Credit bureaus and credit reporting agencies play distinct roles in managing consumer credit information; credit bureaus collect and maintain detailed credit data from various sources, while credit reporting agencies compile this information into credit reports used by lenders to assess creditworthiness. Understanding the difference ensures consumers can effectively monitor their credit history and correct any inaccuracies promptly. Accurate credit reporting from these entities influences loan approvals, interest rates, and overall financial opportunities.

Table of Comparison

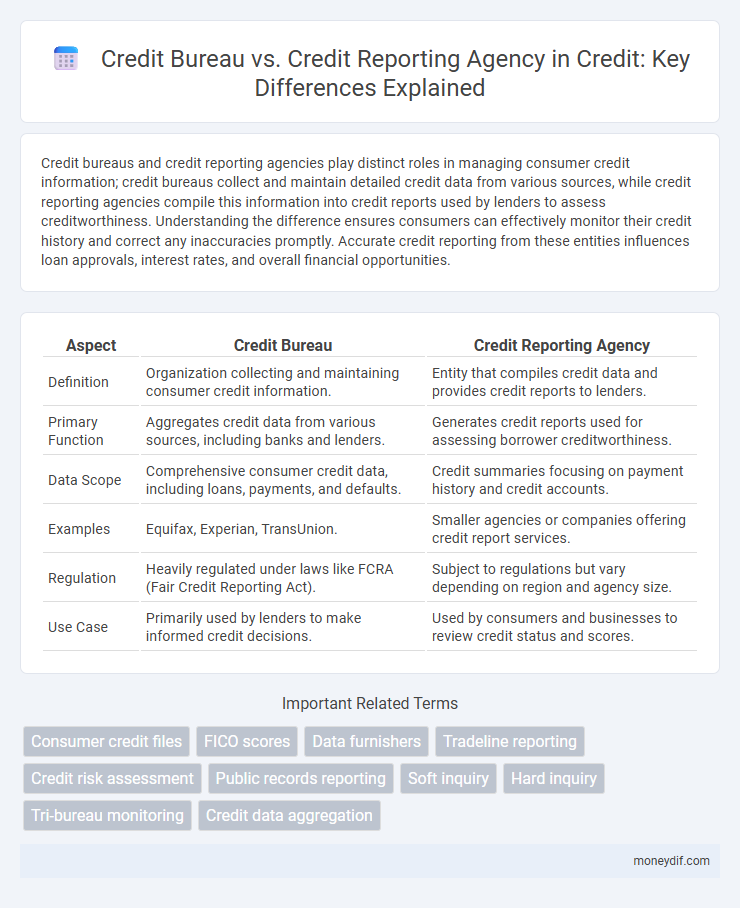

| Aspect | Credit Bureau | Credit Reporting Agency |

|---|---|---|

| Definition | Organization collecting and maintaining consumer credit information. | Entity that compiles credit data and provides credit reports to lenders. |

| Primary Function | Aggregates credit data from various sources, including banks and lenders. | Generates credit reports used for assessing borrower creditworthiness. |

| Data Scope | Comprehensive consumer credit data, including loans, payments, and defaults. | Credit summaries focusing on payment history and credit accounts. |

| Examples | Equifax, Experian, TransUnion. | Smaller agencies or companies offering credit report services. |

| Regulation | Heavily regulated under laws like FCRA (Fair Credit Reporting Act). | Subject to regulations but vary depending on region and agency size. |

| Use Case | Primarily used by lenders to make informed credit decisions. | Used by consumers and businesses to review credit status and scores. |

Introduction to Credit Bureaus and Credit Reporting Agencies

Credit bureaus and credit reporting agencies play crucial roles in the credit industry by collecting and maintaining consumer credit information. Both entities provide detailed credit reports used by lenders to assess creditworthiness, though credit bureaus primarily gather raw data while credit reporting agencies compile and analyze this information into comprehensive reports. Understanding their functions helps consumers and businesses make informed credit decisions and manage financial risk effectively.

Defining Credit Bureaus

Credit bureaus are specialized organizations that collect, maintain, and analyze individuals' credit information to generate credit reports used by lenders to assess creditworthiness. They compile data such as payment history, outstanding debts, credit utilization, and public records from various sources to create comprehensive credit profiles. Unlike broader credit reporting agencies, credit bureaus primarily focus on the accurate aggregation and evaluation of credit-related data to support risk assessment and lending decisions.

What Are Credit Reporting Agencies?

Credit reporting agencies are organizations that collect, maintain, and provide consumers' credit information to lenders, creditors, and other authorized entities. They compile data such as credit history, payment records, and outstanding debts to generate credit reports used in credit scoring. Major credit reporting agencies in the U.S. include Experian, Equifax, and TransUnion, which play a critical role in evaluating creditworthiness.

Key Differences Between Credit Bureaus and Credit Reporting Agencies

Credit bureaus collect and maintain consumer credit information, while credit reporting agencies compile and distribute credit reports based on data from multiple bureaus. Credit bureaus primarily focus on gathering accurate credit data directly from lenders and financial institutions, whereas credit reporting agencies utilize this data to generate comprehensive credit profiles for lenders, employers, and consumers. Understanding the distinction helps clarify the roles each entity plays in the credit decision-making process.

Services Offered by Credit Bureaus vs Credit Reporting Agencies

Credit bureaus compile and analyze consumer credit information to provide credit scores, detailed credit reports, and risk assessments used by lenders for creditworthiness evaluation. Credit reporting agencies primarily collect and distribute credit data from various sources, offering standardized credit reports without extensive analytical services. The key distinction lies in credit bureaus delivering comprehensive credit insights and scoring, while credit reporting agencies focus on data aggregation and reporting.

Data Sources and Collection Methods

Credit bureaus aggregate financial data from diverse sources including banks, lenders, and public records to compile comprehensive credit reports. Credit reporting agencies primarily collect data through direct interactions with creditors and financial institutions, often focusing on specific types of credit information. The differences in data sources and collection methods influence the depth and accuracy of the credit profiles they provide.

Impact on Consumer Credit Scores

Credit bureaus and credit reporting agencies both collect and maintain consumer credit information, but credit bureaus typically aggregate data from multiple sources to generate comprehensive credit reports, which are crucial for lenders in assessing creditworthiness. The accuracy and timeliness of data provided by these entities directly impact consumer credit scores, influencing loan approvals and interest rates. Understanding differences in data collection methods and reporting practices helps consumers manage their credit profiles effectively.

Privacy and Data Security Practices

Credit bureaus and credit reporting agencies both collect and maintain consumer credit information, but credit bureaus typically have stricter privacy controls and advanced data encryption methods to protect personal data. Credit reporting agencies are regulated under laws like the Fair Credit Reporting Act (FCRA) in the U.S., requiring adherence to stringent privacy and data security standards to prevent unauthorized access and data breaches. Both entities implement comprehensive risk management frameworks, but credit bureaus often invest more heavily in real-time monitoring and fraud detection systems to enhance consumer data protection.

Choosing Between a Credit Bureau and a Credit Reporting Agency

Choosing between a credit bureau and a credit reporting agency depends on the scope and purpose of credit data needed, as credit bureaus collect comprehensive credit histories from multiple sources while reporting agencies often specialize in compiling and distributing specific credit reports. Credit bureaus like Experian, Equifax, and TransUnion provide detailed credit scores and histories essential for lending decisions, whereas credit reporting agencies may focus on niche areas such as tenant screening or employment verification. Evaluating data accuracy, coverage, and service specialization is crucial when selecting between these entities to ensure reliable credit information tailored to particular financial or business requirements.

Summary: Which Is Better for Consumers?

Credit bureaus and credit reporting agencies both collect and provide consumer credit information, but credit bureaus typically have more comprehensive data and offer advanced analytics for credit evaluation. Consumers benefit more from credit bureaus due to their broader data sources, frequent updates, and detailed credit scoring insights. Choosing a credit bureau generally results in a more accurate and reliable credit profile, aiding in better financial decisions and loan approvals.

Important Terms

Consumer credit files

Consumer credit files contain detailed records of an individual's credit history, compiled by credit bureaus that collect and maintain data from various lenders and financial institutions. Credit reporting agencies manage these files to generate credit reports used by lenders for creditworthiness assessment and risk management decisions.

FICO scores

FICO scores rely on data collected primarily from credit bureaus such as Experian, TransUnion, and Equifax, which compile consumer credit information to generate comprehensive credit reports. Credit reporting agencies act as intermediaries providing this data, but the accuracy and timeliness of their reporting directly influence FICO score calculations and the subsequent credit decisions by lenders.

Data furnishers

Data furnishers provide critical consumer credit information such as payment history and account status to credit bureaus, which compile and maintain these records. Credit reporting agencies then use this data to generate credit reports that lenders utilize for credit risk assessment and decision-making.

Tradeline reporting

Tradeline reporting involves the detailed recording of credit account information, which is processed and maintained by credit bureaus such as Experian, Equifax, and TransUnion, key entities in the credit reporting ecosystem. Credit reporting agencies collect, update, and distribute consumers' credit data, ensuring accuracy and regulatory compliance to influence credit scores and lending decisions.

Credit risk assessment

Credit risk assessment relies heavily on data from credit bureaus, which aggregate and analyze borrower credit histories to generate credit scores, while credit reporting agencies primarily collect and provide raw credit information to lenders. Both entities play crucial roles in evaluating borrower creditworthiness, but credit bureaus focus more on scoring and predictive risk models, whereas credit reporting agencies emphasize data collection and accuracy.

Public records reporting

Public records reporting involves the collection and dissemination of information such as bankruptcies, tax liens, and judgments that impact an individual's credit profile, primarily managed by credit reporting agencies like Experian, Equifax, and TransUnion. Credit bureaus act as intermediaries that gather this public data, verify its accuracy, and supply it to lenders and consumers for credit assessments and risk evaluations.

Soft inquiry

Soft inquiries occur when a credit bureau or credit reporting agency checks a consumer's credit report without impacting their credit score, commonly used for pre-approval offers or background checks. Unlike hard inquiries, these soft pulls do not affect creditworthiness evaluations or lending decisions but remain visible only to the consumer on their credit report.

Hard inquiry

A hard inquiry occurs when a credit bureau or credit reporting agency reviews your credit report as part of a loan or credit application process, potentially impacting your credit score. Credit bureaus such as Experian, Equifax, and TransUnion compile credit data, while credit reporting agencies collect and provide this information to lenders and other authorized entities.

Tri-bureau monitoring

Tri-bureau monitoring combines data from the three major credit bureaus--Experian, Equifax, and TransUnion--to provide a comprehensive credit profile, enhancing accuracy and detection of discrepancies. Unlike a single credit reporting agency that gathers information from one bureau, tri-bureau monitoring offers a unified view, crucial for thorough credit analysis and fraud prevention.

Credit data aggregation

Credit data aggregation consolidates financial information from multiple sources, enhancing the accuracy of credit bureau reports that compile comprehensive credit histories. Credit reporting agencies focus on collecting and maintaining individual credit data, while credit bureaus analyze aggregated data to assess creditworthiness and produce credit scores.

Credit bureau vs Credit reporting agency Infographic

moneydif.com

moneydif.com