure borrowers meet specific financial criteria, reducing default risk and facilitating responsible lending decisions.

What is a Debt-to-Income Ratio (DTI)?

A Debt-to-Income Ratio (DTI) measures the percentage of a borrower's gross monthly income that goes towards paying debts, including mortgages, credit cards, and loans. Lenders use DTI to evaluate a borrower's ability to manage monthly payments and repay debts, typically requiring a ratio below 43% for mortgage approval. Unlike the qualifying ratio, which assesses specific loan criteria, the DTI provides a comprehensive view of overall financial obligations relative to income.

Key Differences Between Qualifying Ratio and DTI

Qualifying ratio measures the percentage of a borrower's gross monthly income dedicated to housing expenses, primarily focusing on mortgage payments, property taxes, and insurance. Debt-to-income (DTI) ratio calculates the borrower's total monthly debt obligations, including housing costs, credit cards, car loans, and other debts, relative to gross income. The key difference lies in qualifying ratio targeting housing-related expenses for loan approval, while DTI provides a broader view of overall financial health and debt burden.

How Lenders Use Qualifying Ratios

Lenders use qualifying ratios to evaluate a borrower's ability to repay a loan by comparing monthly housing expenses and total debt to gross income, typically focusing on the front-end and back-end ratios. The front-end ratio measures housing costs alone, usually capped around 28-31%, while the back-end ratio includes all monthly debt payments, generally not exceeding 36-43%. These qualifying ratios help lenders determine loan eligibility and set borrowing limits more precisely than the broader debt-to-income ratio.

The Role of DTI in Mortgage Approval

The debt-to-income (DTI) ratio plays a critical role in mortgage approval by measuring a borrower's monthly debt obligations against their gross monthly income, ensuring lenders assess repayment capability accurately. Unlike the qualifying ratio, which may vary by loan type and lender criteria, the DTI offers a standardized metric that directly impacts loan eligibility and interest rates. Maintaining a DTI below 43% is generally preferred to improve chances of mortgage approval and secure favorable loan terms.

Calculating Your Qualifying Ratio

Calculating your qualifying ratio involves assessing the percentage of your gross monthly income allocated to housing expenses, including mortgage payments, property taxes, and insurance. This ratio helps lenders determine your ability to manage monthly housing costs without financial strain. Unlike the broader debt-to-income ratio, which includes all monthly debt obligations, the qualifying ratio specifically evaluates housing affordability within your income limits.

Impact of Qualifying Ratios on Loan Eligibility

Qualifying ratios, including the front-end and back-end ratios, directly impact loan eligibility by measuring the borrower's ability to manage monthly housing payments and overall debt obligations relative to income. Lenders use these ratios to ensure borrowers do not exceed risk thresholds, typically requiring a front-end ratio below 28% and a back-end ratio below 36%. High qualifying ratios can limit loan approval chances or reduce the maximum loan amount, emphasizing their critical role in credit decisions.

Improving Your Debt-to-Income Ratio

Improving your debt-to-income ratio (DTI) begins with reducing monthly debt payments relative to your gross income, which can enhance credit qualification prospects. Prioritizing high-interest debts and avoiding new credit lines ensures a lower DTI, making lenders view you as less risky. Maintaining a DTI below 36% is generally recommended for better loan qualification and favorable interest rates.

Common Misconceptions: Qualifying Ratio vs. DTI

Many borrowers confuse qualifying ratio with debt-to-income (DTI) ratio, but qualifying ratios specifically evaluate the portion of income allocated to housing expenses only, whereas DTI considers total monthly debts relative to gross income. Lenders often use front-end qualifying ratio to assess if housing costs align with income limits, while back-end DTI ratio measures overall debt burden and risk. Understanding this distinction is crucial for accurate credit assessment and mortgage approval processes.

Qualifying Ratio and DTI: Which Matters More?

Qualifying ratio and debt-to-income (DTI) ratio both play crucial roles in credit assessments, with qualifying ratio focusing on the portion of income allocated to housing expenses, while DTI encompasses all monthly debts relative to income. Lenders prioritize qualifying ratio to ensure borrowers can comfortably afford mortgage payments, but DTI provides a broader view of financial obligations impacting credit risk. Understanding how each metric influences loan approval helps borrowers optimize their credit profiles for better financing opportunities.

Important Terms

Front-end ratio

The front-end ratio measures the percentage of gross monthly income allocated to housing expenses, directly impacting loan approval decisions as it reflects affordability limits. It differs from the debt-to-income (DTI) ratio, which includes all monthly debt obligations, making the front-end ratio a more focused qualifier in mortgage underwriting.

Back-end ratio

Back-end ratio measures the percentage of a borrower's gross monthly income devoted to all monthly debt payments, including housing costs, and is a key component of the qualifying ratio used by lenders to assess loan eligibility. Unlike the debt-to-income (DTI) ratio that broadly encompasses total debt obligations versus income, the qualifying ratio specifically focuses on demonstrating an applicant's capacity to manage mortgage payments relative to income and expenses.

Housing expense ratio

Housing expense ratio specifically measures the portion of an individual's gross monthly income allocated to housing costs, typically including mortgage payments, property taxes, and insurance, serving as a critical qualifying ratio for lenders evaluating loan eligibility. Debt-to-income (DTI) ratio encompasses all monthly debt obligations relative to gross income, offering a broader assessment of financial health by incorporating housing expenses along with credit card payments, car loans, and other debts.

Total debt ratio

Total debt ratio measures a company's total liabilities relative to its total assets, indicating financial leverage and risk, while the qualifying ratio in lending evaluates a borrower's ability to afford loan payments by comparing monthly debt obligations to income. The debt-to-income ratio specifically calculates the percentage of a borrower's gross monthly income allocated to debt payments, serving as a critical component of the qualifying ratio in mortgage and loan approvals.

Mortgage underwriting

Mortgage underwriting focuses on assessing qualifying ratios, which include the debt-to-income (DTI) ratio as a key metric to evaluate a borrower's ability to repay the loan. The DTI ratio measures monthly debt obligations against gross income, helping underwriters determine the borrower's financial capacity and risk level.

Loan-to-value (LTV)

Loan-to-value (LTV) ratio measures the loan amount against the appraised property value, directly impacting mortgage risk and qualifying ratios used by lenders. Debt-to-income (DTI) ratio evaluates a borrower's monthly debt obligations relative to income, influencing approval thresholds alongside LTV for comprehensive credit assessment.

Residual income

Residual income is the amount of income remaining after all debt obligations are paid, serving as a critical factor in the qualifying ratio which measures a borrower's capacity to cover living expenses and debts. Unlike the debt-to-income (DTI) ratio that compares total monthly debt payments to gross income, residual income focuses on the borrower's effective disposable income, making it a more precise indicator of financial stability and loan qualification.

Debt service coverage ratio (DSCR)

Debt service coverage ratio (DSCR) measures a borrower's ability to cover debt payments with net operating income, serving as a qualifying ratio crucial for lenders to assess loan eligibility, while debt-to-income (DTI) ratio compares total monthly debt payments to gross monthly income, focusing on overall personal financial burden. DSCR provides insight into repayment capacity from income generated, whereas DTI emphasizes affordability across all debts, making DSCR more relevant in commercial lending and DTI predominant in consumer credit evaluations.

Gross income multiplier

Gross Income Multiplier (GIM) measures the relationship between a property's gross income and its market value, serving as a key metric in property valuation and investment analysis. Unlike the debt-to-income ratio, which assesses an individual's ability to manage monthly debt payments relative to gross income, the qualifying ratio includes broader criteria for loan approval, incorporating factors like housing expenses and total debt obligations.

Creditworthiness

Creditworthiness assessment often involves comparing the qualifying ratio, which measures the percentage of income available for debt repayment, against the debt-to-income (DTI) ratio, reflecting total monthly debts relative to gross income. Lenders prioritize a low qualifying ratio and a DTI ratio typically below 36% to ensure borrowers maintain sufficient capacity to manage new credit obligations.

qualifying ratio vs debt-to-income ratio Infographic

moneydif.com

moneydif.com