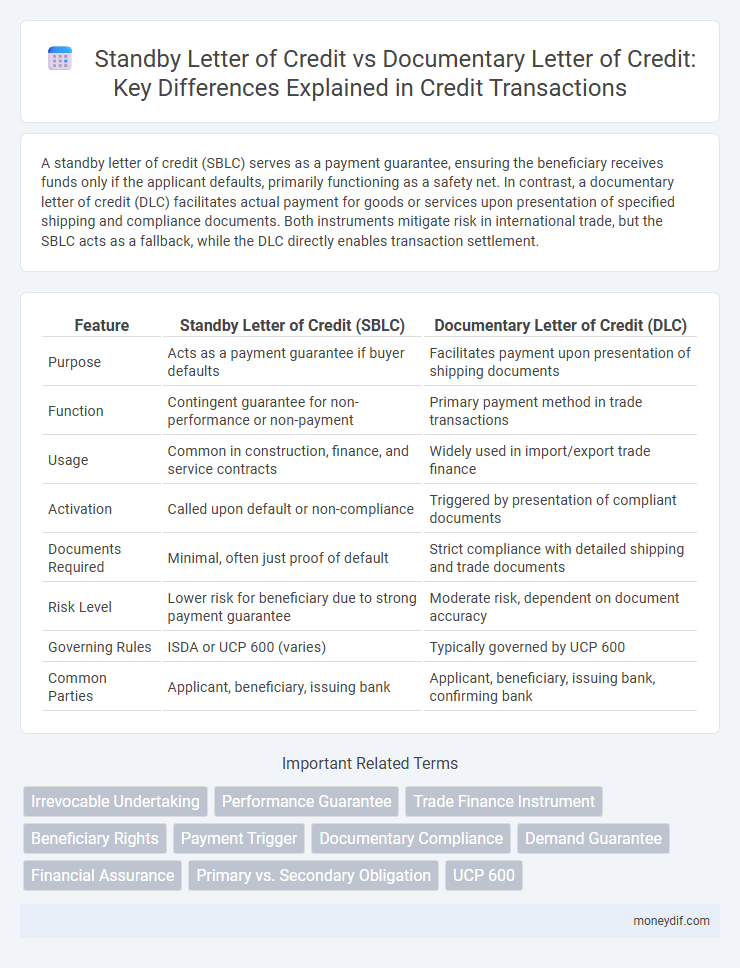

A standby letter of credit (SBLC) serves as a payment guarantee, ensuring the beneficiary receives funds only if the applicant defaults, primarily functioning as a safety net. In contrast, a documentary letter of credit (DLC) facilitates actual payment for goods or services upon presentation of specified shipping and compliance documents. Both instruments mitigate risk in international trade, but the SBLC acts as a fallback, while the DLC directly enables transaction settlement.

Table of Comparison

| Feature | Standby Letter of Credit (SBLC) | Documentary Letter of Credit (DLC) |

|---|---|---|

| Purpose | Acts as a payment guarantee if buyer defaults | Facilitates payment upon presentation of shipping documents |

| Function | Contingent guarantee for non-performance or non-payment | Primary payment method in trade transactions |

| Usage | Common in construction, finance, and service contracts | Widely used in import/export trade finance |

| Activation | Called upon default or non-compliance | Triggered by presentation of compliant documents |

| Documents Required | Minimal, often just proof of default | Strict compliance with detailed shipping and trade documents |

| Risk Level | Lower risk for beneficiary due to strong payment guarantee | Moderate risk, dependent on document accuracy |

| Governing Rules | ISDA or UCP 600 (varies) | Typically governed by UCP 600 |

| Common Parties | Applicant, beneficiary, issuing bank | Applicant, beneficiary, issuing bank, confirming bank |

Introduction to Letters of Credit

Letters of credit are essential financial instruments used in international trade to guarantee payment between buyers and sellers. A standby letter of credit serves as a backup payment method, activated only if the buyer defaults, while a documentary letter of credit requires the seller to present specific documents proving shipment before payment is made. Understanding the distinction between these two types enhances risk management and ensures smooth transaction settlements in cross-border commerce.

What is a Standby Letter of Credit?

A Standby Letter of Credit (SBLC) serves as a secondary payment guarantee, activating only if the buyer fails to fulfill contractual obligations, ensuring financial security for the beneficiary. Unlike a Documentary Letter of Credit, which facilitates payment against submitted trade documents, the SBLC functions as a safety net in commercial transactions, protecting parties from credit risk or default. Issued by banks, SBLCs are commonly used in construction, international trade, and service agreements to mitigate financial exposure.

What is a Documentary Letter of Credit?

A Documentary Letter of Credit (DLC) is a financial instrument issued by a bank guaranteeing payment to the exporter upon presentation of specified documents that prove shipment and compliance with the terms of the sales contract. This credit ensures the seller receives payment once the required documents, such as invoices, bills of lading, and certificates of origin, are presented and verified by the bank. DLCs are widely used in international trade to reduce risks related to payment and shipment between importers and exporters.

Key Differences Between Standby and Documentary Letters of Credit

Standby letters of credit serve as a payment guarantee primarily used in case of contract default, ensuring financial security for the beneficiary, while documentary letters of credit facilitate international trade by assuring payment upon presentation of specified shipping documents. Standby letters of credit are typically activated only when the applicant fails to fulfill contractual obligations, whereas documentary letters of credit require strict compliance with documentary terms for payment. The fundamental difference lies in standby letters acting as a backup payment mechanism, contrasting with documentary letters being a primary payment method tied directly to trade transactions.

Purpose and Use Cases of Standby Letters of Credit

Standby letters of credit (SBLC) serve as a financial guarantee ensuring payment or performance in case of default, primarily used in domestic and international trade to secure contractual obligations, such as loan repayments or service agreements. Unlike documentary letters of credit that facilitate payment against presentation of shipping documents, SBLCs function as a secondary payment method, activating only when the applicant fails to fulfill terms. Common use cases include construction contracts, import-export transactions, and performance bonds, offering risk mitigation for beneficiaries by providing assurance of funds.

Purpose and Use Cases of Documentary Letters of Credit

Documentary Letters of Credit primarily facilitate international trade by ensuring payment to exporters upon presentation of compliant shipping documents, reducing risks for both buyers and sellers. They are commonly used in transactions involving goods shipment where verification of documentation such as bills of lading, invoices, and certificates of origin is critical. This mechanism provides assurance that payment will be made only if the stipulated documentary conditions are met, safeguarding interests in cross-border commercial activities.

Risk Allocation: Standby vs Documentary LC

Standby letters of credit primarily serve as a payment guarantee, providing risk protection by ensuring payment only if the applicant defaults, thus shifting risk to the issuer and protecting the beneficiary. Documentary letters of credit involve detailed document compliance, allocating risk to the issuer who must pay upon presentation of conforming documents, minimizing payment risk for exporters. The key risk allocation difference lies in standby LCs acting as secondary payment mechanisms triggered by non-performance, while documentary LCs require strict document verification, reducing commercial risk.

Document Requirements for Each LC Type

Standby letters of credit typically require minimal documentation, often just a statement of default or non-performance, reflecting their primary role as a payment guarantee. Documentary letters of credit demand comprehensive documentation, including bills of lading, commercial invoices, packing lists, and certificates of origin to ensure compliance with shipment and contract terms. The exact documents required for each letter of credit type directly impact their processing time and risk mitigation effectiveness.

Cost and Processing Time Comparison

Standby letters of credit typically incur lower processing fees than documentary letters of credit due to their role as a payment guarantee rather than primary payment method. Documentary letters of credit require comprehensive document verification, resulting in longer processing times and higher administrative costs. Businesses often choose standby letters of credit for cost efficiency and faster issuance when the primary transaction documents are not extensively scrutinized.

Choosing the Right Letter of Credit for Your Business

Standby Letter of Credit (SBLC) serves as a payment guarantee, activating only if the buyer defaults, making it ideal for risk mitigation in financial transactions. Documentary Letter of Credit (DLC) ensures payment upon presentation of specified shipping documents, providing assurance in international trade deals. Selecting the appropriate letter of credit depends on your business's risk tolerance, transaction nature, and the need for payment assurance versus guarantee.

Important Terms

Irrevocable Undertaking

An Irrevocable Undertaking in the context of a standby letter of credit guarantees payment upon default, while in a documentary letter of credit it ensures payment only after presentation of specified shipping documents compliant with the credit terms.

Performance Guarantee

A Performance Guarantee issued through a standby letter of credit offers unconditional payment assurance upon beneficiary's demand, whereas a documentary letter of credit requires specific document presentation to trigger payment, impacting the level of risk and security in international trade.

Trade Finance Instrument

A standby letter of credit serves as a payment guarantee in trade finance, activating only upon buyer default, while a documentary letter of credit ensures payment upon presentation of specified shipping documents, directly facilitating the transaction.

Beneficiary Rights

Beneficiary rights under a standby letter of credit primarily involve payment upon documentary compliance or demand for non-performance, whereas under a documentary letter of credit, rights depend on strict adherence to presentation of specified shipping and commercial documents.

Payment Trigger

Payment triggers for standby letters of credit rely on the beneficiary's demand for payment upon default or non-performance, whereas documentary letters of credit require presentation of specified documents proving shipment or contract fulfillment.

Documentary Compliance

Documentary compliance ensures that a standby letter of credit is used strictly as a payment guarantee triggered by default, whereas a documentary letter of credit functions as a primary payment mechanism contingent on the presentation of specified shipping and commercial documents.

Demand Guarantee

A Demand Guarantee provides unconditional payment upon presentation of a demand, unlike a Standby Letter of Credit which serves as a payment of last resort, and a Documentary Letter of Credit that requires specific documents for payment authorization.

Financial Assurance

A standby letter of credit serves as a financial assurance for payment only if the applicant defaults, while a documentary letter of credit guarantees payment upon presentation of specified shipping documents in international trade.

Primary vs. Secondary Obligation

A standby letter of credit imposes a primary obligation on the issuer to pay upon default, whereas a documentary letter of credit creates a secondary obligation contingent on the beneficiary presenting compliant shipping documents.

UCP 600

UCP 600 primarily governs documentary letters of credit, providing standardized rules for their issuance and operation, while standby letters of credit are generally governed by ISP98 and serve as a payment guarantee rather than a method of payment.

standby letter of credit vs documentary letter of credit Infographic

moneydif.com

moneydif.com