A credit freeze restricts access to your credit report, preventing new creditors from viewing it without your permission, which helps protect against identity theft. A credit lock offers similar protection but can be more easily toggled on and off through the credit bureau's app or website, providing greater convenience. Both tools are effective for safeguarding your credit, but a freeze is often considered more secure legally.

Table of Comparison

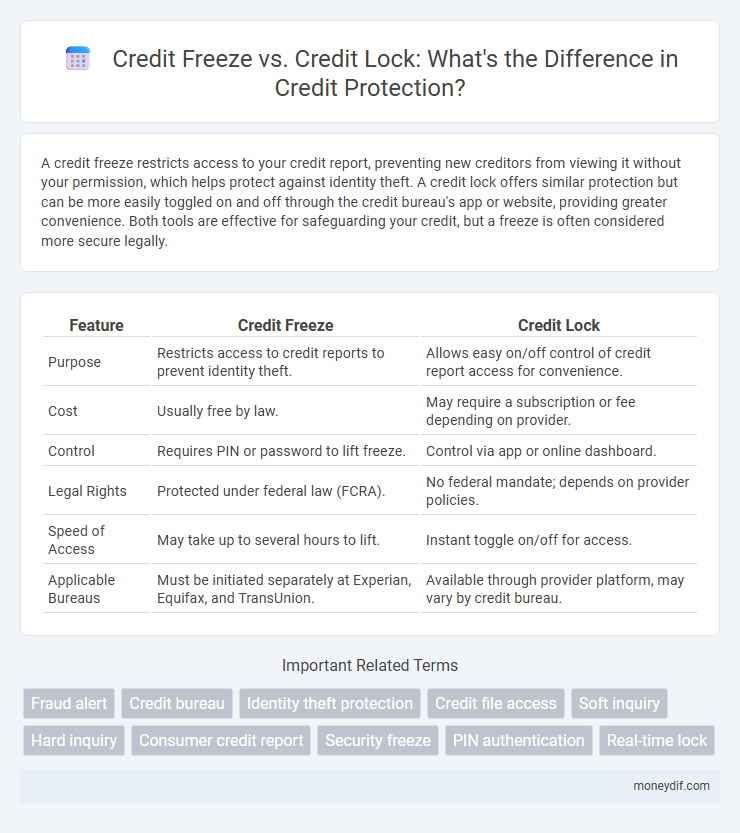

| Feature | Credit Freeze | Credit Lock |

|---|---|---|

| Purpose | Restricts access to credit reports to prevent identity theft. | Allows easy on/off control of credit report access for convenience. |

| Cost | Usually free by law. | May require a subscription or fee depending on provider. |

| Control | Requires PIN or password to lift freeze. | Control via app or online dashboard. |

| Legal Rights | Protected under federal law (FCRA). | No federal mandate; depends on provider policies. |

| Speed of Access | May take up to several hours to lift. | Instant toggle on/off for access. |

| Applicable Bureaus | Must be initiated separately at Experian, Equifax, and TransUnion. | Available through provider platform, may vary by credit bureau. |

Understanding Credit Freeze and Credit Lock

Credit freeze restricts access to your credit reports from all creditors, preventing new credit accounts from being opened without your permission, and is regulated by federal law with a free setup and removal process. Credit lock offers similar protections but is managed by credit bureaus as a paid service with more flexible on/off controls and additional monitoring features. Understanding the differences helps consumers safeguard their credit security effectively while balancing convenience and cost.

Key Differences Between Credit Freeze and Credit Lock

Credit freeze and credit lock both restrict access to your credit report, but a credit freeze is a legal right regulated by federal law that prevents creditors from accessing your credit file without your permission, providing stronger protection against identity theft. A credit lock is a service offered by credit bureaus that allows consumers to quickly lock and unlock their credit reports, often with more convenience but less formal legal standing. Unlike credit locks, credit freezes require a PIN or password to lift and may involve a small fee, whereas credit locks are typically free and managed through user-friendly apps.

How Credit Freezes Work

Credit freezes restrict access to your credit report by requiring a PIN or password to lift the freeze, effectively preventing unauthorized lenders from viewing your credit information. This security measure blocks new credit inquiries, reducing the risk of identity theft and fraudulent accounts. Unlike credit locks, which can be managed via apps and may have fees, credit freezes are mandated by law to be free and provide stronger protection through formal regulatory processes.

How Credit Locks Function

Credit locks function by providing consumers with an immediate and reversible way to restrict access to their credit reports, helping to prevent unauthorized credit inquiries and potential identity theft. Unlike credit freezes, which are regulated by federal laws and often require more time to lift or place, credit locks are typically offered as a convenient, on-demand service by credit bureaus through online platforms or mobile apps. This service allows users to toggle their credit file access quickly without incurring additional fees, enhancing control over personal credit information.

Pros and Cons of Credit Freeze

A credit freeze restricts access to your credit report, preventing unauthorized lenders from opening new accounts and reducing identity theft risk, but it can be cumbersome to lift, especially in emergencies. Unlike credit locks offered by credit bureaus with more flexibility and convenience, credit freezes are regulated by law, making them free but potentially slower to manage. The primary advantage of a credit freeze is its strong security, while the downside involves less immediate control and possible delays in accessing credit during legitimate applications.

Pros and Cons of Credit Lock

Credit lock offers immediate and flexible control over access to your credit report, allowing you to lock and unlock it at any time without fees, which helps prevent unauthorized inquiries and potential fraud. However, unlike a credit freeze, credit locks are managed by the credit reporting agencies themselves rather than being governed by federal law, potentially reducing legal protections and causing variability in how locks are enforced. The convenience and speed of credit locks come with trade-offs in security and regulatory strength compared to the more formal and legally backed credit freeze.

Which Option Offers Better Protection?

A credit freeze offers stronger protection by restricting access to your credit report, making it difficult for identity thieves to open new accounts in your name. Credit locks provide more flexibility as you can quickly turn them on or off, but they may not offer the same level of legal protection as freezes under the Fair Credit Reporting Act (FCRA). For maximum security against unauthorized credit inquiries and fraud, a credit freeze is generally the better choice.

Costs and Accessibility: Freeze vs Lock

A credit freeze typically requires a free setup and removal process mandated by federal law, offering strong control by restricting access to all creditors unless temporarily lifted by the consumer. In contrast, a credit lock often involves a monthly fee and grants more flexible, instant management through service providers but may not have the same legal protections as a freeze. Consumers prioritizing cost-effectiveness and federal safeguards often prefer freezes, while those valuing convenience and quick access tend to choose credit locks.

How to Implement a Credit Freeze or Lock

To implement a credit freeze, contact each of the three major credit bureaus--Equifax, Experian, and TransUnion--either online, by phone, or by mail, providing personal identification details to verify your identity. For a credit lock, enroll directly through the credit bureau's website or mobile app, typically requiring an account creation and electronic authentication for instant control. Both credit freeze and lock restrict access to your credit report, but the freeze usually requires a PIN or password to lift, while a lock offers more flexible and immediate access management.

Choosing the Right Solution for Your Credit Security

A credit freeze offers stronger protection by legally restricting access to your credit report, preventing unauthorized new accounts, while a credit lock provides more convenience with instant on/off control but may lack legal enforcement. Choosing the right solution depends on your need for security versus flexibility, with credit freezes favored by those seeking long-term fraud prevention and credit locks preferred for quick access management. Evaluate factors like cost, ease of use, and the credit bureau's policies to ensure optimal credit security tailored to your financial situation.

Important Terms

Fraud alert

A fraud alert notifies lenders to verify identity before extending credit, offering temporary protection without restricting access to your credit report, whereas a credit freeze blocks all access to your credit report, preventing new credit applications entirely until lifted. Unlike a credit lock that provides similar access control with more convenience through apps or websites, a credit freeze is regulated by federal law and free to implement.

Credit bureau

Credit bureaus maintain and manage consumer credit information, where a credit freeze legally restricts all access to your credit report to prevent new credit accounts without your permission, while a credit lock offers similar protection but can be controlled and toggled more easily through the bureau's online tools. Freezes are typically free and governed by federal laws like the FACT Act, whereas locks may involve fees and vary by bureau policies with less legal regulation.

Identity theft protection

Credit freeze and credit lock are both tools designed to prevent unauthorized access to your credit report, with a credit freeze being a federally regulated service that restricts all access unless you lift it using a PIN or password, offering stronger protection against identity theft. Credit locks provide more flexibility and convenience, often managed via mobile apps, but may not offer the same legal protections as credit freezes, making credit freezes the preferred choice for maximum security against fraudulent credit activity.

Credit file access

Credit file access differentiates significantly between credit freeze and credit lock, where a credit freeze, regulated by federal law, restricts all potential creditors from viewing your credit report without prior authorization, ensuring maximum security. In contrast, a credit lock is typically a service offered by private credit bureaus allowing more flexible and immediate control over credit file access but may involve fees and limited legal protections compared to a freeze.

Soft inquiry

Soft inquiries do not impact credit scores and occur during routine checks such as account reviews or pre-approved offers, whereas credit freezes and credit locks both restrict access to credit reports to prevent identity theft but differ in management; credit freezes require contacting each credit bureau directly and may take longer to lift, while credit locks can be toggled instantly through user-friendly apps or websites. Understanding these distinctions is crucial for consumers aiming to protect their credit without negatively affecting their credit score or delaying legitimate credit applications.

Hard inquiry

A hard inquiry occurs when a lender or creditor checks your credit report as part of a loan or credit application, potentially lowering your credit score slightly. Unlike a credit lock that grants instant control over your credit files via a service, a credit freeze legally restricts access to your credit report, preventing hard inquiries and new credit accounts without your authorization.

Consumer credit report

A consumer credit report contains detailed information about an individual's credit history, which is protected by security measures such as credit freezes and credit locks; a credit freeze restricts all access to the credit report unless temporarily lifted by the consumer, providing stronger legal protection under federal law. In contrast, a credit lock offers more flexibility with easier on-off toggling but typically lacks the legal safeguards of a freeze, making it crucial for consumers to choose based on their security needs and convenience preferences.

Security freeze

Security freeze, also known as a credit freeze, restricts access to your credit report, preventing lenders from viewing it without your consent, which helps protect against identity theft. Credit locks offer similar protections but are typically easier to toggle on and off through a credit bureau's app or website, providing more flexibility than the formal and sometimes regulated credit freeze process.

PIN authentication

PIN authentication enhances security by requiring a unique personal identification number during credit file access, offering an additional layer beyond credit freeze and credit lock mechanisms. Unlike credit freezes that legally restrict all access to credit reports, credit locks provide more flexible control but may not always require PIN verification, potentially impacting the level of protection against identity theft.

Real-time lock

Real-time lock enables immediate control over credit reports, preventing unauthorized access instantly, whereas a credit freeze requires a formal process that may take several hours or days to activate. Credit locks offer more flexibility with on-demand toggling, while credit freezes provide stronger legal protections under the Fair Credit Reporting Act (FCRA).

Credit freeze vs Credit lock Infographic

moneydif.com

moneydif.com