A credit builder loan is specifically designed to help individuals establish or improve their credit score by making small, manageable payments reported to credit bureaus. Personal loans provide a lump sum of money for various expenses but usually require a higher credit score for approval and may not directly contribute to building credit if payments are not consistently made. Choosing between these options depends on credit goals: improving credit history favors credit builder loans, while immediate access to funds suits personal loans.

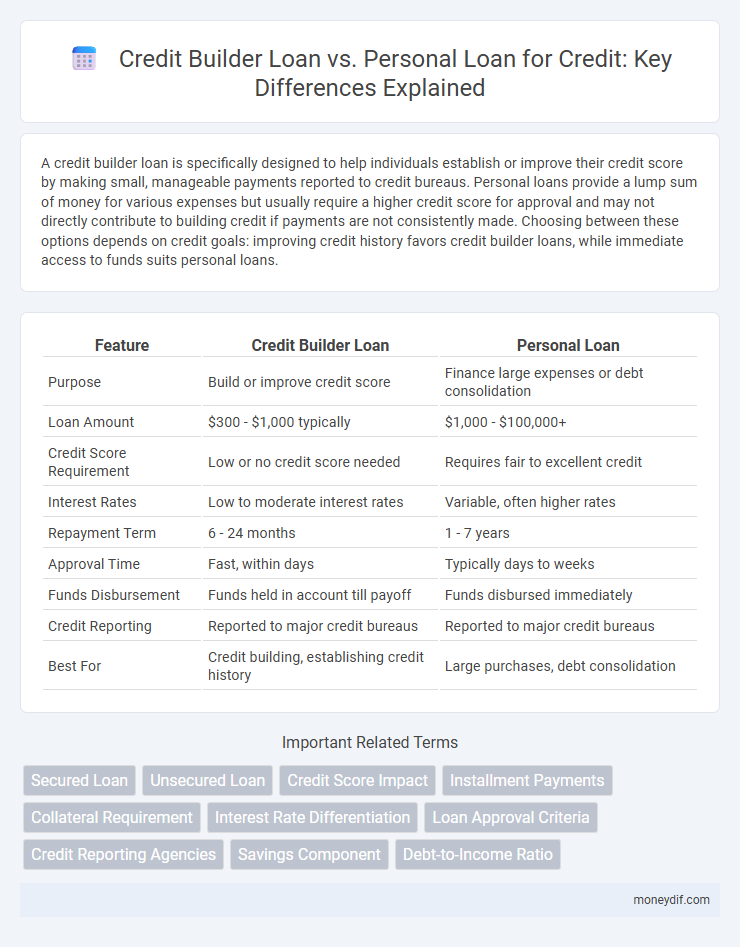

Table of Comparison

| Feature | Credit Builder Loan | Personal Loan |

|---|---|---|

| Purpose | Build or improve credit score | Finance large expenses or debt consolidation |

| Loan Amount | $300 - $1,000 typically | $1,000 - $100,000+ |

| Credit Score Requirement | Low or no credit score needed | Requires fair to excellent credit |

| Interest Rates | Low to moderate interest rates | Variable, often higher rates |

| Repayment Term | 6 - 24 months | 1 - 7 years |

| Approval Time | Fast, within days | Typically days to weeks |

| Funds Disbursement | Funds held in account till payoff | Funds disbursed immediately |

| Credit Reporting | Reported to major credit bureaus | Reported to major credit bureaus |

| Best For | Credit building, establishing credit history | Large purchases, debt consolidation |

Understanding Credit Builder Loans

Credit builder loans are designed specifically to help individuals improve their credit scores by making regular, on-time payments that are reported to credit bureaus. Unlike personal loans, which provide immediate funds and may require strong credit history, credit builder loans function by holding the loan amount in a secured account until full repayment, thereby minimizing risk for lenders. This structured repayment process helps build a positive credit history, making credit builder loans an effective tool for those with limited or poor credit profiles.

What Is a Personal Loan?

A personal loan is a fixed-term, unsecured loan offered by banks, credit unions, or online lenders to help borrowers cover various expenses such as debt consolidation, home improvements, or emergency costs. Unlike credit builder loans that focus on improving credit score by reporting payment history, personal loans typically offer larger amounts with fixed interest rates and repayment schedules based on creditworthiness. Borrowers with strong credit profiles often qualify for lower interest rates and better loan terms on personal loans, making them a versatile financial tool.

Key Differences Between Credit Builder Loans and Personal Loans

Credit builder loans are specifically designed to help individuals establish or improve their credit score by making small, manageable payments reported to credit bureaus, while personal loans provide a lump sum upfront for various purposes with fixed or variable interest rates. Credit builder loans typically feature lower loan amounts and require consistent monthly payments over a set term, whereas personal loans usually offer higher borrowing limits and flexible repayment terms but may require higher credit scores for approval. The key difference lies in their purpose: credit builder loans focus on credit improvement with minimal immediate financial benefit, whereas personal loans serve as a direct source of funds for immediate expenses or debt consolidation.

How Credit Builder Loans Impact Your Credit Score

Credit builder loans positively impact your credit score by establishing a consistent payment history, which is reported to major credit bureaus, helping to build or improve credit profiles over time. Unlike personal loans that are often used for larger expenses and can increase debt significantly, credit builder loans are specifically designed to minimize risk and encourage disciplined repayment. Timely payments on credit builder loans demonstrate financial responsibility, boosting your creditworthiness and potentially leading to better loan terms in the future.

Personal Loans: Effects on Credit and Finances

Personal loans impact credit scores by influencing credit mix and payment history, with timely payments boosting creditworthiness and missed payments causing significant score declines. These loans typically carry fixed interest rates and repayment terms, which can improve budgeting and financial planning but may strain finances if overborrowed. Unlike credit builder loans designed solely to build credit, personal loans serve broader financial needs but require disciplined repayment to avoid debt accumulation and negative credit effects.

Eligibility Requirements for Credit Builder Loans vs Personal Loans

Credit builder loans typically require minimal eligibility criteria, focusing on steady income, a valid ID, and a checking account, making them accessible to individuals with limited or poor credit history. Personal loans usually demand higher eligibility standards, including a strong credit score, proof of stable income, and a low debt-to-income ratio. Lenders evaluate creditworthiness more rigorously for personal loans, while credit builder loans prioritize establishing or improving credit profiles.

Pros and Cons of Credit Builder Loans

Credit Builder Loans offer a strategic way to improve credit scores by reporting consistent, timely payments to credit bureaus, which is ideal for individuals with limited or poor credit history. These loans typically have lower borrowing amounts and slower access to funds since payments are made into a secured account, limiting immediate use of loan proceeds. While Personal Loans provide larger sums with quicker access, they often require higher credit scores and may carry higher interest rates, making Credit Builder Loans a safer option for focused credit improvement.

Advantages and Disadvantages of Personal Loans

Personal loans offer quick access to funds with fixed interest rates and repayment terms, making budgeting easier and providing flexibility for various expenses. However, they often require higher credit scores for approval and can come with higher interest rates compared to secured loans, increasing the overall cost if payments are missed. Unlike credit builder loans, personal loans do not directly help improve credit scores unless consistently repaid on time, limiting their utility for credit building purposes.

Which Loan Is Right for Building Credit?

Credit builder loans are specifically designed to improve credit scores by reporting timely payments to credit bureaus, making them ideal for individuals with little or no credit history. Personal loans offer larger amounts but often require good credit for approval and may not impact credit improvement as directly. Choosing a credit builder loan is generally more effective for establishing or repairing credit, while personal loans better serve those seeking immediate funds with existing creditworthiness.

Choosing Between Credit Builder and Personal Loans: Factors to Consider

Credit builder loans are designed to improve credit scores by reporting consistent, on-time payments to credit bureaus, making them ideal for individuals with limited or poor credit history. Personal loans offer larger sums with fixed terms and interest rates, suitable for immediate needs like debt consolidation or major expenses but often require good credit for favorable rates. Key factors to consider include credit goals, loan purpose, interest rates, repayment terms, and existing credit profile to determine the best fit for financial improvement or funding needs.

Important Terms

Secured Loan

A secured loan requires collateral, offering lower interest rates compared to unsecured personal loans, while a credit builder loan specifically helps improve credit scores by reporting payments to credit bureaus. Personal loans are typically unsecured and may have higher interest rates but provide immediate funds without the need for collateral, contrasting with credit builder loans that focus on credit improvement rather than instant cash access.

Unsecured Loan

Unsecured loans include credit builder loans and personal loans, both designed without collateral but serving different purposes; credit builder loans focus on improving credit scores through small, controlled borrowing, while personal loans offer larger amounts for diverse financial needs with fixed repayment terms. Interest rates on credit builder loans tend to be lower due to their credit-enhancing intent, whereas personal loans may have higher rates reflecting the borrower's creditworthiness and loan amount risk.

Credit Score Impact

A credit builder loan positively impacts credit scores by reporting timely payments to credit bureaus, establishing a history of responsible debt management, while personal loans can improve credit scores through on-time payments but may initially cause a temporary score dip due to hard credit inquiries. Credit builder loans specifically target credit improvement by locking funds in a secured account, reducing risk and promoting consistent payment behavior compared to unsecured personal loans with higher interest rates and variable terms.

Installment Payments

Installment payments for credit builder loans are typically smaller, fixed amounts designed to improve credit scores through timely repayments, whereas personal loans usually have higher installment payments reflecting larger principal amounts and varying interest rates. Credit builder loans focus on credit enhancement over time, while personal loans prioritize immediate access to funds with structured repayment schedules.

Collateral Requirement

Collateral requirements for Credit Builder Loans are typically minimal or nonexistent, as these loans focus on helping borrowers establish or improve credit through small, manageable payments secured by the loan itself. In contrast, Personal Loans often require collateral, such as property or other assets, especially if they involve larger amounts or if the borrower has a lower credit score, which helps mitigate lender risk.

Interest Rate Differentiation

Interest rate differentiation between credit builder loans and personal loans is significant due to their differing risk profiles; credit builder loans typically offer lower interest rates as they are designed to help borrowers build credit with smaller principal amounts and secured repayment terms. Personal loans generally carry higher interest rates reflecting unsecured credit risk and often larger loan amounts, impacting the overall repayment cost and borrower qualification criteria.

Loan Approval Criteria

Loan approval criteria for Credit Builder Loans primarily focus on assessing creditworthiness through factors like credit utilization, payment history, and income stability, while Personal Loan approvals emphasize debt-to-income ratio, credit score, employment status, and existing liabilities. Credit Builder Loans target individuals looking to improve or establish credit, often featuring lower loan amounts and stricter repayment terms, whereas Personal Loans typically require higher credit scores and offer larger amounts with more flexible terms based on borrower risk profile.

Credit Reporting Agencies

Credit reporting agencies collect and analyze data from credit builder loans and personal loans to assess individual creditworthiness, with credit builder loans specifically designed to improve credit scores by reporting timely payments. Personal loans impact credit profiles based on payment history and debt utilization, influencing credit scores differently depending on repayment consistency and loan terms.

Savings Component

The Savings Component in a Credit Builder Loan functions as a secured deposit that accumulates over the loan term, enhancing credit scores while simultaneously building savings, unlike a Personal Loan which provides an immediate lump sum without savings benefits. Credit Builder Loans combine credit improvement with disciplined saving, whereas Personal Loans focus exclusively on borrowing funds for immediate use without a parallel savings mechanism.

Debt-to-Income Ratio

Debt-to-Income Ratio (DTI) plays a critical role in comparing Credit Builder Loans and Personal Loans, as Credit Builder Loans typically have lower monthly payments that help maintain a favorable DTI, improving credit score potential. Personal Loans often require higher monthly payments that can increase DTI, potentially limiting borrowing capacity and affecting loan approval odds.

Credit Builder Loan vs Personal Loan Infographic

moneydif.com

moneydif.com