Bullet payments require the borrower to pay the entire principal amount in one lump sum at the end of the loan term, which can lead to significant financial strain if not planned properly. Amortizing payments spread both principal and interest over the life of the loan, resulting in regular, manageable payments that gradually reduce the outstanding balance. Understanding the differences between bullet and amortizing payments helps borrowers choose the best repayment structure aligned with their cash flow and financial goals.

Table of Comparison

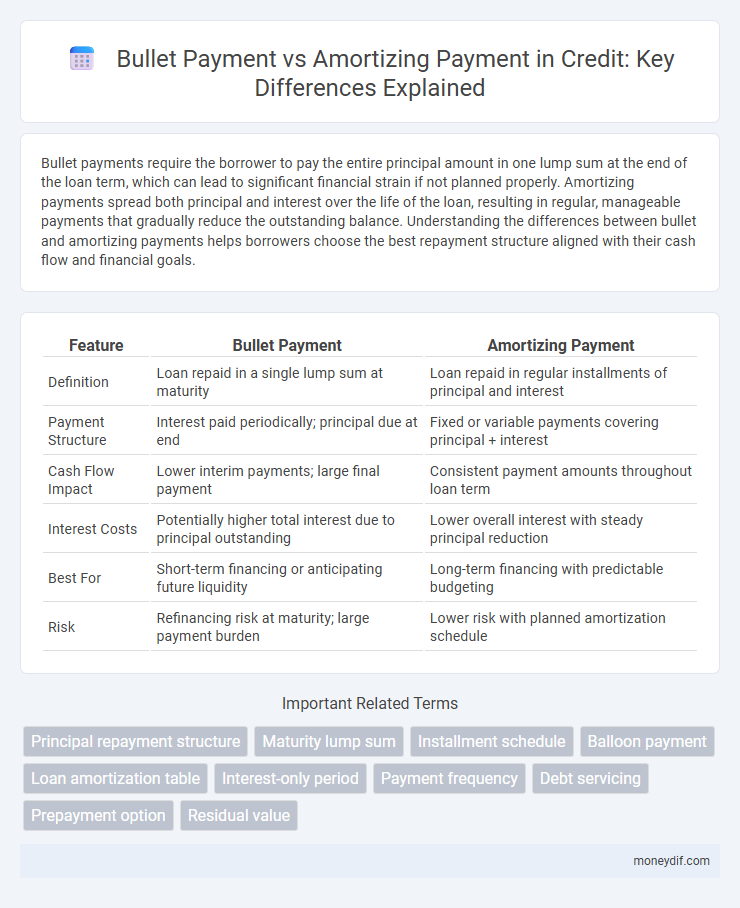

| Feature | Bullet Payment | Amortizing Payment |

|---|---|---|

| Definition | Loan repaid in a single lump sum at maturity | Loan repaid in regular installments of principal and interest |

| Payment Structure | Interest paid periodically; principal due at end | Fixed or variable payments covering principal + interest |

| Cash Flow Impact | Lower interim payments; large final payment | Consistent payment amounts throughout loan term |

| Interest Costs | Potentially higher total interest due to principal outstanding | Lower overall interest with steady principal reduction |

| Best For | Short-term financing or anticipating future liquidity | Long-term financing with predictable budgeting |

| Risk | Refinancing risk at maturity; large payment burden | Lower risk with planned amortization schedule |

Understanding Bullet Payments in Credit

Bullet payments in credit refer to a lump-sum payment due at the end of a loan term, where the principal remains unpaid during the loan period, contrasting with amortizing payments that spread principal and interest over regular installments. This structure allows borrowers lower periodic payments since they only cover interest until the final bullet payment, increasing cash flow flexibility but posing refinancing or repayment risks at maturity. Bullet loans are commonly used in corporate financing, real estate, and short-term credit strategies, emphasizing the importance of understanding repayment ability and timing.

What Are Amortizing Payments?

Amortizing payments are structured to gradually reduce the principal balance of a loan through a fixed schedule of periodic payments that include both principal and interest components. Each payment decreases the loan's outstanding balance until it is completely paid off by the end of the term. This contrasts with bullet payments, where the principal is repaid in a lump sum at maturity.

Key Differences: Bullet vs Amortizing Payment

Bullet payments require the borrower to pay the entire principal amount in a single lump sum at the end of the loan term, while amortizing payments involve gradual repayment of both principal and interest through regular installments over the loan duration. Bullet loans often result in lower periodic payments but higher risk due to the large final payment, whereas amortizing loans provide steady reduction of principal, lowering outstanding debt progressively. Choosing between bullet and amortizing payments impacts cash flow management, interest costs, and credit risk exposure.

Advantages of Bullet Payments

Bullet payments offer significant advantages by reducing monthly cash flow obligations, as borrowers only pay interest during the loan term and repay the principal in a lump sum at maturity. This structure allows businesses to allocate capital more efficiently, investing in growth opportunities without the burden of high periodic principal payments. Bullet loans enhance flexibility and can optimize cash management, especially for projects with uneven revenue streams or short-term financing needs.

Benefits of Amortizing Payments

Amortizing payments provide predictable monthly installments that cover both principal and interest, reducing outstanding loan balance over time and minimizing overall interest expense. This structured repayment method enhances financial planning by eliminating large lump-sum payments at loan maturity, lowering default risk. Borrowers benefit from steadily building equity and improved credit profiles through consistent amortization schedules.

Risks Associated with Bullet Payments

Bullet payments pose significant risks due to the substantial lump-sum repayment required at maturity, increasing the borrower's default probability if cash flow is insufficient. Unlike amortizing payments, which spread principal repayment over time, bullet payments concentrate financial pressure in a single future obligation, potentially leading to refinancing risk and liquidity challenges. This concentrated risk profile demands thorough assessment of the borrower's repayment capacity and access to funds at maturity to avoid severe credit losses.

When to Choose Amortizing Payment Structures

Amortizing payment structures are ideal for borrowers seeking predictable monthly payments that cover both principal and interest, facilitating easier budgeting and steady debt reduction. These payments are advantageous when long-term financial planning and gradual equity building are priorities. Choosing amortizing payments minimizes the risk of a large lump-sum bullet payment at maturity, reducing refinancing uncertainty and potential cash flow challenges.

Impact on Cash Flow Management

Bullet payments require a large lump sum at the end of the loan term, creating potential cash flow challenges and necessitating careful financial planning to ensure liquidity. Amortizing payments spread out principal and interest evenly over the loan period, allowing for predictable monthly outflows and easier cash flow management. Businesses with fluctuating revenues often prefer amortizing schedules to avoid the risk of a large, unexpected payment that could disrupt operations.

Borrower Suitability: Bullet vs Amortizing

Bullet payments suit borrowers seeking lower initial monthly payments and flexibility in cash flow, often preferred for short-term loans or when expecting a large future inflow. Amortizing payments distribute principal and interest evenly over the loan term, ideal for borrowers prioritizing steady repayment and reducing overall interest cost. Suitability depends on financial stability, income predictability, and long-term cash flow management goals of the borrower.

How Lenders Evaluate Payment Structures

Lenders evaluate bullet payment versus amortizing payment structures by assessing the borrower's risk profile and cash flow stability, as bullet payments require a large lump sum repayment at maturity, increasing default risk. Amortizing payments, involving regular principal and interest installments, offer predictable cash flows and reduce lender risk through gradual principal reduction. Lenders consider factors such as loan-to-value ratio, debt service coverage ratio (DSCR), and borrower creditworthiness when determining the suitability of each payment structure.

Important Terms

Principal repayment structure

Principal repayment structure significantly impacts cash flow management, with bullet payments requiring a single lump-sum repayment at maturity, whereas amortizing payments involve periodic principal repayments that gradually reduce the outstanding loan balance.

Maturity lump sum

Maturity lump sum refers to a bullet payment where the entire principal is paid at the end of the loan term, contrasting with amortizing payments that spread principal repayment evenly throughout the loan period.

Installment schedule

An installment schedule with a bullet payment features a lump-sum principal repayment at maturity, whereas an amortizing payment schedule gradually reduces the principal through regular installments over the loan term.

Balloon payment

A balloon payment is a large, lump-sum payment due at the end of a loan term, distinct from bullet payments which involve interest-only installments followed by principal repayment, and amortizing payments that gradually reduce both principal and interest over time.

Loan amortization table

A loan amortization table details each payment, contrasting bullet payments with a lump sum at maturity against amortizing payments that gradually reduce principal over time.

Interest-only period

An interest-only period features bullet payments with principal due at maturity, contrasting with amortizing payments that combine principal and interest throughout the loan term.

Payment frequency

Bullet payment involves a single lump-sum repayment at maturity, while amortizing payment spreads principal and interest over regular intervals, reducing outstanding balance gradually.

Debt servicing

Debt servicing involving bullet payments requires a large lump-sum repayment at maturity, while amortizing payments spread principal and interest evenly over the loan term, reducing repayment risk and improving cash flow stability.

Prepayment option

The prepayment option allows borrowers to pay off their loan principal ahead of schedule, impacting both bullet and amortizing payment structures differently. In bullet payment loans, prepayment reduces the lump sum due at maturity, while in amortizing loans, it lowers remaining installment amounts and total interest paid over the loan term.

Residual value

Residual value represents the estimated asset worth at lease end, critically affecting bullet payments by requiring a lump sum, while amortizing payments spread principal and interest evenly, minimizing residual value impact.

bullet payment vs amortizing payment Infographic

moneydif.com

moneydif.com