A positive item on a credit report reflects responsible financial behavior, such as on-time payments and credit limit increases, which can improve credit scores. Negative items, including late payments, defaults, or collections, signal potential risk to lenders and negatively impact creditworthiness. Monitoring and managing these items are essential for maintaining a healthy credit profile and accessing favorable loan terms.

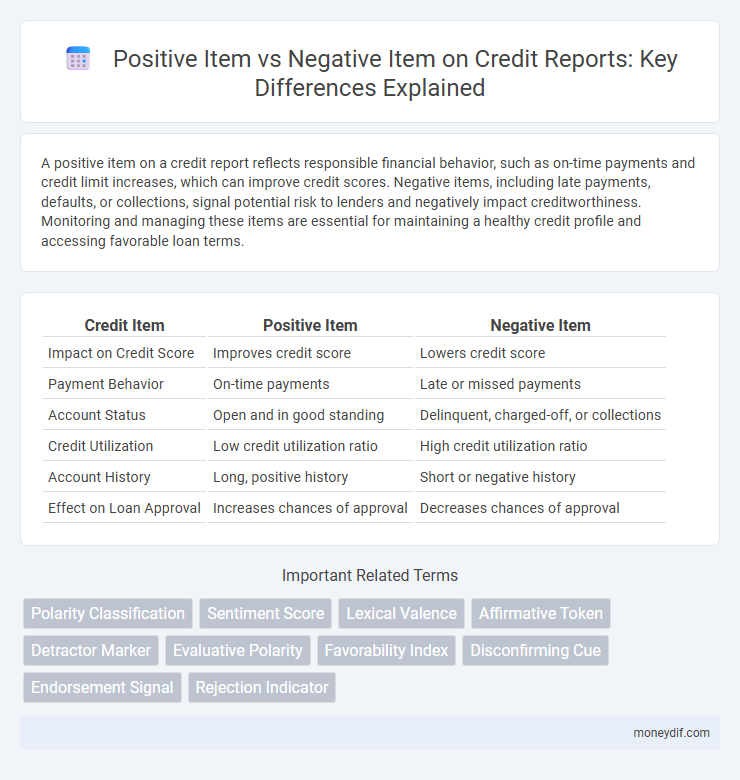

Table of Comparison

| Credit Item | Positive Item | Negative Item |

|---|---|---|

| Impact on Credit Score | Improves credit score | Lowers credit score |

| Payment Behavior | On-time payments | Late or missed payments |

| Account Status | Open and in good standing | Delinquent, charged-off, or collections |

| Credit Utilization | Low credit utilization ratio | High credit utilization ratio |

| Account History | Long, positive history | Short or negative history |

| Effect on Loan Approval | Increases chances of approval | Decreases chances of approval |

Definition of Positive and Negative Credit Items

Positive credit items refer to transactions or record entries that add to a credit account balance, such as payments made on time, credit card credits, or deposits. Negative credit items represent entries that reduce the credit score or account balance, including late payments, defaults, charge-offs, or collections. Understanding the distinction between positive and negative credit items is crucial for managing overall credit health and improving creditworthiness.

Impact of Positive Items on Credit Score

Positive items, such as timely payments and low credit utilization, significantly enhance credit scores by demonstrating responsible credit management and reducing perceived risk to lenders. These favorable entries increase creditworthiness, leading to better loan approval odds and lower interest rates. Consistently positive account behavior is a critical factor in building and maintaining a strong credit profile.

How Negative Items Affect Credit Reports

Negative items such as late payments, collections, charge-offs, and bankruptcies significantly lower credit scores by signaling higher risk to lenders. These adverse entries remain on credit reports for up to seven years, impacting borrowing ability, interest rates, and credit approval chances. Consistently addressing and resolving negative items helps improve credit health and restores lender confidence over time.

Examples of Positive Credit Items

Positive credit items include consistent on-time payments, credit limit increases, and resolved disputes that result in account adjustments. These items enhance credit reports by demonstrating reliability and responsible credit management. For example, a history of timely mortgage or credit card payments significantly boosts credit scores.

Common Negative Credit Items

Common negative credit items include late payments, charge-offs, collections, and bankruptcies, which significantly lower credit scores and impact creditworthiness. These negative entries remain on credit reports for 7 to 10 years, signaling financial distress to lenders and creditors. Addressing negative items promptly through payment plans or disputes can improve credit profiles and overall credit health.

Strategies to Increase Positive Credit Items

Increasing positive credit items involves consistent on-time payments, reducing credit utilization below 30%, and diversifying credit types, such as installment loans and revolving accounts. Regularly monitoring credit reports to identify and dispute inaccuracies helps maintain accurate positive entries. Establishing secured credit cards or becoming an authorized user on a responsible party's account can also boost positive credit activity.

Removing or Disputing Negative Items

Removing or disputing negative items on a credit report can significantly improve credit scores by eliminating inaccurate or outdated information. Consumers should gather evidence such as payment records or correspondence before initiating disputes with credit bureaus to ensure successful removal. Timely resolution of negative entries like late payments or collections enhances creditworthiness and access to better financial opportunities.

Balancing Positive and Negative Items for Healthy Credit

Balancing positive and negative items on a credit report is essential for maintaining a healthy credit score and financial reputation. Positive items such as timely payments, low credit utilization, and long credit history mitigate the impact of negative items like late payments, defaults, or high debt levels. Consistently managing credit accounts responsibly ensures long-term creditworthiness and improved access to favorable lending terms.

Long-term Effects of Negative Items

Negative items such as late payments, charge-offs, and collections remain on credit reports for up to seven years, significantly impacting credit scores and borrower risk profiles. These negative marks lower creditworthiness, resulting in higher interest rates and reduced access to favorable loan terms over the long term. Unlike positive items that build credit history, negative entries delay financial recovery and limit credit opportunities for years.

Monitoring and Maintaining Positive Credit Items

Regularly monitoring positive credit items, such as timely payments and low credit utilization, strengthens your overall credit profile by demonstrating responsible financial behavior. Maintaining a history of on-time payments, low debt-to-credit ratios, and avoidable credit inquiries helps sustain a positive credit score. Consistently managing these positive items reduces risk for lenders and enhances access to favorable loan terms and interest rates.

Important Terms

Polarity Classification

Polarity classification involves categorizing items into positive or negative sentiment based on their linguistic and contextual features, using techniques like machine learning and natural language processing to analyze text data. Effective polarity classification enhances sentiment analysis accuracy by distinguishing positive items, which convey favorable opinions, from negative items expressing unfavorable views.

Sentiment Score

Sentiment Score quantifies the emotional tone of text by measuring the proportion of positive items, such as words expressing happiness or approval, against negative items that convey sadness, anger, or disapproval. High positive item counts increase the overall Sentiment Score, indicating favorable sentiment, while a prevalence of negative items lowers the score, reflecting unfavorable sentiment in the analyzed content.

Lexical Valence

Lexical valence refers to the intrinsic emotional value carried by words, categorizing them as positive items (e.g., joy, love) or negative items (e.g., anger, fear) based on their affective connotations. This semantic property influences emotional processing and cognitive responses, playing a critical role in sentiment analysis and language comprehension tasks.

Affirmative Token

Affirmative Token plays a critical role in distinguishing Positive Items from Negative Items in natural language processing by signaling acceptance, agreement, or presence. This token enhances sentiment analysis accuracy by reinforcing positive contexts and reducing ambiguity in contrasting negative expressions.

Detractor Marker

Detractor Marker identifies negative sentiment within text by highlighting phrases or words that contrast with positive items, helping to distinguish customer dissatisfaction from favorable feedback. This semantic tool enhances sentiment analysis accuracy by differentiating between positive item references and negative item critiques in reviews or surveys.

Evaluative Polarity

Evaluative polarity distinguishes between positive items, which convey approval or favorable judgment, and negative items, which express disapproval or unfavorable sentiment. This polarity plays a crucial role in sentiment analysis by categorizing words or phrases to accurately interpret subjective opinions in texts.

Favorability Index

The Favorability Index measures the ratio of Positive Items to Negative Items within a dataset, reflecting overall sentiment or approval levels. A higher Favorability Index indicates a greater prevalence of positive feedback relative to negative responses, serving as a key metric in customer satisfaction and brand reputation analysis.

Disconfirming Cue

Disconfirming cues occur when information contradicts initial assumptions about positive or negative items, prompting reevaluation of their perceived value or meaning. In cognitive processing, such cues enhance accuracy by reducing confirmation bias and encouraging a balanced assessment of both favorable and unfavorable attributes.

Endorsement Signal

Endorsement signals indicate user preferences by highlighting positive items that receive higher ratings, clicks, or purchases compared to negative items with lower engagement metrics. These signals improve recommendation algorithms by focusing on user behavior patterns and implicit feedback to distinguish favorable content from unfavorable or irrelevant items.

Rejection Indicator

Rejection Indicator measures the frequency or likelihood of negative items being dismissed compared to positive items within a dataset or behavioral pattern. This metric is crucial for optimizing recommendation systems and filtering algorithms by accurately distinguishing user preferences toward favorable versus unfavorable content.

Positive Item vs Negative Item Infographic

moneydif.com

moneydif.com