Mezzanine debt offers higher returns and greater risk compared to senior debt, as it sits below senior debt in the capital structure but above equity. Senior debt provides lower interest rates and higher security with priority claims on assets in case of default. Companies often use mezzanine debt to bridge financing gaps when they seek additional capital beyond what senior debt can provide.

Table of Comparison

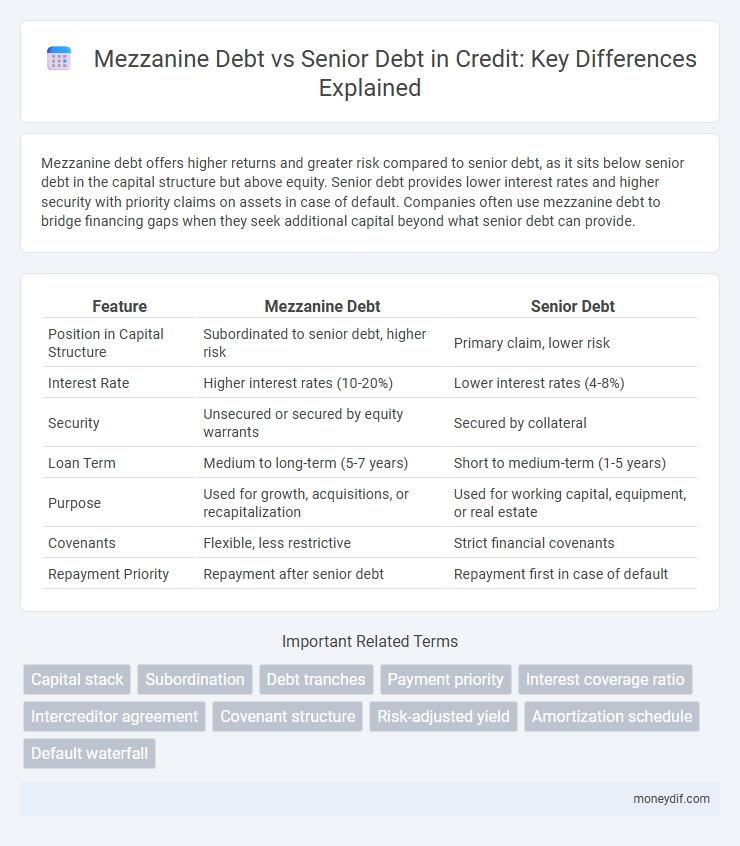

| Feature | Mezzanine Debt | Senior Debt |

|---|---|---|

| Position in Capital Structure | Subordinated to senior debt, higher risk | Primary claim, lower risk |

| Interest Rate | Higher interest rates (10-20%) | Lower interest rates (4-8%) |

| Security | Unsecured or secured by equity warrants | Secured by collateral |

| Loan Term | Medium to long-term (5-7 years) | Short to medium-term (1-5 years) |

| Purpose | Used for growth, acquisitions, or recapitalization | Used for working capital, equipment, or real estate |

| Covenants | Flexible, less restrictive | Strict financial covenants |

| Repayment Priority | Repayment after senior debt | Repayment first in case of default |

Understanding Senior Debt and Mezzanine Debt

Senior debt holds the highest priority in a company's capital structure, secured by assets, and carries lower interest rates due to reduced risk for lenders. Mezzanine debt occupies a subordinated position beneath senior debt, offering higher returns to investors but with increased risk, often including equity conversion options. Understanding the distinctions between senior and mezzanine debt is crucial for optimizing capital structure, balancing cost of capital, and managing financial risk in corporate financing.

Key Structural Differences Between Senior and Mezzanine Debt

Senior debt holds priority claim on assets and cash flows in a borrower's capital structure, typically secured by collateral and featuring lower interest rates due to reduced risk. Mezzanine debt occupies a subordinated position below senior debt but above equity, often unsecured and carrying higher interest rates paired with equity warrants to compensate for increased risk. The key structural distinctions include repayment priority, security status, interest cost, and the presence of equity participation rights in mezzanine financing.

Risk Profiles: Senior Debt vs. Mezzanine Debt

Senior debt holds a higher priority claim on assets and cash flows in a company's capital structure, resulting in lower risk and typically lower interest rates compared to mezzanine debt. Mezzanine debt is subordinate to senior debt, exposing lenders to greater credit risk but offering higher returns through interest rates and equity kickers. The increased risk profile of mezzanine debt is balanced by its potential for enhanced yield, making it attractive in leveraged buyouts and growth financing scenarios.

Priority of Claims in Capital Structure

Mezzanine debt ranks below senior debt in the capital structure, meaning senior lenders have the first claim on assets and cash flows in case of default. Senior debt is typically secured by company assets, providing lower risk and higher priority repayment rights, whereas mezzanine debt is unsecured or subordinated and carries higher risk but offers higher returns. This priority of claims influences the cost of capital and the lender's position during insolvency or liquidation events.

Interest Rates and Returns Comparison

Mezzanine debt typically carries higher interest rates than senior debt due to its subordinated position in the capital structure and increased risk exposure. Senior debt offers lower returns and interest rates because it is secured and prioritized for repayment, minimizing lender risk. Investors in mezzanine debt seek higher returns that compensate for its junior status and increased default vulnerability.

Covenants and Security: Senior vs. Mezzanine

Senior debt typically carries stringent covenants and is secured by the borrower's assets, giving lenders priority claims in default scenarios, which reduces their risk exposure. Mezzanine debt usually has looser covenants and is unsecured or subordinated, placing lenders behind senior debt holders in repayment priority but allowing higher returns through interest and equity kickers. The differing security levels and covenant strictness reflect the risk profiles and expected returns associated with each debt type in capital structures.

Use Cases: When to Choose Senior or Mezzanine Debt

Senior debt is typically chosen for lower-risk projects requiring secured financing with priority repayment, ideal for companies seeking cost-effective capital with minimal dilution. Mezzanine debt suits businesses aiming for growth or acquisitions where senior debt limits are reached, offering flexible financing through subordinated loans combined with equity warrants. Choosing between them depends on the company's risk tolerance, capital structure, and need for balancing control versus financial cost.

Impact on Borrower’s Creditworthiness

Mezzanine debt carries higher interest rates and subordinate claim status, increasing the borrower's financial risk and potentially lowering creditworthiness compared to senior debt. Senior debt's priority repayment reduces lender risk, often enhancing the borrower's credit profile by demonstrating stronger capacity to meet obligations. Excessive reliance on mezzanine financing can strain cash flow and elevate default risk, adversely affecting credit ratings and future borrowing capability.

Investor Perspective: Senior Debt vs. Mezzanine Debt

Senior debt offers investors lower risk due to its priority claim on assets and fixed interest payments, resulting in more stable returns. Mezzanine debt carries higher risk as it is subordinate to senior debt but provides greater potential returns through higher interest rates and equity kickers. Investors often balance their portfolios by combining senior debt for capital preservation and mezzanine debt for enhanced yield opportunities.

Hybrid Financing: Combining Senior and Mezzanine Debt

Hybrid financing combines senior debt and mezzanine debt to optimize capital structure and manage risk. Senior debt offers lower interest rates and priority in repayment, while mezzanine debt provides flexible, subordinated capital with higher returns. This combination supports growth initiatives by balancing cost efficiency with increased leverage capacity.

Important Terms

Capital stack

Mezzanine debt occupies a subordinated position in the capital stack, offering higher interest rates and greater risk than senior debt while providing flexible financing options between equity and senior loans.

Subordination

Mezzanine debt carries higher risk and interest rates than senior debt due to its subordinated claim on assets and cash flows in the capital structure.

Debt tranches

Mezzanine debt, positioned between senior debt and equity, carries higher interest rates and subordinated claims, making it riskier but offering greater returns compared to the lower-risk, lower-cost senior debt tranche.

Payment priority

Senior debt holds payment priority over mezzanine debt, ensuring senior lenders receive repayments before mezzanine lenders in the capital structure.

Interest coverage ratio

The interest coverage ratio for mezzanine debt typically is lower than that for senior debt due to higher interest expenses and greater risk factors associated with subordinated financing.

Intercreditor agreement

An intercreditor agreement clearly defines the rights, priorities, and obligations between mezzanine debt holders and senior debt lenders to manage repayment hierarchy and protect each party's interests during default or restructuring.

Covenant structure

Covenant structures in mezzanine debt typically allow for higher leverage and fewer restrictions compared to senior debt covenants, which enforce stricter financial ratios and collateral requirements.

Risk-adjusted yield

Risk-adjusted yield measures the return of mezzanine debt relative to its higher default risk compared to senior debt, blending potential higher interest rates with increased credit risk. Mezzanine debt offers greater risk-adjusted yields due to subordinate claim on assets but compensates investors with higher interest rates and equity participation opportunities.

Amortization schedule

An amortization schedule for mezzanine debt typically features interest-only payments with a balloon principal repayment, contrasted with senior debt schedules that include regular principal and interest payments reducing the loan balance over time.

Default waterfall

Default waterfall prioritizes repayment by first allocating recoveries to senior debt holders, followed by mezzanine debt investors, reflecting the seniority in the capital stack. This structured payment hierarchy ensures that senior debt, having lower risk, receives principal and interest before mezzanine debt absorbs losses.

mezzanine debt vs senior debt Infographic

moneydif.com

moneydif.com