A credit pull involves a lender accessing your full credit report to make a detailed assessment for a loan or credit application, often impacting your credit score. A credit check, however, can be a soft inquiry that reviews limited information without affecting your score, commonly used for background screening or pre-approval offers. Understanding the difference helps consumers navigate credit applications strategically and minimize potential score damage.

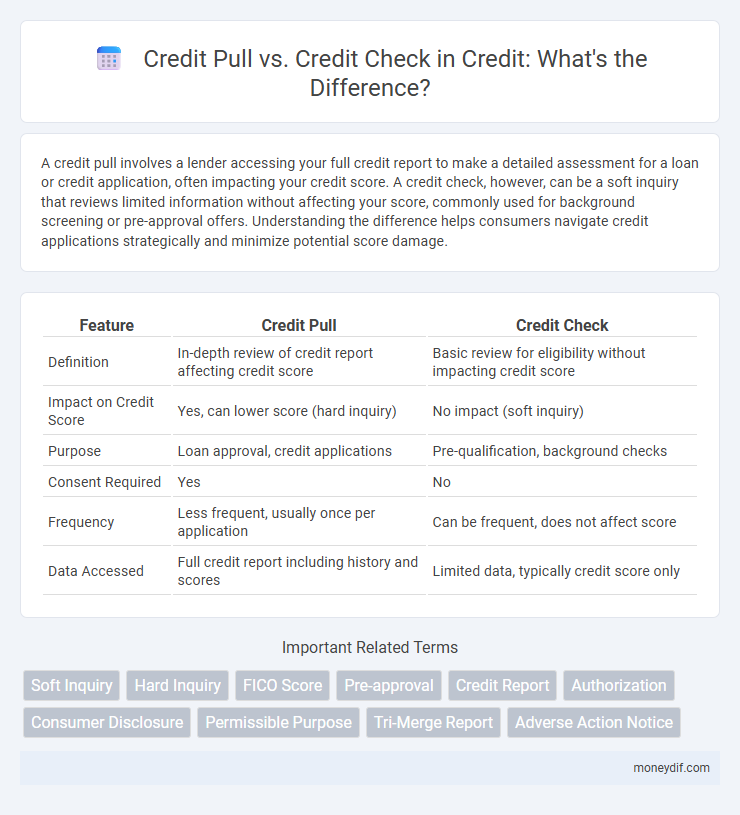

Table of Comparison

| Feature | Credit Pull | Credit Check |

|---|---|---|

| Definition | In-depth review of credit report affecting credit score | Basic review for eligibility without impacting credit score |

| Impact on Credit Score | Yes, can lower score (hard inquiry) | No impact (soft inquiry) |

| Purpose | Loan approval, credit applications | Pre-qualification, background checks |

| Consent Required | Yes | No |

| Frequency | Less frequent, usually once per application | Can be frequent, does not affect score |

| Data Accessed | Full credit report including history and scores | Limited data, typically credit score only |

Credit Pull vs Credit Check: Key Differences Explained

Credit pull and credit check both involve accessing an individual's credit report, but a credit pull, specifically a hard inquiry, affects credit scores and is typically used by lenders during loan or credit card approval processes. A credit check can be a soft inquiry that doesn't impact credit scores, often used for background verification or pre-approval offers. Understanding these key differences helps consumers manage their credit health more effectively by recognizing when their credit score might be impacted.

Understanding Hard Pulls vs Soft Credit Checks

A hard credit pull occurs when a lender reviews your credit report as part of a lending decision, which can temporarily lower your credit score. Soft credit checks, often used for background or pre-approval screenings, do not impact your credit score and are only visible to you. Understanding the difference between hard pulls and soft credit checks helps in managing your credit health and maintaining a strong credit profile.

How Credit Pulls Affect Your Credit Score

Credit pulls, also known as hard inquiries, occur when a lender reviews your credit report to make lending decisions, directly impacting your credit score by potentially lowering it by a few points. Multiple hard inquiries within a short period, especially for loans or credit cards, can signal higher risk to creditors, causing a temporary dip in your credit score. Soft inquiries, or credit checks, do not affect your credit score as they are only for informational purposes or pre-approved offers.

When Are Credit Checks Performed?

Credit checks are performed by lenders, landlords, and employers primarily during application processes to evaluate an individual's creditworthiness and financial history. These checks are typically conducted when applying for loans, credit cards, rental agreements, or new jobs that require financial responsibility. Timely credit checks help assess risk and guide decision-making without impacting the applicant's credit score.

Impact of Hard and Soft Pulls on Credit Reports

Hard credit pulls, also known as hard inquiries, occur when lenders review your credit report as part of a loan or credit application process, potentially causing a slight decrease in your credit score. Soft credit pulls, or soft inquiries, happen during background checks or pre-approvals, allowing you to check your own credit or employers to verify creditworthiness without affecting your score. Understanding the difference between hard and soft pulls is crucial for managing credit health, as multiple hard inquiries in a short period can lower your credit score and signal risk to lenders.

Credit Pulls in Loan and Credit Applications

Credit pulls, also known as hard inquiries, occur when lenders or creditors access an individual's credit report during loan or credit applications to assess creditworthiness, potentially impacting the credit score. Unlike soft credit checks used for pre-approval or background verification, hard pulls are recorded on credit reports and may temporarily lower scores by a few points. Frequent credit pulls within a short period, especially for multiple loan or credit card applications, can signal higher risk to lenders and affect approval chances.

Consent and Authorization in Credit Checks

Credit checks require explicit consent and authorization from the individual, ensuring compliance with the Fair Credit Reporting Act (FCRA) and protecting consumer rights. A credit pull typically refers to the actual retrieval of credit information, which cannot be conducted without prior permission obtained through a credit check process. Unauthorized credit pulls can lead to legal penalties and damage to the consumer's credit profile.

How Multiple Credit Pulls Influence Creditworthiness

Multiple credit pulls, especially hard inquiries, can temporarily lower a credit score by signaling increased risk to lenders. Each hard inquiry may reduce a credit score by a few points, and numerous inquiries within a short period can compound this effect, potentially lowering creditworthiness. Soft inquiries, such as those for pre-approved offers or personal credit checks, do not impact credit scores or creditworthiness.

Soft Credit Checks: When and Why They Happen

Soft credit checks occur when a lender or company reviews your credit report without impacting your credit score, commonly during pre-approval offers, background checks, or personal credit monitoring. These inquiries allow consumers to understand their financial standing without the risk of a hard inquiry, which can lower credit scores. Understanding when soft checks happen helps individuals manage their credit health effectively and avoid unnecessary hard pulls.

Best Practices to Manage Credit Pulls and Checks

Minimize hard credit pulls by consolidating credit applications to reduce impact on credit scores. Regularly review credit reports through soft pulls to monitor for inaccuracies or fraud without affecting your credit rating. Use authorized credit checks selectively and ensure consumer consent to maintain transparency and trust in credit management.

Important Terms

Soft Inquiry

Soft inquiry refers to a credit check that does not impact a borrower's credit score, typically used for pre-approval or background checks. Unlike hard credit pulls, soft inquiries allow lenders and individuals to review credit reports without signaling active credit seeking, preserving credit score integrity.

Hard Inquiry

A hard inquiry occurs when a lender or creditor reviews your credit report to make a lending decision, commonly referred to as a credit pull, and can slightly lower your credit score for a short period. In contrast, a credit check can be either a hard or soft inquiry, with soft checks, such as those done by employers or pre-approved lenders, not affecting your credit score.

FICO Score

A FICO Score is calculated based on data from credit pulls, which are hard inquiries typically initiated when applying for new credit and can impact the score by a few points. In contrast, a credit check often refers to soft inquiries that do not affect the FICO Score and are used for pre-approvals or background verification.

Pre-approval

Pre-approval involves a hard credit pull, which temporarily impacts your credit score by accessing your full credit report to assess loan eligibility, while a credit check can be either a soft or hard inquiry depending on its purpose. Lenders use hard credit pulls during pre-approval to evaluate risk thoroughly, whereas soft credit checks, such as those for background reviews or pre-qualified offers, do not affect credit scores.

Credit Report

A credit pull refers to the process where a financial institution obtains your full credit report, often impacting your credit score, while a credit check is a broader term that may include soft inquiries causing no score change. Understanding the difference helps consumers manage their credit inquiries effectively to maintain or improve their creditworthiness.

Authorization

Authorization in credit processes refers to obtaining permission to access a consumer's credit information, often categorized as a credit pull or credit check; a credit pull involves querying a credit report that may impact the consumer's credit score, while a credit check generally refers to a less intrusive review used for pre-approval or internal assessments. Understanding the distinction between hard credit pulls, which can affect credit scores, and soft credit checks, which do not, is crucial for both consumers and lenders in managing credit inquiries responsibly.

Consumer Disclosure

Consumer disclosure refers to the requirement that lenders inform consumers when a credit pull occurs, which is a hard inquiry impacting credit scores, unlike a credit check that could be a soft inquiry with no effect on credit ratings. Understanding the distinction between hard credit pulls and soft credit checks is essential for managing credit health and ensuring transparency in financial transactions.

Permissible Purpose

Permissible purpose under the Fair Credit Reporting Act (FCRA) defines the legal reasons a lender or creditor can perform a credit pull, which differs from a credit check as the former involves formally obtaining a consumer's credit report for authorized transactions like loan applications. Credit checks can be informal assessments not always governed by permissible purpose, but credit pulls require strict adherence to FCRA guidelines to protect consumer rights and prevent unauthorized inquiries on credit reports.

Tri-Merge Report

Tri-Merge Report consolidates credit data from the three major credit bureaus--Equifax, Experian, and TransUnion--providing lenders with a comprehensive credit profile for more accurate risk assessment. Credit Pull refers to the process of obtaining this report, which can be either a hard inquiry impacting credit scores or a soft inquiry that does not affect scores, while a Credit Check often implies a preliminary review potentially involving fewer data points.

Adverse Action Notice

An Adverse Action Notice is a mandatory disclosure sent to consumers when a credit decision negatively impacts them due to information obtained from a credit pull, which involves accessing a full credit report for lending purposes. A credit check, often used for pre-approval or screening, may not trigger this notice unless it results in a denial, increase in interest rate, or other unfavorable changes based on the pulled credit data.

Credit Pull vs Credit Check Infographic

moneydif.com

moneydif.com