Credit enhancement improves a borrower's credit profile by reducing risk through mechanisms such as collateral, insurance, or reserve funds, which ultimately lowers borrowing costs. Credit guarantee involves a third party promising to fulfill the borrower's obligations if they default, providing lenders with added security. Both tools increase lender confidence but differ in their approach to risk mitigation and the source of assurance.

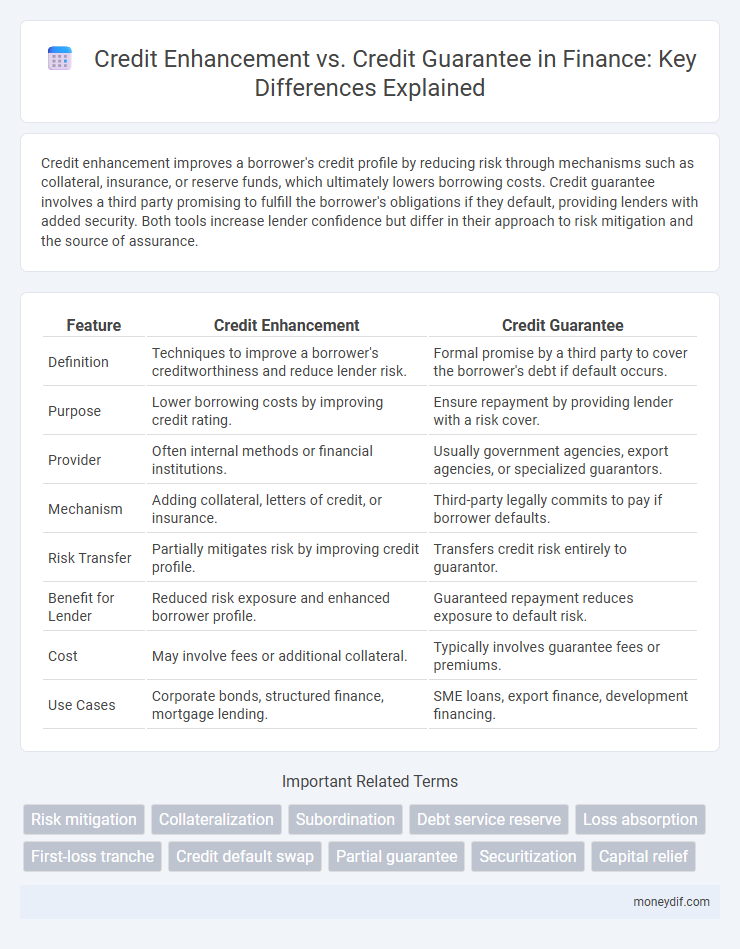

Table of Comparison

| Feature | Credit Enhancement | Credit Guarantee |

|---|---|---|

| Definition | Techniques to improve a borrower's creditworthiness and reduce lender risk. | Formal promise by a third party to cover the borrower's debt if default occurs. |

| Purpose | Lower borrowing costs by improving credit rating. | Ensure repayment by providing lender with a risk cover. |

| Provider | Often internal methods or financial institutions. | Usually government agencies, export agencies, or specialized guarantors. |

| Mechanism | Adding collateral, letters of credit, or insurance. | Third-party legally commits to pay if borrower defaults. |

| Risk Transfer | Partially mitigates risk by improving credit profile. | Transfers credit risk entirely to guarantor. |

| Benefit for Lender | Reduced risk exposure and enhanced borrower profile. | Guaranteed repayment reduces exposure to default risk. |

| Cost | May involve fees or additional collateral. | Typically involves guarantee fees or premiums. |

| Use Cases | Corporate bonds, structured finance, mortgage lending. | SME loans, export finance, development financing. |

Understanding Credit Enhancement and Credit Guarantee

Credit enhancement improves a borrower's credit profile by reducing risk through mechanisms like collateral, insurance, or third-party support, thereby lowering borrowing costs and increasing lending capacity. Credit guarantees involve a guarantor promising to fulfill the borrower's debt obligations if default occurs, providing lenders with a direct assurance of repayment. Both tools aim to boost creditworthiness, but credit enhancement involves structural improvements, while credit guarantees rely on explicit contractual commitments.

Key Differences Between Credit Enhancement and Credit Guarantee

Credit enhancement improves a borrower's credit profile by reducing the lender's risk through internal or external measures like reserves, collateral, or insurance. Credit guarantees involve a third party promising to fulfill the borrower's obligations if they default, providing a direct assurance to the lender. The key difference lies in credit enhancement boosting creditworthiness proactively, while credit guarantees act as a fallback risk mitigation tool.

Types of Credit Enhancement Methods

Credit enhancement methods include internal techniques like reserve funds, overcollateralization, and subordination, which improve a borrower's creditworthiness by reducing risk exposure. External credit enhancements involve third-party interventions such as surety bonds, letters of credit, and credit guarantees, providing lenders with additional assurance of repayment. These strategies collectively reduce default risk, facilitate better borrowing terms, and increase access to capital markets.

Forms of Credit Guarantee in Financial Markets

Forms of credit guarantee in financial markets include government guarantees, private insurer guarantees, and partial credit guarantees, each serving to reduce the risk for lenders by assuring repayment in case of borrower default. Credit guarantees typically involve a third party promising to cover losses, whereas credit enhancement may use internal mechanisms such as collateral or subordinated debt to improve creditworthiness. This differentiation influences the structuring of loans and the confidence level of investors and financial institutions.

Benefits of Credit Enhancement for Borrowers and Lenders

Credit enhancement improves a borrower's creditworthiness by reducing the perceived risk for lenders, leading to lower interest rates and increased loan accessibility. Lenders benefit from credit enhancement through reduced default risk and enhanced portfolio quality, which supports better capital allocation. This mechanism fosters greater financial stability and facilitates smoother borrowing processes for both parties.

Advantages of Credit Guarantee Schemes

Credit Guarantee Schemes enhance access to finance by reducing lenders' risk through government or third-party backing, facilitating loans for small and medium enterprises (SMEs) without requiring collateral. These schemes improve credit availability, promote financial inclusion, and lower borrowing costs by providing a safety net that encourages banks to extend credit to higher-risk borrowers. Unlike credit enhancement, credit guarantees directly support lenders, accelerating economic growth and supporting entrepreneurship.

Risks Associated With Credit Enhancement vs Credit Guarantee

Credit enhancement reduces default risk by improving the credit profile of a loan or bond, but it may expose issuers to higher costs and moral hazard due to reduced incentives for borrowers to maintain creditworthiness. Credit guarantees transfer repayment risk to a guarantor, mitigating lender exposure but potentially creating contingent liabilities for guarantors if defaults occur. Both mechanisms impact risk distribution differently, with credit enhancement focusing on improving borrower credit quality while credit guarantees provide a direct backstop against losses.

Role of Credit Enhancement in Structured Finance

Credit enhancement plays a crucial role in structured finance by improving the creditworthiness of financial instruments, thereby reducing the risk for investors. Techniques such as overcollateralization, reserve funds, and third-party guarantees strengthen the credit profile of asset-backed securities. Unlike credit guarantees, which serve as explicit promises of payment, credit enhancement involves structural adjustments designed to absorb losses and enhance investor confidence.

Credit Guarantee Mechanisms: Government and Private Sector

Credit guarantee mechanisms involve the government or private sector providing assurances to lenders against borrower default, thereby reducing credit risk and encouraging lending to underserved sectors. Government-backed credit guarantees often target small and medium enterprises (SMEs) and social development projects, mitigating gaps in credit markets and fostering economic growth. Private sector guarantees typically include insurance products or collateral substitutes that enhance creditworthiness, facilitating higher borrowing capacity and competitive financing terms.

Choosing Between Credit Enhancement and Credit Guarantee

Choosing between credit enhancement and credit guarantee depends on the risk appetite and financial structure of the borrowing entity. Credit enhancement improves the creditworthiness of a loan by lowering perceived risk through mechanisms like collateral or insurance, while credit guarantee involves a third party legally promising to cover the debt in case of default. Evaluating factors such as cost efficiency, regulatory impact, and the likelihood of default helps determine the optimal solution for securing financing.

Important Terms

Risk mitigation

Risk mitigation through credit enhancement involves improving the credit profile of a borrower or financial instrument to reduce default risk, often by using collateral, insurance, or subordinated debt. Credit guarantee, in contrast, entails a third party assuming responsibility for the borrower's debt repayment, providing a direct backing that lowers the lender's risk and enhances creditworthiness.

Collateralization

Collateralization involves pledging assets to secure a loan, enhancing creditworthiness by reducing lender risk, while credit enhancement includes various measures such as guarantees or insurance to improve the credit profile of a borrower or security. Unlike credit guarantees, which provide a direct promise to cover losses, collateralization offers tangible asset backing that can be liquidated in case of default.

Subordination

Subordination in credit enhancement prioritizes the repayment hierarchy by placing certain debts below senior obligations, thereby reducing lender risk and improving the credit profile of the senior debt. Unlike credit guarantees, which provide a direct assurance of payment from a third party, subordination modifies the claim structure within the capital stack to enhance creditworthiness without explicit external payment commitments.

Debt service reserve

Debt service reserve funds strengthen credit enhancement by providing a dedicated pool to cover missed debt payments, reducing lender risk and improving borrower creditworthiness. Unlike credit guarantees, which involve third-party promises to cover defaults, debt service reserves directly secure loan repayment through pre-set reserves, making them a proactive risk mitigation tool in structured finance.

Loss absorption

Loss absorption in credit enhancement involves mechanisms such as subordinated debt or reserve funds that directly absorb losses before affecting senior creditors, enhancing the creditworthiness of a financial instrument. In contrast, credit guarantees provide a third-party promise to cover losses up to a specified amount, mitigating risk by transferring potential loss exposure away from the original lender.

First-loss tranche

The first-loss tranche absorbs initial credit losses, providing a credit enhancement by protecting senior tranches from default risk, whereas a credit guarantee directly assures repayment to investors by transferring risk to a third party. Credit enhancement through the first-loss tranche improves the overall credit quality of a securitized asset pool, while credit guarantees offer explicit risk mitigation via contractual guarantees.

Credit default swap

Credit default swaps (CDS) serve as financial derivatives that provide credit enhancement by transferring the credit risk of a borrower to a third party, thereby improving the credit profile of the debt issuer. Unlike credit guarantees, which involve a direct promise from a guarantor to fulfill debt obligations upon default, CDS offer a market-based mechanism for managing credit risk without legal obligation to assume the debt.

Partial guarantee

Partial guarantee offers a limited credit enhancement by covering a portion of the borrower's obligation, reducing lender risk without assuming full liability, unlike a full credit guarantee that provides complete assurance of debt repayment. This mechanism improves creditworthiness and borrowing terms while maintaining shared risk between guarantor and borrower.

Securitization

Securitization involves pooling financial assets and issuing securities backed by these assets, where credit enhancement techniques like overcollateralization or reserve funds improve the credit quality of the issued securities, reducing investor risk. Credit guarantee, in contrast, is a third-party promise to cover losses on the securities, providing direct assurance that enhances the creditworthiness and marketability of the securitized instruments.

Capital relief

Capital relief achieved through credit enhancement reduces regulatory capital requirements by improving the credit quality of exposures via mechanisms such as collateral or third-party guarantees, whereas credit guarantees specifically involve a promise from a guarantor to cover losses, directly transferring credit risk and providing explicit risk mitigation recognized under Basel III frameworks. Both methods serve to lower risk-weighted assets on bank balance sheets but differ in their legal structure and impact on capital adequacy calculations.

Credit enhancement vs Credit guarantee Infographic

moneydif.com

moneydif.com