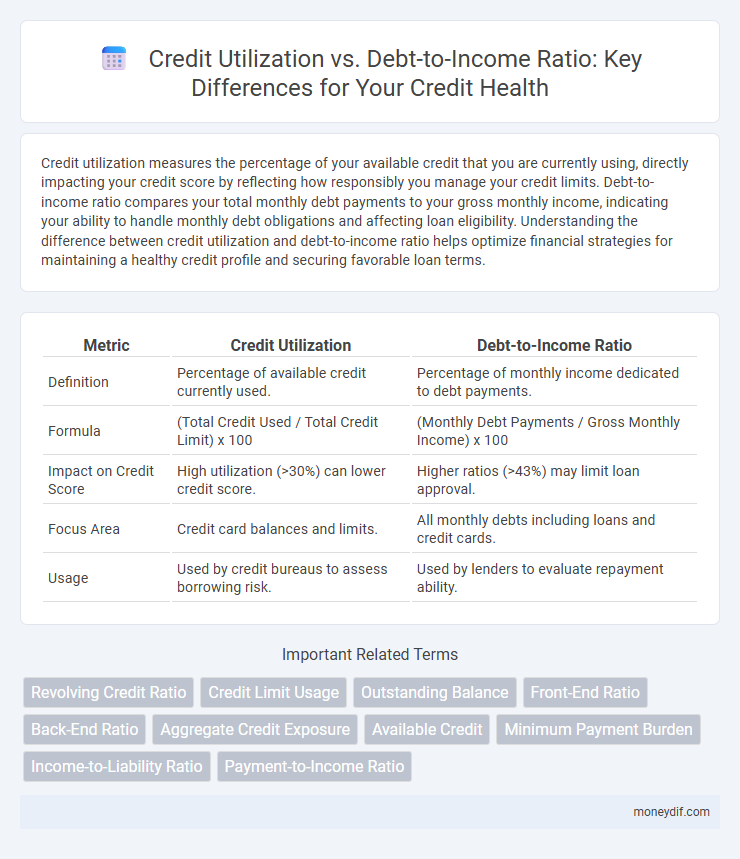

Credit utilization measures the percentage of your available credit that you are currently using, directly impacting your credit score by reflecting how responsibly you manage your credit limits. Debt-to-income ratio compares your total monthly debt payments to your gross monthly income, indicating your ability to handle monthly debt obligations and affecting loan eligibility. Understanding the difference between credit utilization and debt-to-income ratio helps optimize financial strategies for maintaining a healthy credit profile and securing favorable loan terms.

Table of Comparison

| Metric | Credit Utilization | Debt-to-Income Ratio |

|---|---|---|

| Definition | Percentage of available credit currently used. | Percentage of monthly income dedicated to debt payments. |

| Formula | (Total Credit Used / Total Credit Limit) x 100 | (Monthly Debt Payments / Gross Monthly Income) x 100 |

| Impact on Credit Score | High utilization (>30%) can lower credit score. | Higher ratios (>43%) may limit loan approval. |

| Focus Area | Credit card balances and limits. | All monthly debts including loans and credit cards. |

| Usage | Used by credit bureaus to assess borrowing risk. | Used by lenders to evaluate repayment ability. |

Understanding Credit Utilization

Credit utilization measures the percentage of available credit currently used on revolving accounts, directly impacting credit scores by indicating credit management effectiveness. Maintaining credit utilization below 30% helps improve creditworthiness, signaling lenders responsible borrowing behavior. Unlike debt-to-income ratio, which compares total monthly debt payments to income, credit utilization focuses solely on revolving credit limits and balances, providing a clear view of short-term credit risk.

What is Debt-to-Income Ratio?

Debt-to-Income Ratio (DTI) measures the percentage of a borrower's gross monthly income that goes toward paying debts, including loans, credit cards, and mortgages. Lenders use DTI to assess an individual's ability to manage monthly payments and repay debts without financial strain. Maintaining a low DTI ratio, typically below 36%, is crucial for qualifying for favorable loan terms and improving creditworthiness.

Key Differences Between Credit Utilization and DTI

Credit utilization measures the percentage of available revolving credit currently used by a borrower, directly impacting credit scores. Debt-to-Income (DTI) ratio calculates the portion of monthly gross income that goes toward total debt payments, influencing loan eligibility. While credit utilization affects creditworthiness, DTI primarily assesses repayment capacity for lenders.

Impact on Credit Scores: Utilization vs DTI

Credit utilization ratio directly impacts credit scores by indicating how much available credit is being used, with lower utilization typically boosting scores. Debt-to-income (DTI) ratio, while not a direct factor in credit scoring models, influences lenders' assessments of creditworthiness and loan approval decisions. Maintaining a credit utilization below 30% and a DTI under 36% helps optimize creditworthiness and improve chances for favorable lending terms.

How to Calculate Credit Utilization

Credit utilization is calculated by dividing your total credit card balances by your total credit limits and then multiplying by 100 to get a percentage. For example, if you have $2,000 in balances and $10,000 in credit limits, your credit utilization ratio is 20%. Maintaining a credit utilization below 30% is recommended to support a healthy credit score and improve creditworthiness.

How to Determine Your Debt-to-Income Ratio

Calculating your debt-to-income (DTI) ratio involves dividing your total monthly debt payments by your gross monthly income, expressed as a percentage. This crucial financial metric helps lenders evaluate your ability to manage monthly payments and repay debts. Maintaining a DTI ratio below 36% is generally recommended to secure favorable loan terms and improve creditworthiness.

Ways to Improve Credit Utilization

Maintaining a low credit utilization ratio, ideally below 30%, can significantly boost your credit score by demonstrating responsible borrowing behavior. Strategies to improve credit utilization include paying down existing balances, increasing credit limits, and spreading purchases across multiple credit cards to avoid maxing out any single account. Regularly monitoring credit reports and keeping balances low relative to available credit helps lenders view you as a low-risk borrower.

Strategies to Lower Your Debt-to-Income Ratio

Lowering your debt-to-income (DTI) ratio involves increasing your income or reducing overall debt, particularly high-interest credit card balances that contribute heavily to monthly obligations. Strategically paying down installment loans and avoiding new debt can significantly improve your DTI, reflecting better creditworthiness to lenders. Regularly tracking your DTI alongside credit utilization rate ensures a balanced approach to managing credit health and enhancing loan approval chances.

Why Lenders Assess Both Metrics

Lenders assess both credit utilization and debt-to-income ratio to evaluate an individual's financial health and creditworthiness from different angles. Credit utilization measures how much of available credit is being used, indicating risk of over-reliance on borrowed funds, while debt-to-income ratio compares monthly debt payments to gross income, reflecting the borrower's ability to manage current debt obligations. By analyzing both metrics, lenders gain a comprehensive view of borrowing behavior and repayment capacity, improving their decision-making accuracy.

Common Myths About Credit Utilization and DTI

Common myths about credit utilization suggest that keeping it below 30% is the only way to improve credit scores, while experts emphasize that utilization below 10% can be even more beneficial for scoring models. Many believe the debt-to-income (DTI) ratio only affects loan approvals, but lenders use DTI extensively to assess overall financial health and repayment risk. Misunderstandings often cause consumers to prioritize one metric over the other, despite the fact that managing both credit utilization and DTI strategically enhances creditworthiness and borrowing potential.

Important Terms

Revolving Credit Ratio

Revolving Credit Ratio measures the proportion of revolving credit used, directly impacting Credit Utilization, which reflects the percentage of available credit currently in use and significantly influences credit scores. In contrast, the Debt-to-Income Ratio compares total monthly debt payments to gross monthly income, highlighting overall financial health and credit risk rather than specific credit usage.

Credit Limit Usage

Credit Limit Usage measures the percentage of available credit currently being utilized, directly impacting credit utilization, which ideally stays below 30% for optimal credit scores. Debt-to-Income Ratio (DTI) compares monthly debt payments to gross income, influencing loan approvals by assessing overall financial health beyond just credit card utilization.

Outstanding Balance

Outstanding balance directly impacts credit utilization, which measures the ratio of revolving credit used to total credit limits and significantly influences credit scores. Debt-to-income ratio, calculated by dividing monthly debt payments by gross monthly income, reflects overall debt burden and affects loan approval and interest rates.

Front-End Ratio

The Front-End Ratio measures the percentage of gross monthly income allocated to housing expenses, directly impacting credit utilization by indicating how much income is dedicated to debt repayment. Unlike the Debt-to-Income Ratio, which assesses total monthly debt obligations against income, the Front-End Ratio focuses solely on housing costs, playing a crucial role in mortgage lending decisions and credit risk evaluations.

Back-End Ratio

Back-End Ratio measures the portion of income dedicated to all monthly debt payments, encompassing credit utilization and other obligations, while Credit Utilization specifically reflects the balance ratio on revolving credit accounts relative to their limits. Debt-to-Income Ratio assesses total monthly debt payments against gross income, with a higher Back-End Ratio indicating greater financial strain due to increased credit utilization or debt levels.

Aggregate Credit Exposure

Aggregate Credit Exposure measures the total amount of credit risk from all outstanding debts, reflecting the borrower's overall liability exposure to creditors. Credit Utilization ratio indicates the percentage of available credit currently used, influencing short-term credit risk, while Debt-to-Income Ratio assesses long-term repayment capacity by comparing total monthly debt payments to gross income, both critical for evaluating creditworthiness within Aggregate Credit Exposure.

Available Credit

Available credit significantly impacts credit utilization, which is calculated by dividing total credit card balances by total credit limits, reflecting how much of the credit line is being used. A lower credit utilization ratio, ideally below 30%, positively influences credit scores, whereas the debt-to-income (DTI) ratio measures total monthly debt payments against gross monthly income, assessing overall financial health but not directly affecting credit utilization.

Minimum Payment Burden

Minimum payment burden directly impacts credit utilization by influencing the outstanding balance relative to the credit limit, while debt-to-income ratio measures monthly debt payments against gross income to assess financial health. Maintaining a low credit utilization below 30% and a debt-to-income ratio under 36% optimizes credit scores and minimizes financial stress.

Income-to-Liability Ratio

The Income-to-Liability Ratio measures the proportion of income dedicated to servicing outstanding debts, closely related to credit utilization which reflects the percentage of available credit in use on revolving accounts. Unlike the Debt-to-Income Ratio that compares total monthly debt payments to gross monthly income, credit utilization specifically impacts credit scores by indicating how much revolving credit is being used relative to total credit limits.

Payment-to-Income Ratio

Payment-to-Income Ratio measures the portion of monthly income allocated to debt payments, directly influencing credit utilization by impacting available credit capacity. Unlike Debt-to-Income Ratio, which assesses total debt relative to income, Payment-to-Income Ratio focuses on payment obligations, providing a more immediate indicator of credit management and financial health.

Credit Utilization vs Debt-to-Income Ratio Infographic

moneydif.com

moneydif.com