Payment history is the most critical factor in credit scoring, reflecting timely or late payments that directly impact creditworthiness. Credit age measures the length of time your credit accounts have been active, influencing the stability and reliability perceived by lenders. A strong payment history combined with a long credit age enhances credit scores and increases borrowing potential.

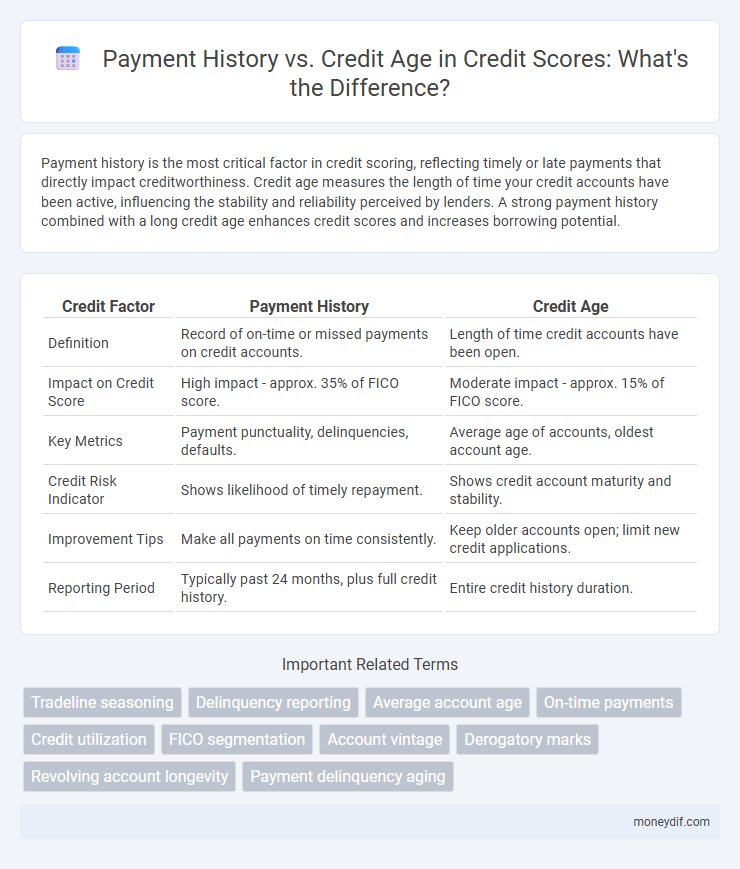

Table of Comparison

| Credit Factor | Payment History | Credit Age |

|---|---|---|

| Definition | Record of on-time or missed payments on credit accounts. | Length of time credit accounts have been open. |

| Impact on Credit Score | High impact - approx. 35% of FICO score. | Moderate impact - approx. 15% of FICO score. |

| Key Metrics | Payment punctuality, delinquencies, defaults. | Average age of accounts, oldest account age. |

| Credit Risk Indicator | Shows likelihood of timely repayment. | Shows credit account maturity and stability. |

| Improvement Tips | Make all payments on time consistently. | Keep older accounts open; limit new credit applications. |

| Reporting Period | Typically past 24 months, plus full credit history. | Entire credit history duration. |

Understanding Payment History in Credit Reports

Payment history represents the record of on-time and late payments on credit accounts, significantly impacting credit scores. Lenders analyze this data to assess the risk and reliability of borrowers, making it a crucial element in credit reports. Negative payment history entries like missed or late payments can lower creditworthiness, emphasizing the importance of consistent timely payments.

What is Credit Age and Why Does It Matter?

Credit age refers to the length of time your credit accounts have been open, reflecting your experience with managing credit over the years. It significantly impacts your credit score by demonstrating your credit behavior consistency and reliability to lenders. A longer credit age typically improves your creditworthiness as it provides a more comprehensive history of your financial responsibility.

Payment History vs Credit Age: Key Differences

Payment history reflects an individual's record of on-time payments, which constitutes about 35% of credit score calculations and directly impacts creditworthiness. Credit age measures the length of time credit accounts have been open, contributing roughly 15% to the credit score and indicating the stability of credit usage. While payment history emphasizes consistent repayment behavior, credit age highlights long-term credit experience, both essential for a strong credit profile.

The Impact of Payment History on Credit Scores

Payment history accounts for approximately 35% of a credit score, making it the most influential factor in credit evaluation. Consistently on-time payments demonstrate creditworthiness, significantly improving credit scores and access to favorable loan terms. Late or missed payments can drastically reduce credit scores, increasing borrowing costs and limiting credit opportunities.

How Credit Age Influences Your Creditworthiness

Longer credit age positively affects your creditworthiness by demonstrating your ability to manage credit responsibly over time, which lenders consider a strong indicator of reliability. Older accounts boost your credit history length, accounting for approximately 15% of your credit score, and can improve your chances of loan approvals and favorable interest rates. Consistently maintaining older credit accounts helps establish a stable credit profile, reducing perceived risk to creditors.

Which Matters More: Payment History or Credit Age?

Payment history holds greater influence on credit scores, accounting for approximately 35% of the FICO scoring model, as it reflects a borrower's reliability in making timely payments. Credit age contributes around 15%, measuring the length of time credit accounts have been open, which signals experience but has less immediate impact. Consistent on-time payments build strong credit history, making payment history more critical than credit age in credit evaluations.

Strategies to Improve Your Payment History

Consistently making on-time payments is the most effective strategy to enhance your payment history, which significantly impacts your credit score. Setting up automatic payments or payment reminders helps avoid missed or late payments, reinforcing a positive credit record. Regularly reviewing your credit reports ensures accuracy and identifies any discrepancies that could affect your payment history.

Tips to Increase Your Credit Age Effectively

To increase your credit age effectively, maintain older credit accounts instead of closing them, as the length of your credit history significantly impacts your credit score. Regularly use and pay off your oldest credit cards to demonstrate consistent, responsible credit management over time. Avoid opening multiple new credit accounts frequently, as this can reduce your average credit age and lower your overall creditworthiness.

Common Myths About Payment History and Credit Age

Payment history often gets more attention than credit age, but both factors significantly impact credit scores. Common myths suggest that a perfect payment history can fully offset a short credit age, yet credit scoring models value long-standing accounts for demonstrating consistent credit behavior over time. Accurate understanding of these components helps optimize credit management strategies and avoid misinformed decisions.

Balancing Payment History and Credit Age for Better Credit

Balancing payment history and credit age is crucial for improving credit scores, as consistent on-time payments demonstrate reliability while a longer credit history shows financial experience. Maintaining a mix of old and new credit accounts helps optimize both factors, ensuring steady credit utilization and repayment patterns. Lenders often prioritize borrowers who exhibit a positive payment record alongside an established credit age, reflecting responsible credit management over time.

Important Terms

Tradeline seasoning

Tradeline seasoning significantly impacts Payment History by demonstrating consistent, timely payments over an extended period, which enhances creditworthiness. Older seasoned tradelines increase Credit Age, contributing to a higher credit score through a longer, positive credit history.

Delinquency reporting

Delinquency reporting significantly impacts credit history by highlighting missed or late payments, which can lower credit scores and affect future lending decisions. Payment history constitutes approximately 35% of credit scoring models, whereas credit age--reflecting the length of credit accounts--accounts for about 15%, both essential in evaluating creditworthiness.

Average account age

Average account age represents the mean duration of all open credit accounts, directly influencing credit age, which is a crucial factor in credit scoring models. Payment history, while primarily reflecting on-time or late payments, indirectly impacts credit age by affecting account status and length, with positive payment behavior helping maintain older accounts in good standing.

On-time payments

On-time payments significantly impact your payment history, demonstrating reliability to lenders and boosting your credit score over time. A longer credit age combined with consistent on-time payments strengthens creditworthiness by showcasing sustained financial responsibility.

Credit utilization

Credit utilization measures the ratio of revolving credit used to total credit limits, significantly impacting credit scores alongside Payment History, which tracks timely repayments, and Credit Age, reflecting the average duration of credit accounts. Maintaining low credit utilization below 30% complements a strong Payment History and longer Credit Age, collectively enhancing creditworthiness by demonstrating responsible credit management over time.

FICO segmentation

FICO segmentation analyzes credit risk by evaluating Payment History as a critical factor indicating on-time or late payments, while Credit Age reflects the length of credit accounts, influencing score stability and reliability. A longer Credit Age combined with a strong Payment History typically results in higher FICO scores, signaling lower default risk to lenders.

Account vintage

Account vintage reflects the length of time an account has been open and is a critical factor in assessing credit age, which impacts credit score calculations. Payment history, detailing timely or missed payments, interacts with credit age by demonstrating creditworthiness over the account's lifetime, thereby influencing risk assessments and lending decisions.

Derogatory marks

Derogatory marks significantly impact payment history by highlighting late payments, defaults, or collections, which lowers credit scores and signals higher risk to lenders. While credit age reflects the length of credit history, consistent negative records within payment history often outweigh the positive effects of a longer credit age in credit evaluations.

Revolving account longevity

Revolving account longevity is significantly influenced by payment history, as consistent on-time payments demonstrate creditworthiness and enhance credit age, which reflects the length of time a credit account has been open. A longer credit age positively impacts credit scores by showing a stable credit history, while a strong payment history prevents delinquency and reduces the risk of account closure, contributing to overall credit profile longevity.

Payment delinquency aging

Payment delinquency aging measures the duration of overdue balances, directly impacting credit history by highlighting payment inconsistencies over credit age. Extended delinquency periods weaken credit profiles, as credit scoring models weigh recent payment history more heavily than the overall credit age.

Payment History vs Credit Age Infographic

moneydif.com

moneydif.com