Subprime lending targets borrowers with lower credit scores and higher risk profiles, often resulting in higher interest rates and less favorable loan terms. Prime lending serves individuals with strong credit histories, offering competitive rates and more flexible repayment options. Understanding the differences helps borrowers choose the best financing suited to their creditworthiness and financial goals.

Table of Comparison

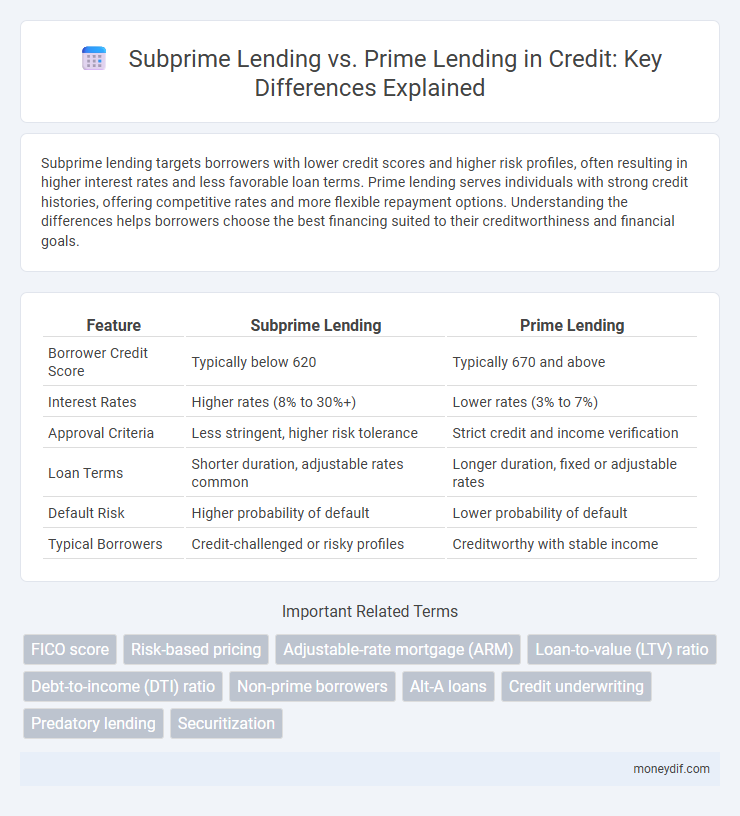

| Feature | Subprime Lending | Prime Lending |

|---|---|---|

| Borrower Credit Score | Typically below 620 | Typically 670 and above |

| Interest Rates | Higher rates (8% to 30%+) | Lower rates (3% to 7%) |

| Approval Criteria | Less stringent, higher risk tolerance | Strict credit and income verification |

| Loan Terms | Shorter duration, adjustable rates common | Longer duration, fixed or adjustable rates |

| Default Risk | Higher probability of default | Lower probability of default |

| Typical Borrowers | Credit-challenged or risky profiles | Creditworthy with stable income |

Understanding Subprime Lending vs Prime Lending

Subprime lending targets borrowers with lower credit scores, typically below 620, offering higher interest rates and less favorable terms due to increased risk of default. Prime lending serves borrowers with strong credit histories, often above 700, providing lower interest rates and better loan conditions because of their proven creditworthiness. Understanding the differences between subprime and prime lending helps consumers make informed decisions and lenders manage risk effectively in the credit market.

Key Differences Between Subprime and Prime Loans

Subprime loans typically target borrowers with credit scores below 620, carrying higher interest rates and increased risk of default compared to prime loans, which are extended to borrowers with credit scores above 700 and more favorable terms. Prime loans generally offer lower interest rates, better loan conditions, and easier access to credit due to the borrower's strong credit history and financial stability. Differences also include varying down payment requirements, loan approval processes, and repayment flexibility, reflecting the lender's risk assessment based on borrower creditworthiness.

Credit Score Requirements: Subprime vs Prime

Prime lending typically requires a credit score above 700, ensuring borrowers have a strong history of on-time payments and low credit risk. Subprime lending targets individuals with credit scores below 640, reflecting higher risk due to past defaults, late payments, or limited credit history. Lenders in the subprime market compensate for increased risk through higher interest rates and stricter loan terms.

Interest Rates: Comparing Subprime and Prime Lending

Subprime lending typically features significantly higher interest rates than prime lending, reflecting the increased risk associated with borrowers who have lower credit scores or limited credit history. Prime lending offers lower interest rates due to the borrower's strong creditworthiness and lower default risk, resulting in more favorable loan terms. The interest rate gap between subprime and prime loans impacts borrowing costs, influencing borrower eligibility and overall loan affordability.

Loan Terms and Conditions: What Sets Them Apart

Subprime lending typically involves higher interest rates and stricter repayment terms due to increased default risk, while prime lending offers lower rates and more favorable conditions for borrowers with strong credit profiles. Subprime loans often include larger fees, shorter repayment periods, and less flexible options compared to the longer terms and lower fees associated with prime loans. These differences in loan terms and conditions reflect the borrower's creditworthiness and significantly impact overall borrowing costs.

Risks and Benefits for Borrowers

Subprime lending offers credit to borrowers with lower credit scores, allowing access to funds that might otherwise be unavailable, but it carries higher interest rates and increased default risk. Prime lending targets individuals with strong credit histories, providing lower interest rates and more favorable terms, which reduces the likelihood of financial strain. Borrowers in prime loans benefit from better repayment conditions, while subprime borrowers gain credit access despite higher costs and potential financial instability.

Lender Perspectives: Assessing Subprime and Prime Borrowers

Lenders assess prime borrowers as low-risk entities with strong credit scores, stable income, and reliable repayment history, leading to lower interest rates and higher loan approval rates. Subprime borrowers exhibit higher default risk due to poor credit history, inconsistent income, or high debt-to-income ratios, causing lenders to impose higher interest rates and stricter lending terms. Evaluating borrower creditworthiness involves advanced risk modeling and portfolio diversification strategies to balance profitability against potential loan defaults.

Impact on Credit History and Scores

Subprime lending typically involves higher interest rates and less favorable terms, which can lead to missed payments and increased credit utilization, negatively impacting credit history and lowering credit scores. Prime lending offers more favorable terms and lower interest rates, encouraging timely payments and responsible credit use, thereby improving credit history and boosting scores. Consistent repayments on prime loans build a strong credit profile, while struggles with subprime loans often result in defaults that damage creditworthiness.

Subprime vs Prime Lending: Market Trends

Subprime lending involves providing credit to borrowers with lower credit scores, typically below 620, whereas prime lending targets individuals with credit scores above 700. Market trends show a fluctuating demand for subprime loans due to economic cycles, regulatory changes, and rising default rates impacting lender risk assessments. Prime lending remains dominant in the credit market, driven by lower interest rates and stronger borrower creditworthiness, contributing to more stable loan performance.

Choosing the Right Loan Type for Your Financial Situation

Subprime lending offers loans to borrowers with lower credit scores, typically above 600 but below prime standards, often featuring higher interest rates and fees to mitigate lender risk. Prime lending is designed for borrowers with strong credit profiles, generally above 700, providing more favorable terms, lower interest rates, and better repayment flexibility. Evaluating your credit score, income stability, and long-term financial goals is essential to choosing between subprime and prime lending options for optimal loan affordability and credit impact.

Important Terms

FICO score

FICO scores below 650 typically classify borrowers as subprime, leading to higher interest rates and less favorable loan terms compared to prime lending, which generally requires scores above 700 for qualification. Lenders use these score thresholds to assess credit risk, influencing loan approval decisions and pricing models in consumer finance.

Risk-based pricing

Risk-based pricing differentiates interest rates and loan terms by assessing borrower creditworthiness, often charging higher rates in subprime lending due to increased default risk compared to prime lending, where borrowers have strong credit scores and receive more favorable conditions. Lenders use detailed credit risk models, including FICO scores and debt-to-income ratios, to set prices that reflect the probability of repayment and potential loss severity.

Adjustable-rate mortgage (ARM)

Adjustable-rate mortgages (ARMs) often target subprime lending markets due to their initially low interest rates that adjust higher over time, increasing default risk among borrowers with lower credit scores. In contrast, prime lending ARMs typically feature more favorable adjustment terms and lower risk profiles, reflecting borrowers' strong creditworthiness and stable income.

Loan-to-value (LTV) ratio

Loan-to-value (LTV) ratio measures the loan amount relative to the appraised property value, typically higher in subprime lending to reflect greater borrower risk and less favorable loan terms. Prime lending usually involves lower LTV ratios, indicating stronger borrower credit profiles and reduced default risk.

Debt-to-income (DTI) ratio

Debt-to-income (DTI) ratio is a key metric used by lenders to assess borrower creditworthiness, with subprime lending typically allowing higher DTI ratios--often above 43%--reflecting increased risk tolerance for borrowers with lower credit scores. Prime lending generally requires lower DTI ratios, usually below 36%, indicating stricter standards for borrowers with strong credit profiles to minimize default risk.

Non-prime borrowers

Non-prime borrowers possess lower credit scores and higher default risk, making them typical candidates for subprime lending characterized by higher interest rates and less favorable loan terms. In contrast, prime lending targets borrowers with strong credit profiles and stable financial histories, resulting in lower interest rates and more advantageous lending conditions.

Alt-A loans

Alt-A loans are a middle category between prime and subprime lending, often extended to borrowers with good credit but limited documentation or higher loan-to-value ratios. These loans carry more risk than prime loans yet less than subprime loans, commonly used by borrowers who do not fully meet prime lending standards but are considered less risky than subprime borrowers.

Credit underwriting

Credit underwriting evaluates borrower risk by analyzing credit history, income, and debt levels, with stricter criteria applied in prime lending to ensure low default rates. Subprime lending targets higher-risk borrowers with lower credit scores, resulting in higher interest rates and increased default probabilities due to relaxed underwriting standards.

Predatory lending

Predatory lending involves unfair, deceptive, or fraudulent practices targeting borrowers, often seen in subprime lending where high-interest loans are offered to individuals with poor credit. In contrast, prime lending provides loans to borrowers with strong credit histories at lower interest rates and transparent terms, reducing the risk of financial exploitation.

Securitization

Securitization in subprime lending involves bundling high-risk loans with higher default rates, often leading to increased credit risk and market volatility. In contrast, securitization of prime lending pools typically features lower-risk mortgages, producing more stable, investment-grade securities favored by conservative investors.

Subprime lending vs Prime lending Infographic

moneydif.com

moneydif.com