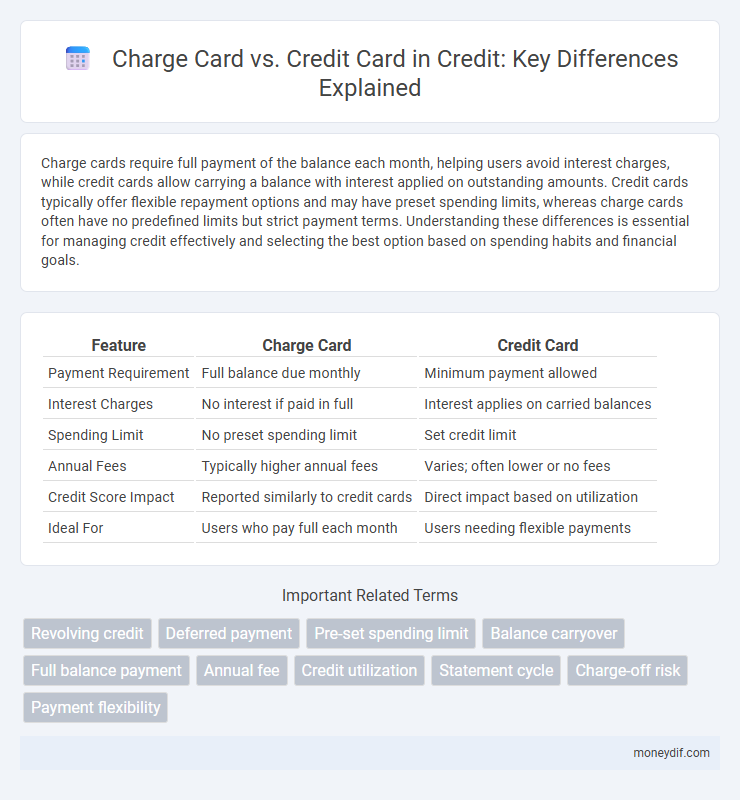

Charge cards require full payment of the balance each month, helping users avoid interest charges, while credit cards allow carrying a balance with interest applied on outstanding amounts. Credit cards typically offer flexible repayment options and may have preset spending limits, whereas charge cards often have no predefined limits but strict payment terms. Understanding these differences is essential for managing credit effectively and selecting the best option based on spending habits and financial goals.

Table of Comparison

| Feature | Charge Card | Credit Card |

|---|---|---|

| Payment Requirement | Full balance due monthly | Minimum payment allowed |

| Interest Charges | No interest if paid in full | Interest applies on carried balances |

| Spending Limit | No preset spending limit | Set credit limit |

| Annual Fees | Typically higher annual fees | Varies; often lower or no fees |

| Credit Score Impact | Reported similarly to credit cards | Direct impact based on utilization |

| Ideal For | Users who pay full each month | Users needing flexible payments |

Understanding Charge Cards and Credit Cards

Charge cards require full payment of the balance each month, offering no preset spending limit but potentially higher fees and stricter payment terms. Credit cards provide a revolving credit line with minimum monthly payments, allowing users to carry balances and incur interest charges. Understanding these differences helps consumers choose between immediate full repayment with charge cards or flexible borrowing with credit cards.

Key Differences Between Charge Cards and Credit Cards

Charge cards require full payment of the balance each month, eliminating interest charges but often carrying annual fees and strict spending limits. Credit cards allow users to carry a balance with minimum monthly payments, accruing interest on unpaid amounts while offering flexible repayment options and often rewards programs. The fundamental difference lies in charge cards enforcing immediate full repayment, whereas credit cards provide revolving credit with variable borrowing costs.

How Charge Cards Work

Charge cards require full payment of the balance each billing cycle, avoiding interest charges common with credit cards. Unlike credit cards, charge cards typically have no preset spending limit, allowing flexibility based on usage and payment history. This payment model encourages disciplined financial management by mandating on-time, complete repayment to maintain account status.

How Credit Cards Operate

Credit cards operate by allowing users to borrow funds from a pre-approved credit limit to make purchases, which they must repay either in full or through monthly installments with interest. Unlike charge cards, which require full payment each billing cycle, credit cards offer flexibility with minimum payments and the ability to carry a balance. Interest rates, credit limits, and billing cycles are critical factors influencing credit card usage and costs.

Pros and Cons of Charge Cards

Charge cards offer unlimited spending capacity without preset limits, enhancing purchasing power and flexibility, but require full payment each month to avoid steep fees and penalties. Unlike credit cards, charge cards do not build revolving credit balances, which can be beneficial for disciplined spenders but limits the ability to carry debt. They often provide premium rewards and exclusive benefits, yet their stringent payment terms and higher annual fees may not suit all users.

Pros and Cons of Credit Cards

Credit cards offer a revolving line of credit that enables flexible repayment and often include rewards programs, purchase protection, and fraud liability coverage, enhancing consumer convenience and security. However, they carry risks such as high-interest rates, potential for accumulating debt, and fees for late payments or exceeding credit limits, which can impact credit scores negatively. Responsible use of credit cards fosters credit-building and financial management, while misuse can lead to significant financial strain.

Eligibility and Application Requirements

Charge cards often require a higher credit score and a strong credit history, as they typically involve paying the balance in full each month, reflecting a higher financial responsibility. Credit cards generally have more flexible eligibility criteria, allowing applicants with varying credit scores to apply and often offering options for building or improving credit. Application requirements for charge cards may include proof of income and a good credit rating, while credit cards usually require basic personal information and a credit check to determine credit limits.

Rewards and Benefits Comparison

Charge cards typically offer premium rewards programs with higher point multipliers on travel and dining, while credit cards provide more flexible rewards options across various spending categories including groceries and gas. Charge cards often include exclusive benefits such as concierge services and no preset spending limits, whereas credit cards may feature cashback, balance transfer offers, and introductory APR promotions. Understanding the differences in rewards structure and benefits helps consumers select the ideal card based on their spending habits and financial goals.

Impact on Credit Score

Charge cards typically require full payment each month, which can positively impact credit scores by demonstrating responsible use without revolving balances. Credit cards allow carrying a balance, affecting credit utilization rates that are a major factor in credit scoring models like FICO and VantageScore. High credit utilization on credit cards can lower credit scores, while consistent full payments on either card type generally support score improvement.

Which Card is Right for You?

Charge cards require full monthly payment and offer no preset spending limit, ideal for disciplined spenders who pay off balances regularly; credit cards allow revolving credit with minimum payments and interest charges, suitable for users who want flexibility and rewards. Consider your financial habits, spending frequency, and ability to manage debt when choosing between charge cards and credit cards. Assess fees, interest rates, and benefits to determine which card aligns best with your financial goals and lifestyle.

Important Terms

Revolving credit

Revolving credit allows cardholders to carry a balance month-to-month, which is typical for credit cards but not for charge cards that require full payment each billing cycle. Credit cards offer flexible repayment options with interest charges on unpaid balances, whereas charge cards impose no interest but mandate complete settlement to avoid penalties.

Deferred payment

Deferred payment allows charge card users to pay the full balance at the end of each billing cycle without interest, while credit card holders can carry a balance over time with interest charges applied. Charge cards typically require full payment monthly to avoid penalties, whereas credit cards offer revolving credit with minimum payments options.

Pre-set spending limit

Charge cards impose a pre-set spending limit based on the user's creditworthiness, requiring full payment each billing cycle, whereas credit cards offer a revolving credit line with variable limits and minimum monthly payments. This difference affects cash flow management and spending flexibility for consumers.

Balance carryover

Balance carryover on charge cards is typically not allowed, requiring full payment each billing cycle, whereas credit cards permit balance carryover with interest charges applied to the unpaid amount. This fundamental difference impacts user flexibility, monthly budgeting, and the potential for accumulating debt.

Full balance payment

Full balance payment on a charge card is mandatory each billing cycle, avoiding interest charges, whereas credit cards allow carrying a balance with minimum payment options but incur interest on unpaid amounts. Charge cards promote disciplined spending without debt accumulation, while credit cards offer flexibility with revolving credit and potential interest costs.

Annual fee

Annual fees for charge cards often exceed those of credit cards due to premium benefits like rewards and travel perks, with average charges ranging from $95 to $550 annually. Credit cards typically have lower or no annual fees, offering flexibility in spending and repayment, making them suitable for varying financial needs and credit profiles.

Credit utilization

Credit utilization on a charge card differs from a credit card as charge cards require full payment each billing cycle, often lacking a preset spending limit, resulting in no traditional utilization ratio reported to credit bureaus. Credit cards report a percentage of the credit limit used, with high utilization ratios potentially lowering credit scores, making it crucial to maintain utilization below 30% for optimal credit health.

Statement cycle

Statement cycles for charge cards typically span 28 to 31 days, with full payment required by the due date to avoid fees, whereas credit cards also have monthly statement cycles but allow users to carry a balance and pay interest on revolving credit. Charge cards often do not have preset spending limits, contrasting with credit cards that have fixed credit limits influencing statement balances and minimum payments.

Charge-off risk

Charge-off risk for charge cards is generally lower because balances typically must be paid in full each billing cycle, reducing the chance of prolonged debt accumulation. Credit cards carry higher charge-off risk due to revolving credit lines that allow minimum payments, increasing the likelihood of default and loss for lenders.

Payment flexibility

Charge cards require full payment of the balance each month, offering no interest charges but potential late fees, while credit cards allow carrying a balance with interest charges applied on unpaid amounts, providing greater payment flexibility. Charge cards often have no preset spending limits but demand disciplined repayment, whereas credit cards offer revolving credit lines with minimum monthly payments, enabling users to manage cash flow more flexibly.

Charge card vs Credit card Infographic

moneydif.com

moneydif.com