Pari passu and pro rata are key concepts in credit agreements that determine how payments or distributions are allocated among creditors. Pari passu ensures that all creditors share equally and simultaneously in repayments, maintaining an equal ranking without preference. Pro rata allocation divides payments proportionally based on each creditor's share, ensuring fairness relative to the size of their claims.

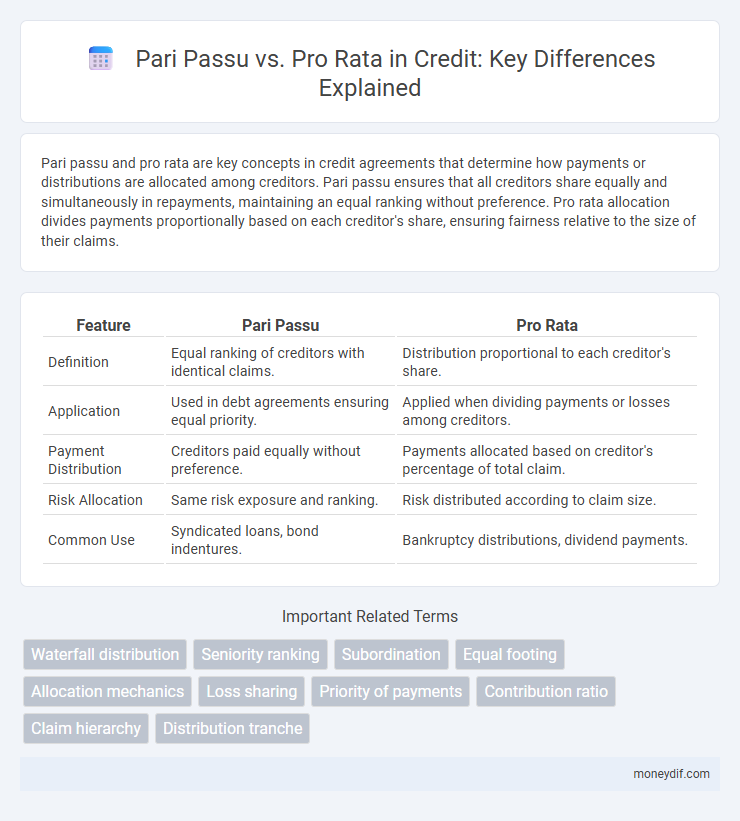

Table of Comparison

| Feature | Pari Passu | Pro Rata |

|---|---|---|

| Definition | Equal ranking of creditors with identical claims. | Distribution proportional to each creditor's share. |

| Application | Used in debt agreements ensuring equal priority. | Applied when dividing payments or losses among creditors. |

| Payment Distribution | Creditors paid equally without preference. | Payments allocated based on creditor's percentage of total claim. |

| Risk Allocation | Same risk exposure and ranking. | Risk distributed according to claim size. |

| Common Use | Syndicated loans, bond indentures. | Bankruptcy distributions, dividend payments. |

Understanding Pari Passu and Pro Rata in Credit Agreements

Pari passu and pro rata are key principles in credit agreements that dictate the order and distribution of repayments among creditors. Pari passu ensures all creditors have equal rank and share repayments simultaneously without preference, preventing junior creditors from receiving funds ahead of senior ones. Pro rata defines proportional allocation of payments based on each creditor's claim size, ensuring fairness when distributing limited funds.

Key Differences Between Pari Passu and Pro Rata

Pari passu and pro rata are fundamental concepts in credit agreements, where pari passu means equal rank or priority among creditors with no preference in payment order. Pro rata refers to the proportional distribution of payments based on each creditor's share or claim relative to the total debt. The key difference lies in pari passu ensuring equal treatment in priority, while pro rata governs the allocation of amounts received among creditors based on their individual stakes.

Legal Interpretation of Pari Passu Clauses

Pari passu clauses in credit agreements ensure that all creditors rank equally without any preference in repayment, establishing a legal framework that prevents subordinated claims. Courts interpret these clauses strictly to uphold the equal treatment of creditors, often invalidating any attempts to prioritize payments unless explicitly stated. This interpretation maintains creditor confidence by reinforcing predictable debt servicing and enforcing the principle of proportional sharing of liabilities.

Pro Rata Distribution: Mechanism and Applications

Pro rata distribution allocates funds proportionally based on each creditor's share of the total outstanding debt, ensuring equitable repayment. This mechanism is commonly applied in bankruptcy proceedings and loan syndications to maintain fairness among multiple creditors or investors. Its precise formula adjusts distributions according to the size of claims, preventing preferential treatment and promoting transparency.

Impact of Pari Passu on Creditor Rights

Pari passu treatment ensures all creditors hold equal rights and receive payments proportionally, preventing any creditor from gaining priority over others. This principle preserves the equitable distribution of repayments during insolvency or restructuring scenarios. It minimizes legal disputes by maintaining uniform claims, thereby stabilizing creditor confidence and influencing borrowing terms.

Practical Implications for Loan Syndication

In loan syndication, pari passu ensures all lenders share equal ranking and proportional repayment, preventing subordination among creditors and simplifying enforcement rights. Pro rata allocation mandates borrowers distribute repayments proportionally based on each lender's share, promoting fairness but potentially complicating cash flow management during partial repayments. Understanding these distinctions is crucial for structuring syndicate agreements, risk allocation, and priority in default scenarios.

Risk Assessment: Pari Passu vs Pro Rata Structures

Pari passu structures distribute risk equally among creditors, ensuring all parties have the same priority level in claims and reducing the likelihood of disputes during default scenarios. Pro rata arrangements allocate risk proportionally based on each creditor's investment size, allowing for tailored exposure but potentially complicating recovery if some creditors face higher losses. Assessing risk under these frameworks involves analyzing creditor equity, default probabilities, and the potential impact on recovery rates within credit portfolios.

Pari Passu and Pro Rata in Debt Recovery

Pari passu and pro rata are critical concepts in debt recovery, determining how creditors are paid when a debtor defaults. Pari passu ensures all creditors share equally in repayments, receiving the same proportion of their claims simultaneously. Pro rata allocates repayments based on the size of each creditor's claim, meaning larger creditors recover more but always in proportion to their outstanding debt.

Common Pitfalls When Drafting Credit Agreements

Common pitfalls when drafting credit agreements include misinterpreting pari passu and pro rata clauses, which can lead to unintended priority or payment distribution issues among creditors. Confusing pari passu--a provision ensuring creditors share equally in the same rank of security--with pro rata, which dictates proportional distribution based on each creditor's claim, often results in disputes and enforcement challenges. Clear, precise language distinguishing these concepts is critical to avoid conflicting interpretations and ensure equitable treatment of all parties involved.

Choosing the Right Approach: Pari Passu or Pro Rata?

Choosing between pari passu and pro rata methods hinges on the specific credit structure and risk distribution goals of the involved parties. Pari passu ensures equal ranking and payment priority among creditors, minimizing disputes in insolvency scenarios. Pro rata allocation suits situations requiring proportional distribution of payments or losses based on each creditor's share, optimizing fairness in diverse credit portfolios.

Important Terms

Waterfall distribution

Waterfall distribution prioritizes repayment tiers, allocating funds pari passu within the same level but distributing pro rata across different stakeholders.

Seniority ranking

Seniority ranking determines the payment priority in debt structures where pari passu creditors share equal claims, while pro rata allocation divides payments proportionally based on individual claim sizes.

Subordination

Subordination determines the priority of claims in debt structures, causing pari passu creditors to share equal payment ranks while pro rata creditors receive payments proportionally based on their individual holdings.

Equal footing

Equal footing ensures pari passu treatment where all stakeholders share rights and obligations proportionally, unlike pro rata which allocates benefits strictly based on individual share percentages.

Allocation mechanics

Allocation mechanics in finance determine how assets, liabilities, or payments are distributed among stakeholders, often distinguished by pari passu and pro rata methods. Pari passu ensures equal ranking and simultaneous treatment of claims without preference, while pro rata allocates amounts proportionally based on each party's share or interest.

Loss sharing

Loss sharing under pari passu ensures equal proportional losses among creditors, whereas pro rata allocates losses based on the specific size of each creditor's claim.

Priority of payments

Priority of payments determines the order in which creditors are paid, with pari passu ensuring equal ranking and pro rata distributing payments proportionally among stakeholders.

Contribution ratio

The contribution ratio determines the proportional amount each party contributes in pari passu arrangements, ensuring equal ranking without preference, whereas pro rata allocation distributes contributions according to each party's specific share or stake.

Claim hierarchy

Claim hierarchy prioritizes pari passu treatment where claims share equal ranking, whereas pro rata allocates payments proportionally based on claim size within the same priority level.

Distribution tranche

The distribution tranche allocates payments pro rata among investors to maintain pari passu status, ensuring equal ranking and proportional sharing of returns.

pari passu vs pro rata Infographic

moneydif.com

moneydif.com