An authorized user has permission to use a credit account without being legally responsible for the debt, while a joint account holder shares equal legal responsibility and liability for all charges and payments. Authorized users typically benefit from the primary account holder's credit history without affecting the account management, whereas joint account holders must both manage the account and impact each other's credit scores equally. Understanding these distinctions is crucial for managing credit risk and building personal credit effectively.

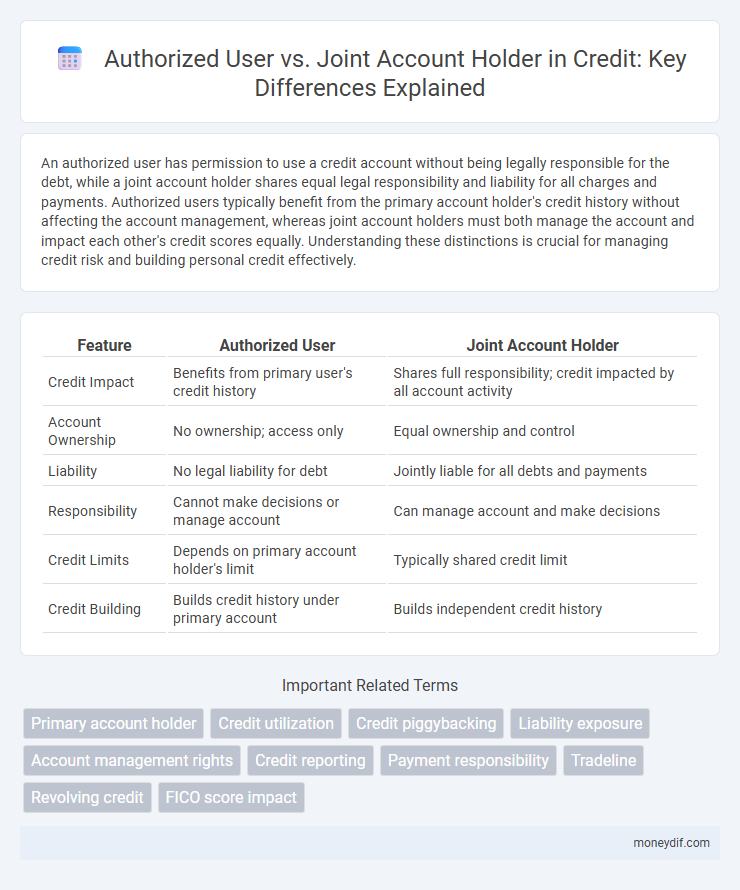

Table of Comparison

| Feature | Authorized User | Joint Account Holder |

|---|---|---|

| Credit Impact | Benefits from primary user's credit history | Shares full responsibility; credit impacted by all account activity |

| Account Ownership | No ownership; access only | Equal ownership and control |

| Liability | No legal liability for debt | Jointly liable for all debts and payments |

| Responsibility | Cannot make decisions or manage account | Can manage account and make decisions |

| Credit Limits | Depends on primary account holder's limit | Typically shared credit limit |

| Credit Building | Builds credit history under primary account | Builds independent credit history |

Understanding Authorized Users and Joint Account Holders

Authorized users have permission to use a credit account without being legally responsible for the debt, which can help them build credit history without the risk of liability. Joint account holders share equal responsibility for managing the credit account and are both legally accountable for payments, impacting their credit reports equally. Understanding these distinctions is crucial for choosing the right credit sharing strategy to optimize credit building and risk management.

Key Differences Between Authorized Users and Joint Account Holders

Authorized users have permission to use the credit account without legal responsibility for debt, while joint account holders share equal ownership and liability for the account balance. Credit activity on the account typically impacts both joint holders' credit scores, whereas authorized users benefit from credit reporting but are not legally accountable. Joint account holders can make decisions regarding account management, unlike authorized users who have limited control.

How Credit Reports Are Affected

Authorized users benefit from credit reporting as their activity is reflected on the primary account holder's credit report, positively impacting their credit score without legal responsibility for the debt. Joint account holders share equal responsibility for the credit account, with the account's activity fully affecting both parties' credit reports and credit profiles. Lenders consider both authorized user and joint account holder statuses differently when assessing creditworthiness, emphasizing the importance of understanding each role's impact on credit histories.

Responsibility for Debt and Payments

Authorized users have limited responsibility for debt and payments since the primary account holder remains fully liable for all charges. Joint account holders share equal responsibility for debt repayment and financial obligations on the account. Credit reporting agencies typically hold joint account holders accountable for missed payments, impacting both parties' credit scores.

Impact on Credit Scores

Authorized users benefit from the primary account holder's credit history, often seeing an immediate positive impact on their credit scores without being legally responsible for the debt. Joint account holders share equal responsibility for repayments, meaning their credit scores are influenced by both positive and negative account activity. Credit bureaus factor in payment history and credit utilization for both authorized users and joint account holders, affecting their individual credit risk profiles differently.

Benefits and Drawbacks of Being an Authorized User

Being an authorized user on a credit account allows access to the primary cardholder's credit history, which can help build or improve credit scores without legal responsibility for payments. The benefits include potential credit score enhancement and spending flexibility, while drawbacks involve lack of control over account activity and possible negative impact from the primary user's poor credit management. Unlike joint account holders who share equal responsibility and credit risk, authorized users rely entirely on the primary account holder's credit behavior.

Advantages and Disadvantages of Joint Account Ownership

Joint account ownership allows multiple individuals to share equal control and responsibility over the account, facilitating simplified financial management and access to funds. Advantages include combined credit history benefits, shared liabilities for loans, and streamlined bill payments, while disadvantages involve risks of overspending, potential disputes over account use, and exposure to each user's credit behavior affecting all parties. Unlike authorized users who have limited control, joint account holders are equally liable for debts, making financial trust and clear communication essential.

How to Decide: Authorized User or Joint Account Holder?

Choosing between an authorized user and a joint account holder depends on credit goals and financial responsibility. An authorized user gains credit benefits without legal obligation for debt, ideal for building credit history with minimal risk. A joint account holder shares equal responsibility for account management and debt repayment, suitable for partners seeking full account access and credit impact.

Risk Factors and Protections

Authorized users face limited risk since they are not legally responsible for debt but gain credit benefits; joint account holders share full liability for all charges, increasing financial exposure. Creditors can pursue joint account holders for missed payments or debt defaults, while authorized users' credit scores may be affected without legal debt obligation. Protection mechanisms differ: joint account holders should manage spending carefully and monitor accounts regularly, whereas authorized users rely on the primary account holder's payment habits to maintain good credit standing.

Steps to Add or Remove an Authorized User or Joint Account Holder

To add an authorized user, the primary account holder must contact the credit card issuer and provide personal information of the authorized user, such as name and social security number, while joint account holders require both parties to apply together. Removing an authorized user typically involves the primary cardholder notifying the issuer to delete the user from the account, whereas closing or modifying a joint account often requires consent from all account holders. Credit bureaus update the credit reports promptly after the issuer processes these changes, impacting credit utilization and responsibility.

Important Terms

Primary account holder

A primary account holder holds full ownership and control over the account, while an authorized user is granted permission to use the account without legal responsibility for the debt. A joint account holder shares equal ownership and liability with the primary account holder, allowing both parties full access and responsibility for the account.

Credit utilization

Credit utilization impacts both authorized users and joint account holders differently, as authorized users benefit from the primary account holder's credit limit and payment history without direct responsibility, while joint account holders share equal liability and their credit utilization directly influences their credit scores. Monitoring credit utilization ratios is crucial for joint account holders to maintain optimal scores, whereas authorized users gain passive credit improvements primarily based on the primary account's credit management.

Credit piggybacking

Credit piggybacking involves adding an individual as an authorized user on a credit account to improve their credit score without granting them account control, unlike a joint account holder who shares full responsibility and access to the account. Authorized users benefit from the primary account holder's credit history for credit-building purposes, whereas joint account holders have equal liability and decision-making authority on the account.

Liability exposure

Liability exposure for an authorized user is limited as they are not legally responsible for debts on the account, whereas joint account holders share equal responsibility and legal obligation for all charges and payments. Creditors can pursue joint account holders individually or collectively to recover any outstanding balance, increasing financial risk compared to authorized users.

Account management rights

Account management rights differ significantly between authorized users and joint account holders; authorized users can typically make transactions but lack full control or liability, while joint account holders share equal ownership, full access, and legal responsibility for the account's activity. Financial institutions define these roles clearly to determine account access, liability, and decision-making authority, impacting credit reports, dispute resolution, and account closure rights.

Credit reporting

Authorized users have access to credit accounts without legal responsibility for repayment, so their credit reports reflect account history but not liability, while joint account holders share equal responsibility for debts, impacting their credit scores directly through payment behavior and account status. Credit reporting agencies distinguish these roles to accurately attribute credit risk and repayment history, influencing lenders' decisions and individual credit profiles accordingly.

Payment responsibility

Payment responsibility for an authorized user lies solely with the primary account holder, as authorized users can make charges but are not legally obligated to pay the debt. In contrast, joint account holders share equal legal responsibility for all charges and payments on the account, making each party accountable for the full balance.

Tradeline

An authorized user on a tradeline can build credit by piggybacking on the primary account holder's positive payment history without having legal responsibility for the debt, while a joint account holder shares full liability and equal ownership of the credit account. Credit reporting agencies typically attribute authorized user tradelines differently, often benefiting the authorized user's credit score, whereas joint account activity appears fully on both parties' credit reports with shared accountability.

Revolving credit

Revolving credit allows authorized users to access credit without being legally responsible for the debt, whereas joint account holders share equal liability and credit responsibility. Authorized users benefit from credit history buildup without the risks of repayment, while joint account holders must manage payments collaboratively to maintain credit standing.

FICO score impact

FICO scores often weigh authorized users less heavily than joint account holders because authorized users do not legally share responsibility for debt repayment, which can limit the positive or negative impact on credit. Joint account holders share equal liability, directly affecting their credit reports and scores based on the account's payment history and balances.

Authorized user vs Joint account holder Infographic

moneydif.com

moneydif.com