Covenant-lite loans offer borrowers fewer restrictions and less stringent financial maintenance requirements compared to traditional loans, increasing their flexibility but also elevating risk for lenders. Traditional loans include covenants that impose strict conditions and regular financial reporting, providing more protection for creditors through early warning signals of borrower distress. The trade-off between covenant-lite and traditional loans hinges on balancing borrower freedom with lender security in credit agreements.

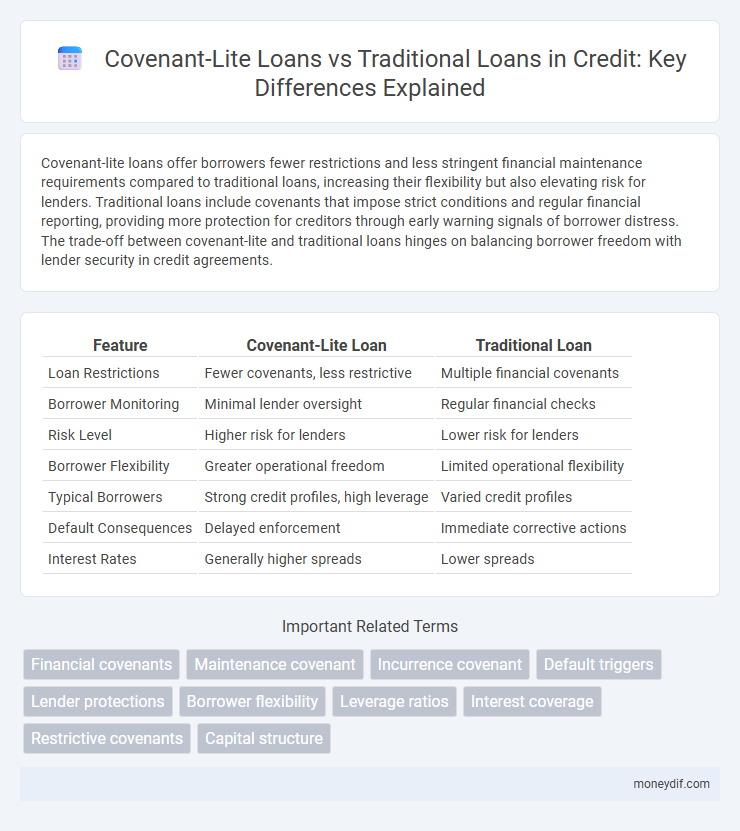

Table of Comparison

| Feature | Covenant-Lite Loan | Traditional Loan |

|---|---|---|

| Loan Restrictions | Fewer covenants, less restrictive | Multiple financial covenants |

| Borrower Monitoring | Minimal lender oversight | Regular financial checks |

| Risk Level | Higher risk for lenders | Lower risk for lenders |

| Borrower Flexibility | Greater operational freedom | Limited operational flexibility |

| Typical Borrowers | Strong credit profiles, high leverage | Varied credit profiles |

| Default Consequences | Delayed enforcement | Immediate corrective actions |

| Interest Rates | Generally higher spreads | Lower spreads |

Understanding Covenant-Lite Loans

Covenant-lite loans differ from traditional loans by having fewer borrower restrictions and minimal financial maintenance covenants, making them riskier for lenders. These loans often appeal to borrowers seeking greater flexibility but increase the potential for credit deterioration unnoticed by lenders. Understanding the trade-offs involves recognizing that covenant-lite structures can lead to higher default risk due to limited early warning mechanisms.

Defining Traditional Loans

Traditional loans in credit agreements typically include strict covenants that require borrowers to meet specific financial ratios, maintain certain performance benchmarks, and restrict additional borrowing or asset sales. These covenants provide lenders with protective measures to monitor credit risk and ensure timely repayments under agreed terms. In contrast to covenant-lite loans, traditional loans offer more lender control and early intervention opportunities in case of financial distress.

Key Differences Between Covenant-Lite and Traditional Loans

Covenant-lite loans differ from traditional loans primarily in their reduced number of financial maintenance covenants, resulting in fewer restrictions and less frequent borrower oversight. Traditional loans typically require regular compliance with financial ratios such as debt-to-equity and interest coverage, whereas covenant-lite loans waive or loosen these conditions, allowing borrowers greater operational flexibility. The risk profile of covenant-lite loans is higher due to limited lender protections, leading to potential challenges in early default detection and creditor recourse.

Types of Covenants in Loan Agreements

Covenant-lite loans typically have fewer financial covenants compared to traditional loans, emphasizing primarily on incurrence covenants that restrict certain actions like additional borrowings or asset sales. Traditional loans include both maintenance covenants, requiring borrowers to meet specific financial ratios regularly, and incurrence covenants to control risk proactively. The reduced covenant structure in covenant-lite loans increases borrower flexibility but may raise risk exposure for lenders due to limited ongoing financial oversight.

Benefits of Covenant-Lite Loans for Borrowers

Covenant-lite loans offer borrowers greater operational flexibility by reducing the frequency and severity of financial maintenance covenants, allowing them to focus on growth rather than compliance. These loans minimize the risk of technical default since fewer triggers can prompt lender intervention, thereby enhancing borrower stability during economic fluctuations. Access to covenant-lite financing often attracts a broader investor base, enabling borrowers to secure larger loan amounts or more favorable terms.

Risks Associated with Covenant-Lite Loans

Covenant-lite loans pose increased risks compared to traditional loans due to their minimal borrower restrictions and fewer performance covenants. These loans limit lenders' ability to intervene early during borrower distress, potentially resulting in delayed default recognition and higher recovery losses. The absence of protective covenants in covenant-lite structures heightens credit risk by reducing lender oversight and remedy options.

Lender Protections in Traditional Loans

Traditional loans offer stronger lender protections through stringent covenants that require borrowers to maintain specific financial ratios and provide timely financial reporting. These covenants enable lenders to monitor borrower health closely and trigger corrective actions if the borrower's financial condition deteriorates. In contrast, covenant-lite loans have fewer restrictions, increasing risk exposure for lenders by limiting early intervention opportunities.

Market Trends: The Rise of Covenant-Lite Lending

Covenant-lite loans have surged in popularity, accounting for over 70% of the U.S. leveraged loan market as of 2024, reflecting a shift towards looser borrower protections and increased risk tolerance among investors. This trend is driven by high demand for yield in a low-interest-rate environment, encouraging lenders to accept fewer maintenance covenants compared to traditional loans. Institutional investors like collateralized loan obligations (CLOs) and private equity firms are key players fueling this rise, reshaping credit market dynamics.

Impact on Credit Risk and Loan Performance

Covenant-lite loans often carry higher credit risk than traditional loans due to fewer borrower restrictions and less frequent financial reporting, which can delay early warning signals of financial distress. The reduced covenants lower lenders' ability to intervene early, potentially leading to higher default rates and increased loan losses during economic downturns. In contrast, traditional loans with stringent covenants enhance credit risk monitoring and improve loan performance by providing lenders with greater control and timely information on borrower financial health.

Choosing Between Covenant-Lite and Traditional Loans

Choosing between covenant-lite and traditional loans involves assessing risk tolerance and borrower flexibility needs. Covenant-lite loans offer fewer restrictions and financial maintenance covenants, appealing to borrowers seeking operational freedom but presenting higher risk for lenders. Traditional loans include stricter covenants that protect lenders by requiring regular financial performance benchmarks and enabling early intervention if terms are breached.

Important Terms

Financial covenants

Financial covenants in covenant-lite loans are significantly fewer and less restrictive compared to traditional loans, often omitting maintenance covenants that require borrowers to meet specific financial ratios regularly. This reduced oversight allows borrowers greater operational flexibility but increases risk for lenders, who rely primarily on incurrence covenants triggered by specific events rather than ongoing financial performance metrics.

Maintenance covenant

Maintenance covenants in traditional loans require borrowers to meet specific financial ratios regularly, providing lenders with early warnings and control. Covenant-lite loans, in contrast, significantly reduce or eliminate these maintenance requirements, increasing borrower flexibility but raising risk exposure for lenders.

Incurrence covenant

Incurrence covenants in covenant-lite loans are less restrictive compared to traditional loans, allowing borrowers greater flexibility in taking on additional debt or making significant financial decisions without lender approval. Traditional loans impose stricter incurrence covenants that trigger penalties or loan defaults if specific financial or operational thresholds are breached, providing stronger protection for lenders.

Default triggers

Default triggers in covenant-lite loans are less stringent compared to traditional loans, focusing primarily on payment defaults without maintenance covenants, which reduces lender control and increases borrower flexibility. Traditional loans include both incurrence and maintenance covenants triggering default events, enabling lenders to intervene earlier if financial metrics deteriorate.

Lender protections

Lender protections in covenant-lite loans are significantly reduced compared to traditional loans, as they lack stringent financial maintenance covenants that trigger default upon borrower underperformance. Traditional loans typically include robust covenants such as leverage ratios and interest coverage requirements, providing lenders early warning signs and legal recourse to mitigate credit risk.

Borrower flexibility

Borrower flexibility in covenant-lite loans significantly exceeds that of traditional loans by allowing fewer financial maintenance covenants and greater freedom to operate without lender intervention. This reduced covenant burden minimizes default risk triggers, enabling companies to pursue growth strategies and manage cash flows with less restrictive oversight.

Leverage ratios

Leverage ratios in covenant-lite loans are typically higher than those in traditional loans, reflecting looser financial maintenance requirements that allow borrowers greater debt capacity and operational flexibility. Traditional loans impose stricter leverage ratio covenants to protect lenders by limiting borrower indebtedness and signaling early financial distress.

Interest coverage

Interest coverage ratio in covenant-lite loans often exhibits lower thresholds compared to traditional loans, reflecting reduced lender protections and greater borrower flexibility. Covenant-lite structures typically allow interest coverage ratios below 2.0x, whereas traditional loans enforce stricter coverage requirements above 3.0x to mitigate default risk.

Restrictive covenants

Restrictive covenants in traditional loans impose stringent borrower obligations and financial performance requirements, limiting flexibility to protect lenders, while covenant-lite loans reduce or eliminate these covenants, offering borrowers greater operational freedom but increasing lender risk exposure. The shift from traditional restrictive covenants to covenant-lite structures reflects a trend toward looser credit conditions, often seen in leveraged finance and private equity markets.

Capital structure

Covenant-lite loans feature fewer restrictions and less frequent financial maintenance requirements compared to traditional loans, impacting a company's capital structure by increasing leverage flexibility but potentially elevating credit risk. This relaxed covenant environment allows borrowers to optimize debt capacity and preserve liquidity, while traditional loans enforce stricter financial covenants that constrain capital structure adjustments through tighter risk management.

covenant-lite loan vs traditional loan Infographic

moneydif.com

moneydif.com