The Annual Percentage Rate (APR) provides a comprehensive measure of the total cost of borrowing by including both the nominal interest rate and additional fees or charges associated with a loan. Unlike the nominal interest rate, which only reflects the stated interest rate on the principal balance, the APR offers a more accurate reflection of the true cost over a year. Comparing APRs allows borrowers to better evaluate loan options and avoid hidden costs.

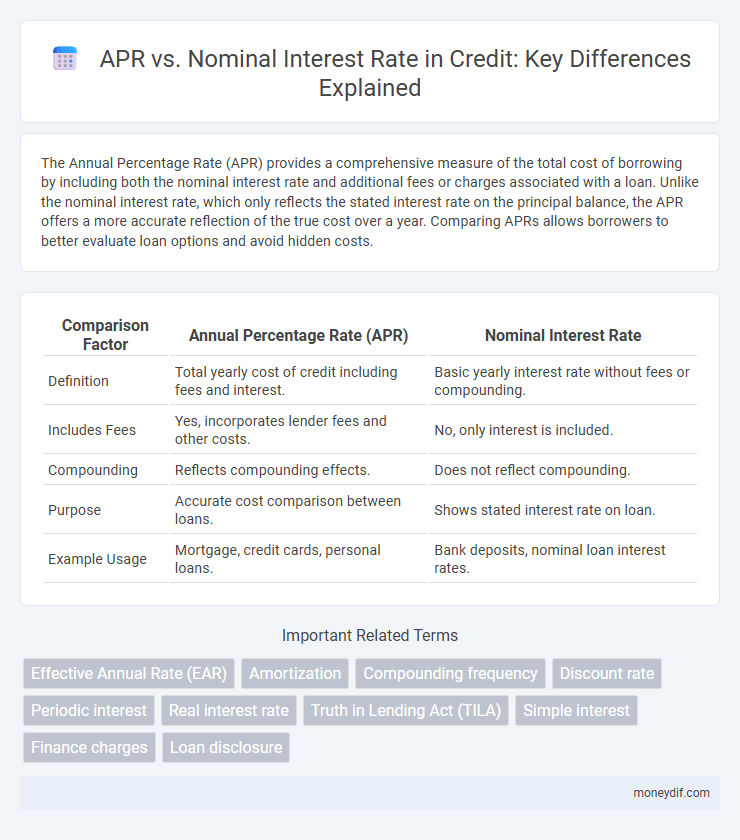

Table of Comparison

| Comparison Factor | Annual Percentage Rate (APR) | Nominal Interest Rate |

|---|---|---|

| Definition | Total yearly cost of credit including fees and interest. | Basic yearly interest rate without fees or compounding. |

| Includes Fees | Yes, incorporates lender fees and other costs. | No, only interest is included. |

| Compounding | Reflects compounding effects. | Does not reflect compounding. |

| Purpose | Accurate cost comparison between loans. | Shows stated interest rate on loan. |

| Example Usage | Mortgage, credit cards, personal loans. | Bank deposits, nominal loan interest rates. |

Understanding Annual Percentage Rate (APR)

Annual Percentage Rate (APR) represents the total cost of borrowing, including the nominal interest rate plus additional fees and compounding effects, providing a more comprehensive measure than nominal interest alone. Understanding APR helps consumers compare credit offers accurately by reflecting the true cost of a loan annually. Lenders disclose APR to enhance transparency and enable borrowers to make informed financial decisions.

Defining Nominal Interest Rate

Nominal interest rate refers to the stated interest rate on a loan or credit product without accounting for fees or compounding effects. It represents the basic cost of borrowing expressed as a percentage of the principal amount over a specific period. Unlike the Annual Percentage Rate (APR), the nominal rate excludes additional costs, offering a simplified view of interest charges.

Key Differences Between APR and Nominal Rate

The Annual Percentage Rate (APR) reflects the total cost of borrowing, including interest and fees, expressed as a yearly rate, whereas the nominal interest rate represents only the base interest charged on the loan without additional costs. APR provides a more comprehensive measure of loan affordability, incorporating loan-related charges such as origination fees, points, and insurance premiums. Understanding the key differences between APR and nominal interest rate helps borrowers accurately compare credit offers and assess their true financial obligations.

How Lenders Calculate APR

Lenders calculate the Annual Percentage Rate (APR) by including both the nominal interest rate and additional fees or costs associated with the loan, such as origination fees, closing costs, and insurance premiums. The APR reflects the true annual cost of borrowing, expressed as a percentage, enabling borrowers to compare different credit offers more accurately. Unlike the nominal interest rate, which only accounts for the periodic interest, the APR provides a comprehensive measure of the loan's financial impact over the entire term.

Why Nominal Interest Rate Matters

The nominal interest rate is crucial because it represents the stated rate lenders charge before compounding effects and fees, directly impacting loan agreements and borrower expectations. Unlike the Annual Percentage Rate (APR), which includes fees and compounding, the nominal rate allows borrowers to understand the basic cost of borrowing and compare offers on a straightforward basis. Understanding the nominal interest rate helps in assessing the immediate cost of credit and planning repayment strategies effectively.

APR vs Nominal Rate: Impact on Borrowing Costs

Annual Percentage Rate (APR) includes both the nominal interest rate and additional fees, providing a comprehensive measure of the true cost of borrowing. Nominal interest rate reflects only the basic interest charged on a loan, excluding fees and compounding effects. Comparing APR versus nominal rate reveals the actual financial impact on borrowing costs, helping consumers make informed credit decisions.

Common Misconceptions About APR and Nominal Rates

Many consumers mistakenly believe the Annual Percentage Rate (APR) and nominal interest rate are interchangeable, overlooking that APR includes fees and compounding effects, reflecting the true cost of credit. Nominal interest rate only shows the basic interest charged annually without additional costs, which can lead to underestimating the total loan expenses. Understanding the distinction helps borrowers make informed decisions and avoid surprises from hidden charges embedded in the APR.

Comparing Loans: Using APR and Nominal Rates

When comparing loans, the Annual Percentage Rate (APR) provides a more comprehensive cost measure than the nominal interest rate by including fees and other charges beyond the base interest. APR reflects the true annual cost of borrowing, enabling borrowers to evaluate different loan offers accurately. Nominal interest rates only indicate the periodic interest without accounting for additional expenses, which can lead to underestimating the loan's total cost.

Tips for Borrowers: Choosing the Best Rate

Borrowers should compare the Annual Percentage Rate (APR) instead of just the nominal interest rate to understand the true cost of credit, as APR includes fees and other charges. Evaluating APR helps in accurately assessing loan affordability and preventing unexpected expenses. Always review the loan's APR disclosure to make informed borrowing decisions and select the most cost-effective option.

APR and Nominal Rates in Different Credit Products

Annual Percentage Rate (APR) provides a more comprehensive cost of borrowing by including fees and compounding interest, unlike the nominal interest rate which reflects only the simple stated interest. Credit products such as credit cards and personal loans often advertise nominal rates, but the APR reveals the true cost by incorporating additional charges like annual fees and processing costs. Comparing APRs across mortgages, auto loans, and credit cards allows consumers to understand the effective interest burden and select the most cost-efficient financing option.

Important Terms

Effective Annual Rate (EAR)

Effective Annual Rate (EAR) accurately reflects the true annual cost of borrowing by accounting for compounding periods, unlike Annual Percentage Rate (APR), which typically excludes compounding effects and only represents the nominal interest rate plus certain fees. EAR is crucial for comparing financial products because it provides a standardized measure of the actual return or cost, while nominal interest rates simply state the stated yearly rate without considering compounding frequency.

Amortization

Amortization schedules are heavily influenced by the Annual Percentage Rate (APR), which reflects the total cost of borrowing including fees, making it a more comprehensive measure than the nominal interest rate that only accounts for periodic interest charges. Understanding the difference between APR and nominal interest rate is crucial for borrowers to accurately calculate monthly payments and total interest paid over the loan term.

Compounding frequency

Compounding frequency directly impacts the relationship between Annual Percentage Rate (APR) and nominal interest rate, as higher compounding frequencies cause the effective annual rate (EAR) to exceed the nominal rate despite a constant APR. Understanding how daily, monthly, or quarterly compounding intervals affect interest accumulation is essential for accurately comparing loan and investment costs.

Discount rate

The discount rate reflects the present value of future cash flows and differs from the Annual Percentage Rate (APR), which includes fees and compounding effects to represent the total annual cost of borrowing. Unlike the nominal interest rate that states the basic interest charged without considering compounding or additional costs, APR provides a comprehensive measure for comparing loan costs.

Periodic interest

Periodic interest refers to the interest charged or earned over a specific period, such as monthly or quarterly, and is a key component for calculating the Annual Percentage Rate (APR). Unlike the nominal interest rate, which excludes fees and compounding within the year, APR incorporates both the periodic interest rate and additional costs to provide a more accurate measure of the true annual cost of borrowing.

Real interest rate

The real interest rate adjusts the nominal interest rate by subtracting the inflation rate, providing a clearer measure of purchasing power changes, whereas the Annual Percentage Rate (APR) includes nominal interest plus additional fees and costs, reflecting the true cost of borrowing. Understanding the distinction between real interest rate and APR is crucial for accurately assessing loan affordability and investment returns in inflationary environments.

Truth in Lending Act (TILA)

The Truth in Lending Act (TILA) mandates clear disclosure of the Annual Percentage Rate (APR), ensuring borrowers understand the true cost of credit by including interest and certain fees beyond the nominal interest rate. APR provides a comprehensive measure of loan costs, while the nominal interest rate only reflects the basic interest charged without additional fees or compounding effects.

Simple interest

Simple interest calculates the cost of borrowing based only on the principal amount, while the Annual Percentage Rate (APR) provides a broader measure by incorporating both the nominal interest rate and any additional fees or compounding effects. APR offers a more accurate representation of the true yearly cost of a loan compared to the nominal interest rate, which reflects only the stated annual interest without extra charges.

Finance charges

Finance charges represent the total cost of borrowing, including interest and fees, expressed through the Annual Percentage Rate (APR) which provides a comprehensive measure of loan expense over a year. Unlike the nominal interest rate that reflects only the basic interest cost, APR incorporates finance charges, enabling borrowers to accurately compare loan products by their true cost.

Loan disclosure

Loan disclosures must clearly differentiate the Annual Percentage Rate (APR) from the nominal interest rate to provide borrowers with an accurate measure of the total cost of borrowing, including fees and compounding periods. The APR reflects the true annual cost by incorporating additional charges beyond the nominal rate, enabling informed comparison of loan offers.

Annual Percentage Rate (APR) vs nominal interest rate Infographic

moneydif.com

moneydif.com