Credit enhancement improves a borrower's creditworthiness by reducing the lender's risk through mechanisms like guarantees or collateral, making loan approval easier and often resulting in lower interest rates. Credit insurance, however, protects lenders or borrowers against losses arising from default or non-payment by insuring the outstanding debt. While credit enhancement proactively strengthens credit profiles, credit insurance serves as a reactive safety net to mitigate potential financial losses.

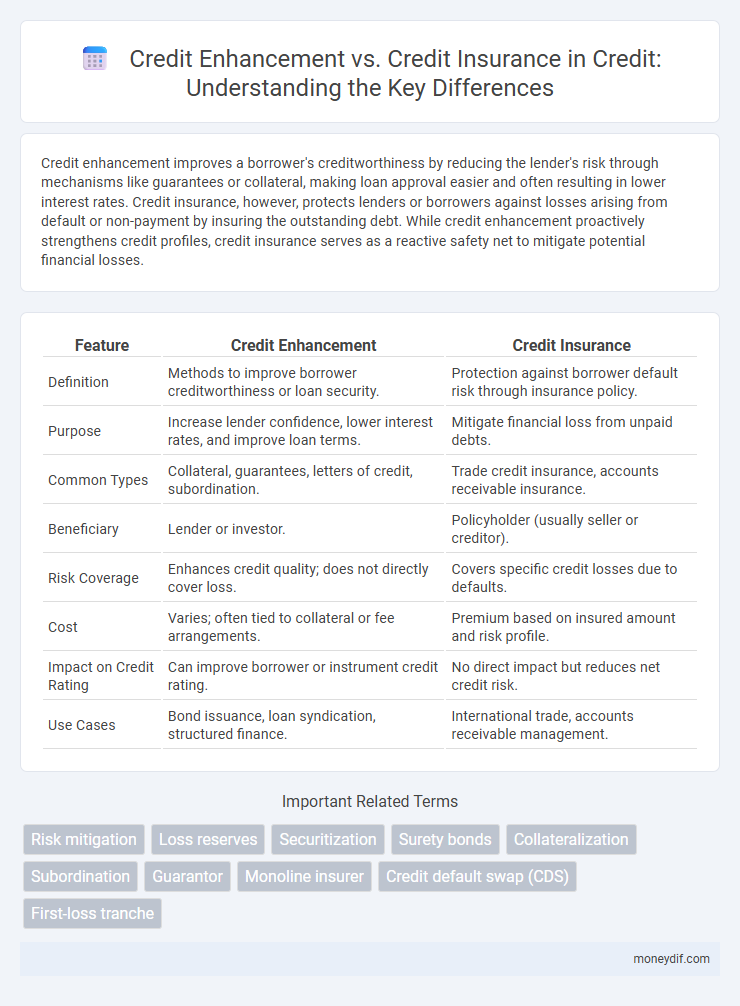

Table of Comparison

| Feature | Credit Enhancement | Credit Insurance |

|---|---|---|

| Definition | Methods to improve borrower creditworthiness or loan security. | Protection against borrower default risk through insurance policy. |

| Purpose | Increase lender confidence, lower interest rates, and improve loan terms. | Mitigate financial loss from unpaid debts. |

| Common Types | Collateral, guarantees, letters of credit, subordination. | Trade credit insurance, accounts receivable insurance. |

| Beneficiary | Lender or investor. | Policyholder (usually seller or creditor). |

| Risk Coverage | Enhances credit quality; does not directly cover loss. | Covers specific credit losses due to defaults. |

| Cost | Varies; often tied to collateral or fee arrangements. | Premium based on insured amount and risk profile. |

| Impact on Credit Rating | Can improve borrower or instrument credit rating. | No direct impact but reduces net credit risk. |

| Use Cases | Bond issuance, loan syndication, structured finance. | International trade, accounts receivable management. |

Understanding Credit Enhancement: Key Concepts

Credit enhancement improves a borrower's creditworthiness by reducing risk through methods such as guarantees, collateral, or subordinated debt, thereby facilitating better loan terms. Unlike credit insurance, which provides protection against borrower default or non-payment, credit enhancement proactively strengthens the credit profile to attract investors or lenders. Key concepts include risk mitigation, improved debt ratings, and increased access to capital markets.

What Is Credit Insurance?

Credit insurance protects businesses from losses due to non-payment by customers, covering risks such as bankruptcy or insolvency. It provides financial security by ensuring that outstanding receivables are paid even if the buyer defaults. This insurance mechanism differs from credit enhancement, which improves creditworthiness but does not guarantee repayment.

Credit Enhancement vs Credit Insurance: Core Differences

Credit enhancement improves a borrower's creditworthiness by reducing risk through methods like collateral, guarantees, or subordinated debt, which directly impact loan terms and investor confidence. Credit insurance protects lenders or investors against borrower default by transferring the risk to an insurer, thereby minimizing potential financial losses. While credit enhancement strengthens the credit profile within the capital structure, credit insurance provides a contractual safety net to cover specific default events.

Types of Credit Enhancement Methods

Types of credit enhancement methods include internal enhancements such as overcollateralization, where assets exceed the borrowed amount, and external enhancements like letters of credit or surety bonds provided by third parties. Subordination is another common technique, involving the prioritization of debt repayments to protect senior creditors. These methods improve creditworthiness by reducing risk exposure and increasing the likelihood of timely debt service.

Common Credit Insurance Products

Credit insurance products commonly include trade credit insurance, which protects businesses from losses due to customer non-payment, and payment protection insurance, safeguarding borrowers against income loss. Credit enhancement, in contrast, typically involves methods like guarantees or collateral to improve creditworthiness and reduce lender risk. Both serve to mitigate credit risk, but credit insurance directly covers potential defaults while credit enhancement strengthens the borrower's credit profile.

Benefits of Credit Enhancement for Lenders

Credit enhancement provides lenders with improved risk profiles by reducing the likelihood of default, which can lead to lower borrowing costs and increased loan approval rates. It strengthens the creditworthiness of the borrower or the underlying asset, enabling lenders to offer more competitive interest rates and attract a broader range of borrowers. Unlike credit insurance, credit enhancement directly boosts lender confidence and portfolio quality through mechanisms such as guarantees, collateral, or subordination.

Advantages of Credit Insurance for Borrowers and Businesses

Credit insurance provides borrowers and businesses with protection against the risk of non-payment, ensuring cash flow stability even during economic downturns or customer defaults. Unlike credit enhancement, which often involves third-party guarantees or collateral requirements, credit insurance reduces the need for additional assets and improves access to financing by mitigating credit risk. This insurance also enhances credit management by offering risk assessment and loss recovery services, enabling businesses to expand confidently into new markets.

Risk Mitigation: Comparing Credit Enhancement and Insurance

Credit enhancement improves a borrower's credit profile by providing guarantees or collateral to reduce lender risk, facilitating access to financing at lower costs. Credit insurance protects lenders or investors against losses from borrower default, transferring risk to the insurer and ensuring repayment in adverse scenarios. Both methods mitigate credit risk, but credit enhancement strengthens creditworthiness upfront, while credit insurance offers post-loss financial protection.

Costs Involved: Credit Enhancement vs Credit Insurance

Credit enhancement typically involves upfront fees or collateral requirements that can increase borrowing costs but improve loan terms and creditworthiness. Credit insurance requires regular premium payments based on the insured amount and risk profile, offering protection against default but adding ongoing expenses. Evaluating the total cost impact of each option depends on the transaction size, risk level, and financial strategy.

Choosing the Right Solution: Factors to Consider

Evaluating credit enhancement versus credit insurance involves analyzing risk tolerance, cost implications, and coverage scope tailored to the specific credit profile. Credit enhancement boosts a borrower's creditworthiness by improving repayment terms or collateral, while credit insurance protects against default losses by transferring risk to an insurer. Decision-makers must consider financial stability, exposure size, and regulatory environment to select the optimal credit risk mitigation tool.

Important Terms

Risk mitigation

Risk mitigation strategies such as credit enhancement improve a borrower's creditworthiness by providing guarantees or collateral, reducing lender exposure to default risk, whereas credit insurance transfers the risk of borrower non-payment to an insurer, offering protection against potential losses through indemnity coverage. Both methods optimize credit risk management but differ in mechanism: credit enhancement strengthens credit terms, while credit insurance provides a financial safety net.

Loss reserves

Loss reserves represent funds set aside by insurers to cover potential claims, playing a crucial role in credit enhancement by improving the lender's confidence and financial stability. Unlike credit insurance, which transfers risk to a third party, loss reserves directly mitigate credit risk internally, influencing both the assessment of creditworthiness and capital allocation.

Securitization

Securitization involves pooling financial assets and issuing securities backed by those assets, with credit enhancement techniques such as overcollateralization or subordinated debt improving the creditworthiness of these securities. Credit insurance, a form of credit enhancement, provides protection against borrower default, transferring risk to insurers and thereby enhancing the securitized asset's credit profile.

Surety bonds

Surety bonds function as a credit enhancement by providing a third-party guarantee that contractual obligations will be fulfilled, whereas credit insurance protects lenders or suppliers against the risk of borrower default or non-payment. Unlike credit insurance, which reimburses losses after default, surety bonds focus on preventing defaults through a contingent obligation backed by the surety company.

Collateralization

Collateralization improves credit enhancement by securing loans with tangible assets, reducing lender risk through asset-backed guarantees, whereas credit insurance protects lenders against borrower default by transferring risk to an insurer. Both methods increase creditworthiness, but collateralization ties credit risk to specific assets, while credit insurance provides a risk transfer mechanism without requiring asset pledges.

Subordination

Subordination ranks debt obligations to provide credit enhancement by prioritizing senior creditors over subordinated ones, thereby reducing risk and improving creditworthiness. Credit insurance protects lenders from borrower default, offering direct risk mitigation compared to subordination's structural risk allocation.

Guarantor

A guarantor provides a credit enhancement by legally committing to repay a borrower's debt if they default, thereby reducing the lender's risk without transferring the credit risk entirely. Credit insurance, however, transfers the risk of borrower default to an insurer who compensates the lender, offering protection against losses but typically at a higher cost than a guarantor arrangement.

Monoline insurer

A Monoline insurer specializes in credit enhancement by providing guarantees that improve the creditworthiness of a financial transaction or instrument, thereby lowering borrowing costs for issuers. Unlike credit insurance, which directly protects lenders or investors against borrower default, Monoline insurers focus on enhancing debt securities' credit rating without assuming the primary credit risk.

Credit default swap (CDS)

Credit default swaps (CDS) serve as a financial derivative providing credit enhancement by transferring the risk of default from the bondholder to the protection seller, thereby improving the credit profile of the underlying debt instrument. Unlike credit insurance, which is a contractual policy offering direct indemnification against specific credit events, CDS contracts are tradable securities that facilitate risk management and speculative strategies in credit markets.

First-loss tranche

The first-loss tranche represents the highest risk layer in a structured finance deal, absorbing initial losses to protect senior tranches, thereby serving as a form of credit enhancement by improving the overall credit quality of the securitization. Unlike credit insurance, which transfers risk to a third party through insurance contracts, the first-loss tranche retains losses internally within the capital structure to shield other investors.

credit enhancement vs credit insurance Infographic

moneydif.com

moneydif.com